|

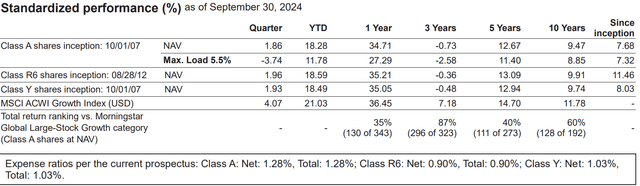

Performance quoted is past performance and cannot guarantee comparable future results; current performance may be lower or higher. Visit Country Splash for the most recent month-end performance. Performance figures reflect reinvested distributions and changes in net asset value (NAV). Investment return and principal value will vary so that you may have a gain or a loss when you sell shares. Returns less than one year are cumulative; all others are annualized. As the result of a reorganization on May 24, 2019, the returns of the fund for periods on or prior to May 24, 2019 reflect performance of the Oppenheimer predecessor fund. Share class returns will differ from the predecessor fund due to a change in expenses and sales charges. Index source: RIMES Technologies Corp. Please keep in mind that high, double-digit returns are highly unusual and cannot be sustained. Had fees not been waived and/or expenses reimbursed in the past, returns would have been lower. Performance shown at NAV does not include the applicable front-end sales charge, which would have reduced the performance. Class Y and R6 shares have no sales charge; therefore performance is at NAV. Class Y shares are available only to certain investors. Class R6 shares are closed to most investors. Please see the prospectus for more details. |

Manager perspective and outlook

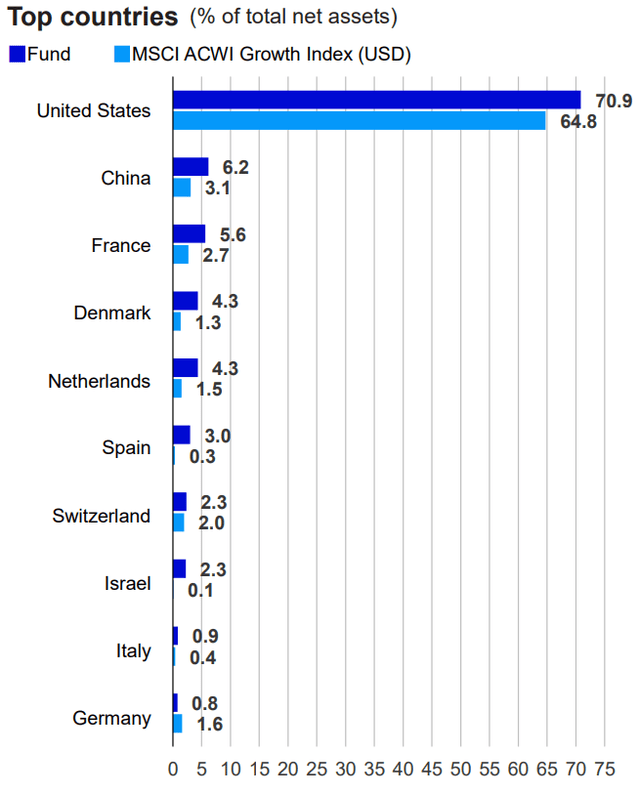

- Non-US equities outperformed the US for the quarter, with the MSCI ACWI ex US Index topping the S&P 500 Index. Small and mid-cap stocks outperformed globally, as we’d expected in the early stages of an interest rate cutting cycle. Market breadth expanded in the US and across the world. September returns from mega-cap bellwethers such as NVIDIA and Apple (not fund holdings) were negative while the broader market appeared solid. This pattern is familiar to us. When growth picks up more broadly, the incentive to pay a steep premium to acquire future cash flow streams diminishes.

- China has had a difficult two years since the end of COVID lockdowns. Fiscal stimulus announced during the quarter should in our view boost its economy, especially since it coincides with easing by western central banks. Europe’s industrial base may get some much-needed benefit from China’s actions, which may begin to filter into market sentiment.

- We believe that, on balance, inflation will not return to pre COVID levels and global growth will be good to improving. That may foster a rebound in cyclical stocks but one more muted than the 2020 recovery. US GDP growth is likely to remain rather good, enough to sustain a fairly strong labor backdrop. We believe equities remain broadly preferable to bonds.

Portfolio positioning

|

Top issuers |

||

|

(% of total net assets) |

||

|

Fund |

Index |

|

|

Meta Platforms Inc (META) |

11.14 |

3.13 |

|

Alphabet Inc (GOOG)(GOOGL) |

6.57 |

4.54 |

|

Amazon.com Inc (AMZN) |

6.41 |

4.35 |

|

Hermes International SCA |

5.63 |

0.19 |

|

Uber Technologies Inc (UBER) |

4.71 |

0.35 |

|

Mastercard Inc (MA) |

4.52 |

1.02 |

|

Novo Nordisk A/S (NVO) |

4.33 |

0.95 |

|

ServiceNow Inc (NOW) |

4.02 |

0.46 |

|

Thermo Fisher Scientific Inc (TMO) |

3.99 |

0.29 |

|

Tencent Holdings Ltd (OTCPK:TCEHY) |

3.76 |

0.93 |

|

As of 09/30/24. Holdings are subject to change and are not buy/sell recommendations. |

||

Invesco Global Focus Fund is a concentrated portfolio seeking businesses that benefit from structural forces permanently altering the way we live, work and communicate, among others. Businesses benefiting from such forces and in possession of durable competitive advantages and strong management teams historically often can compound their shareholder returns at above-average rates for many years.

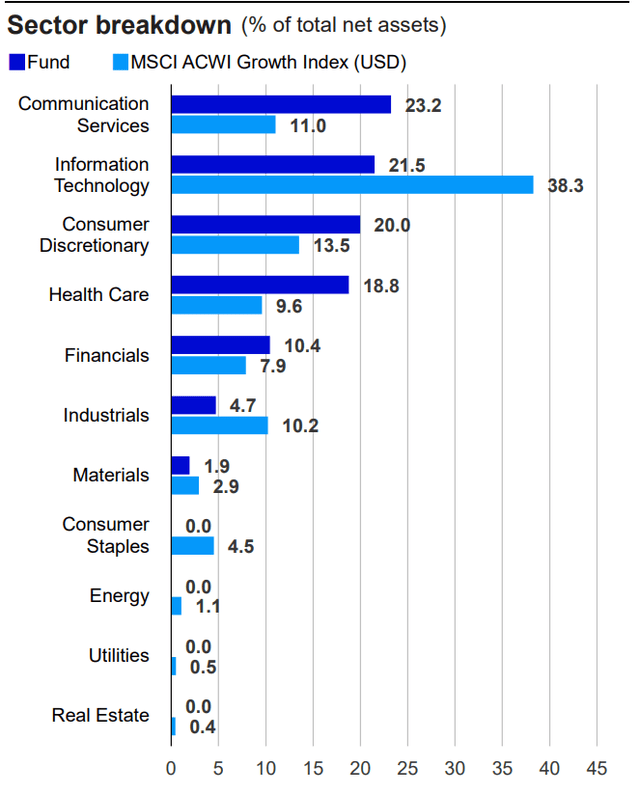

At quarter end, the fund had 38 holdings spread across seven sectors. The largest sector exposures were communication services, information technology, consumer discretionary and health care. Notable sector overweights, compared to the benchmark, were communication services, health care and consumer discretionary. The fund had noteworthy underweights in the IT, industrials and consumer staples sectors, as was also the case in the second quarter.

We initiated three new positions during the third quarter: Qualcomm , Synopsys and TJX.

Qualcomm, previously known as the lead maker of modem chips used in mobile devices, has begun to move into other verticals such as autos and personal computers. Synopsys makes semiconductor design software, which we believe will experience rising demand. TJX, owner of discount retail chains TJ Maxx, Marshalls and HomeGoods, has been a steady grower and we believe it will remain so in the years ahead.

During the quarter, we sold four holdings: Edwards Lifesciences, BeiGene, Infineon and Illumina. Each had performed poorly and for a variety of reasons, we saw little to indicate a robust recovery just ahead.

Performance highlights

|

Top contributors (%) |

||

|

Issuer |

Return |

Contrib. to return |

|

Meta Platforms, Inc. |

13.64 |

1.55 |

|

JD.com, Inc. (JD) |

54.80 |

0.71 |

|

ServiceNow, Inc. (NOW) |

13.69 |

0.58 |

|

Tencent Holdings Limited |

17.28 |

0.57 |

|

Mastercard Incorporated |

12.10 |

0.54 |

|

Top detractors (%) |

||

|

Issuer |

Return |

Contrib. to return |

|

Novo Nordisk A/S |

-17.41 |

-1.01 |

|

CrowdStrike Holdings, Inc. (CRWD) |

-26.81 |

-0.99 |

|

Alphabet Inc. |

-8.83 |

-0.83 |

|

Edwards Lifesciences Corporation (EW) |

-24.89 |

-0.79 |

|

ASML Holding NV |

-19.14 |

-0.62 |

In the third quarter, the fund outperformed in three of the 11 GICs sectors in the MSCI All-Country World Growth Index – communication services, financials and energy. However, performance in those sectors was not enough to offset underperformance in the health care, IT, industrials, consumer discretionary, consumer staples, materials, real estate and utilities sectors.

Contributors to performance

Meta Platforms has delivered a string of strong quarterly results. While some have criticized its artificial intelligence spending, we believe Meta has been effective in monetizing AI in its content delivery and ad placements.

JD.com rose 54% in the last two weeks of September, following China’s rollout of an economic stimulus package to boost consumer and business confidence.

ServiceNow is a process automation software company that has been disproving its naysayers as revenues remained in a steady upward trajectory. Once considered vulnerable to AI, the company has been successfully incorporating AI into its products.

Tencent stock had been rising before the announcement of China’s stimulus plan as the government began to ease approvals of new video games, previously stalled by red tape and changing government policies. Stimulus should in our view benefit the company.

Mastercard reported better-than-expected second quarter earnings that showed strong cross border travel volumes and healthy consumer spending trends.

Detractors from performance

ASML fell during the quarter due to general weakness in high end semiconductor stocks and Dutch restrictions on its exports to China.

Edwards Lifesciences lowered its sales guidance for a key new product that has proven to be a commercial disappointment. We saw little reason to continue holding the stock and sold the position.

Alphabet lost a US justice department anti-trust case during the quarter. While that news is not positive, in our view, the penalties for it are unlikely to be severe and will be subject to a lengthy appeals process.

CrowdStrike issued a software update via Microsoft that contained a code error, causing problems for many customers. Given this was not a security breach, which the company has never experienced, we expect the company to recover over upcoming quarters. We have added to the fund’s position.

Novo Nordisk stock has been weaker in recent months due to a clinical trial setback and mounting evidence that Eli Lilly’s (not a fund holding) weight loss drug promotes more weight loss than Novo’s. Also, Novo still has a supply shortage while Eli Lilly does not, leading to apparent fears of eroding market share.

Read the full article here