The Great Market Commonsense Crisis

Don’t keep your opinions to yourself. From an early age, we are taught that passing judgment is rude-casting conclusions about others based on their appearance, preferences, or beliefs is framed as impolite. As our mothers might say, Don’t judge a book by its cover. Yet judgment is a constant, not-so-silent companion in our minds. We instinctively evaluate people, places, and things, assessing potential threats or opportunities for connection and reward. It’s human nature, a survival mechanism ingrained in all of us. I bet your closest friendships began with some form of judgment, whether conscious or subconscious, as you determined who belonged in your circle.

It may be bad manners, but judging and forming opinions is a key step in any good decision-making process, which is why we do it constantly. But what happens when we’re not equipped to fully form strong opinions on complex topics? Consider the accountant trying to work out the science of dieting and fitness to lose weight – got to crush their New Year’s resolution! In that case, we tend to rely on heuristics or rules of thumb as a guide – the fundamentals we all repeat. We already mentioned Don’t judge a book by its cover, but others include Don’t follow the crowd, Listen to your elders, and for our accountant, Everything in moderation when it comes to his dietary choices. Collectively, we call this library of guidelines and their compliance commonsense. We may not have the exact answer, but commonsense should get you more than halfway there.

At their core, most of the everyday movements of financial markets are driven by the trading of opinions translated into numbers and probabilities. The famous Ben Graham referred to this when he described the stock market as a voting machine – at least in the short-run. The thing about financial markets, which we will softly define as the stock and bond market for the purposes of this letter, is that we are all forced to participate. Whether our background is in accounting, hair dressing or dentistry, we all are pressed in some capacity to save and grow our savings over time, mostly for retirement, but not everyone is equipped for the task. So, instead of drawing up an intricate financial model for Apple stock, most people rightfully rely on commonsense (or heuristics if you want to be fancy about it) as their guardrails. Much of that commonsense comes in the form of buying low-cost index funds, diversification and working with investment managers you trust.

Here is the rub on why this all matters to us. If you understand that common sense is one of the principal forces in financial markets from which market movements and rationality are derived, we can measure it and take the temperature of markets. As Warren Buffett would say: the less prudence with which others conduct their affairs, the greater the prudence with which we should conduct our own. Intuitively, as we observe more and more apparent violations of commonsense or worse, heuristics morphed into opinion – think the taxi driver handing out stock tips, we should and do calibrate our own appetite for risk.

At CDT, our entire quantitative risk framework is designed to gauge the commonsense level of the stock market – are people acting rationally? Unfortunately, today, we don’t think so in fact, we believe we may have a commonsense crisis on our hands. Quantitatively, our math suggests the probability of loss is significantly above average, but if we are just looking at numbers alone, well then, we may lose the forest through the trees. There are blatant violations of commonsense behind the numbers, so before we stick our finger in the air and talk about our math, let’s first make some observations around these violations.

Commonsense Violation #1 Don’t follow the crowd.

Artificial intelligence was the sexy term of 2024. Its enablers, users, and posers dominated markets and captured the corporate zeitgeist. In the marketing of every Fortune 500 company, there’s now a nod to this transformative technology and its world-changing potential. Tremendous productivity gains are set to permeate the global economy, from agriculture to banking. At CDT, along with our partners at DNSC.AI, we’ve built bespoke AI tools to collect and analyze unstructured data on insiders and insider transactions – it’s game-changing!

The crowd. While this evolution in AI is going to change the world, market expectations for the technology have become unhinged. The crowd, which is more like an exuberant mob, anointed the Mag 7 with spectacular, nonsensical valuations based on the premise that AI will be an amazing, money-printing growth engine for these companies – and the truth is it likely will be. The problem is that the math just isn’t mathing.

Let me explain what I mean by picking on the world’s most valuable stock, Apple Inc. (AAPL). For background, Apple does not have a robust homegrown AI platform, nor does it have a plan to meaningfully monetize AI from Apple users. Right now, from our perspective, Apple’s, Apple Intelligence strategy of implementing third-party AI tools to stay competitive will likely be more of a cost of doing business than an avenue for sales and yet in 2024, the stock soared+33% based on the AI dream as exemplified by the quote below.

“A golden era of growth for Cupertino is now on the horizon into 2025.”

– Dan Ives, Wedbush Securities

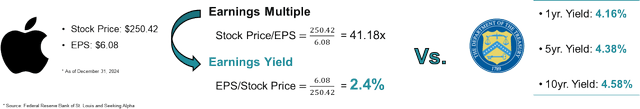

Divorced from reality and driven by this AI craze the big run in AAPL stock in 2024 has translated into an earnings multiple of 41x. As a quick digression, I understand that most people don’t fully appreciate earnings multiples. How the heck do you know what is a good vs. bad multiple? So, I will take another tact. Instead of thinking about the earnings multiples from now on, we will talk about earnings yields, which I think are more intuitive and just more common in everyday life – I bet you know the exact interest rate you pay on your home mortgage.

A 41x earnings multiple is the same as an earnings yield of 2.4% (see the chart below) meaning for every $100 you invest in AAPL stock, at the end of the year, Apple is expected to return $2.4 back to their shareholders in the form of earnings (‘EPS’). Even if you did not have a good benchmark to base that yield on, I think most of us would say that 2.4% is pretty lousy. For comparison, if you invest that same $100 in treasury bonds, you can get yields between 4-4.6% or $4 – $4.6, nearly double the income.

Critics of that comparison may argue Apple’s earnings are dynamic and can grow over time. Good point, so how much would Apple’s earnings per share need to grow to compete with treasuries?

An astounding 71% to 89% depending on the treasury. That’s simply unrealistic; the law of large numbers makes it nearly impossible for a company generating $93.7B in net income to grow that quickly. Moreover, earnings would need to grow even faster to justify investing in Apple over treasuries. The investment thesis for Apple is even murkier when you factor in stagnant sales growth since 2022 and the uncertainty of whether AI will drive costs or earnings. Yet the crowd keeps buying, common sense valuations be damned.

As we mentioned Apple is not alone, below is the Mag 7 cohort accompanied by their respective forward earnings yield. It is worth noting that not all yields are the same and not all growth prospects are the same and therefore not all valuations are equal. However, we challenge you to do the math to figure out how much the earnings of each company would have to grow in order for them to be competitive with boring old treasuries. We know that the answers are going to underscore the madness of the crowd.

Note: The Tesla earnings yield is not a mistake; spoiler, their earnings would have to grow 677%

Forced groupthink. Stoking the AI – groupthink are passive investment strategies.

Today, almost all retirement accounts are stuffed with some form of set-it-and-forget-it ETF or mutual fund based investment vehicles that aimlessly follow the performance of the S&P 500 index (SP500, SPX). That seems innocent enough, since most people regard this strategy as a tried-and-true way of gaining equity exposure in one’s portfolio without the required stock analysis homework/guesswork. For decades that plan has worked remarkably well, the problem today is that this is not your grandfather’s S&P 500 index.

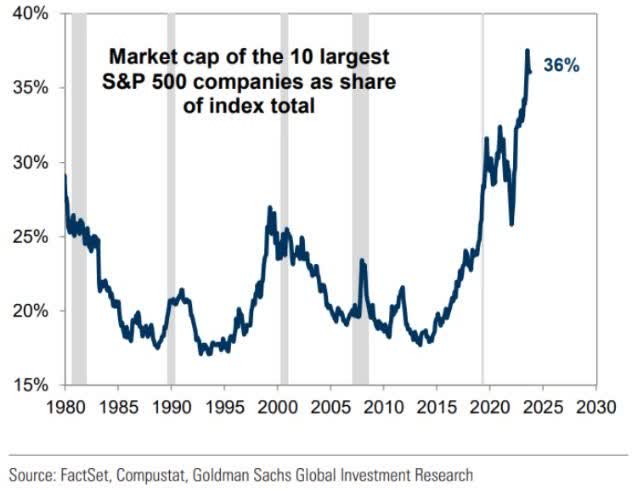

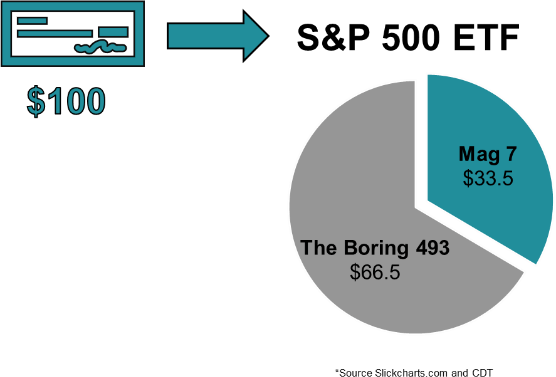

Many don’t realize the S&P 500 is now the most concentrated it has ever been. Most investors think purchasing an S&P 500 investment vehicle like the (SPY) means they are purchasing a basket of 500 stocks in equal amounts – wrong. The S&P 500 is a market capitalization-weighted index, meaning larger companies like the Mag 7 have much higher weightings than their smaller counterparts. Historically, this disparity has fluctuated. From 1980 to 2020, the top 10 companies’ weighting ranged from the mid-teens to mid-twenties, with occasional spikes. Today, it’s nearly 2x! For every $100 invested in an S&P 500 ETF or mutual fund, $36 goes to just 10 of the 500 stocks. At the time of this writing, the Mag 7 alone accounts for 33.5% of the index, with Apple at a staggering 7.5%.

When it comes to stocks, both professional and retail investors have embraced the wisdom of dollar-cost averaging into low-cost, passive S&P 500 ETFs and mutual funds. This practice of monthly contributions to brokerage, retirement, and pension accounts is automatic as people work and save. According to Morningstar, $115B flowed into U.S. mutual funds and ETFs in November, with the majority likely going to S&P 500 vehicles. Unknowingly, these automatic retirement contributions are fueling an index-level concentration bubble driven by a positive feedback loop caused by the market weight design of the index with no historical context.

The more the crowd works, saves and invests their savings in the S&P 500, the more the top names get a disproportionate amount of the capital, the larger their weight in the index – dry, rinse, repeat. This feature of the market-cap weighted index taken to the limit has broken the index as we will discuss below.

Now consider that a lot of AI frenzy energy is being directed toward the same names that benefit in this S&P 500 index market cap feedback loop, and you get the world’s most valuable companies trading at unsustainably high valuations – how the heck can anyone really justify Tesla trading at an earnings yield of just .6%?

Before we leave this section, let me be clear: our gripe is not with the companies of the Mag 7 – they are national treasures. Our objection is with the stocks, there’s a big difference. The crowd is pushing valuations to extremes on the world’s most important companies, and when it reaches a tipping point, I’d suggest we all heed that old commonsense adage: Don’t follow the crowd.

The next two sections are going to be shorter, but I think they are pertinent to our overall message.

Commonsense Violation #2 Everything in Moderation.

Things got weird in December. Markets from the stock market to cryptos are feeling the buck of Animal spirits. Take what must be the most appalling example of risk-taking I think that I have ever seen, Fartcoin. I had to ask AI to summarize what the absolute heck (I wanted to say something different) a Fartcoin is, so here is what I got from Perplexity:

“Fartcoin is a humorous meme cryptocurrency built on the Solana blockchain that allows users to submit fart jokes and memes to earn tokens, featuring a unique “gas fee” system that produces a digital fart sound during transactions”

– Perplexity.AI

From a societal standpoint, the constant gamification and gambling of people’s savings is concerning. It’s like a good joke that was funny the first time but lost its charm on the second attempt and is now just sad. Today, Fartcoin has a market cap of $1.5B, with a “B”. The level of financial insanity has reached new highs. While I believe consenting adults should be free to do whatever they want including participating in crypto manias, one can’t help but notice that we’ve normalized extreme financial risk-taking. With the stock market well beyond rational valuations, cryptos surging, and meme stocks back in the headlines, it’s clear that commonsense risk management isn’t even part of the conversation.

Here we come back to everything in moderation. We typically rely on this commonsense wisdom when it comes to our diet, but I think it’s the perfect framework for our risk appetites. If the world followed a proper risk diet, the Fartcoins of the world wouldn’t exist-side note, I just audibly laughed because I never imagined using the word “fart” in my annual letter.

Risk-taking isn’t just key to building wealth but personal growth as well. Leaps of faith, like asking someone out on a date or discussing a promotion at work, are how we build successful lives. But when risk-taking goes to extremes and leads to unproductive or destructive endeavors, commonsense levels are clearly low.

Commonsense Violation #3 Listen to Your Elders.

Berkshire’s ability to immediately respond to market seizures with both huge sums and certainty of performance may offer us an occasional large-scale opportunity. Though the stock market is massively larger than it was in our early years, today’s active participants are neither more emotionally stable nor better taught than when I was in school. For whatever reasons, markets now exhibit far more casino-like behavior than they did when I was young. The casino now resides in many homes and daily tempts the occupants.

– Warren Buffett, Berkshire 2023 Annual Letter

At the end of the day, the market is 22x earnings and given what is going on in the world, the Middle East and given what’s going on domestically, given our fiscal situation, I would think the market is very fully priced and the market is expensive against interest rates, it is up a lot and interest rates are up.

– Leon Cooperman, CNBC Interview

“The market isn’t just making all-time highs. It is, by many measures, the most expensive stock market that we have seen since the founding of Greenlight”

– David Einhorn, CNBC Delivering Alpha Investor Summit Interview

Are you listening? We think you should be.

Above the Clouds 2025

We are not paid to keep our opinions to ourselves. We have talked at length about an expensive stock market marked by a conspicuous disregard for commonsense. Before we dive into how we navigate this environment, I want to clarify an important point about the stock market and the S&P 500. Until AI takes over, people often say they’re going to “Google” something-the term Google has become a verb for looking something up online. In the same way, the S&P 500 Index has become synonymous with the “stock market.” When the index was first created in 1957, it was meant to represent the performance of the average stock over time. Today, it’s clear that it’s failed in this role, given the weighting distortion we discussed. How can we know how the average stock is performing when Apple’s weighting is 38x larger than the average? So, moving forward, we’ll distinguish between the stock market and the S&P 500 Index.

Underwriting Risk. When we talk to clients and prospects, we’re reminded of the hedge fund industry’s poor reputation for risk management. Part of this stems from popular culture, which often focuses on the implosion of irresponsible actors-think of the countless articles, books, and movies about the 2008 financial crisis and its lack of accountability. But in fairness, this bad reputation also stems from the fact that many hedge funds just don’t do much hedging. However, let me be clear: a good hedge fund isn’t focused on near-term performance but always prioritizes the safety of their partners’ capital.

In that spirit before we invest a penny of our capital, Step #1 is to Underwrite Risk. We do this using a quantitative framework that merges data points and probability models related to our proprietary insider sentiment data, stock market valuation, and leading economic indicators to assess the probability of risk – that is, the likelihood of a stock market decline. These models gauge the collective commonsense of market participants. We didn’t start this letter by throwing a wall of numbers spit out by our risk management process at our reader; instead, we outlined a series of remarkable violations of commonsense first. We did this because, our models are numbers, not storytellers. If we’d started with the numbers, we might have lost your interest early assuming we haven’t already. The interesting thing is that in practice, the opposite is true for us. When underwriting risk, there’s no room for personal bias or sentiment. When our framework detects low commonsense levels and high-risk tolerance in markets, we don’t care much about the why. Our focus is the probability of an adverse outcome and adjusting our capital accordingly we can figure out the why in our spare time.

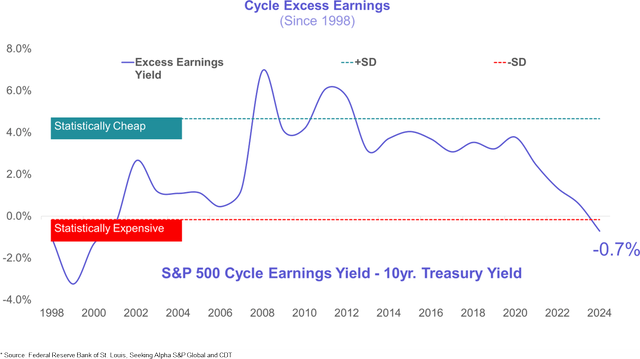

Let me show you what that looks like in practice. Below we have two datapoints, the Excess Earnings Yield of the S&P 500 and a tally of margin debt over the last twelve months – both of the probability models tied to these datapoints suggest that caution is warranted.

As with the earnings yields of the Mag 7 that we discussed earlier, the market’s earnings yield is the sum of the earnings from all 500 companies in the index divided by the index value. To calculate the excess earnings yield, we subtract the 10-year treasury rate (US10Y) from the earnings yield – recall that we did something similar with our Mag 7 valuations. One difference in our calculation is that, instead of using analyst earnings per share forecasts, we use the historical earnings growth rate over the past 25-year profit cycle and extrapolate that trend into the future. From this perspective, stocks are the most expensive they’ve been since the 1990-2000 DotCom Bubble. Simply put, a negative excess earnings yield for stocks suggests that bonds are the safer, better investment. Our probabilistic risk algorithm tied to this dataset indicates a near 70% chance of stock declines in the near-to-medium term. Under more normal conditions, the probability would be nearly 70% that the S&P 500 gains. This high-risk probability is the mathematical manifestation of the Mag 7 and passive ETF bubbles we discussed. Don’t follow the crowd.

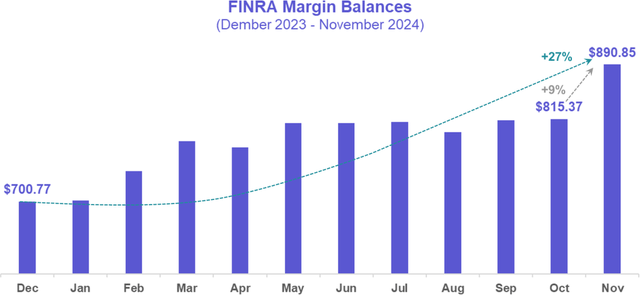

Lastly, when we talked about exuberant animal spirits, we can map that behavior as well. Buying stocks on margin means borrowing capital from a brokerage or bank and purchasing stocks with that borrowed money – it is a highly risky behavior. The abuse of margin is so dangerous that our friends at FINRA or the Financial Industry Regulatory Authority are tasked with keeping tabs and reporting that data to the public.

Have you ever heard the analogy of market sentiment on a pendulum? Sometimes it swings left to overly cautious, sometimes it swings right to overly excited. As it turns out, we can put some math behind that analogy. In our experience, margin levels are a strong indicator of the animal spirits and investor tolerance for risk. No surprise given our discussion up until now, margin levels are on the rise as animal spirits buck, which suggests that the pendulum may have swung a little too hard right – especially after the presidential election, speculators added $85B to margin balances, a +9.25% rise in a single month. Everything in moderation.

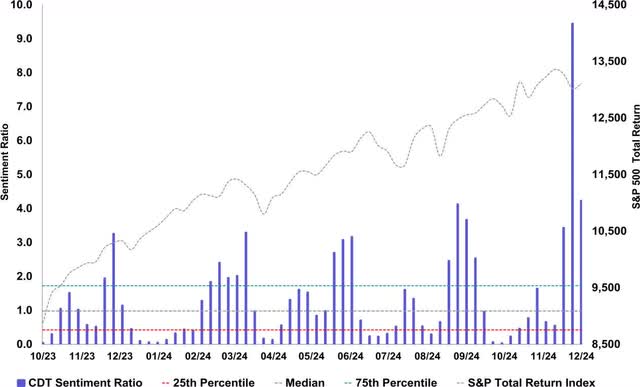

Insiders. At this point, we are a few pages deep and we have not yet spoken about the most important topic, insider activity- our bread and butter. There is something incredibly interesting happening with insider activity. At CDT, leveraging the power of insider activity is our commonsense way of gaining an edge on the stock market. With unfettered real-time access to their business operations and management, we firmly believe that corporate insiders possess and routinely exploit an asymmetric information advantage over the rest of the market.

Earlier, we distinguished between the S&P 500 and the stock market for a reason. Despite our view on the expensive S&P 500, the stock market itself isn’t that overvalued. In fact, Capital Group has noted that the market trades at just 15.5x forward earnings estimates when the Mag 7 are excluded from the index. A 6.4% earnings yield is something we can get excited about, and apparently, so can insiders. As mentioned, the S&P 500 was meant to measure the performance of the average stock. Historically, before the stock weight distortions started to appear in 2023, there was a very strong correlation between the probability of a market decline and total insider sentiment. Today, that relationship has waned, but remains very reliable. As insider sentiment rises, financial risk declines; as sentiment falls, risk increases.

Throughout 2024, we have observed healthy levels of insider activity. We think that there is good reason as to why our Insider Sentiment probability model is not suggesting a high probability of risk despite the warnings from our other models. As more capital is placed with S&P 500 proxy investments, the less attention is being paid to their stock and therefore, insiders are responding by picking up their unloved shares on the cheap – and we want to be right behind them.

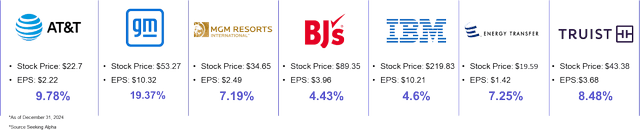

These healthy levels of insider sentiment have been a boon for CDT. Our portfolio is the most diversified it has ever been as insiders from all parts of the industrial complex are actively purchasing their stock; 40 total investments across 13 industries with a weighted-earnings yield of +8.2%. Below is the CDT 7, our largest allocations that collectively account for 43% of our overall portfolio.

It is important to note that except for AT&T (T) which is contending with some legacy business and home phone line challenges, the remaining CDT 7 are slated to close out their fiscal year 2024 with faster sales growth than Apple, while at the same time offering a meaningfully better value. With such a grave difference between the stock market and the S&P 500, it is not an exaggeration to say that it feels like there are two markets today – the Mag 7 and The Boring 493. Insiders and by default, CDT is finding tremendous value in the latter.

The End. Before closing this letter, I want to touch on how all the data points we discussed feed into our hedging policy. No shorting, no derivatives, no leverage, and no market timing. Our quantitative framework is the financial equivalent of sticking our finger in the air to gauge the market’s direction. When our math shows commonsense principles being ignored and market temperatures running hot, there’s no reason to stand on the tracks. Practically, this means when we see the stock market as expensive, we rotate our capital into cash and short-duration treasuries, which we call our Reserve. When we see an opportunity in a cheap market, we use the liquidity in the CDT Reserve to purchase stocks favored by the world’s most knowledgeable investors: insiders.

By forgoing costly directional market bets, we set ourselves up for a tails, I win, heads, I win scenario. Today, in light of all the challenges we’ve covered, we are~16% reserved. If we’re right and we believe we are, we’ll likely see some form of S&P 500 (perhaps not a market-wide) correction this year. In that case, our reserve should buffer the impact, while giving us a great opportunity to deploy idle resources currently sitting in short-duration fixed income and cash earning 4-4.5%. If there’s no market correction, even better. We believe the stocks we own are so undervalued that they should generate a more than generous return for our partners.

I am eager to stop writing and to get started on this plan.

Have a wonderful New Year ahead and we look forward to updating you again in February.

Best Regards,

David Papson & The CDT Team

|

Legal Information and Disclosures: This memorandum expresses the views of the author as of the date indicated and such views are subject to change without notice. CDT Capital Management (“CDT”) has no duty or obligation to update the information contained herein. Further, CDT makes no representation, and it should not be assumed, that past investment performance is an indication of future results. Moreover, wherever there is the potential for profit there is also the possibility of loss. This memorandum is being made available for educational purposes only and should not be used for any other purpose. The information contained herein does not constitute and should not be construed as an offering of advisory services or an offer to sell or solicitation to buy any securities or related financial instruments in any jurisdiction. Certain information contained herein concerning economics trends and performance is based on or derived from information provided by independent third-party sources. CDT believes that the sources from which such information has been obtained are reliable; however, it cannot guarantee the accuracy of such information and has not independently verified the accuracy or completeness of such information or the assumptions on which such information is based. |

Original Post

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Read the full article here