Held in Kazakhstan’s Congress Center, an organic shaped, sci-fi structure that looks like the kind of out-of-this world Mother Ship design seen from Cupertino, California to Abu Dhabi in the Emirates, Astana held its international forum last week. Astana, the capital city of Kazakhstan, has been trying to showcase its self as a Central Asian leader since 1996, culminating with the World Expo in 2017.

This event, dubbed the Astana International Forum (a revamp of the old Astana Economic Forum), comes at what a Chinese proverb calls “an interesting time”. It comes at a time when the emerging world is pulling away from the West. Astana is caught in the middle, as is all of Central Asia.

Geopolitical crises are reshaping national alliances and global trade. Kazakhstan, long aligned with Russia’s sphere through the Eurasia Economic Union and Collective Security Treaty Organization, is more reliant on China’s capital than it is the U.S.’ and Europe’s, but wants to balance its position with access to Western tech, expertise, and know-how. The new Astana stock market (AIX) is basically all Nasdaq equipment, and its legal structure is based on English law and financial market rules out of London.

The world in which this new Central Asian economic and investor forum takes place is in a tug of war between the West and the East. Looking at a map of the Eurasian landmass, one sees Kazakhstan smack dab in the middle of it all.

This spring, the BRICS nations saw an influx of countries looking to join. Talk of ‘de-dollarization’ was everywhere, even if dubbed futile by some, all in an effort to avoid trade disruptions caused by Western sanctions on Russia and China. Even France’s President Emmanuel Macron agreed in an interview with Politico that the politicization of the dollar via sanctions was yanking the developing world out of the West’s orbit.

Kazakhstan’s President Kassym-Jomart Tokayev, an experienced diplomat and a fluent speaker of Chinese and Arabic, can read the tea leaves. Europe and the U.S. are against Russia. The U.S. is bringing Europe in to restrict trade and investment with China, with varying degrees of success. China and Russia are Kazakhstan’s top two trading partners. But the U.S. and The Netherlands are big sources of foreign direct investment into Tokayev’s country.

Then there is the Ukraine war, which makes for volatile commodity markets. The war leads to worst-case scenario planning for an expanding war zone.

“We are also witnessing the return of earlier divisive ‘bloc’ mentalities unseen for 30 years. The forces of division are not purely geopolitical. They are also motivated by economic undercurrents, too,” Tokayev said in his opening remarks. “Economic policy is openly weaponized. These include sanctions and trade wars, targeted debt policies, and reduced access or exclusion from financing. These factors are gradually undermining the foundation upon which the global peace and prosperity of recent decades. This fuels social unrest and division within countries and tensions between countries. Rising inequality, social divides, widening gaps in culture and values: all of these trends have become existential threats.”

The conference ended on June 9.

José Manuel Barroso, Former President of the European Commission, Non-Executive Chairman of Goldman Sachs International and Chairman of the Bill Gates-funded Global Alliance for Vaccines and Immunization, said post-Covid and post-Ukraine war, the world will “no longer be the same.”

“We don’t only have the war in Ukraine, you have this increased risk of decoupling between the U.S. and China,” he said. “You will have economic fragmentation, technological fragmentation. And as I am no longer in public service, and I can get more forthcoming day by day and can tell you…this is a very bad moment for multilateralism. Barroso was one of the people that helped create the G-20, which is made up primarily of emerging market nations. “Now, there is no trust.”

On matters of economic growth, things are not much better.

“The global economy is not in good shape at all,” said Ivailo Izvorski Chief Economist for Europe and Central Asia region at the World Bank. “Whether it is growing at 1% or 2% — let me tell you what 2% means. This is the third weakest global expansion of the last three decades. If not for India and China, the emerging economies would grow one percentage power lower than last year.”

What They Talked About

The Astana International Forum definitely was not anti-Western. There was no talk about how to do workarounds to sanctions or settling trade in currencies other than the dollar. Some 4,000 people attended the two day event, which was a lot like other hybrid economic and political events, with some Davos flare thrown in.

The focus was all on geopolitical risks, but also panel discussions on sustainability issues such as securing supply chains for agriculture (the region could become an alternative source of food commodities for China and the Middle East), women leadership, information control in the era of artificial intelligence, and of course the preferred topic of the Davos-crowd — climate change.

Some panels were centered on Kazakhstan and Central Asia.

Earlier this month, Kazakhstan declared that the Caspian Sea, which it borders, was dangerously low and warranted a ‘state of emergency’. The government attributed the shrinking Caspian to dropping water levels in two prime feeder rivals, the Ural and Volga Rivers. A lack of snowfall this winter, increased water consumption, and the retention of water for use at hydroelectric power stations in Russia have led to a drier Caspian this year.

Water shortages in Central Asia are getting worse because of two key rivers: Amu Darya in the South, and the Black Ili, which are planned to be dammed by the Taliban and China, respectively.

The Caspian Sea shoreline has reportedly retreated by four feet since 2005. Kazakhstan called it an emergency this year. The Sea is a major source of economic might for Kazakhstan, not just as a source of freshwater but also as a source of hydrocarbon development and as a transportation route known as the Middle Corridor connecting Kazakhstan to Azerbaijan, Georgia and Turkey.

China Communist Party Chairman “Xi has been talking about this Corridor for ten years now. There is a huge amount of work to make this happen, with rail, and road,” said Nurlan Sauranbayev, the CEO of Kazakhstan Temir Zholy (KZT), the state-run railway company working with China on the Belt and Road Initiative. KZT’s position was that developing the Middle Corridor was nothing short of a moon landing, and would require long-term capital and commitment to keep developing it.

Wiebke Schloemer, Director for Central Asia and Turkey, at Astana International Financial Center understated the complexity of this project. “There are huge investment needs. The moment you make an estimate in Kazakhstan, you must think beyond Caspian Sea. The investments are huge and there is a lot of scope for the private sector to come in,” she said during her panel discussion on the topic. “This is a transformative endeavor.”

From the perspective of China, Yang Zhao, a macroeconomist with Hong Kong-based investment manager CICC Global, said that ten years ago, when the One Belt One Road Initiative began, it created a reasoning to build this corridor in the first place. But Zhao seemed to have sprinkled some cold water on it.

“Development can be understood as technological innovation mainly,” he said, suggesting that Beijing and CICC might only be lukewarm about investing in the Middle Corridor. Geopolitical strains with Europe also might make it less interesting unless China sees Turkey as a destination market rather than a pit-stop en route to Western European consumers.

“Kazakhstan and China are complimentary to each other,” Zhao said. “The countries in the region will have plenty of room to invest and coordinate on different things to develop the region.”

One way to share in the global demand outlook is a sector Kazakhstan knows well – mining. The push for a de-carbonized economy has led to new demand for rare earth minerals.

The United States Geological Survey has compiled an inventory of 384 significant occurrences of rare earth elements in Kazakhstan. For comparison, other Central Asian nations have much less: Kyrgyzstan has 75, Tajikistan has 60, Uzbekistan has 87, and Turkmenistan has only two known deposits of rare earth minerals.

“Kazakhstan and Central Asia may become a source of mining and refining of strategic minerals and Rare Earth Elements,” Ariel Cohen, a Senior Fellow at the Atlantic Council Eurasia Center and Managing Director at the International Tax and Investment Center, said in a panel discussion.

Nick Popovic, Global Head of Glencore Copper and Zinc Department – said the demand for rare earths comes from the Western world’s ESG financing goals. ESG stands for Environment, Society and Governance, and many lenders in Europe use this as a measure of companies to lend to and invest in. For automotive, electrification was a way to gain access to these funds. This requires more mined goods, including rare earth metals.

He said China is the big player here in both mining and processing. And the West is struggling to find supply elsewhere. “You also don’t want to commit to such a large investment when you are out of date by the time you’re project is ready,” he said in a warning to Kazakhstan. “This is an entirely new industry. What we are producing today for car batteries may not be needed years from now.”

Gaye Christoffersen, a former professor of International Politics at Johns Hopkins University’s Nanjing China campus, disagreed. “Japan is investing in Central Asian rare earths. I do think it is very important for Kazakhstan to invest in this space,” she said, wondering out loud on why the United States is not invested there.

Nicolas Maes, CEO of Orano Mining, a uranium miner, said for Kazakhstan to develop the rare earths it has, it would either must process some in China, or focus on the lighter rare earth metals to get involved in the market in a timely manner.

“The industries that will be using rare earths are mainly located in the U.S., Europe, and Japan. They are operating on a free market basis. And they cannot beat China on cost because of whatever reason, including subsidies, and that killed the rare earths industry everywhere on this planet,” Maes said. “We hope there will be other options to China. This is not good for the world to have only one option. That becomes a matter of division and not of efficiency. For a country like Kazakhstan, you have the light rare earths which are feasible and there are deposits here. Heavier rare earths not worth it because you cannot process it here, so you would have to send it to China.”

Astana International Forum is the reboot of the now defunct Astana Economic Forum, which was held between 2008 and ended in 2019. It coincides with St. Petersburg International Economic Forum in Russia, which this year is a shadow of its former self. For those who don’t want to go talk to Vladimir Putin or have had their companies destroyed because of the sanctions and complexity of dollar transactions with the Russians, Astana is the place to be.

“The emerging markets still have higher than average growth rates – about 4%– compared with advanced economies which will expand by only 1%. This highlights the importance of emerging markets to investors at this time,” wrote Serik Zhumangarin, Kazakhstan’s Deputy Prime Minister, in an op-ed published by Qatar-based news agency Al Jazeera on June 6.

Kazakhstan is considered a frontier market by MSCI.

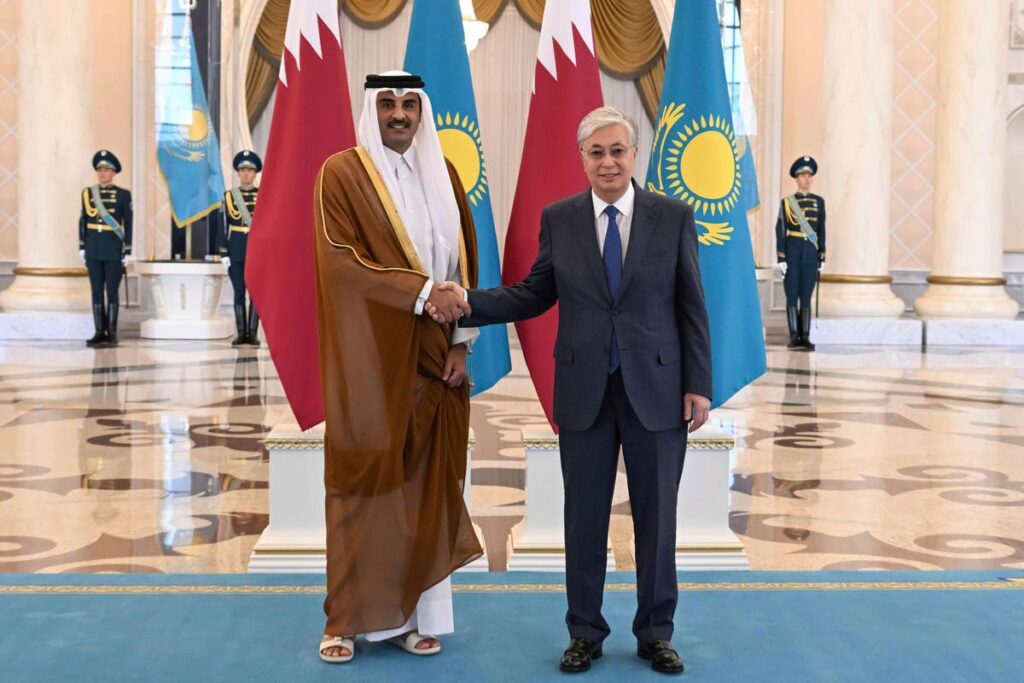

On the sidelines of the Forum, Qatar signed some $500 million in potential investment deals with Kazakhstan, according to Kazakh Invest. The Emir of Qatar was one of several world leaders attending. It was the largest delegation visit from Qatar in the past 30 years. Around 10 Qatari companies visited Astana during the event, leading to MOUs between Elegancia Healthcare and the government to build a medical hub in Astana.

Abdulla Aripov, Prime Minister of next-door neighbor Uzbekistan, and Sadyr Zhaparov President of the Kyrgyz Republic also attended, along with International Monetary Fund director Kristalina Georgieva.

“We are a dynamically developing market,” says Grigory Pogosyan, a Kazakh investor and Partner at Pogosyan and Partners, a Central Asia-focused closed-end private equity fund.

“Over the past year, Tokayev has traveled half the world, and everywhere he goes, in addition to meetings with officials, he has met with business representatives, and has invited them to see Kazakhstan. We are seeing a boom in entrepreneurship here. I would call this an emerging market,” he says.

“There is probably no event in all of Central Asia that could bring together so many world-class politicians, journalists, businessmen, and experts on various issues all in one place,” he says. “Kazakhstan acts as the main consolidating force for all of Central Asia. Tokayev is promoting a new brand of open and progressive Kazakhstan to the world.”

Read the full article here