In early March of this year, concerns raged about a banking crisis that had begun. The worry was that it could cause a domino effect, with one banking failure resulting in the failure of additional firms. A number of banks did fall during this time, largely those with high amounts of uninsured deposits and ones that had a great deal of exposure to some of the riskiest companies out there. But as I have been pointing out since then, it seems as though the market threw the baby out with the bathwater. Many financial institutions saw steep declines in the price of their shares. This occurred even when the declines were not warranted.

Since then, things have died down. But many of the financial institutions that saw their share prices collapse have not staged a full recovery. One such example can be seen by looking at investment and banking giant The Charles Schwab Corporation (NYSE:SCHW). From its closing share price at the end of February, which was about two weeks before the bottom fell out, until shares hit their 52-week low, the price of the stock plummeted 41.9%. Since then, we have seen a nice recovery. But even with that recovery, shares are down 28.4%. Previously, I saw this as a buying opportunity. I don’t own a lot of the stock, but it is one of the 8 different holdings that I currently own. Having said that, I do recognize that my stance on the company should change based on what data becomes available. Fortunately for investors, management just revealed some additional results. And while the company has shown some weakness in some respects compared to last year, the overall financial picture for the company is very solid.

Still an excellent prospect

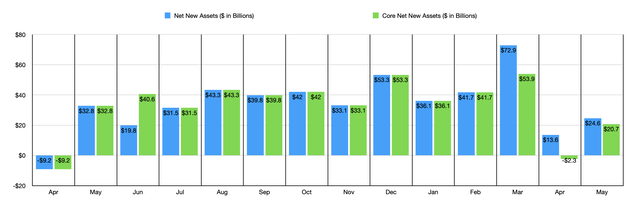

Just the other day, the management team at Charles Schwab revealed some financial data covering the month of May. While I don’t believe it’s necessary to go over each individual data point, there are some that are incredibly important to cover. For starters, the one that I think is most important, is the value of net new assets that comes onto the company’s platform. For the month, this number totaled $24.6 billion. Even though this represents a decline compared to the $32.8 billion that the company experienced the same month last year, it did represent a near doubling compared to the $13.6 billion recorded for April.

Author – Financial Data

There is another way to look at this particular metric. The alternative version of this metric is referred to as core net new assets. This strips out significant one-time events, such as those involving acquisitions or divestitures, or large contracts that expire or are won by the company. Through this lens, the picture looks even better. For the month of May, core net new assets came in at $20.7 billion. This compares to the $2.3 billion outflow experienced only one month earlier.

Author – Financial Data

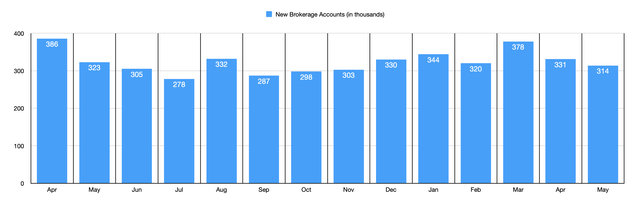

There are, obviously, other important metrics that we should touch on. Another one that I place a high amount of value in involves the brokerage account activities of the firm. The first metric that pops to mind is referred to as the new brokerage accounts. These are new accounts with the company’s brokerage arm that are opened up during the month. In May, this number came in at 314,000. This was down from the 331,000 reported one month earlier and compared poorly relative to the 323,000 reported the same month last year. But it is important to keep in mind that it is still well within the historical average for the enterprise. Over the past 12 months, there have been five months where the number of new brokerage accounts was lower than what the company reported for last month.

Author – Financial Data

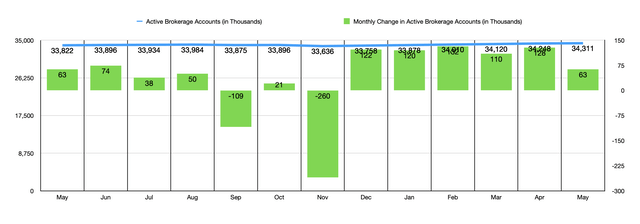

There is a difference between the number of new brokerage accounts and the number of active brokerage accounts. Not every account that ends up being opened is used on a regular basis or is used at all. During the month, the company recorded 34.31 million active brokerage accounts. That was 63,000 higher than the 34.25 million reported one month earlier. Over the past 12 months, Charles Schwab has seen this number bounce around quite a bit from month to month. The best month during this time was February of this year when the company saw 132,000 additional active brokerage accounts compared to what it reported for January. The worst month was in November of last year. Compared to October, the company reported a decline of 260,000 active brokerage accounts. So to see this number come in positive at all, particularly during such difficult times, and when considering that it matches with the company reported the same time last year, is a positive.

Author – Financial Data

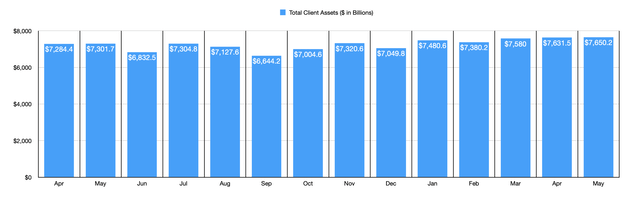

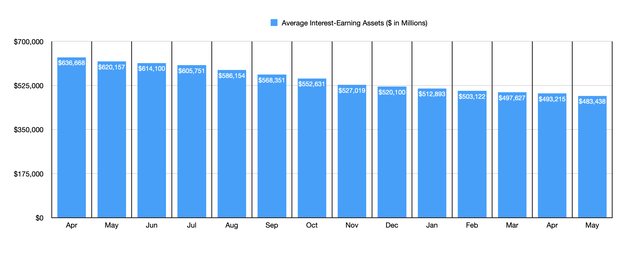

Due to attractive market returns and continued net new assets, the company has seen the total value of its client assets grow for the third consecutive month. In May, this number came in at $7.65 trillion. That’s up from $7.38 trillion reported for February of this year. To say that everything was great for the business. Average interest earning assets for the company continues to drop. In fact, this metric has declined each month for over a year now. Back in April of last year, for instance, it totaled $636.7 billion. By April of this year, it had declined to $493.2 billion. And last month, it came in at $483.4 billion. The decline in interest earning assets on its books, combined with a ‘temporarily compressed’ NIM (net interest margin) should result in revenue coming in between 10% and 11% lower than with the company experienced in the second quarter of the 2022 fiscal year. Analysts had been forecasting a decline of about 6.4%.

Author – Financial Data

For those wondering, the NIM is being compressed in part because of certain account balances, including borrowings and retail CDs, that carry with them higher interest rates than the company would normally have to pay. The CFO of the company, Peter Crawford, stated that the company plans to repay certain borrowings that are weighing down on it before the end of the 2024 fiscal year. That is certainly unappealing. But it’s not the end of the world.

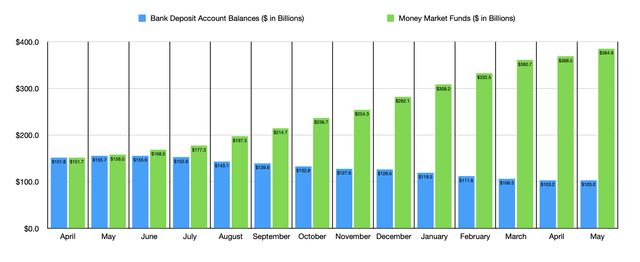

There is one more thing that I would like to touch on. Part of the company’s asset problem is that overall bank deposit balances have been on the decline as well. With higher interest rates, depositors are seeking more attractive yields. And that has served as a draw on pretty much the entire financial industry. When it comes to Charles Schwab, the pain has been palpable. Back in May of last year, for instance, the company had $155.7 billion of bank deposits. That number has declined every month since then, and now totals $103 billion. The good news is that the declines on this front are slowing materially. The drop from April to May, for instance, was only about $200 million. At the same time, the company is seeing a nice inflow of capital into its money market funds. These experienced an all-time high last month of $384.9 billion. That represents a nice improvement over the $368.5 billion reported for April. And it is significantly higher than the $158 billion the company had one year ago.

Author – Financial Data

Takeaway

It would be disingenuous for me to sit here and tell you that everything is going fantastic for Charles Schwab and its shareholders. Because of current economic circumstances and concerns over the banking industry, the company has faced some pain. The good news is that it continues to grow its core operations and, in the long run, the larger amount of assets on its books will ultimately create more value for its investors. This will take some time. But given what the long-term outlook is, I have no problem keeping the company rated a ‘strong buy’ for now.

Read the full article here