Empire Petroleum’s (NYSE:EP) liquidity is starting to get fairly low now, after weaker commodity prices and changes in working capital reduced its cash balance by approximately $5 million in Q1 2023. Empire’s liquidity is now at $7.1 million and it may end up generating slightly negative adjusted EBITDA in upcoming quarters based on current strip prices, unless it can significantly increase its production levels.

Empire may thus need to do an equity offering to give it more funds for operations and its 2023 development plans. I am keeping my estimated value for EP stock at $6 per share in a long-term $75 WTI oil environment, subject to adjustment for what it does to address its liquidity.

Q1 2023 Results

Empire’s production was decent in Q1 2023 as it went up a bit to 2,206 BOEPD (61% oil, 19% NGLs and 20% natural gas). This was up +3% from Empire’s Q4 2022 production, which was 2,149 BOEPD (62% oil, 19% NGLs and 19% natural gas). Empire’s oil production went up +1% from Q4 2022 to Q1 2023.

While Empire’s production increased slightly, it was only able to generate a small amount of adjusted EBITDA due to weaker commodity prices (compared to 2022). Empire reported $0.2 million in adjusted EBITDA in Q1 2023 with a realized oil price of $74.33 per barrel. Empire’s realized price per BOE in Q1 2023 was $50.87.

Empire’s cost structure remains a challenge for it, as its lease operating expenses are high at $32.84 per BOE in Q1 2023 (despite a small decline from Q4 2022), while its G&A costs per BOE are also high due to its relatively small amount of production. Empire’s G&A expense (excluding share-based compensation and cash severance costs associated with Thomas Pritchard’s departure) added up to $13.34 per BOE in Q1 2023. After factoring in production and ad valorem taxes (7.5% or $3.82 per BOE in Q1 2023), Empire’s margins (before any capital expenditures) are minimal at Q1 2023 prices.

Notes On The Rest Of 2023

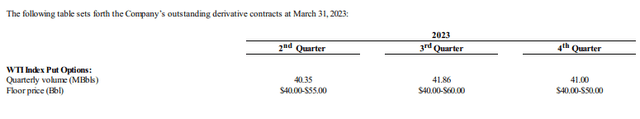

There’s a chance that Empire’s adjusted EBITDA could go slightly negative (zero to negative $1 million) in Q2 2023 due to lower commodity prices compared to Q1 2023. Empire’s hedges don’t provide value until oil prices get to around $50 to $60 or below.

Empire’s Hedges (empirepetroleumcorp.com)

At low-$70s oil, Empire likely needs to increase its production levels to generate positive adjusted EBITDA.

Empire’s cash position went down from $11.9 million at the end of 2022 to $6.8 million at the end of Q1 2023, partially due to working capital changes. Empire’s working capital decreased from $5.1 million at the end of 2022 to $2.3 million at the end of Q1 2023.

Empire’s liquidity was $7.1 million (consisting of $6.8 million in cash and $0.3 million in credit facility availability at the end of Q1 2023. Empire mentioned in its 10-Q filing that it expects to seek additional debt and/or equity funding to help pay for its capital programs and ongoing operations.

I believe that Empire is more likely to use an equity offering instead of debt to give it additional liquidity. The current environment isn’t that favorable for taking on more debt due to high interest costs and Empire’s projected minimal adjusted EBITDAX at current strip.

Notes On Valuation

I am keeping my estimated value for Empire at $6 per share based on long-term $75 WTI oil. This was based on Empire being able to increase its production to around 2,500 BOEPD though, which is looking more uncertain now due to its constrained liquidity.

Empire may still be able to boost its production above its current level (roughly 2,200 BOEPD) through its Starbuck development program if it raises additional funds though.

Conclusion

Empire Petroleum increased its production slightly in Q1 2023, but its adjusted EBITDA dropped to near zero ($0.2 million) due to its high cost structure and weaker commodity prices. At current strip, there is a risk that Empire’s adjusted EBITDA goes slightly negative during the remainder of the year, especially if liquidity constraints hamper its ability to carry out its 2023 development plans.

Empire’s liquidity was down to $7.1 million at the end of Q1 2023, so it will likely need to raise funds through an equity offering this year. My estimated value for Empire remains at $6 per share in a long-term $75 WTI oil scenario, and I will reevaluate it depending on what it does with its 2023 development plans and how it addresses its liquidity.

Read the full article here