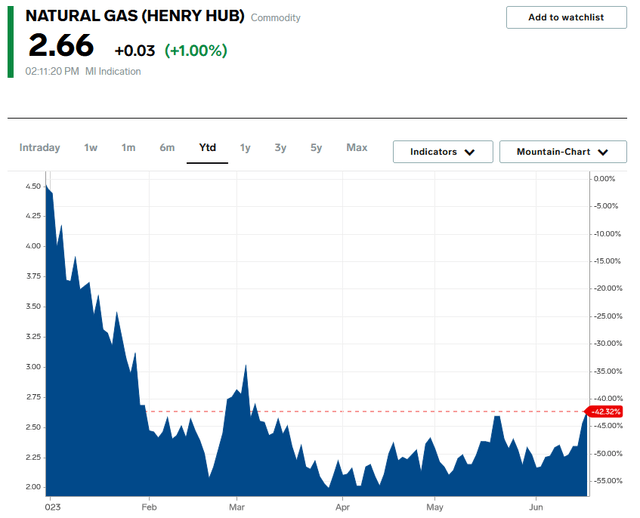

Range Resources Corporation (NYSE:RRC) is an American independent exploration and production company that operates in the Marcellus and Utica Basins in Appalachia. This is a good place to operate for a natural gas producer, as the Appalachian region is by far the richest source of natural gas in the United States. Unfortunately, natural gas producers generally have had a very difficult year so far, as a national oversupply of the compound has caused natural gas prices to decline by 42.32% since January 1:

Business Insider

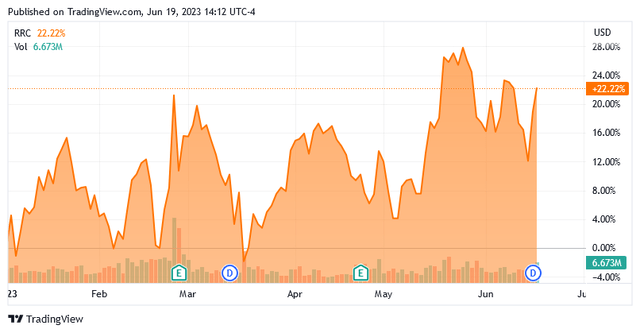

Range Resources has performed much better in the market than the resource, however. Indeed, the company’s stock is up 22.22% since January 1:

Seeking Alpha

This is quite surprising, since normally the company will have a somewhat similar performance to natural gas prices. Range Resources is hardly alone in this outperformance versus natural gas prices, as CNX Resources (CNX) and EQT Corporation (EQT), two other major natural gas-focused independents, have also seen their stock prices climb year-to-date. This could be a sign that the market expects natural gas prices to go up over the next few months, which would naturally be very beneficial for Range Resources’ top and bottom lines. Despite this strong recent performance though, Range Resources appears to be significantly undervalued. Thus, it is certainly not too late for an investor to get in and purchase the shares.

About Range Resources

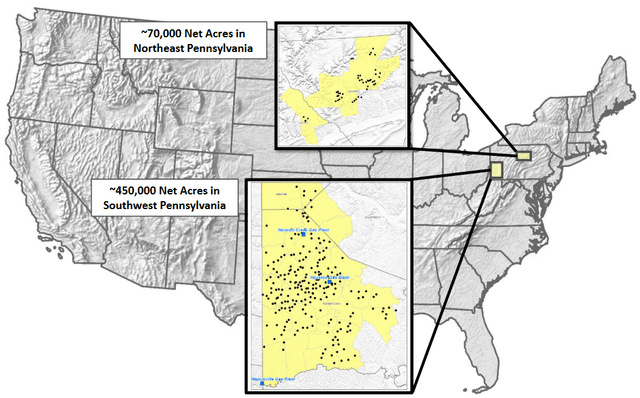

As stated in the introduction, Range Resources is an independent exploration and production company that operates in the Marcellus and Utica Shale plays of Appalachia. In particular, the company operates in Pennsylvania, where it owns a total of 520,000 net acres:

Range Resources

This is one of the richest acreages in the country in terms of natural gas resource wealth. The Marcellus natural gas trend, a region that encompasses most of West Virginia, Western Pennsylvania, Western New York, and Eastern Ohio, is estimated to contain total proved reserves of approximately 148.7 trillion cubic feet of natural gas. Of this, the area around Pittsburgh, Pennsylvania is the most concentrated in terms of natural gas reserves. This is the core area where Range Resources’ acreage is located.

The overall wealth of the company’s acreage positions Range Resources quite well in terms of reserves. As of December 31, 2023, Range Resources had total proved reserves of 18.0 trillion cubic feet of natural gas equivalents. An energy company’s reserves are frequently overlooked by investors, but they are critically important. This is because the production of natural gas is by its nature an extractive process. Range Resources literally obtains the product that it sells by pulling it out of reservoirs in the ground. As these reservoirs only contain a finite quantity of resources, a company must continually discover or acquire new sources of resources or it will eventually run out of products to sell. As this is by no means guaranteed, the company’s reserves determine how long it can continue to produce without any success in this endeavor.

During the first quarter of 2023, Range Resources produced an average of 2.12 billion cubic feet of natural gas equivalents per day. Thus, its reserves are sufficient for it to maintain production at its current level for 8,490 days (about 23 years) without discovering any new sources of resources. That is a very high reserve life that is well above its peers or any of the supermajor energy companies. Thus, it appears that Range Resources is quite well-positioned to continue operating over the long term.

Another advantage that the company’s enormous reserves provide is the ability to grow its production without needing to acquire more acreage. Range Resources was previously looking to do that, but it appears that the company has dialed back this ambition. In the first quarter conference call, Range Resources stated that it expects full-year 2023 production to average 2.12 billion to 2.16 billion cubic feet of natural gas equivalent per day. That is pretty much in line with what the company produced during the first quarter of the year, so it appears to be targeting flat production this year.

This is not particularly surprising. As I mentioned in a recent blog post, American natural gas producers have been cutting back on their production ambitions in response to the current oversupply of natural gas in the United States. This is similar to how we saw several crude oil producers express a reluctance to increase production last year despite the high-price environment. It appears that Range Resources is following this example, which will allow it to reduce its capital spending and drilling activity to what is necessary to maintain production. That should offset some of the adverse impacts that the company’s free cash flow would otherwise suffer due to the low-price environment.

Range Resources has actually been pretty good about achieving and maintaining free cash flow in recent quarters. In fact, the company has reported positive free cash flow consistently over the past five quarters:

| Q1 2023 | Q4 2022 | Q3 2022 | Q2 2022 | Q1 2022 | |

| Levered Free Cash Flow | $241.6 | $198.8 | $273.9 | $33.4 | $491.7 |

| Unlevered Free Cash Flow | $260.4 | $220.6 | $296.7 | $56.5 | $519.2 |

(all figures in millions of U.S. dollars.)

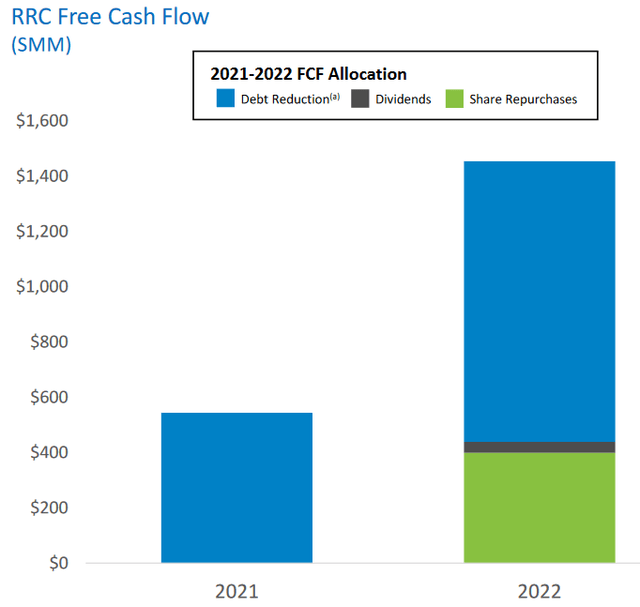

This is much better than the generally negative free cash flow that the company had prior to the pandemic. The reason why a positive free cash flow is a good thing should be fairly obvious as free cash flow is the money that can be used by the company to engage in activities that benefit the shareholders, such as reducing debt or buying back stock. In 2021, the company mostly directed its free cash flow toward debt repayment. Last year, debt repayment again accounted for most of the company’s free cash flow usage but it added share buybacks and a small dividend into the mix:

Range Resources

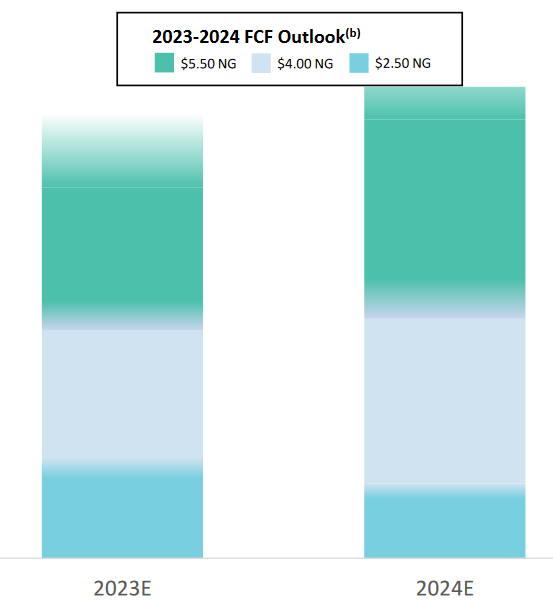

The company has not yet stated what it expects to do with the free cash flow that it earns this year. However, it seems likely that the company’s free cash flow will come in substantially lower than 2022 levels unless natural gas prices significantly rebound. While this is possible, and the company’s recent price action seems to suggest that the market expects such a rebound, it is still unlikely that we will see free cash flow come in above 2022 levels as that would require an average price of $5.50 per thousand cubic feet of natural gas:

Range Resources

The year is half over, so in order to average $5.50 per thousand cubic feet, we would need natural gas to return to the levels that it hit following the start of the Russian-Ukrainian war and stay there for the remainder of the year. That is unlikely in the extreme. Thus, Range Resources will probably have lower free cash flow than it had in 2022. However, the company’s cash flow breakeven is $1.00 to $1.25 per thousand cubic feet, so it should be able to maintain positive free cash flow over the course of this year.

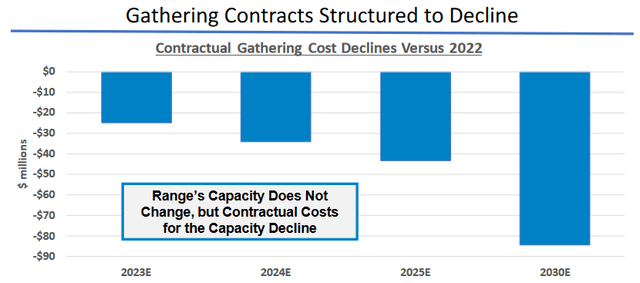

Range Resources is actively working to lower its production costs further, which should help it maintain or even grow its free cash flow in the absence of increases in commodity prices. As is the case with most independent exploration and production companies, Range Resources pays a significant amount of money to midstream companies that operate gathering pipeline networks. In various previous articles, I have discussed these companies. In short, a gathering pipeline is a relatively short pipeline that grabs produced resources from the wellhead and transports them to the first stop on their journey to the end-user. Range Resources pays a volume-based amount to companies that provide this service on its acreage.

Fortunately for Range Resources, the amount that it is paying for this service is expected to decrease going forward. This comes from the fact that some of the contracts that Range Resources has with its midstream providers call for the fees that Range Resources pays per unit of volume to decline. This should save the company a little more than $20 million in total this year relative to 2022 levels. By 2030, Range Resources will be saving more than $80 million annually due to these provisions:

Range Resources

As the graphic shows, Range Resources does not have to give up any of its reserved volumes to achieve these savings. Thus, the savings should simply go straight to the company’s free cash flow and profit all else being equal. That obviously gives the company more money that it can use to benefit the shareholders as opposed to being given to the company’s midstream providers. As this reduces the company’s costs, it should result in rising profits and free cash flow going forward even if natural gas prices remain at today’s depressed levels, which is unlikely. As I have pointed out in numerous previous articles, natural gas demand is likely to grow going forward yet Range Resources and several of its peers are holding production steady or even decreasing it. That should drive prices upward over time, so the fact that Range Resources will be achieving cost savings in the face of this should lead to margin expansion and more money for shareholders overall.

Financial Considerations

It is always important to investigate the way that a company finances its operations before making an investment in it. This is because debt is a riskier way to finance a company than equity because debt must be repaid at maturity. That is typically accomplished by issuing new debt and using the proceeds to repay the maturing debt since very few companies are able to completely pay off their debt with cash as it matures. As new debt is issued with an interest rate that corresponds to the market interest rate at the time of issuance, this can cause a company’s interest expenses to increase in certain conditions. As of the time of writing, interest rates are at the highest level that we have seen in sixteen years, so it seems certain that any debt rollover today will cause a company’s interest expenses to go up. In addition to interest-rate risk, a company must make regular payments on its debt if it is to remain solvent. As such, an event that causes a company’s cash flow to decline could push it into financial distress if it has too much debt. When we consider the impact that volatile commodity prices can have on Range Resources’ revenue and cash flow, this is a risk that we should not overlook.

One metric that can be used to analyze a company’s financial structure is the net debt-to-equity ratio. This ratio tells us the degree to which a company is financing its operations with debt as opposed to wholly-owned funds. It also tells us how well a company’s equity can cover its debt obligations in the event of bankruptcy or liquidation, which is arguably more important.

As of March 31, 2023, Range Resources had a net debt of $1.6246 billion compared to $3.3055 billion of shareholders’ equity. This gives the company a net debt-to-equity ratio of 0.49 today. Here is how that compares to some of the company’s peers:

| Company | Net Debt-to-Equity Ratio |

| Range Resources | 0.49 |

| EQT Corporation | 0.28 |

| CNX Resources | 0.67 |

| Antero Resources (AR) | 0.66 |

| Comstock Resources (CRK) | 0.93 |

As we can clearly see, Range Resources appears to have a very attractive financial structure relative to its peers. The company has lower leverage than any of the other companies on this list except for EQT Corporation, which is a clear sign that the company is not overly reliant on debt to finance its operations. This would appear to indicate that we do not have to worry too much about the company’s debt load.

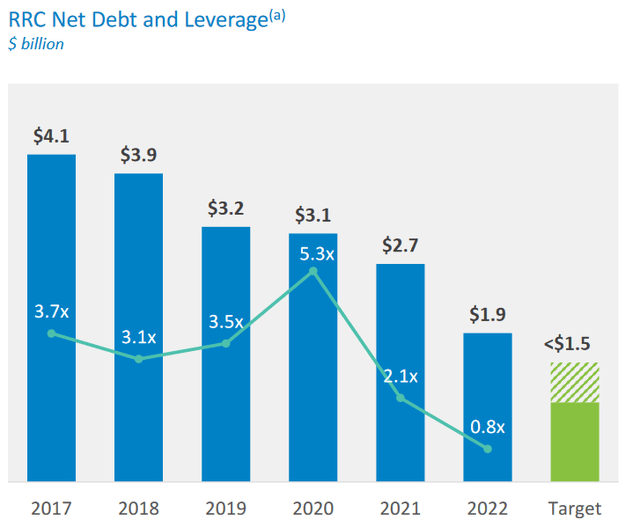

One metric that we can use to measure a company’s ability to carry its debt is the leverage ratio, which is also called the net debt-to-trailing twelve-month EBITDAX ratio. This ratio essentially tells us how many years it would take the company to completely pay off its debt if it were to devote all of its pre-tax cash flow to that task. As of March 31, 2023, Range Resources had a leverage ratio of 0.8x, which is very reasonable. As I have pointed out in various previous articles, many of the companies in the sector have been actively working to reduce their leverage ever since the pandemic-related lockdowns and they have generally succeeded. The strongest firms in the sector now pretty much all have leverage ratios below 1.0x. It is nice to see that Range Resources is included in this category.

We can clearly see how much the company has improved its balance sheet here:

Range Resources

As we can clearly see, Range Resources had a leverage ratio of 3.7x back in 2017 and has been working to improve it ever since. This is in line with our earlier statements that Range Resources has been directing a significant amount of its free cash flow toward debt reduction. We can also see that the company wants to make more progress and reduce its debt by another $400 million as soon as possible. This is admirable, but even at the current level, we should not have to worry too much about the company’s debt.

Valuation

It is always critical that we do not overpay for any asset in our portfolios. This is because overpaying for any asset is a surefire way to earn a suboptimal return on that asset. In the case of an independent exploration and production company like Range Resources, we can value it by looking at the price-to-earnings growth ratio. This is a modified version of the familiar price-to-earnings ratio that takes a company’s earnings per share growth into account. A price-to-earnings growth ratio of less than 1.0 is a sign that the stock may be undervalued relative to the company’s forward earnings per share growth and vice versa. However, as I pointed out in a recent blog post, pretty much everything in the traditional energy sector looks to be enormously undervalued relative to growth. As such, the best way to use this ratio today is to compare Range Resources to its peers and see which company offers the most attractive relative valuation.

According to Zacks Investment Research, Range Resources will grow its earnings per share at a 28.40% rate over the next three to five years. This gives the company a price-to-earnings growth ratio of 0.45 at the current price, which clearly indicates that the stock is very undervalued at the current price. Here is how that compares to the company’s peers:

| Company | PEG Ratio |

| Range Resources | 0.45 |

| EQT Corporation | 0.80 |

| CNX Resources | 1.59 |

| Antero Resources | NA |

| Comstock Resources | NA |

As we can see, Range Resources appears to be quite cheap relative to its peer group (the last two companies are not expected to have any earnings per share growth over the period). This is a clear sign that the price is right here. In fact, the fair price for Range Resources is $63.31 per share, which is a 122% increase over the current price.

Conclusion

In conclusion, Range Resources is a very good way to play the forward demand growth for natural gas. Unfortunately, natural gas prices are currently very weak due to the oversupplied conditions, which will be a drag on the company’s free cash flow and revenue. It is well-positioned to weather the current weakness until conditions improve, however. Range Resources boasts one of the strongest balance sheets in the industry and an attractive valuation. Its substantial reserves also position it for growth as the supply-demand balance improves. Overall, this company looks like a solid holding in the energy space.

Read the full article here