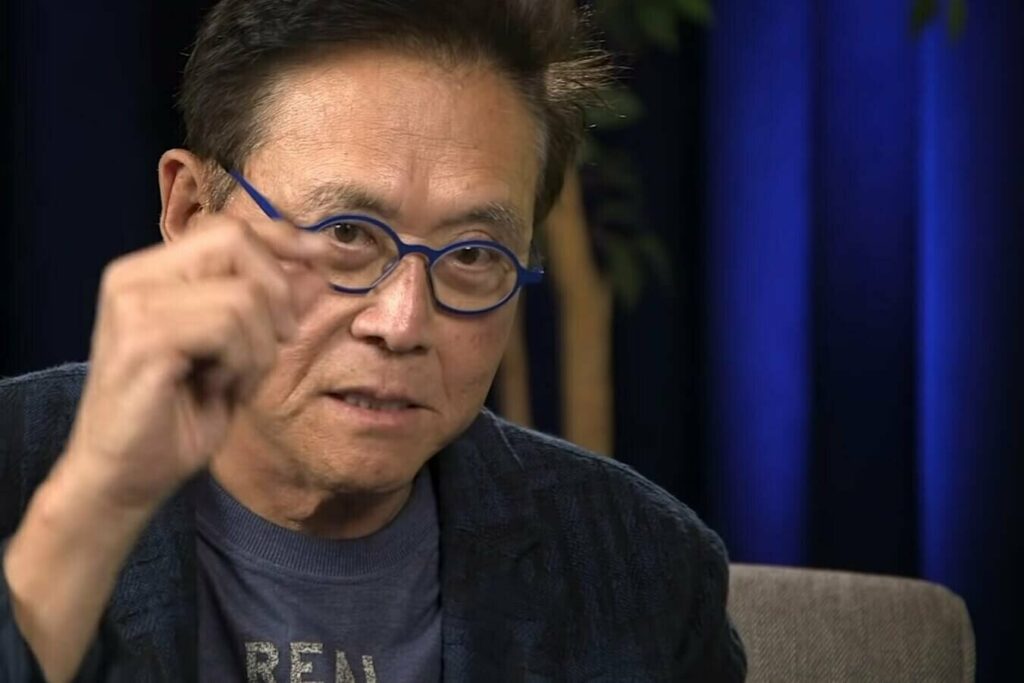

Robert Kiyosaki, the best-selling author of Rich Dad Poor Dad, has said that Bitcoin (BTC), gold, and silver are “bargains” today while warning about an impending stock market crash.

In a Wednesday tweet, Kiyosaki said he is frequently asked about the anticipated prices of assets like gold, silver, and Bitcoin in 2025.

“My reply is that is a silly question,” the best-selling author said. “More important question is how many gold, silver, Bitcoins do you have TODAY?”

Kiyosaki added that these assets are currently available at favorable prices, making them attractive investment options.

“Gold, silver, Bitcoin are bargains today… but not tommow.”

The long-time fiat skeptic also warned against the impending stock market crash, predicting that the decline in stocks, bonds, and real estate would drive people toward assets like Bitcoin, gold, and silver.

Kiyosaki Remains a Bitcoin Proponent

Kiyosaki has long been an advocate of Bitcoin, preferring the leading cryptocurrency over other altcoins.

Earlier this year, he revealed that he is acquiring more BTC because it is classified as a commodity much like gold and silver while other altcoins are classified as securities “and SEC regulations will crush most of them.”

The best-seller author also continues to make wild predictions about the price of Bitcoin, forecasting in February that Bitcoin price will skyrocket to $500,000 by 2025.

On the other hand, he contends that fiat currencies, including the US dollar, are headed for depreciation due to extensive monetary injections into the economy, resulting in rampant inflation.

Kiyosaki’s Rich Dad Poor Dad is a 1997 book that advocates the importance of financial literacy, financial independence, and building wealth through investing in assets, real estate investing, starting and owning businesses, as well as increasing one’s financial intelligence.

It has been on the New York Times Best Seller List for over six years.

Bitcoin Breaks Above $27,000 For First Time in September

On Monday, Bitcoin broke over the $27,000 mark, increasing by 3.7% to $27,418 before trimming some gains.

At the time of writing, the flagship cryptocurrency is trading at $27,100, largely flat over the past day.

The coin is up by more than 4% over the past seven days and around 5% over the past month.

The price gain comes ahead of the Federal Open Market Committee (FOMC) meeting, which will be held on September 19-20.

During the meeting, the Federal Reserve expected to keep borrowing rates steady. Higher rates tend to reduce the allure of higher-risk assets such as cryptocurrencies.

“After a prolonged struggle at the psychological support of $25,000, Bitcoin held steady. Range traders will now be looking to take profits just above $30,000,” Mati Greenspan, chief executive officer of Quantum Economics, told Bloomberg.

Read the full article here