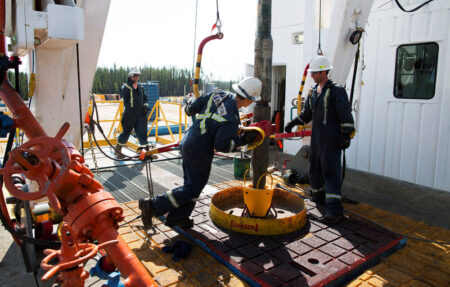

In a recent development, futures saw a significant surge of 3.6%, reaching $93.68 per barrel, a value not seen in over a year. This rise was triggered by an announcement from the Energy Information Administration last Wednesday about a 2.2 million barrel drop in U.S. crude inventories. The reduction in stockpiles has reignited the march towards the $100-per-barrel mark.

Exxon Mobil (NYSE:), once the largest U.S. company by market capitalization, also experienced a notable milestone. Despite not being able to surpass the $500 billion mark, the energy giant managed to hit an all-time high in its market cap. However, it’s worth noting that Exxon Mobil’s market cap remains overshadowed by today’s mega-cap technology stocks.

This information was reported by Rob Curran from Dow Jones on Wednesday, providing key insights into the current state of the energy market and highlighting the potential impact of inventory fluctuations on crude oil prices.

This article was generated with the support of AI and reviewed by an editor. For more information see our T&C.

Read the full article here