When you gift an investment to someone, no gains are realized and your original cost basis is also given to the recipient. In this way, the large unrealized gain of a security can be moved from your tax rate to the tax rate of your recipient.

Gifting appreciated stock to a charity is advantageous because the capital gains rate for a charity is zero.

Gifting appreciated stock to family or friends can also be advantageous if the person receiving the gift is in a lower capital gains tax bracket and couldn’t have otherwise inherited the assets with a step up in basis estate tax free.

However, gifting depreciated stock is more complex and never to anyone’s advantage.

If you give a stock with a loss to charity, there is no additional complexity, but you do lose the benefit of the capital loss. You could have sold the security, used the realized capital loss to reduce your taxes, and then gifted the proceeds for greater personal gain. You are worse off for having gifted the security with a loss.

If you give a stock with a loss to another person, there is additional complexity and everyone loses the advantage of the capital loss.

The government doesn’t want wealthy individuals to be able to save on taxes by receiving gifts of depreciated stock and then selling them. As a result, they have rules which mean that only securities which go down further after the receiving the gift can receive a capital loss. This loss would then be the same value that they could have received by simply purchasing the stock.

Put more technically: If your original cost basis is greater than the value of the security when you gifted it, then the cost basis of the received holding is effectively fractured.

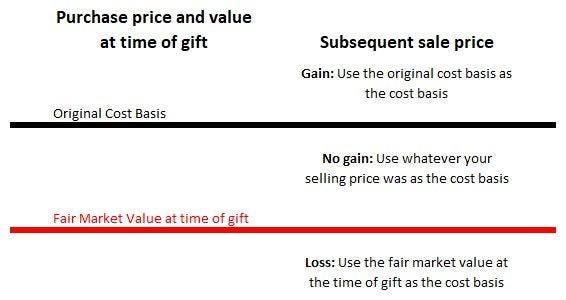

One cost basis is your own original cost basis. A second cost basis is the value of the holding on the date of the gift. The original cost basis is greater; the value of the holding on the date of the gift is smaller. Which cost basis is used depends on the eventual sale price.

If the subsequent sale price is higher than the original cost basis, then the original cost basis is used and the recipient realizes a capital gain.

If the subsequent sale price is higher than fair market value at the time of the gift but lower than the original cost basis, then there is no gain or loss realized and you use the selling price as the cost basis.

If the subsequent sale price is even lower than the fair market value at the time of the gift, then you use the fair market value at the time of the gift as the cost basis and the recipient realizes a capital loss.

If you are trying to maximize the value to families, we don’t recommend gifting stock which is currently lower than the original cost basis. Instead, we suggest selling the stock, realizing the loss, and gifting either the proceeds or something else. When the original owner sells the security they realize the loss.

Schwab provides advisors an alert whenever a security which has been gifted is ultimately sold. If you have never gifted a security which had an unrealized capital loss, you can safely ignore these alerts.

Read the full article here