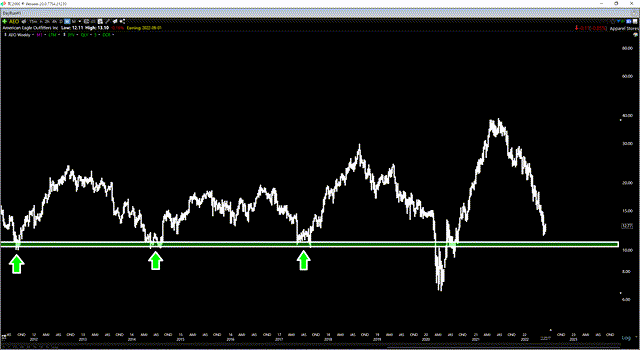

Just over 15 months ago I wrote on American Eagle (NYSE:AEO), noting that the strong momentum at Aerie was positive and the stock was getting much more reasonably valued as it dipped towards key support, suggesting pullbacks below $11.60 would provide buying opportunities. Since falling into this buy zone last July, AEO has outperformed the overall market, up over 60% on a total return basis. This solid performance can be attributed to another strong quarter in Q2 in a difficult macro environment, with Aerie continuing to shine and further progress on the turnaround at AE, where sales were only down slightly year-over-year. In this update, we’ll dig into recent results and whether the stock is worth buying ahead of its upcoming Q3 report.

AEO Long-Term Chart – June 2022 – Worden.com

Recent Results

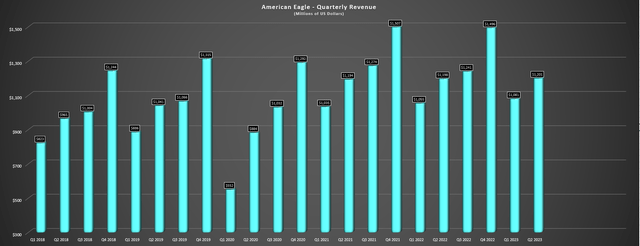

American Eagle released its Q2 results in September, reporting quarterly revenue of ~$1,201 million, a marginal increase from the year-ago period (Q2 2022: $1,198 million). These decent results that exceeded the company’s expectations followed a solid performance in Q1 with positive comp sales growth at Aerie and 2% sales growth company-wide, and American Eagle saw continued strength in women’s tops and improvement in bottoms for its men’s business. As for Aerie, it was another record quarter for the brand with $380.4 million in sales (~3% growth year-over-year) and flat comps, with the company calling out broad-based strength except for swim and intimates, but it noted that intimates turned positive after new collections arrived, helped by better performance in its SMOOTHEZ collection.

American Eagle Quarterly Revenue – Company Filings, Author’s Chart

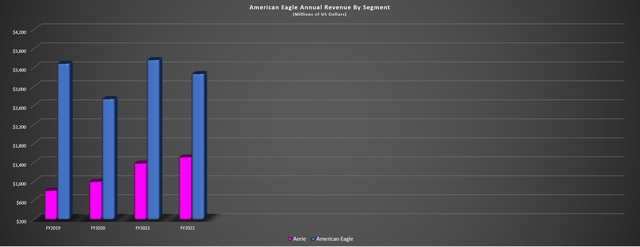

Digging into the results a little closer, we can see that Aerie has continued to see impressive growth, with sales nearly doubling from FY2019 to FY2022 (~$800 million to ~$1.51 billion) and already sitting at ~$740 million year-to-date, setting up another record year for the company even if it only matches its H2 2022 sales results. In addition, the segment looks like it could hit its ambitious goal of $2.0+ billion in sales by 2025. Unfortunately, store closures and negative comp sales in its AE segment have offset some of this growth. However, this finally appears to be turning, with AE sales down only marginally year-over-year despite net store closures and profitability was up meaningfully, with operating profit increasing over 200 basis points to 16.8% (~$128.6 million) despite the lower sales. Meanwhile, the company called out strength in its premium Todd Snyder brand, which will hit the $100 million sales mark this year.

American Eagle – Aerie vs. AE Revenue by Segment – Company Filings, Author’s Chart

Finally, from a profitability standpoint, American Eagle’s operating margins soared to 5.4% vs. 1.2%, prompting the company to raise its full-year operating income guidance from $260 million at the mid-point to $337 million. This was helped by profit improvement initiatives and better-than-expected demand. Meanwhile, merchandise margins expanded on the back of fewer markdowns and lower transportation and product costs, while gross margins came in at 37.7%, benefiting from lower delivery, distribution, and warehousing costs. The company also shared that promotions and end-of-season clearance were down sharply because of its improved inventory position, and it enjoyed the 2nd best Q2 AUR in its history. Finally, the company also reported a multi-year low in cost per shipment and number of shipments required to fulfill an order combined with improved speed of delivery, which should translate to better customer satisfaction.

Macro Backdrop & Earnings Trend

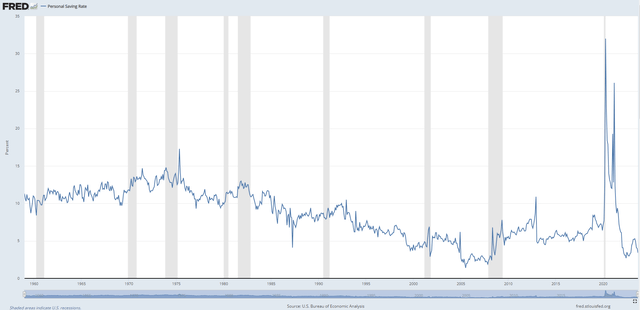

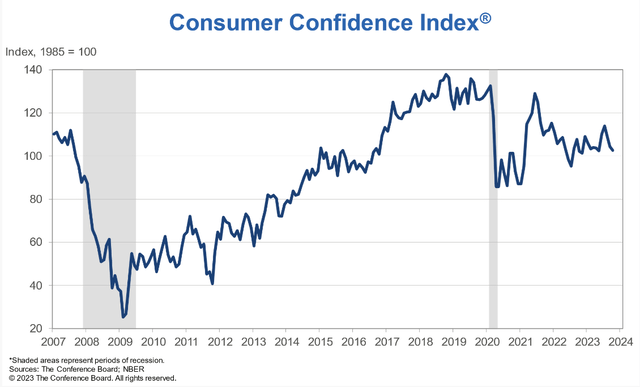

Overall, these results were quite positive, but the macro backdrop remains difficult, with declining consumer confidence (down 2% from September to October) and a sharp decline in personal savings rates in the United States and Canada. This is not an ideal setup at all when combined with record credit card debt and we’ve already seen early signs of negative consumer behavior with traffic at quick-service restaurants slipping into negative territory in August and September after remaining well in positive territory for nearly every month year-to-date. These developments suggest that the average consumer is tapped out and when it comes to highly discretionary categories like apparel, this is certainly not a setup that inspires much confidence for American Eagle and other non-luxury retail brands.

Personal Savings Rate United States – FRED, BLS Consumer Confidence Index – NBER

On a positive note, American Eagle appears to be bucking this trend relative to some of its peers, with strong growth at Aerie and OFFLINE by Aerie (active-wear collection), and the recent expansion with the launch of AE77 (premium denim) and AE24/7 (activewear). Meanwhile, the company continues to work on new store designs for AE that have been rolled out which appear to be seeing positive early signs with a boost in sales, suggesting new store designs might finally be able to help the segment return to positive comp sales and reverse its trend of net closures. So, whether we see industry-wide sales dip or not, American Eagle is delivering significantly higher operating income on similar sales, with benefits from AI-based tech (improved in-store stock levels), continued tailwinds in product costs that should last into early 2024, and its optimized clearance strategy resulting in up to $50 million in annualized savings. Hence, even if one is bearish on the consumer, AEO is making the right moves to improve margins and what it can control.

Lastly, it’s worth noting that commentary on the call was overwhelmingly positive despite the cautious outlook for H2, with the AE segment ending July with positive comps which continued into Q3 and the company quite confident in its assortment heading into the end of the year. And assuming we see similar trends into the latter half of the year, this should result in meaningful earnings per share [EPS] growth, which is expected to come in at $1.33 based on current estimates (+41% year-over-year). Hence, while there are many retail names that remain tough to invest in due to worsening sales trends like Zumiez (ZUMZ), Express (EXPR), Dine Brands (DIN) and Cracker Barrel (CBRL), American Eagle is certainly an exception and executing well, and it’s nice to see that all three of its brands appear to finally be moving in the right direction (Aerie, AE, and Todd Snyder).

So, is the stock reasonably valued heading into its Q3 results later this month?

Valuation

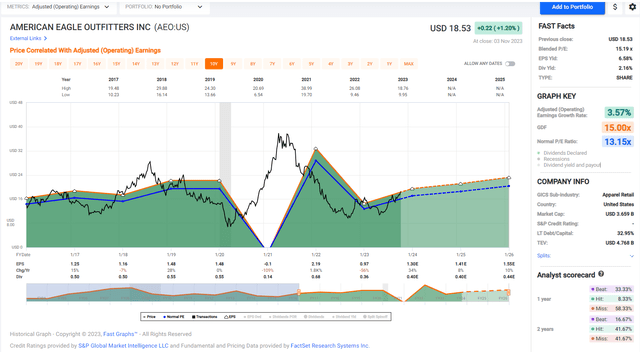

Based on ~196 million shares and a share price of US$18.60, American Eagle trades at a market cap of ~$3.65 billion and an enterprise value of ~$4.76 billion. This leaves American Eagle trading at roughly ~8.0x forward EV/EBITDA and ~13.2x earnings, above its 5-year average EV/EBITDA multiple of ~7.9 and its 10-year average earnings multiple of ~13.1. And although an argument could be made that AEO should trade at a premium to its historical multiples given what looks to be a successful turnaround at AE and the impressive momentum at Aerie, I think a fair multiple for the stock is 13.0x – 14.0x earnings to be more conservative in the current macro environment. So, even if we use the high end of this range and FY2024 earnings estimates of $1.40, I see limited upside in AEO to an estimated fair value of $19.60.

American Eagle Historical Earnings Multiple – FASTGRAPHS.com

Some investors might argue that this is enough upside to justify being long and there’s certainly the possibility that AEO beats FY2024 estimates given that it’s significantly outperformed expectations this year despite the tough environment. However, I am looking for a minimum 30% discount to fair value to justify buying mid-cap names and prefer to use base case estimates to derive fair value, suggesting that AEO would need to decline below $14.00 at a bare minimum to become an attractive buy-the-dip candidate. Finally, the stock is vulnerable to a correction, hovering over 30% above its 200-day moving average. Obviously, I could be wrong and the stock may head higher from here if it can beat Q3 estimates. That said, I think it’s hard to argue for chasing the stock at current levels both from a technical and valuation standpoint.

Summary

American Eagle has done a decent job navigating the challenging macro backdrop, reporting another quarter of record revenue at Aerie and relatively flat comp sales growth across its business. From a bigger picture standpoint, cost-saving initiatives and a new store design at AE with positive early results are encouraging, suggesting the potential for a full turnaround at AE which has been a drag on overall results. That said, I prefer to buy retail names when they are hated and trading at a steep discount to historical multiples, and it’s hard to argue that AEO is hated or cheap after a ~90% rally and with it trading at ~13x FY2024 earnings estimates. Hence, if this strength in the stock were to persist, I would view any rallies above $20.75 before February as an opportunity to book some profits.

Read the full article here