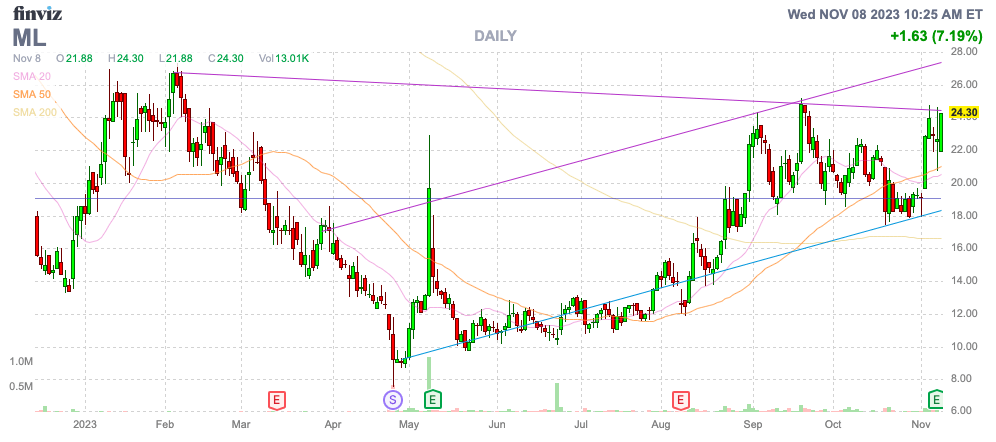

The SPAC craze was brutal to investors as most stocks going public via this path have been crushed. In a lot of cases, stocks like MoneyLion Inc. (NYSE:ML) have been crushed far beyond the actual results of the business. My investment thesis remains ultra Bullish on the fintech stock trading below a pre-reverse split price of $1 now.

Source: Finviz

Curse

As with a lot of SPACs, MoneyLion hasn’t hit all of their financial targets since going public. The economic environment and some aggressive targets led to some initial disappointing results.

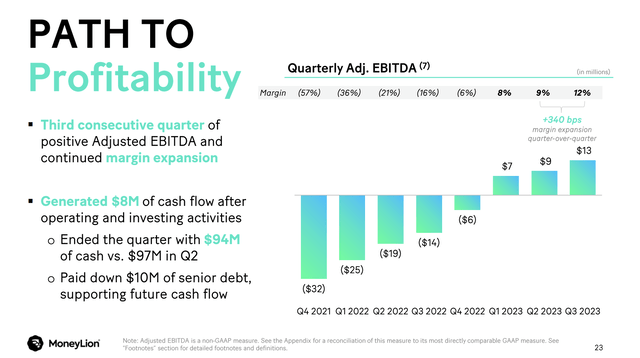

For Q3 ’23, the fintech reported revenues grew 24% to $110 million for record quarterly revenues. Most importantly, MoneyLion continued the shift towards profitable growth with an adjusted EBITDA of $13 million for a margin of 12%.

Source: MoneyLion Q3’23 presentation

The company found itself reporting massive sales growth back in 2022, but the business was highly unprofitable and the enterprise business suddenly slowed down. The company has shifted from a $25 million adjusted EBITDA loss to start 2022 to a $13 million profit in the process. The previous loss amounted to an alarming 38% of revenues.

At this point, the stock should be valued based on the profitable growth in the business, yet MoneyLion trades down 90% from where the stock went public at in late 2021. The $300 split adjusted seems an eternity away for investors lookout at current $24 price.

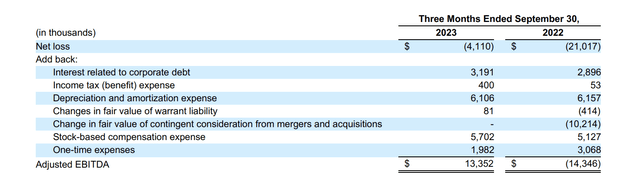

Investors in fintech related stocks have made a strange shift to suggesting GAAP profits are the goal, yet adjusted EBITDA is mostly representative of adjusted profits, traditionally used for growth stocks for decades. In the case of MoneyLion, the prime difference between a GAAP loss of $4.1 million and adjusted EBITDA of $13.4 million is the non-cash charges of $6.1 million primarily for amortization and the $5.7 million charge for stock-based compensation.

Source: MoneyLion Q3’23 presentation

In essence, MoneyLion would have an adjusted profit in the range of $9.8 million based on including the interest income and income tax expenses in the equation along with minimal depreciation charges. The fintech reported positive cash flows of $8.1 million in the quarter.

The business now has 12.1 million customers consuming 20.3 million products per quarter. The key product consumption was up 80% YoY in the quarter while the 124% customer growth provides the funnel for solid sales growth in the future.

For now, revenues are constrained as enterprise partners spend less on advertising and loan origination growth is limited. In Q3 ’23, MoneyLion saw the enterprise business generate a quarterly record of $39.2 million, but the goal is for this business to match the now record $71.1 million produced by the consumer business.

The company has only seen a ~4% loan provision rate. The key to the investment in MoneyLion is that the fintech isn’t as reliant on loan growth going forward, as much as the enterprise market opening back up with Fed rate hikes possibly over.

Brutal Stock Valuation

MoneyLion has seen the market cap crater to only $250 million with the stock below $25. The company even has a cash balance of ~$100 million.

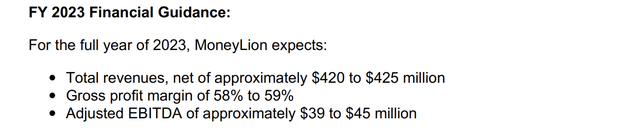

The fintech is guiding to 2023 revenues of at least $420 million with adjusted EBITDA of $42 million at the midpoint.

Source: MoneyLion Q3’23 earnings release

A company that just reported 24% revenue growth in a tough macro environment for consumer fintech products doesn’t normally trade at only 6x adjusted EBITDA targets. Remember, this number isn’t far off from an adjusted profit for a company with strong sales growth in a tough economic environment.

MoneyLion just hosted an earnings call with only 3 analysts covering the company. The fintech is headed towards revenues topping $500 million in 2024, and a similar company like SoFi Technologies (SOFI) has 10 analysts covering the Q3’23 earnings call, with 18 analysts listed with ratings on the stock.

At some point, the SPAC curse will end and MoneyLion will rally on solid growth and additional analyst coverage.

Takeaway

The key investor takeaway is that MoneyLion is too cheap here. As with any fintech involved in the consumer lending segment, the company could face additional risk during any U.S. recession in the next few quarters, but the company has a far better financial position to survive and thrive such a period.

Investors should continue using the weakness to hold up on a fintech that trades below a $1 pre-split price despite strong growth and improving financials.

Read the full article here