Background

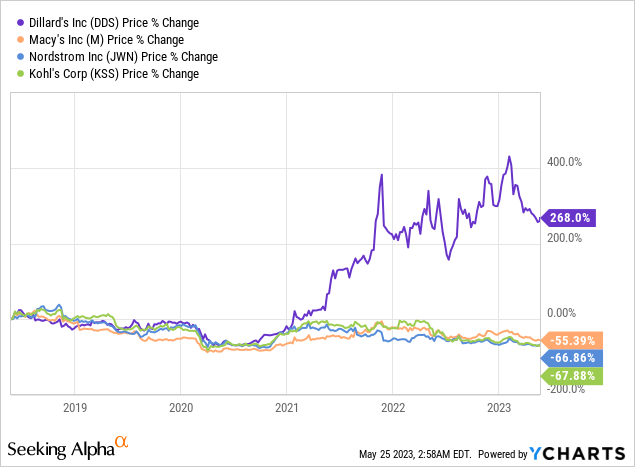

Dillard’s (NYSE:DDS) is one of the leading American upscale department stores offering fashion apparel, cosmetics and home furnishing through its 277 stores across 29 states. It has been a major beneficiary of the pent up demand in dressy categories and back to school assortment which has led to an outsized sales and earnings growth post pandemic (pre-pandemic (2014-2019) sales growth of ~1%). This has resulted for the company to outperform its peers by a huge margin topping 268% returns with most of the outperformance began post 2021. However, as sales growth decelerate amidst a tough macro backdrop, we believe the upside potential could be limited.

Results Point to Slowdown

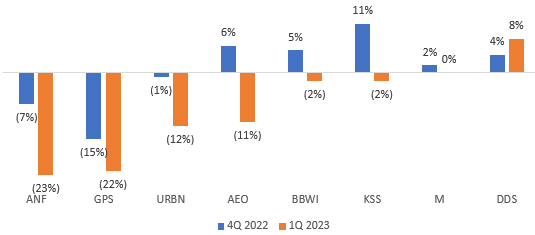

DDS reported revenue growth of 1.9% YoY driven by a 4% decline in same store sales, which still beat the consensus estimates. Management cited cosmetics, shoes and ladies’ apparel as the strongest performing categories (which forms bulk of its total revenue), relative to ladies’ accessories, lingerie, juniors’ and children’s apparel as the weakest performing categories. Gross margin contracted by 280 bps YoY, primarily driven by a drop of 170 bps in retail gross margins. Gross margins continue to contract for the second straight quarter (Q4 decline of 320 bps) as a result of increased markdowns as sales slowed towards the end of the quarter. SG&A $ increased by 1.7% YoY primarily driven by 9% growth in employee wages, which we believe will continue to transcend its impact over the rest of the year. It reported EPS of $11.85 topping expectations, however, the stock remain muted, up 0.2% vs S&P’s -0.2% leaving the street unimpressed.

Management pointed out that customer activity declined in the back half of the quarter and its Q1 sales growth rate decelerated QoQ. Inventory also is a big concern as DDS exited Q1 2023 with inventory increasing 3.3% YoY (vs a decline of 4% in retail store sales growth) leading to widening of inventory to sales spread at 7.5% (from 4.0% in Q4 2022). This is an anomaly compared to its peers where in the inventory to sales spread has improved. Historically, DDS reported inventory to sales spread increase to high single digits in Q3 2015 where the gross margins contracted by 470 bps in the subsequent quarters. With consensus expectation of SSS decline in high single digits for Q2, we believe the gross margins would come under significant pressure and continue to linger throughout the year.

Company filings

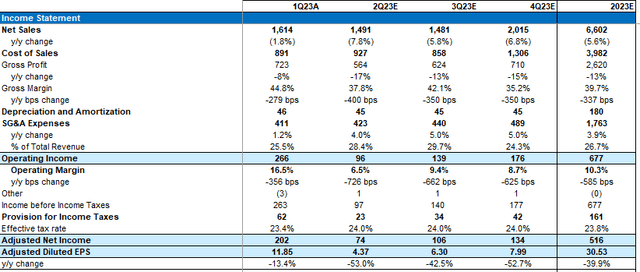

Key Projections

We believe the company to likely post a SSS decline of ~6% for 2023, as a result of Q2 exit being significantly lower than Q1 (according to placer.ai data, foot traffic continue to decline for department stores at about -18% for QTD). Given the inventory to sales spread inching up significantly, we believe increased markdowns would continue to pressure margins partially offset by lower freight expenses and we model ~350 bps gross margin compression for the year. SG&A $ is expected to increase ~4% for the year driven by wage hikes while SG&A as % of sales is expected to rise by ~250 bps primarily due to deleverage on fixed costs and occupancy as a result of declining sales. We model an effective tax rate of ~24% for the year and project EPS of $30.5 against the consensus expectations of ~$36.

Estimates

Valuation

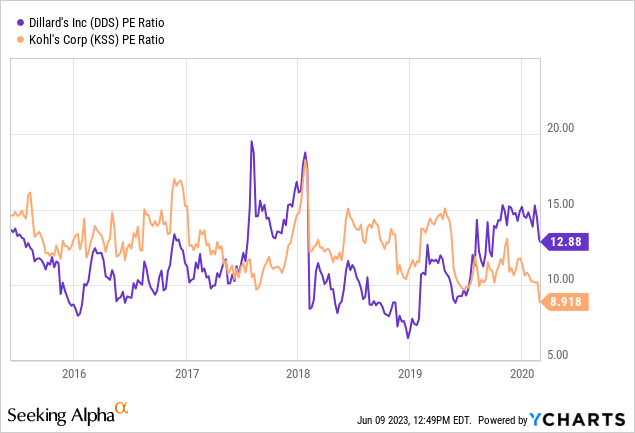

Dillard’s trades at a premium compared to its peers on the back of strong historical performance. However, we believe as growth moderates in line with its pre-pandemic average, it will subsequently lead to downward EPS revisions and P/E derating. Historically, DDS has traded at an average PE of ~12x, prior to the pandemic. We believe at current levels the risk reward is less favorable and initiate this at Underperform. We believe the target price for Dillard’s should be at $270 (at 9x 2023E earnings)

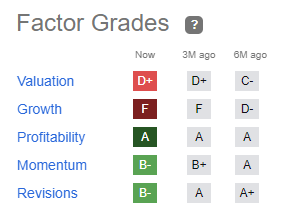

As per SeekingAlpha, the current valuation of DDS appears to be very rich with valuation grade of D+ including a grade F on the ‘Growth metric’s.

SeekingAlpha

Risks to Rating

Risks to rating include 1) Dillard’s grab market share from other distressed retailers including other department and specialized stores (such as struggling JC Penney, Bed Bath and Beyond who recently filed Chapter 11 as well as other retailers who will struggle to survive the downturn) leading to SSS growth 2) inventory management (as demonstrated by other retailers) would improve inventory turnover and reduce markdowns which would help them to improve gross margins 3) SG&A spends remains in check driven by cost initiatives which would help them to partially leverage amidst declining sales momentum and 4) continued buyback to drive shareholder value creation (recently announced a new buyback program of $500 mn)

Final Thoughts

We believe Dillard’s would continue to lose share, given its positioning within Department stores, to other off-price retailers and e-commerce players as consumers prefer value amidst the tough macro backdrop. Decelerating sales and higher inventory would lead to compression in gross margins as it will lead to increased markdowns for management to clear the slow-moving inventory. SG&A would deleverage on the back of rising wage costs and faster sales decline which would lead to downward EPS revisions. We initiate at Underperform.

Read the full article here