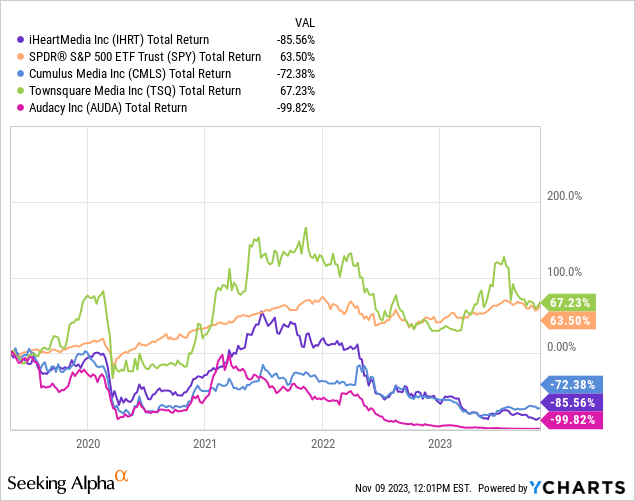

iHeartMedia (NASDAQ:IHRT) emerged from bankruptcy in July 2019. Since then, IHRT has proved a very disappointing investment as shares have delivered a total return of -85.6%. The S&P 500 has delivered a total return of 63.5% during the same period.

IHRT has experienced secular declines in its core radio broadcasting business which has also weighed on its closest peers Audacy (OTCPK:AUDA) and Cumulus Media (CMLS).

While IHRT has made significant progress towards focusing more on the digital business, the company’s results remain primarily driven by its core radio business.

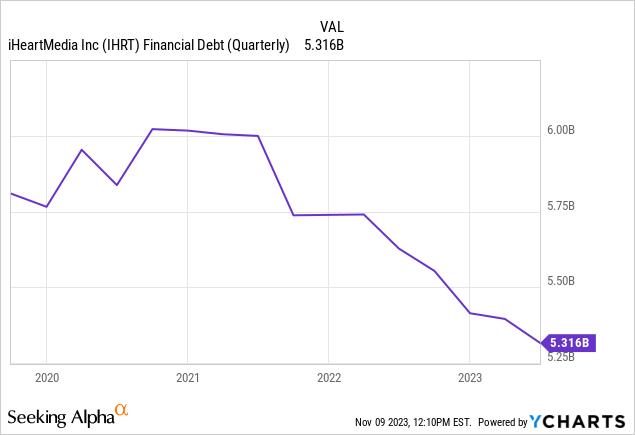

IHRT exited bankruptcy with high levels of debt and has struggled to significantly de-lever its balance sheet.

In my view, the challenges related to the core business decline and highly levered balance sheet are unlikely to go away anytime soon. Thus, I view IHRT as an unattractive investment at current levels.

Company Overview

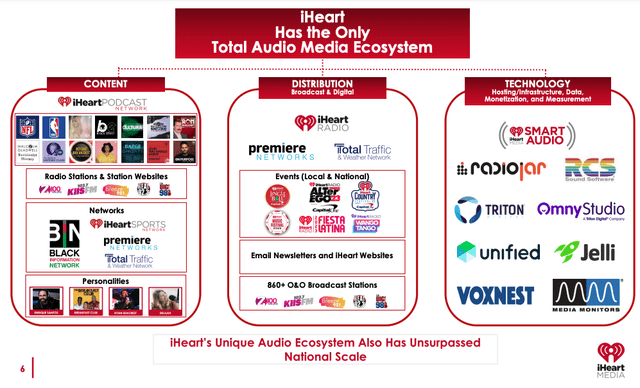

IHRT is the number one audio media company in the U.S. based on total consumer reach. IHRT content can be heard across AM/FM broadcast radio stations, digital radio stations, satellite ratio, on the internet, and through the iHeartRadio mobile application.

IHRT is split into three segments: the Multiplatform group, the Digital Audio Group, and The Audio & Media Services Group.

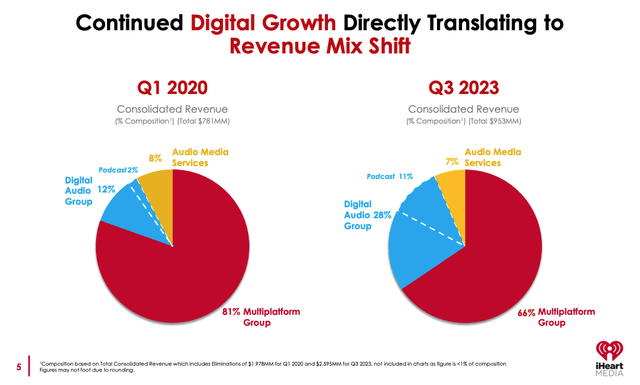

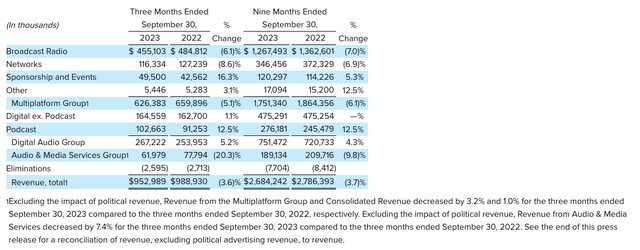

The Multiplatform Group accounts for ~66% of total revenue and includes the company’s traditional broadcast radio, Networks and Sponsorships and Events businesses. The Digital Audio Group accounts for ~28% of total revenue and includes all of the company’s digital business including podcasts. The Audio Media Services Group accounts for ~7% of revenue and includes a media representation business as well as broadcast software and scheduling services.

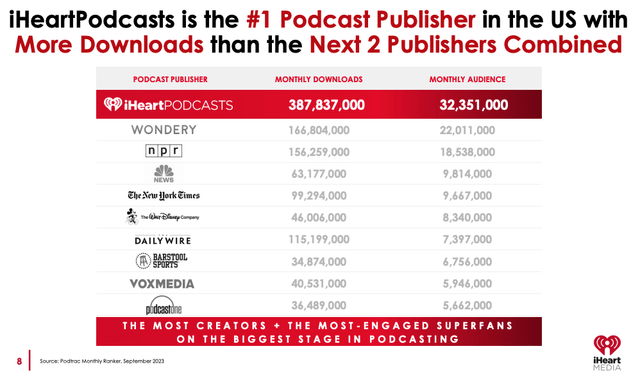

Over the past few years, IHRT has been aggressively investing in its digital business and is now the #1 podcast publisher in the U.S. with more downloads than the next two largest players combined. Growth in the podcast business has helped IHRT significantly increase the percentage of digital revenue from ~12% in Q1 2020 to ~28% as of Q3 2023.

IHRT Investor Presentation IHRT Investor Presentation IHRT Investor Presentation

Traditional Ratio Business Challenges

The traditional radio business has experienced a number of challenges in recent years. The emergence of digital alternatives such as podcasting has proved an attractive alternative to traditional AM/FM radio. Additionally, advertisers have continued to favor digital media over traditional media.

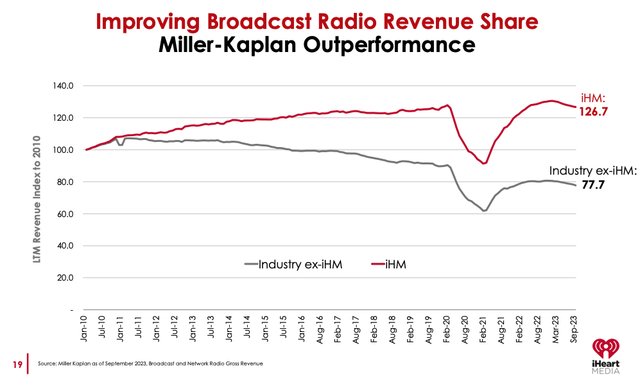

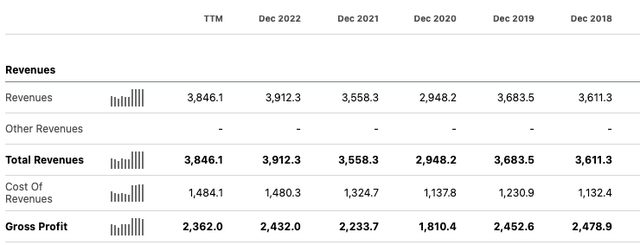

Despite these challenges, IHRT has performed very well on a relative basis and has gained broadcast radio revenue share. However, despite market share gains and a growing digital business IHRT has struggled to generate consistent revenue growth. Moreover, IHRT has also struggled to generate consistent profitability.

For Q3 2023, IHRT reported total revenue of $952.98 million which represents a 3.6% decline on a year-over-year basis and a net loss of $8.97 million. Multiplatform revenue dropped by 5.1% on a year-over-year basis which was offset by a 5.2% increase in Digital revenue. The company reported quarterly Adj. EBITD of $203.7 million compared to $252.2 million during the same period a year ago. Adj. EBITDA margin came in at 21.4% compared to 25.5% during the same period a year ago.

IHRT also issued guidance calling for Q4 revenue to decline by high-single digits (low-single digits excluding the impact of political.) The company expects Q4 Adj. EBITDA to be $205 million to $215 million.

Investors were disappointed with the results and IHRT traded down by ~10% following the earnings release.

IHRT Investor Presentation Seeking Alpha Seeking Alpha IHRT Q2 2023 Earnings Release

Highly Levered Balance Sheet

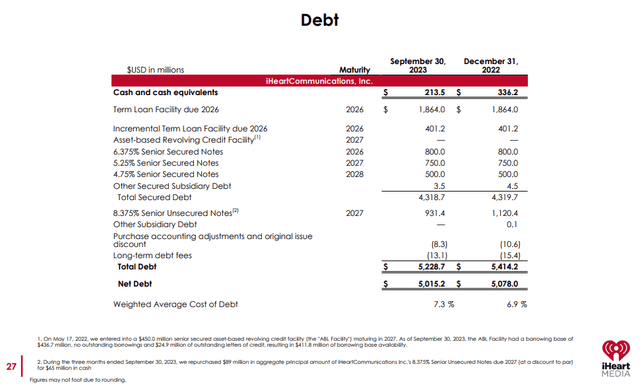

As shown by the table below, IHRT has ~$5.2 billion in total debt and $5.0 billion in net debt. On a LTM basis, IHRT has generated Adj. EBITDA of $804.1 million. Thus, IHRT currently has a net leverage ratio of ~6.2x. This is clearly a high level for any company and is especially problematic for IHRT given its cyclicality and high earnings volatility.

The company has said it is targeting a net leverage ratio of ~4x but there is a long way to go from where the company is now to get to that level. During Q3 2023, the company repurchased $89 million of 8.375% Senior Unsecured Notes at a meaningful discount to par. The company also generated $45 million of cash from the sale of remaining radio broadcast towers which will be used to pay down debt.

In August, S&P downgraded IHRT’s credit rating from B+ to B and also noted that the outlook is negative.

Currently, the company has a weighted average cost of debt of 7.3%. This is fairly low given the current level of interest rates with the 10yr yielding ~4.6%. However, the weighted average cost of debt is likely to increase once the company is forced to refinance existing debt.

The company has significant debt maturities in 2026 including ~$2.26 billion in term loans and $800 million of senior secured notes. It is difficult to see the company being able to refinance this debt at reasonable rates given the current capital markets environment.

IHRT Investor Presentation

Valuation

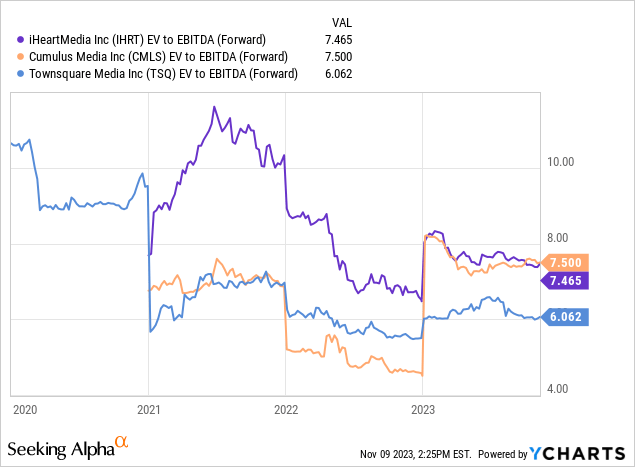

IHRT trades at 7.5x consensus 2024 earnings. Comparably, the S&P 500 trades at ~18x consensus 2024 earnings.

While IHRT appears cheap on a relative basis, it should be noted that 2024 represents a presidential election year which means IHRT earnings should be significantly higher than would be the case in a normal year. IHRT has experienced very high earnings volatility historically (even on a normalized basis) thus it is very difficult to project forward earnings for the company. For this reason, it is difficult to be bullish on the stock given the uncertain nature of future earnings.

IHRT appears to be trading roughly in line with its peers Cumulus Media (CMLS) and Townsquare Media (TSQ)

Potential Upside Drivers

While secular drivers and a highly levered balance sheet represent clear challenges for IHRT, the company does have some potential positive investment catalysts.

Potential Acquisition Target

IHRT is a potentially attractive acquisition target for a number of companies due to its strong digital business. In 2018, while IHRT was in bankruptcy Apple (AAPL) explored buying a stake in the company in order to boost its streaming service. IHRT could also be a potential acquisition target for Sirius XM Holdings (SIRI) or Spotify (SPOT). While I believe IHRT could be attractive to other companies, I believe that IHRT’s high level of debt would make it fairly difficult for a transaction to happen outside of bankruptcy court.

Digital Business Growth

While IHRT’s traditional radio broadcasting business has suffered, its digital business has shown an ability to grow despite a challenging advertising environment. While the digital business accounts for just 28% of IHRT’s total revenue it does account for close to 46% of Adj. EBITDA as the business has a much higher Adj. EBITDA margin vs the Multiplatform business (35% vs 25.9%.) Digital streaming companies such as Spotify trade at a much higher valuation (58x 2025 earnings) compared to traditional radio companies. If IHRT is able to transition to a mostly digital company, it could see a valuation re-rating higher.

Conclusion

IHRT has failed to generate strong returns for shareholders following its emergence from bankruptcy in 2019.

IHRT’s core radio business faces secular challenges due to increased competition from digital players and an advertising shift away from traditional media to digital media. These headwinds are especially challenging for IHRT as the company has little room for error due to its significant debt load.

2024 is expected to be a very strong earnings year for IHRT due to the election. While IHRT stock appears to trading at an attractive valuation of 7.5x consensus 2024 earnings, future earnings are much less predictable.

I believe the structural headwinds currently facing IHRT are only likely to accelerate over the next few years and thus I am concerned about the company’s ability to generate profits in 2025 and beyond. Moreover, the company has relatively limited room for error given the very high debt load and significant maturities in 2026.

For this reason I am initiating coverage with a sell rating but would consider upgrading the stock if the earnings outlook improves due to strength in the digital business and the company is able to de-lever its balance sheet.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here