Introduction

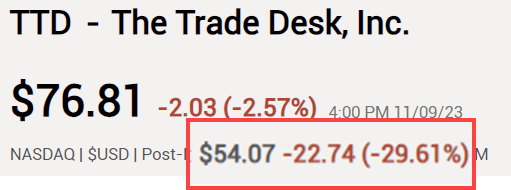

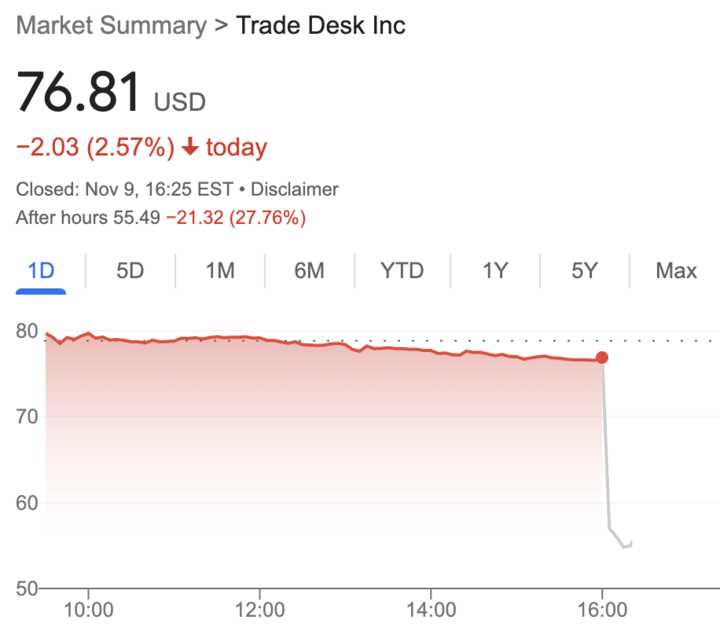

Last Thursday, after the market close, The Trade Desk (NASDAQ:TTD) released its earnings and the stock dropped more than 30% in the aftermarket trading. I don’t have a screenshot of the bottom, as that was more than 30%, but here you see a screenshot of the drop in the after-market hours.

Seeking Alpha, edited by the author

On Friday, though, the stock regained half of that drop and it ended down 16.5%.

The Numbers

This is what I shared immediately after the earnings with my subscribers, the Multis:

Revenue was up 25% to $493.26M, beating the consensus by $6.02M or 1.2%. Non-GAAP EPS: $0.33, 4 cents better than the average of the estimates.

Not great but good.

The big drop comes from guidance: revenue ‘at least’ (that’s how the company has been guiding for a while now): $580M, 5.3% lower than the consensus of $611.07M

No reason in the press release, so looking forward to the conference call. It wouldn’t be the first time Jeff Green talks the stock up.

Just to make sure, this is robotrading, which becomes more and more extreme as time goes on. The story usually follows the stock price drop. We saw the same thing with Adyen recently (a 40% drop) and the reversal yesterday/today.

To be honest, this is the very first time ever that I am tempted to buy AH. But I have to apply for that at my broker and I refuse.

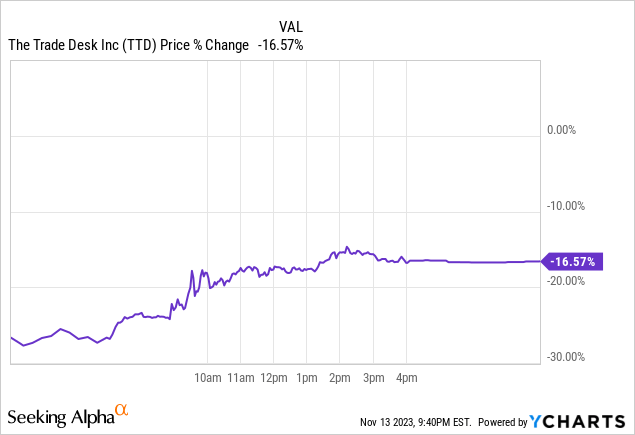

And yes, this was indeed robotrading, as you can see here.

Seeking Alpha

If you really believe that this drop was caused by long-term investors who devoured the earnings in just a few dozen seconds, you probably also still believe Santa Claus is real (sorry if I shocked some believers).

Now, I can tell you that I listened to the conference call and I didn’t hear anything that worried me.

And yes, guidance for Q4 is “only” for 18% growth, but that would have been 22% if you excluded the political spending last year. Not that bad, is it? Especially if you know that Jeff Green, The Trade Desk’s founder and CEO also gave a clear explanation for the miss on the earnings. The strikes, in the car industry and from content producers, impacted the company’s results. Makes sense, in my opinion.

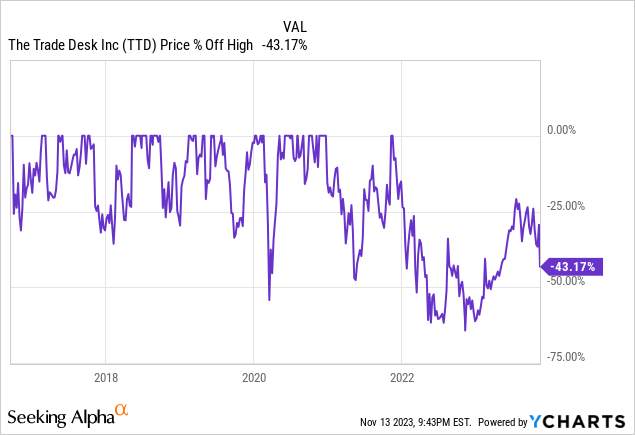

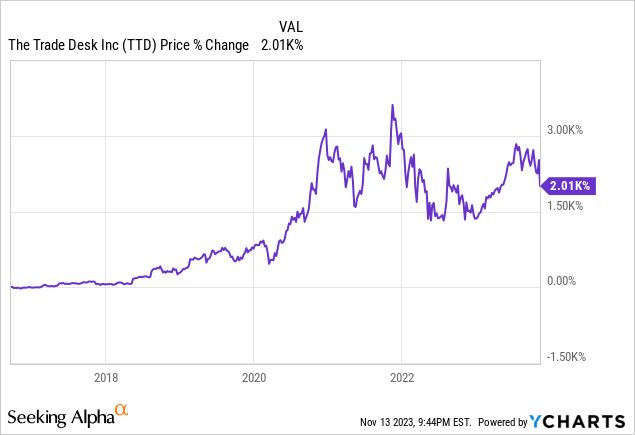

Now, this is not the first time TTD has dropped wildly. Since its IPO it was down by 25% or more about 10 times, of which it dropped by more than 50% from its high.

But if you could hold through the volatility, you were rewarded nicely, with a twenty bagger.

So, yes, The Trade Desk missed Q4 earnings guidance by about 5% and the EBITDA expectations for Q4 by about 7%. We already saw that Jeff Green blamed the strikes. He also mentioned macro in general. But, just like always for TTD, the conference call was interesting again and gave some insights that are important for long-term investors like us.

The problem is often that if a stock drops by so much, you hear all kinds of negative comments. The story always follows the stock movement.

Two Worries Shouldn’t Worry You

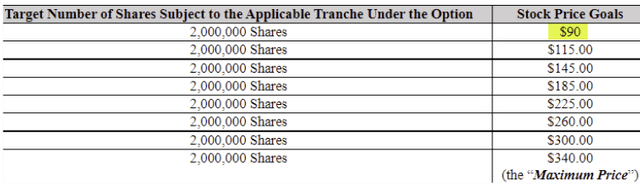

One of the things I heard many comments about is The Trade Desk’s stock-based compensation. Yes, Jeff Green got a big grant, two million shares and some extra. But it’s a part of his compensation plan. He can get many more grants and as a shareholder, I would be very happy with this, as it would mean the stock price is up a lot, as you can see in this table.

The Trade Desk’s SEC filing

If Jeff Green gets all those targets before 2031, when the plan expires, he will have received 16 million shares. Right now, there are 446.46 million shares outstanding. That means if Jeff Green would get all the remaining 14 million shares, that would mean a total dilution of 3.1%.

If Jeff Green gets the stock price above $340 before 2031, I think the stock-based compensation would be a small price to pay. So, don’t let this distract you from the core investment thesis. This looks bad right now, but that’s accounting, not cash flow.

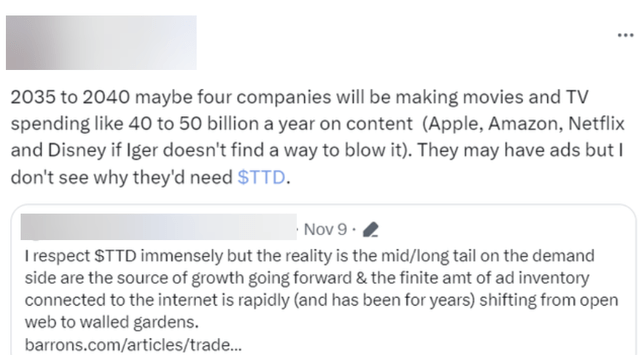

The second thing is this (I blurred the names for privacy reasons).

X

First, Amazon has been partnering with The Trade Desk for its Fire platform since 2019. Netflix tried to work around The Trade Desk, by partnering with Microsoft but it didn’t get its ad slots filled and reworked the deal. Everybody in the know agrees they need The Trade Desk to make ads a huge success.

But is The Trade Desk losing to the walled gardens?

This was explained on the call, though, as it is on almost every call. Jeff Green on the Q3 conference call:

We spend most of our time thinking about how we compete with the biggest technology companies in the world.

And the way that we compete is not to play the game the way they do. Most of them have conflicts of interest all over the place and most brands are terrified to hand over their data and honestly to hand over their future to those businesses so that they’re dependent on growth to come from just handing over their budgets and hoping that they get good stuff.

Instead with us, they have somebody who doesn’t own any media and that is a feature, not a bug, in that we help them objectively decide what media they should buy because we don’t have a dog in that hunt.

And by not having a conflict of interest, we help them to buy objectively across the entire media landscape, especially the most perfectly fragmented portion of that which is in CTV.

The money comes from advertisers, right? If they side with The Trade Desk, you can be Apple (AAPL), Alphabet (GOOG) (GOOGL), Amazon (AMZN), Netflix (NFLX) or Disney (DIS), you’ll want access to that money. That’s not a bearish comment on the giants or a biased look, as I also own shares of Amazon and Google and our daughter’s account holds shares of Disney and Netflix. It’s just an insight that Jeff Green is right in this case.

Again, I don’t think this is something to worry about. Jeff Green also emphasized that the company was taking market share.

We’re gaining market share as we’re outperforming our advertising peers, both big and small.

The continued impact of UID2

For UID2, The Trade Desk’s alternative for cookies, there was a lot of scepsis as well initially. Who would adopt a standard developed by such a small company compared with Google? Well, almost everyone, it turns out. Jeff Green on the conference call:

Nearly all of the major streaming companies in the U.S. have embraced UID2. They understand that if advertisers only advertise on users likely to be interested in their products, then advertisers will pay meaningfully more for those impressions.

If you wonder why, it’s the most powerful motivator companies know: money. Jeff Green gave an example.

One leading streaming platform recently implemented UID2 and the results have been remarkable. Their average daily revenue from The Trade Desk has increased 150%. Their average daily revenue when those impressions are open and biddable, has increased 222% and all because they are able to offer advertisers a much clearer sense of relevance and addressability.

But it’s not just streamers that do much better with UID2. Jeff Green also shared the impressive numbers for a customer:

Luxury Escapes is a high-end travel agency with more than 7 million customers worldwide. They activated their first-party data on our platform and then used UID2 to help find potential new customers who shared characteristics with the most loyal customers they already had. In this way, their first-party data acted as a seed to grow their potential customer base.

And the results were very impressive. In the U.S. alone, their conversion rate with UID2 was more than 400% higher than with cookies. Their return on asset was 900% higher and their cost per acquisition was 83% lower.

More insights from the call

If you have never listened to an earnings call, The Trade Desk’s earnings calls are usually a good starting point, as Jeff Green is a passionate and clear speaker.

Jeff Green explained why digital TV is ideal for The Trade Desk. He emphasized that all streamers, like Disney, NBCU, Sky and Netflix have introduced advertising.

Not all of them have yet embraced or centered around programmatic advertising but we predict they will. In order to get incremental subscribers, they can’t simply keep raising prices. Some consumers would rather spend a few extra minutes, considering ads they watch than pay more for subscriptions. High-priced subscriptions alone will not provide the incremental subscribers media companies need to continue growing.

Green then referred to the fact that the total revenue per user for the ad-supported plans is already more than double that of paying subscribers. And the upside is also much higher for streamers. There is a limit to how much viewers are willing to spend on subscriptions but with ads, a lot of growth is still possible. And then, Green explained very clearly why streaming will be different than traditional TV when it comes to ads.

Economic pressures on the consumer right now are increasing the appeal of a free or low-cost option that is supported by ads. However, this model is only sustainable if the ad load is significantly lower than traditional linear television. And the only way we get there is if the ads are relevant to the viewer so that the advertisers are willing to pay more for each of them.

This makes total sense, in my opinion. Nobody wants so many ads. Brands now pay based on your general profile, but not on your individual preferences. In other words, you watch a certain program, let’s say The Big Bang Theory, and that’s how you are profiled, for example: probably 35 to 45, more male, upper middle class etc.

Of course, there are many mistakes when you paint with such a broad brush and that’s why we all have gotten so many ads we are not interested in at all. Programmatic advertising gets to know us better and better and can serve ads that we are really interested in. Of course, those are much more valuable for advertisers. It also means that content makers can monetize their content without interjecting boring ads we’re not interested in.

Jeff Green also gave another example of one of The Trade Desk’s USPs (unique selling positions). It’s tying everything together through its partnerships with Walmart, Home Depot, Target, Instacart, Albertson’s and many other big retailers. That means you can bid on display places in these stores. That means that The Trade Desk is making the analog digital as well. But it also leads to the holy grail of advertising, as it makes it possible for the first time to measure the effectiveness of ad campaigns precisely. Jeff Green gave an example.

NBCUniversal has teamed up with the Walmart DSP which partners with The Trade Desk so brands can now deliver targeted ads on Peacock live sports inventory using Walmart shopper data. Brands can then measure and provide attribution on the results of those ads in terms of impact and in-store and online sales.

So now, North America which includes brands such as Danone, Silk and Activia, reported a 30%-plus increase in new-to-brand buyers from their CTV campaign earlier this year.

This is a revolution and what the ad industry has wanted forever: measuring direct impact. On the internet, with online shops, you already have measurability to a big extent, but offline, this is a new field and The Trade Desk is a pioneer.

And that is recognized by the market. Jeff Green:

All major retailers are working on activating that data for advertisers, so brands can understand how their advertising dollars impact actual sales, whether online or in-store and most of them are partnering with us.

The significance of this shift should not go unstated. All advertisers are focused at their core on driving sales growth. But until very recently, especially in the consumer space, advertisers have been missing the link between their advertising dollars and the real-world sales growth.

Instead, they have had to use proxy metrics to showcase the ROI of their campaigns. How many click-throughs did their ads strive for example.

But now we can measure with much more precision whether the ad dollars actually led to a consumer purchase. We can attribute value to all parts of the funnel, not just the last touch. We can understand the relevance of every ad impression more clearly and we can better prioritize the right channel at the right time for the right audience.

Now, if you know all this, do you still think Google and Meta (META) will crush The Trade Desk? Do you understand what Jeff Green means when he says that retailers will not want to share their customer data with these walled gardens? The problem is that they can be used by the walled gardens in ways the retailers don’t want. In that sense, The Trade Desk is a safer partner for many brands, that are very careful with their customer data.

Another example was given about Rossman, a big European drugstore chain, that wanted to drive first sales for their organic food brand. It used its customer data to reach its target audience across the internet.

With data-driven precision, they were able to determine that 99% of their ad spend was hitting their specific target audience.

These are impressive innovations and they are still early, but it already seems clear that The Trade Desk is the clear leader for this revolution, as it uses the open internet. Counter-positioning versus the incumbents’ strategy is a characteristic of many of the best investments ever.

What to think of these earnings?

I think there will be few that disagree that these earnings were very strong. The lowlight was, of course, the lower-than-expected revenue growth guidance and EBITDA for Q4. Mind you, The Trade Desk is usually a prudent guidance issuer, so the results could be better than the “at least” guidance. Probably not 5%, though.

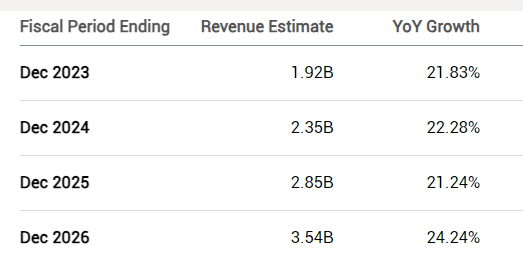

With The Trade Desk’s many innovations, I think years of continued 20%+ revenue growth is likely. There is a clear shift to programmatic. The expectations are that it will grow at a CAGR of 10% for years to come. And I could see the ad leader of the open internet, TTD, growing twice as fast. The company is still early in its story and the total addressable market is gigantic.

A bit above 20% revenue growth, that’s also what the analysts expect for the next few years.

Seeking Alpha Premium

Valuation

The Trade Desk is often called ‘insanely’ overvalued. People look at the very high P/S ratio, for example.

But The Trade Desk has high gross margins of 80% and higher, and that warrants a higher PS, especially because the company is also profitable, also if you withdraw stock-based compensation. And it has been profitable since 2013.

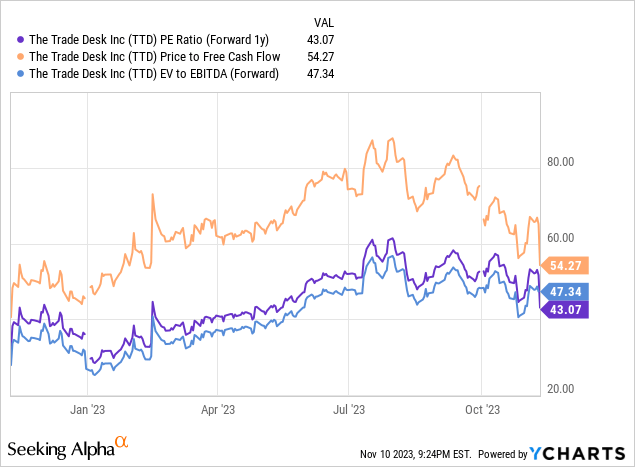

Of course, the stock is not cheap; it’s expensive, but not that expensive. If you look at the forward PE, the price to free cash flow and the forward EV to EBITDA, you see that the valuation is between 43 and 54.

Data by YCharts

I don’t know what the stock will do over the short term. To be honest, and I hope you don’t find this insensitive, I had hoped the stock had dropped more, so I could add substantially to my position. Now I have added a little bit. Now, in the market, everything is possible, so who knows? It might head back to the 50s. We’ll see. But the most important thing to me was that the long-term investing thesis is alive and kicking. I have owned this stock since 2019 at $19.50 and it has never been cheap. I think this will continue.

Conclusion

Even though most of the attention was given to the Q4 guidance miss, The Trade Desk had great earnings again. On a comparable basis, so excluding political spend, the revenue is still expected to grow by 22% in Q4. For 2024, an election year, there could be positive surprises for the company.

Let’s finish with the words of Jeff Green to end this article, as they summarize my opinion as a long-term investor:

The fundamentals of our long-term business are as solid as they’ve ever been and we are poised to continue to outpace the industry and gain share

In the meantime, keep growing!

Read the full article here