Investment Thesis

JFrog Ltd. (NASDAQ:FROG) provides a comprehensive DevOps platform centered around “Liquid Software,” facilitating continuous and secure software delivery across diverse systems. Their core offering, Artifactory, serves as a universal package repository, and they prioritize flexibility, and customer-centricity in supporting modern software development practices.

The bull case here focuses on this business as a growth story. A profitable growth story that should be amply rewarded by investors with time. The bear case asserts that this stock is already pricing in high expectations.

Even if I recognize JFrog Ltd. prospects as being alluring, I struggle with its high valuation, therefore, I’m neutral on this name.

Rapid Recap

In my previous analysis, I said,

[…] there are some positive aspects and some negative ones. The reason why I’m not particularly bullish on this stock is that I believe that the stock is already fairly priced. What this means in practice is that I suspect that the stock will continue to perform strongly, but I don’t believe it makes sense for me to buy at this valuation.

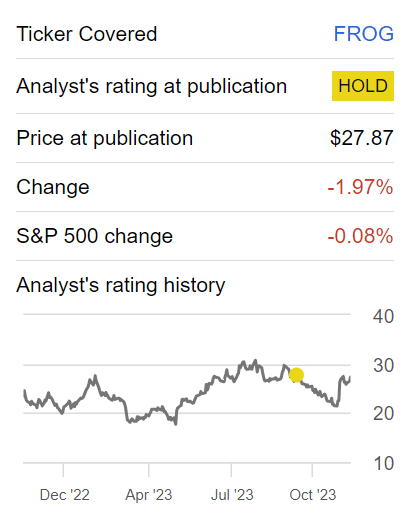

Author’s work on JFrog

Since I made that analysis, this stock has gone nowhere fast. Even if I want to cheer for this stock, I find that it’s already pricing in too many years of rosy performance for me to get a suitable entry point.

JFrog’s Near-Term Prospects

JFrog specializes in enabling “Liquid Software,” providing a DevOps platform that manages the entire software supply chain. JFrog offers version-free software as part of their customer-centric approach.

At the core is Artifactory, a universal package repository. They address security with tools like Xray and Advanced Security, promoting flexibility through multi-cloud deployment. JFrog actively supports DevOps and DevSecOps practices, fostering collaboration between development and operations teams. Their customer-centric approach includes freemium options, free trials, and open-source versions, allowing users to explore their platform before committing to subscriptions.

Moving on, JFrog strategically aligns its product portfolio with the evolving landscape of cloud and security. The recent product releases, announced at SwampUp, demonstrate a thematic consistency with the growth drivers of the industry. By addressing security concerns comprehensively throughout the software supply chain, from development to production, JFrog positions itself as a key player in the DevOps ecosystem.

The introduction of tools such as Georgian security, Curation, and Catalog underscores the company’s commitment to providing end-to-end solutions for DevOps, with additional plans to enhance security capabilities in the runtime phase. Furthermore, the integration of artificial intelligence and machine learning capabilities into the platform positions JFrog at the forefront of supporting security scanning for ML models and the storage of such models in Artifactory. With a roadmap that extends further into the next few quarters, JFrog aims to solidify its position in the market by offering innovative solutions that align with the growing demands of cloud-native development and security-conscious practices.

Given this context, let’s discuss JFrog’s growth rates.

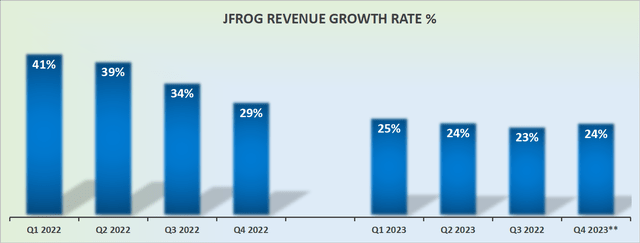

Revenue Growth Rates Stabilize

FROG Revenue Growth Rates

As you know, the DevOps industry is dynamic marked by emerging players. Furthermore, there was a noticeably slower pace of customer adoption this quarter. More specifically, Q2 2023 saw customers spending +$100K in ARR increase by approximately 26% y/y, while Q3 2023 saw this figure decelerate to approximately 22% y/y.

This is not a thesis breaker, but rather something to keep an eye on. As the market continues to shift, JFrog needs to effectively communicate the unique value proposition of its solutions to potential customers who might still be relying on open-source alternatives.

Moreover, JFrog marginally beat Q3 revenue estimates and its guidance for Q4, including a ”likely” 2% top line beat should come in around 24% CAGR.

This implies that, in all likelihood, the times when this business could be counted on for higher than 30% CAGR are for now in the rearview mirror.

That being said, JFrog continues to clearly grow at a rapid rate. Accordingly, given the easier comparables next year, it appears likely that JFrog should continue to see mid to high 20s% CAGR in 2024. In other words, this business will continue to be recognized by investors as a rapidly growing business, something that ”should” carry a high premium, particularly since it is already profitable.

FROG Stock Valuation — 55x Forward Operating Profits

Let’s think about this from a different perspective. JFrog is guiding for nearly 12% operating profit margins. If we assume that JFrog grows its revenues by around 26% in 2024 and that its operating profit margins continue to move ever-so-slightly higher towards 12% non-GAAP operating profits, this implies that JFrog could see around $52 million of non-GAAP operating profits.

As you can see, I’ve attempted to be reasonable with this figure, without factoring in any heroic assumptions. A figure that should provide me with a margin of safety.

This implies that JFrog is priced at approximately 55x forward non-GAAP operating profits. A valuation at which I simply struggle to see a lot of upside for investors.

The Bottom Line

While I acknowledge JFrog’s innovative strides in the DevOps landscape and its commitment to providing end-to-end solutions, my reservations lie in the steep valuation of approximately 55x forward non-GAAP operating profits.

Despite the company’s rapid growth and profitability, this valuation appears to leave little room for substantial upside.

The market dynamics are evolving, and the slower pace of customer adoption in recent quarters raises questions about JFrog Ltd.’s ability to effectively communicate its unique value proposition, especially to those still relying on open-source alternatives.

As a JFrog Ltd. investor myself, I find myself grappling with the uncertainty of whether the current valuation aligns with the long-term growth potential of the business, making me adopt a cautious stance on committing to an investment at this juncture.

Read the full article here