Summary

Since my initial report in September, CMG’s shares have rallied ~23%. Following the Bluware acquisition and Q2 results, I am pleased with the success of new CEO Pramod Jain’s strategy of M&A and driving organic growth through CCS and energy transition. Despite the strong results and ample capacity to fund future M&A, risks are developing for CMG’s core ResSim business, and the current valuation offers a much smaller margin of safety. Increasing M&A activity among E&Ps in the US, a softening oil market, and the large rally in recent months have prompted me to change my rating to Hold. If I were to continue holding a position in CMG, I would significantly reduce my position size.

Earnings Update

Bluware Acquisition

Shortly after my initial report, Computer Modelling Group (TSX:CMG:CA) announced the acquisition of subsurface software and services provider Bluware-Headwave Ventures Inc. (“Bluware” or “BHV”) for US$22MM (n.b., ~1x ’22A revenue, ~19x ’22A EBITDA). Bluware’s software focuses on subsurface learning, including seismic interpretation, and generated ~US$23.5MM of revenue in 2022 with a ~5% adjusted EBITDA margin.

Bluware specializes in cloud and interactive deep learning for subsurface decision-making. According to CMG, its flagship product is called InteractivAI, which significantly reduces seismic fault interpretation timelines. In addition to the US$22MM purchase price, the deal also includes an earn-out of up to US$8MM, depending on software revenue thresholds over the next 18 months. CMG says it funded the acquisition with cash on its balance sheet (~C$64MM in the prior quarter, ~$48MM in Q2).

CMG has historically been very conservative in its M&A, but this appears to be changing under new CEO Pramod Jain. The acquisition of Bluware is CMG’s second acquisition of 2023, the other being Unconventional Subsurface Integration in February. USI was a bolt-on for CMG’s legacy reservoir simulation software, while Bluware represents an expansion into the rather different market of seismic interpretation. Despite their differences, CMG should be able to realize some synergies from customer overlap and back-end rationalization (e.g., management indicated potential R&D synergies on its webcast about the acquisition).

One major risk outlined by management was Bluware’s customer concentration. CMG should be able to mitigate this through cross-selling to its large customer base and its strong relationship with Shell, Bluware’s largest customer (n.b., CMG also has a strong relationship with Shell through its CoFlow project).

The BHV acquisition added ~$0.6/share (n.b., ~6%) to my target price. Considering CMG’s large cash balance and debt-free balance sheet, it has considerable room to pursue further M&A. Given the value uplift from BHV, this is a significant upside opportunity.

Revenue

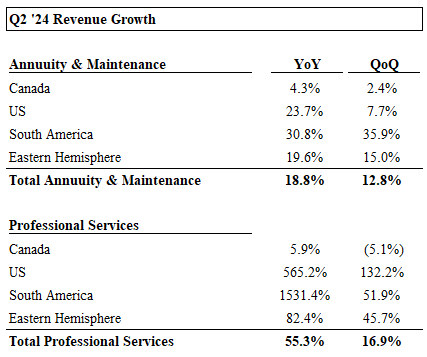

Revenue growth was quite impressive across the board, both YoY and sequentially, with the exception of a small QoQ decrease in the Canadian consulting segment. The excerpt below from the quarterly CEO letter outlines this quarter’s growth drivers.

“Growth is being fueled by a combination of underlying strength of the industry and the changes we have made to our business over the past year. We experienced growth in our annuity/maintenance revenue as well as perpetual licenses and consulting. A combination of new customers, increased licensing by existing customers, and price increases all contributed to our financial outperformance in the first half of the year.” (Pramod Jain, CEO)

Q2 ’24 Revenue Growth (Author; CMG)

Growth in total software revenue (A&M + Perpetual) is driven by two factors: 1) strength in the core ResSim market due to a strong O&G in the quarter, and 2) growth in CCS.

The strength of the core ResSim business is essential, as it accounts for ~80% of CMG’s software revenue and provides leverage to oil prices which helps CMG act as a portfolio hedge against inflation (n.b., fuel and energy prices have been a significant contributor to inflation and, therefore, interest rates; thus, I have used CMG as a hedge for my more interest rate sensitive holdings, like Tricon and Northview). However, leverage to the energy markets is a double-edged sword. It has been a tailwind this year but could easily turn into a headwind in the event of a recession that weakens oil markets. I believe CMG’s CCS business, driven by government climate policies and incentives, provides a long growth runway with a lower correlation to oil prices. This is necessary to support the long-term growth rates and sustainably higher multiple necessary to justify my valuation.

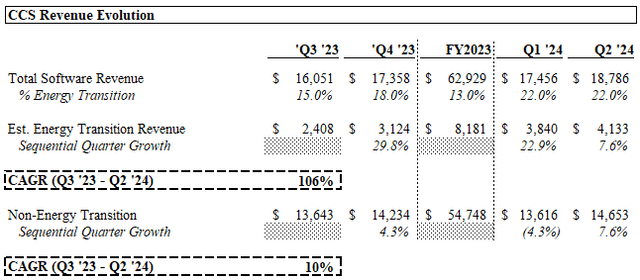

In the quarter, CCS contributed ~22% of CMG’s total software revenue (n.b., flat contribution QoQ, but up from ~13% for FY2023). I estimate that CCS revenue has grown at a ~106% CAGR from Q2 ’23 – Q2 ’24. I was surprised to see a material deceleration in the sequential growth rate for CCS in Q2 to ~8% from ~23% in the prior quarter. Some deceleration is expected as the segment matures, but it seems too early for such a slowdown. If this trend continues in the coming quarters, it may warrant a closer look at the true TAM of this opportunity and could jeopardize the growth story.

CCS Revenue Evolution (Author; CMG)

Costs & Margins

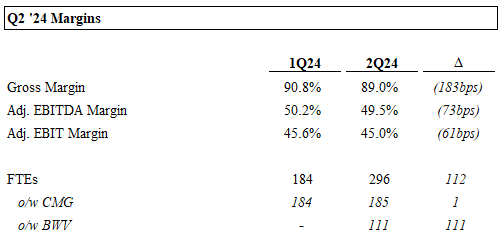

Margins were stable QoQ, though I expect the reported figures to be diluted by BHV starting next quarter (n.b., BHV EBITDA margins of ~5%). I believe there may be opportunities for operational synergies due to the fact that BHV’s revenue/FTE is ~26% lower than CMG’s, while total opex/FTE is ~19% higher. Assuming BHV could achieve CMG’s productivity and cost/FTE implies a +30% revenue boost and doubling of EBITDA. This is an unlikely outcome in the near-term but illustrates the potential for longer-term growth. I believe CMG needs to realize some form of synergies on BHV to keep the market bought into its M&A strategy, as BHV appears to be a lower-quality business on a standalone basis.

Q2 ’24 Margins (Author; CMG)

Valuation

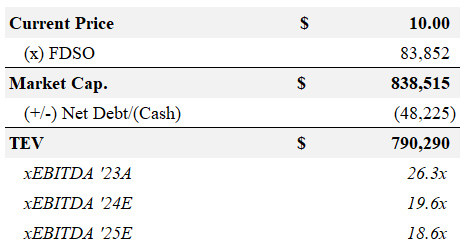

At ~$10/share, CMG is trading at ~31x ’25E FCF (n.b., excluding BHV earn-out payment) and ~19.6x / 18.6x ’24E / ’25E EBITDA. The current dividend yield is ~2%, and the net cash position is worth ~6% of the current market cap.

CMG Capitalization (Author; CMG)

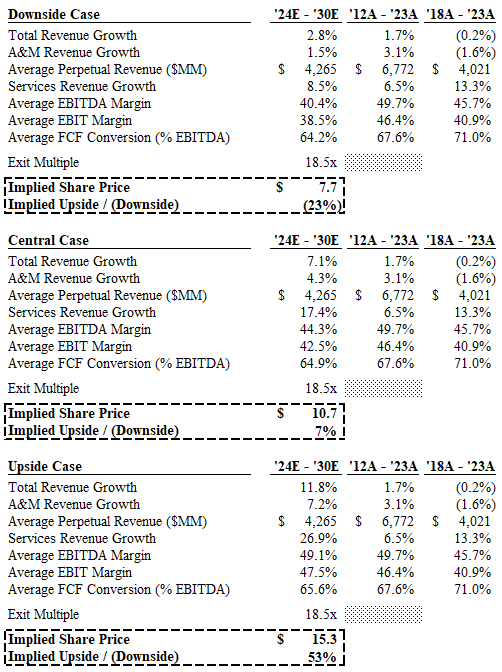

I have reconstructed my downside, central (i.e., What You Need to Believe, “WYNTB”), and upside cases. In the downside case, I created a case that was close to the historical performance CMG has experienced on its core ResSim business over the past ~10 years. This case illustrates what would happen if we experienced a prolonged downturn in oil markets and a significant slowdown in the CCS segment. With the central case, I gave more credit to the CCS segment, assumed no major weakness in oil markets, and continued strong performance of the Services segment. The upside case assumes a pickup in CCS growth, strong oil markets, and material margin expansion. All cases assume a discount rate of 12%, consistent with my original report, and an exit multiple of 18.5x NTM EBITDA vs 20.0x in my original report (n.b., current NTM EBITDA multiple of ~18.8x).

CMG Valuation Cases (Author)

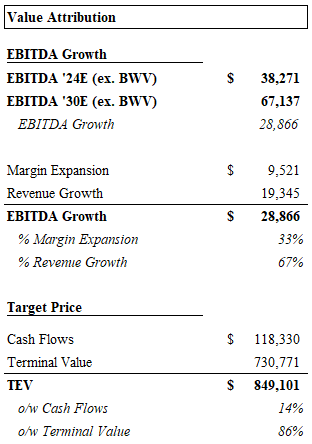

For my central case, nearly 90% of the value is attributable to the terminal value (n.b., 18.5x NTM EBITDA), ~70% of which is attributable to revenue growth (see below). This makes my valuation highly reflexive. Higher revenue growth warrants a higher multiple and vice versa.

Value Attribution (Author)

Given this fact, caution is warranted due to this quarter’s deceleration of CCS growth. I would need a significant pullback in the share price (n.b., likely to ~$9/share) or a return to HDD CSS growth in the next quarter to change my rating to Buy.

Risks

Oil Price Risk

Although E&P activity currently appears healthy, there are some signs of weakness as economic indicators raise concerns about demand in the near and medium term. While short-term price action has a limited impact on CMG’s top line due to the contracted nature of its revenues, a sharp and/or protracted downturn in oil markets would be immediately negative for its share price and eventually hit earnings.

CMG Share Price Evolution (Yahoo Finance)

E&P M&A

Following its acquisition of Pioneer, Exxon is reportedly still in the market for other M&A targets. The FT described this transaction as the deal “that fired the starting gun on what is expected to be a race to consolidate the sector.”

As Jain noted in his Q2 CEO letter, industry consolidation has historically been negative for CMG:

“The energy industry has also seen some remarkable events recently, with the announcement of two high profile consolidations. Industry consolidation has had an adverse effect on our business in the past, with acquirors reducing software licenses to streamline costs or achieve synergies. As we approach year-end, we acknowledge this challenge given the high volume of contract renewals we experience early in the new year (our fiscal Q4). Our customer teams are even more focused on building relationships, understanding market needs and collaborating closely with our clients to tailor solutions to address the specific challenges and objectives of these new, larger organizations.” (Pramod Jain, CEO)

This impact is hard to quantify, but any significant deceleration or decline in the core ResSim A&M segment may become an inflection point in sentiment, especially if the current oil market weakness persists.

Slowdown in CCS

As discussed earlier, the recent quarter showed a significant deceleration in CCS growth. The growth of this segment is critical for CMG to achieve the growth rates required to sustain its current share price and any potential upside. It is also likely necessary to reduce CMG’s sensitivity to oil prices, which would help sustain a higher multiple. Should this slower growth rate persist, the market may question the size of the TAM and the competitiveness of CMG’s product.

Catalysts / Upsides

M&A

As I mentioned earlier, I estimate the BHV acquisition added ~$0.6/share of value to CMG (n.b., ~6% of the current price). With ~$48MM of cash and no debt, CMG has ample capacity for more M&A. With no M&A in my case, this could be a significant upside in the medium term.

Return of Capital

CMG could pursue either buybacks or dividend increases as an alternative to, or in conjunction with, M&A. I see dividend increases as unlikely given the emphasis on M&A and reinvestment/R&D. However, the board may raise the dividend to its prior level of $0.1/share/quarter from $0.05 currently (n.b., the dividend was decreased during COVID as a precautionary measure). I view buybacks as the more significant catalyst here, as I doubt the investor base is dividend-focused.

Conclusion

CMG reported a solid Q2, beating consensus estimates. However, recent consolidation among US E&Ps, economic weakness, and a slowdown in the critical CCS segment have increased CMG’s risk profile. Shares are up +20% since my initial report, and I believe the easy money has been made. I am moving CMG to a Hold for now and will revisit my rating if shares decline to ~$9/share, CCS growth picks up in the next quarter, or a large M&A deal is announced.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here