Editor’s note: Seeking Alpha is proud to welcome Nickle Lyu as a new contributor. It’s easy to become a Seeking Alpha contributor and earn money for your best investment ideas. Active contributors also get free access to SA Premium. Click here to find out more »

Thesis

Crocs (NASDAQ:CROX) ticks four key boxes that I typically look for when searching for investments that offer deep value. These elements are: 1) a great business model, 2) a healthy company, 3) substantial safety margins or moats to weather market fluctuations, and 4) an extremely low price. Crocs embodies all of these characteristics, making it a textbook example of a deep value case. If you invest now, you could very likely achieve a return of 200% or more in three years.

Deep Value Enabler 1: Great Business Model

When considering a great business, I look for a strong brand, high gross margins, high operational margins, low capital requirements, potential for longevity, dominance over competitors, and a straightforward and comprehensible business model.

Business Model

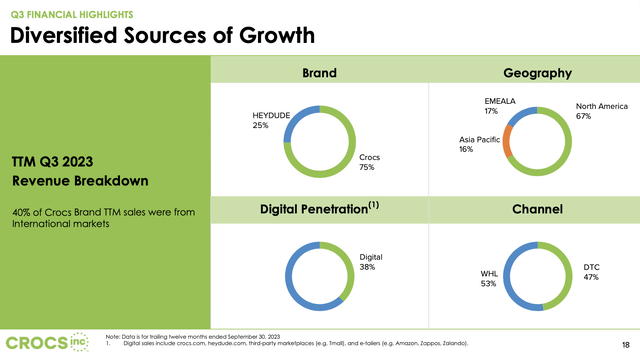

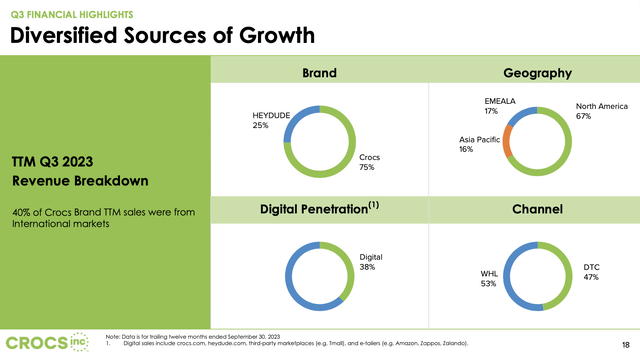

Crocs’ business primarily consists of two brands: Crocs and Hey Dude. In terms of revenue contribution, Crocs accounts for 75%, while Hey Dude contributes 25%. The company specializes in manufacturing and selling casual footwear, specifically clogs, sandals, and loafers.

Brands revenue breakdown (Crocs earning call presentation )

Crocs 2023 Q3 earnings call presentation

Top-Class Profitable Business Model

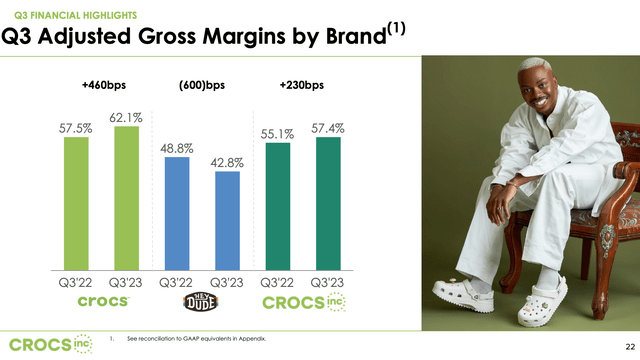

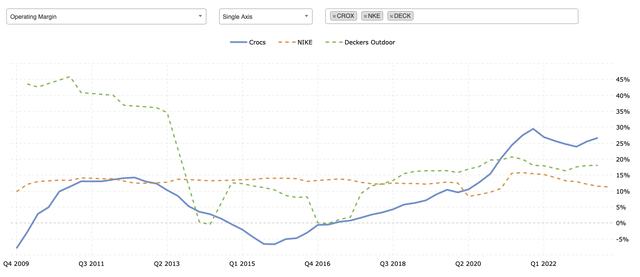

Yes, according to its recent financial reports, Crocs maintains a gross margin of approximately 55%, with Crocs itself achieving an even higher margin at 62%, and Hey Dude at 42%. Moreover, its operating margin ranks among the top in the footwear industry, currently at 28%, surpassing competitors like Nike (NKE) (11.5% in 2023) and Skechers (SKX) 5.28% in 2023).

Gross Margin of Crocs and Hey Dude (Crocs Earnings Call Presentation)

Crocs 2023 Q3 earnings call presentation

Minimal Capital and Asset Needs

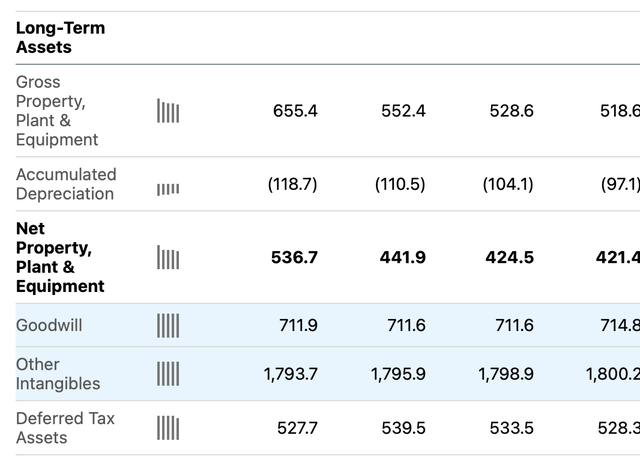

Production can be outsourced to regions like China and Southeast Asia with expertise in manufacturing. Crocs has followed this strategy over the past two decades, yielding positive results. When comparing the return on capital for 2023 so far, Crocs boasts 23.15%, surpassing Nike (18.69%) and Skechers (10.27%). Similarly, comparing return on assets, Crocs leads with 14.80%, ahead of Nike (13.30%) and Skechers (7.38%). The data clearly demonstrates its efficiency in capital utilization. Furthermore, the inclusion of $2.5 billion in Goodwill and Intangibles, which incurs no costs to maintain, makes it even more efficient. Excluding goodwill, the return on assets ratio would triple. Overall, thanks to its simplistic core product design, the classic clog, for instance, comprises only three parts, Crocs operates as a lean and efficient business.

Good will and intangibles (Seeking Alpha )

Crocs Balance Sheet

Dominate Competition

Crocs dominate the clogs market. Hey Dude does the same in the loafer market. Crocs ranked No. 6 and Hey Dude ranked No. 8 as favorite footwear brands among all teens, both gaining approximately 25 basis points of share year-over-year, according to Piper Sandler survey.

Strong Brand Durable for Decades

I would argue that it has a great brand, started from the classic clog and has kept on building the brand in the last two decades. It recently strengthened its hold on the comfort casual shoes market by acquiring Hey Dude. Also, for the last two decades, people have shown their love for the shoes, and they continue to pay a premium for that passion. Plus, they have strong and diverse moats, which, as I will show you below, can help the company go through the ups and downs of economic cycles. But most importantly, I will argue that it is the brand that will keep it alive and relevant. I would like to offer some proofs here. Please check them. There are important things to consider, as Charlie Munger said, ‘If you don’t get the qualitative factor right, it’s going to be very hard to make a lot of money in the stock market

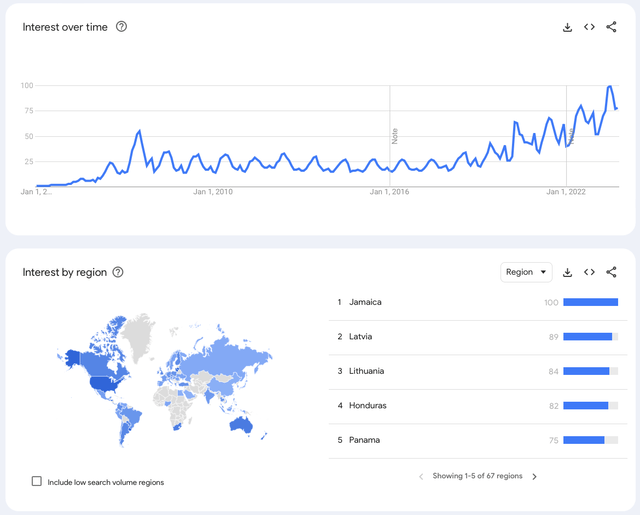

Stars love them, People buy Crocs and Hey Dude, and people collect them. And it is a global phenomenon, Just check Google search data.

Crocs on Google Trends (Google Trends)

In summary, it is a great business with a strong brand, high gross margin, top-class operating margin, minimal capital required to operate, low need for innovation, a large and growing addressable market, and a strong market position. I give it 90 out of 100 in terms of the business model. It is the major reason that its revenue grew from 10 million in 2005 to 4 billion in 2023, and the company’s value grew from 880 million to 5 billion, even after massive underestimation.

Deep Value Enabler 2: Healthy Company

For a healthy company, I am looking for efficient operations, a strong balance sheet, and also an honest and capable management team. Crocs has all of them.

Efficient Operations

Top-Class Operating Margin

Crocs has a top-of-the-category operating margin, which is a mind-blowing 27%. I give it 80 out of 100. Although Nike and Deckers Outdoor (DECK) are the top dogs in this sector, in terms of efficiency, Crocs is not losing to anyone.

Crocs Nike Decker Operating Margin (macrotrends.net)

Crocs Nike Deck

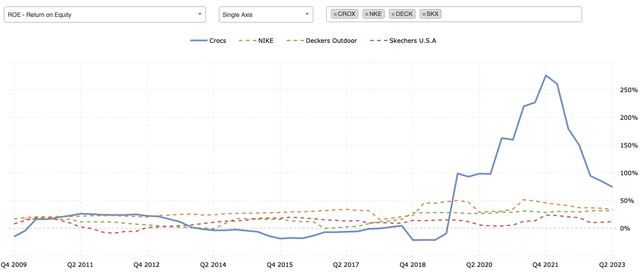

Top-Class in Return on Equity

If we compare it to its peers, we know that it has been at its best for a few years, and then settled at a normal level, but still much higher than its peers.

Crocs Nike Skechers ROE (macrotrends.net)

Strong Finances

A healthy company must have strong finances. It all comes down to whether the company has enough money to pay its debts, cover operational costs, and continue growing.

Strong Cash Flow

Right now, Crocs can generate around $500 million to $600 million in operating cash flow. It has been very stable for the last few years, except for 2019.

Operation Cash Flow (Seeking Alpha) Free cash flow (Seeking Alpha)

Enough to Pay Its Interest

We can see its interest coverage ratio is roughly above 4.5 since 2017.

Crocs Interests Coverage (stockAnalysis.com)

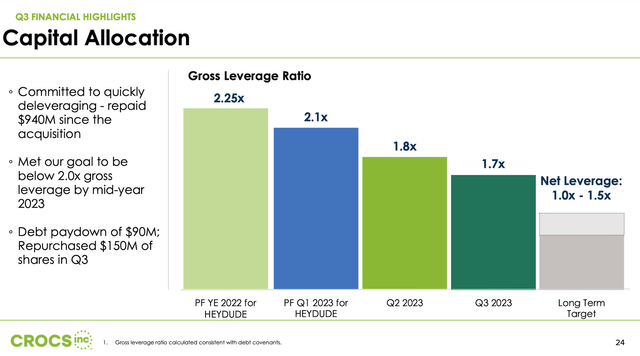

Enough to Pay Its Debt

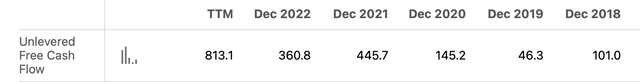

From the latest Q3 2023 report, we can see that the Current Ratio (Current Assets / Current Liabilities) is 1.51. This isn’t exceptionally high, but it is sufficiently good. The company can easily pay its short-term debts. From the latest Q3 2023 balance sheet, we see it has $2.38 billion in debt, with long-term debt accounting for $2.2 billion. With an estimated $800 million in free cash flow each year, there’s no need to worry about the long-term debt—it can be paid off quite quickly if the company chooses to do so. However, if the debt has a favorable rate, there’s no need to rush to pay it off. The management team tends to maintain a net leverage ratio of around 1.0 to 1.5. That’s a prudent strategy.

Free cash flow (Seeking Alpha)

Crocs Capital Allocation (Crocs Earnings Call Presentation)

Crocs 2023 Q3 earnings call presentation

Enough to Pay Its Operating Costs

With a 28% top-of-the-class operating margin, it is definitely enough to cover all operating costs, and there’s a 16.93% profit margin remaining. That’s not bad at all.

Enough Capital to Grow

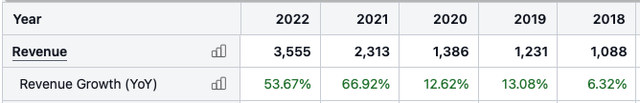

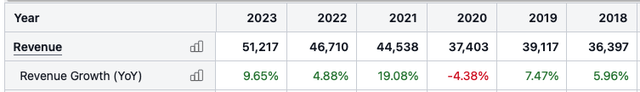

Crocs Revenue Growth (StockAnalysis.com)

When we look at the revenue growth, we could see that the revenue growth is coming down and down. From 50% to 6.15%. But we need to know the reason for the revenue growth drop. If we look at Nike’s revenue during the same period, given Nike’s stable performance, we might get some clue that the revenue decline is related to an overall sector decline. Even when compared with Nike, the growth is not bad at all. During this time, plus the company continued to release new products for both the Crocs and Hey Dude brands. So it got enough money to grow.

Nike Revenue Growth Annually (StockAnalysis.com)

Management Team

The management team truly understands the importance of their core products for both Crocs and Hey Dude brands. They also actively try new products to capture the full potential of the casual footwear market. They are bold enough to seize big opportunities, like the acquisition of Hey Dude and heavy investment into Asian markets, while also excelling in daily operations, maintaining top-of-class operating margins.

Led the Legendary Crocs Comeback

It is this team that has done a great job turning the Crocs brand around after the 2008 crash. They also seized the opportunity during the pandemic when the desire for comfort became more significant than ever. That was strong evidence of a capable team.

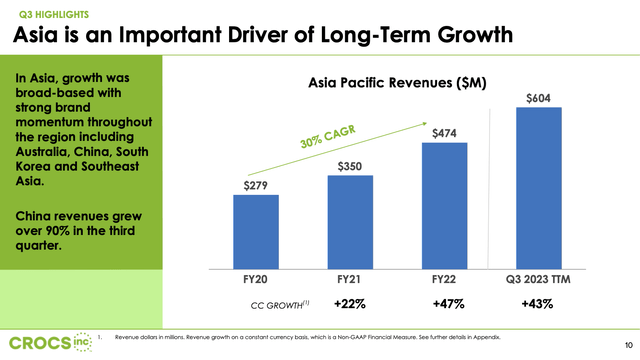

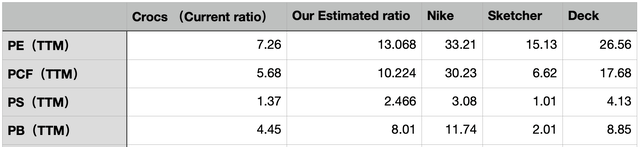

Growing the Overseas Market

The management team also excelled in growing the overseas market, especially in Asia. The USA accounts for less than 4% of the world’s population. For a footwear company, the overseas market is very important. They continue to invest and optimize even when the returns do not seem justified until they get the market working and growing faster, which has largely offset the slowdown in growth in the US. According to Q3, Crocs obtained 33% of its revenue from international markets but almost 67% from North America, so there is still a long way to go. Currently, the Asian market constitutes only 16% of revenue. However, it is growing rapidly, especially in China, where Q3 revenues increased by over 90% in constant currency.

Crocs Asia Pacific Revenue (Crocs Earnings Call Presentation )

Acquisition of Hey Dude

The acquisition of Hey Dude for $2.5 billion, though appearing costly, mirrors Nike’s successful purchase of Converse. Nike’s $300 million investment in a then-bankrupt Converse, now generating $2.4 billion in revenue, highlights the value of a strong brand. Similarly, the Hey Dude acquisition promises significant synergies in design, marketing, distribution, and manufacturing, exceeding those of Nike-Converse. This strategic move, backed by a skilled management team adept at sustaining growth and high operating margins, positions the company well for future success in the casual footwear sector.

Great Control of Distribution Channels

I am pleased to see Crocs increasing the number of products sold through its own direct-to-consumer (DTC) channels—direct to customers. This means higher margins and more control over brand image. I’m not suggesting that more DTC is always better; there needs to be a good balance. With your own distribution channels, you have better control and profits, and a good understanding of the end market. With wholesale channels, you get valuable shelf space to maintain your brand and market share. To me, a good proportion is around 50% for your own channels. According to its Q2 financial report presentation, it is at 46% DTC. That is a really good mix.

Diversified Sources of Growth (Crocs 2023 Q3 earnings call presentation)

In summary, the management team is comprised of mature experts in their field. They can make bold moves, such as entering new markets or acquiring a significant competitor. They also excel in daily operations, maintaining top-of-class operating margins. Moreover, they truly understand the value of brand health, not only keeping an eye on it but also striving to build the brand. They are able to sacrifice short-term revenue growth to protect brand health, such as by removing small distribution accounts of Hey Dude and refusing to match grey market prices for Hey Dude in their own channels.

Deep Value Enabler 3: Substantial Safety Margins and Moats

“Fake” risks for a long-term investor

Those are risks may not affect the intrinsic value, only the short-term price. For long term investor, they are just fine as they are not real risks, but something could bring us buy-in opportunities.

Reasonable Debt Burden

Currently, the company has $2.2 billion in long-term debt. For a company with $4 billion in revenue, a 28% operating margin, and an annual cash flow of approximately $800 million, it is just fine. Additionally, the company has already repaid $950 million, and the leverage ratio stands at around 1.8, according to the Q3 2023 earnings report.

Temporary Growth Slowdown

Concerns about Crocs’ growth due to the durability of their shoes are offset by their strong market presence. They’ve captured the kids and teen market, ensuring both immediate growth and long-term brand loyalty. New product lines like Echo and expansion into the sandal market, valued at $30 billion, according to Q3 2023 earnings report, show promise. The acquisition of Hey Dude broadens their reach in casual footwear. Moreover, their rapid expansion in global markets, particularly in Asia, with China showing triple-digit growth, positions them well in the casual footwear sector.

“Fashion Fading Out”

There are concerns about Crocs being a temporary trend, but this overlooks the lasting appeal of comfort in footwear, exemplified by the long history of the Dutch clog, Crocs’ inspiration. The enduring popularity of comfortable, casual fashion, as seen in brands like Crocs CROX, Hey Dude, and Lululemon, mirrors the consistent demand for products like sugary drinks, which companies like Coca-Cola have successfully tapped into for over a century. The shift towards remote work and the growing appreciation for comfortable fashion suggest that the appeal of Crocs is not just a passing phase but a lasting trend.

Short -Term Economic Recession

People are worried about a potential recession triggered by high interest rates, conflicts in the Middle East, or persistent inflation. Indeed, discretionary products, or those not essential to daily life, are impacted by economic cycles. However, this impact can be significantly mitigated during a strong economy. It’s important to note that for professionals like nurses and chefs, who spend long hours on their feet, products like Crocs are essential. Likewise, remote workers who choose not to return to the office, or those who work from home periodically, will find value in owning a comfortable pair of Crocs or Hey Dude shoes. Additionally, the effects of economic cycles are often overly reflected in the stock price.

Real Risks

Over Expansion Leading to Financial Crisis

For any brand, beyond commodities, consumers purchase not only products but also the brand’s value.

Diversification Undermining Brand Health

Companies often diversify their offerings to stabilize performance, but there’s a risk of straying too far from their core brand identity and losing their essence.

Difficulty Maintaining Gross Margin

If a brand cannot maintain its gross margin, it suggests that consumers are no longer buying into the brand, which could result in permanent damage.

Declining Operating Margin

A decrease in operating margin indicates that a brand is losing efficiency.

Timing the market

Even a great company’s stock price fluctuates with the economy and interest rates, but timing the market often leads to losses. Holding through economic cycles tends to balance out, as highs offset lows.

Moats to Withstand These Risks

Unique Product Design of the Core Products

The current unique design of Crocs’ core products has brought the brand recognition and offers consumers comfort, durability, and a variety of styles. Its design also allows for effortless slipping on and off, easy maintenance, multiple ways to wear them, and simple manufacturing with just three parts. This has created a solid cash flow from a loyal customer base. The company can always refocus on its core products for a turnaround if needed.

Brand Reputation and Price Power

Crocs has built strong brand recognition over the years around the mantra of proudly embracing comfort. This brand reputation is a key factor in the high gross margins for everything the company produces, providing a buffer against misfortune or mismanagement. Moreover, a strong brand provides the flexibility to raise prices if necessary. Crocs ranked No. 6 and Hey Dude ranked No. 8 as favorite footwear brands among all teens, both gaining approximately 25 basis points of share year-over-year, according to the Piper Sandler survey cited above.

Global Market Reach and Supply Chain Mastery

Crocs boasts a robust global presence, with supply chains and distribution networks spanning numerous countries. This international framework not only allows the company to cater to diverse markets and consumer preferences but also affords it a low cost of production and extensive access to the global market, also the top-of-class operating margin of 28% makes it easy to compete in any tough economy.

Social Influence and Demand Awareness

Crocs’ collaborations with celebrities, designers, and brands have significantly heightened the excitement and buzz surrounding its products. By launching limited-edition collections and partnering with popular figures and organizations, the company has effectively bolstered its influence and heightened awareness of both fashion trends and consumer needs.

In summary, short-term risks may affect prices, but for the long-term investor, these fluctuations are often temporary, as prices tend to realign with intrinsic value. Such dips are not entirely negative, as they can present opportunities to invest at lower prices. As for substantial risks, Crocs has demonstrated its robust defenses, or “moats,” which safeguard its market position. The company’s performance during the pandemic has proven its resilience, suggesting a substantial safety margin for future operations.

Deep Value Enabler 4: An extremely low price

Valuation Considerations

To achieve accuracy, I analyze the company’s main business segments separately to estimate the value of each. This is because the aggregate value of the company is often greater than the sum of its parts, allowing for a ‘safety margin’ in our valuation. Take Crocs, for instance, which owns two brands. Valuing each brand individually and then adding them together often underrepresents the company’s true value due to the synergies between the brands.

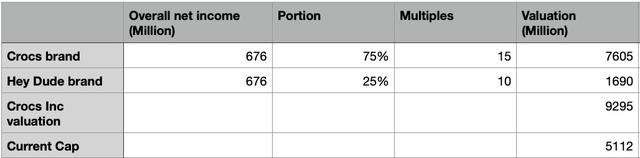

1. PE Valuation

The Price-to-Earnings ((P/E)) ratio is the metric I prefer due to its widespread use and straightforward nature. For Crocs, I assign a P/E multiple of 15, reflecting the strong business performance highlighted in our analysis, but still very conservative. For the newer brand Hey Dude, a more conservative multiple of 10 seems appropriate. Crocs’ trailing net income stands at $676 million. While we lack separate profit figures for Hey Dude and Crocs, a rough estimation is still feasible and should not significantly impair our valuation. With Hey Dude and Crocs accounting for 25% and 75% of total revenue, respectively, we can proportionately attribute 75% of the profits to Crocs and the remaining 25% to Hey Dude. This yields the following estimates:

Calculation based on Crocs Earnings Q32023 (Author’s Calculation)

Refinement of P/E Valuation

Considering the gross margins for Crocs and Hey Dude, which are 62% and 42% respectively, it appears we may have underestimated the value contribution from Crocs due to its higher profitability. To refine our model, we’ll maintain the assumption of equal operating margins between the two brands for simplicity, despite Hey Dude likely having a lower margin than Crocs. By adjusting the profit contribution assumption to reflect 85% for Crocs and the remaining 15% for Hey Dude, we align our valuation more closely with their respective gross margins. This revised allocation leads us to the following valuation figures:

Calculations bases on Crocs Q3 2023 Earning Call report (Author’s Calculation)

Our analysis indicates that, relative to the market’s current valuation, Crocs Inc. may be undervalued by nearly 50%. This suggests that the fair value could be approximately twice the current market price. This assessment is conservative, considering I have not factored in higher PE multiples aligned with industry peers or the potential impact of the company’s share buyback program, which has a substantial $900 million remaining. Taking these elements into account, it is reasonable to propose that the fair value of Crocs Inc. is closer to $150 – $180 per share, rather than the current $83 as I write this article.

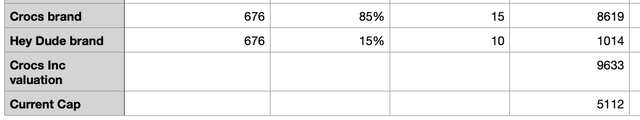

Comparison with Peer Valuation

Data based on Nov 2023

Valuation Comparison (SeekingAlpha.com)

Crocs | Nike | Sketcher | Deck valuation data on Seeking Alpha

We observe that even after adjusting our valuation to 1.8 times to reflect the fair value, the figures remain modest. This conservatism in market valuation seems to be driven by disappointment in Hey Dude’s revenue performance. Intriguingly, if the company were to divest Hey Dude at no cost, market dynamics suggest that Crocs Inc.’s overall valuation might actually increase, likely due to a higher PE multiple being ascribed to the remaining business.

2. Forward Valuation Based on DCF

Global Market growth

Based on the Report of MER “The global footwear market size reached a value of around USD 417.50 billion in the year 2023. The footwear market is further expected to grow at a CAGR of 4.9% between 2024 and 2032 to reach a value of approximately USD 642.16 billion by 2032.”

Based on the research of Allied Market Research, CAGR of 4.9% between 2024 and 2032 to reach a value of approximately USD 725.1 billion by 2032.

Footwear Market Growth (Allied Market Research)

DCF Valuation

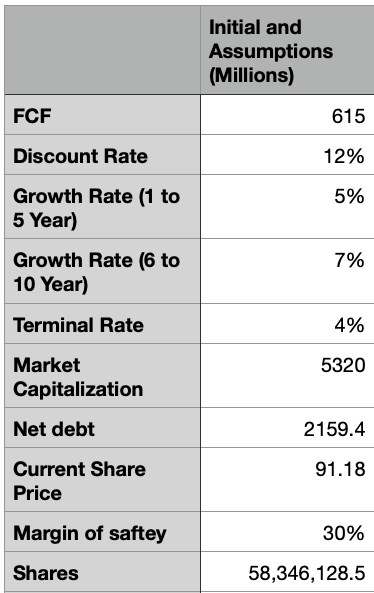

If we assume that the free cash flow (FCF) growth matches the overall market’s 5% per year for the next five years, and then increases to 7% for the subsequent five years due to faster economic growth and improved company performance, we can proceed with our analysis. Let’s use 4% as the terminal rate moving forward and consider the three-year average of the initial FCF, which is $615 million, also the 12% discount rate a comparable rate with the last 10 years S&P 500 growth rate. We should also account for the net debt of $2,159 million.

Assumptions of our valuation

Assumptions (Author’s Valuation Assumptions )

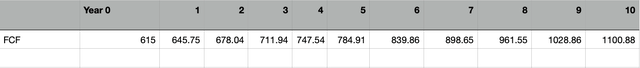

Free cashflow

Free Cash Flow For Next 10 Years (Author’s Calculation)

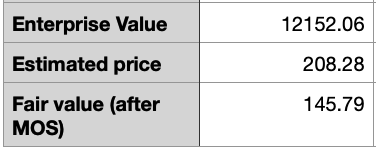

Enterprise value

Enterprise value and fair value after MOS (Author’s Calculations)

This leads to a DCF valuation for Crocs of $208 per share. Applying a 30% price margin of safety, the calculated ‘safe value’ is $145 per share or below, aligning with our simple P/E valuation $150. Given the current price of $91.18, it appears to be an excellent bargain.

Investor Takeaway

In summary, Crocs Inc. is an attractive deep value investment with a strong business model, operational efficiency, significant competitive moats, and an extreme low price. Investors can anticipate gains from profit growth, potential PE expansion as the market gains understanding of the business, or even from a revaluation excluding Hey Dude should it underperform. Additionally, the company’s active share buyback program could provide further returns, particularly if the company accelerates buybacks during price dips. I recommend a strong buy for Crocs in the $80 to $100 range. We are likely to see a 200%+ return within 3 to 5 years, given current trends and analysis. Again, it’s a bargain you don’t see every day.

Read the full article here