In this piece, we will outline how fiscal policy–specifically, deficit-spending– results in positive net-transfers from the Treasury into private-sector bank accounts and thus drives the stock market higher.

Fiscal-Policy

The Federal government is the currency-creator and, therefore, has no need for an income like a currency-using household does. The laws of Congress allow the creation of US dollars by spending them into existence, and the cancellation of US dollars by taxing them out of existence.

The matching of deficits with bond sales, and the regarding of those sales as “borrowing”, are choices left over from the old gold-standard days, not a necessity under the current floating-exchange system. What the herd considers as public “debt”, is simply the depositing of ‘already-created’ dollars into risk-free savings accounts called “Treasuries” that pay interest. The fear-mongering around the ticking “debt bomb” has been around for 80-years, and still it persists; It is not a bomb, it is not ticking, and it isn’t debt. It is simply the accounting of the dollars that have been spent into existence (deposited in private bank accounts) and that have not been taxed back and cancelled. How is having dollars in private hands (the economy) a problem?

The Treasury creates US dollars when it directs the Federal Reserve Bank to (indirectly) deposit money into private bank accounts (to pay for the real-resources it buys), and it cancels US $ when it collects taxes from the private bank accounts. The aggregated result is a net-transfer into or out of the private sector (the economy)–depending on whether spending is greater than taxation, or taxation is greater than spending, respectively.

If spending is greater than tax-collection, then there is a budget deficit for the Treasury, but a budget surplus for the private sector (very good for the stock market), with the reverse situation producing a private-sector deficit (very bad for the stock market).

Government Deficit = Private sector surplus

A balanced budget means that every dollar spent into the economy by the government gets taxed back and cancelled (zero net-transfer), thereby, leaving nothing in private hands.

The way I see it is that we cannot grow the economy by having a balanced budget, or worse still by cutting the deficit. The economy can only grow by deficit-spending. The economy “follows” the fund-flows, and so does the stock market.

The Stock Market

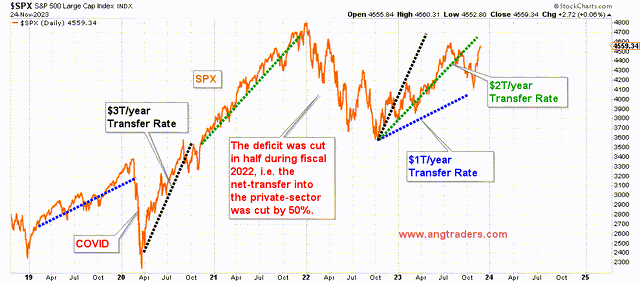

The chart below, shows how the average slope of the S&P 500 (SPX) depends on the net-transfer rate: Blue is when the government was spending (transferring to the private-sector) $1T more than it taxed back in the fiscal year: Green is $2T/year: and Black is $3T/year. In fiscal 2023 (ended September 30, 2023), the government spent $1.7T (green line). So far, in the 2024 fiscal year, the rate of net-transfer is $1.8T/year.

ANG Traders, US Treasury

Net-Transfer Rate and the SPX (ANG Traders, US Treasury)

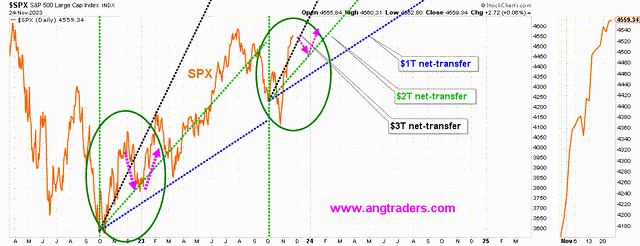

Similar to last year at this time, the SPX has moved above the $3T transfer-rate (black line). If the similarity continues, then we can expect the SPX to drop back to the $2T transfer-rate (green line) and then rally into the new year (pink arrows).

ANG Traders, US Treasury

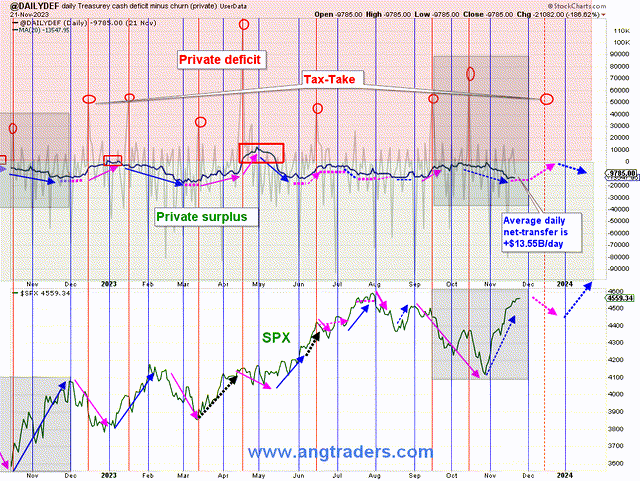

So far in the month of November, +$222B has been net-transferred into private bank accounts, compared to only +$196B last year. Higher fund-flows have produced net-transfers that are now 13% above last year which means the net-transfer for this year is running closer to the $2T/year rate than it was last year–a year that saw a 25% move (low-to-high).

The 20-day average of the daily net-transfers is +$13.55B/day which is 17% higher than last year. This higher average net-transfer, could mean that the SPX weakness we expect as the mid-December tax-take approaches (vertical red-line below), will be less severe than last year’s. Regardless, we expect the SPX to rally once the tax-take is done with.

Private Surpluses and Deficits (ANG Traders, US Treasury)

The stock market will be supported as long as the net-transfer rate, from the Treasury into the private-sector, is maintained. Short-term traders might take advantage of the pre-tax weakness by trading options on an index ETF such as SPXL or TQQQ, while investors can wait to buy the dip that is expected to develop.

Read the full article here