Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on June 9th, 2023.

Bancroft Fund (NYSE:BCV) continues to trade at a deep discount. In fact, the discount has expanded a bit since our prior update. Since our prior update, the fund’s performance hasn’t been doing much of anything. On a total return basis, it’s basically flat, and that’s also considering the discount expanding a touch.

BCV Performance Since Prior Update (Seeking Alpha)

While the S&P 500 Index has provided stronger returns during this period, it was mostly reserved for the mega-cap tech names. That’s mostly why the broader market, as measured by the S&P 500, shows that a new bull market has started. However, there have been narrow participation, with most everything else flat or negative for the year outside of that handful of tech names. More recently, we have been getting a bit more participation from other areas of the market, which is a good development for a more sustainable rally.

BCV invests mostly in convertible securities and can experience some upside due to the convertibility feature of the underlying securities. In addition to the potential benefit of broader participation to the upside from other market participants, that funds discount is attractive at this time. The fund has also recently published its latest semi-annual report, providing a good time to give the fund an updated look.

The Basics

- 1-Year Z-score: -1.36

- Discount: 15.28%

- Distribution Yield: 7.54%

- Expense Ratio: 1.38%

- Leverage: 20.26%

- Managed Assets: $147.648 million

- Structure: Perpetual

BCV’s investment objectives are “…providing income and the potential for capital appreciation, which objectives the Fund considers to be relatively equal over the long term.” Their approach is quite simple; they “operate as a closed-end, diversified management investment company and invest primarily in convertible securities…” Along with convertible securities, they can mix in various other equity and fixed-income securities.

The fund is fairly small, even including the fund’s leverage. This fund is better positioned in terms of its leverage compared to some other closed-end funds because they have a locked-in fixed rate. This is through their cumulative preferred shares coming in with a fixed 5.375% dividend rate. This is publicly traded (BCV.PA), and more conservative investors could consider investing in this over the common shares. As BCV itself has light volume, it’s preferred is showing even less volume. That can make it difficult to accumulate or offload a sizeable position.

While this fixed-rate dividend was expensive relative to credit facilities when rates were at zero, most funds are now paying over 6% on their credit facilities. With not knowing exactly when interest rates will quit rising – despite signals that we could be near a pause phase for now – certainty can be a great thing. With a fixed-rate dividend for leverage, certainty is exactly what you can get.

Performance – Attractive Discount

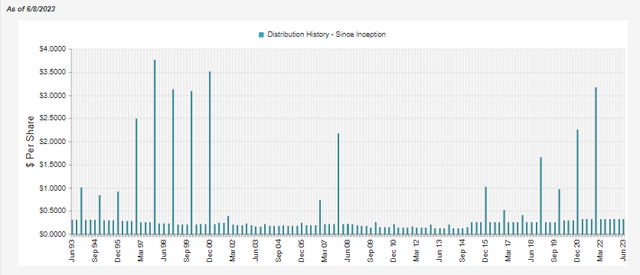

The fund’s longer-term historical results had been fairly competitive against its included benchmarks. However, more recent results have left a lot to be desired. With a big negative year over the last year, that really dragged down the results. In the first quarter of 2023, there was a glimmer of hope with things rebounding that saw BCV once again providing alpha over their benchmarks.

BCV Annualized Performance (Gabelli)

Of course, being a leveraged fund with its preferred offering, a down year will be felt more sharply, and that adds to the risks. The positive side of leverage is that there is potential for outperformance, too.

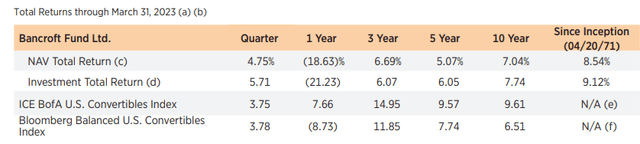

Another advantage of BCV over investing in an ETF that trades one of these listed benchmarks is playing the discount/premiums that come up in CEFs. BCV has historically traded at quite a deep discount. It was the more recent history with the fund trading where it touched a premium level in 2021 that was unusual.

Ycharts

At this point, though, the fund is back trading at a deep discount. In fact, the discount is deeper than its longer-term historical average. Outside of black swan market sell-off events, this is about as low of a discount as the fund normally trades.

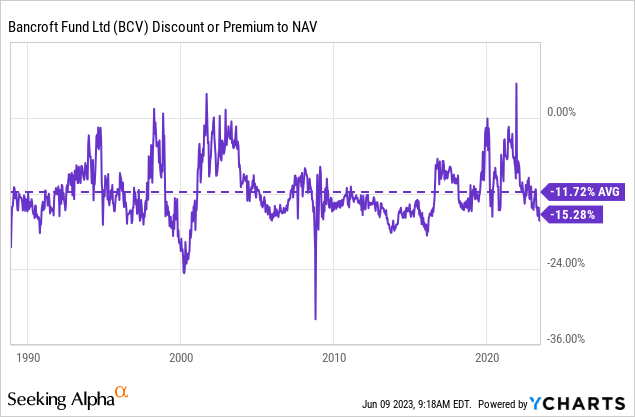

Distribution – Managed Distribution

The fund works with a managed distribution where they intend to pay out a minimum of 5% of their NAV annually. At this point, after last year’s sharp sell-off, they are already above the minimum. This is also why we didn’t see a special in the prior year. However, in years where there are adequate returns, the fund will often pay out a larger year-end distribution to top it off and meet the minimum.

BCV Distribution History (CEFConnect)

Most investors tend not to like this payout strategy, but it does keep the payout more reasonable, with flexibility for the fund to adjust as needed. Paying out too high of a distribution would mean a fund manager could be forced to either cut the distribution or sell off assets they’d otherwise like to retain for a rebound.

With interest rates rising and seeing the price of BCV falling meant that the current distribution rate has become more competitive. On a share price basis, investors are collecting 7.54%, while on a NAV basis, due to the large discount, it works out to 6.39%.

For most of the last decade, we were in a near-zero rate environment, and yields on convertibles have been very slim or nonexistent. Companies were getting away with issuing more zero-coupon convertibles for a while. That means that all or nearly all of the distribution will have to be funded via capital appreciation.

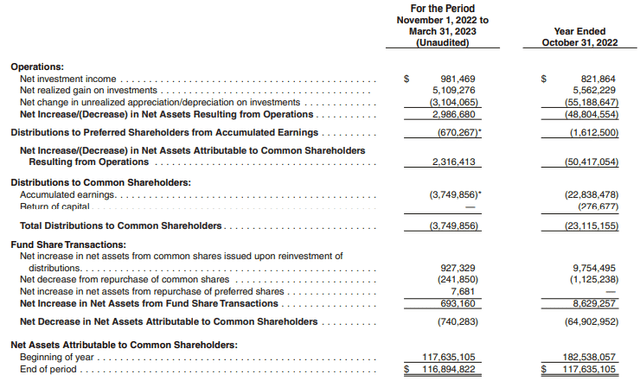

That being said, BCV has really seen its net investment income ramp up year-over-year. Remember, this is only a six-month report, so if this continues, we would see an over doubling of the NII for the fund.

BCV Semi-Annual Report (Gabelli)

On a per-share basis, the entirety of 2022 showed NII of $0.18. In this latest report now, we are at $0.17 per share in half the amount of time. One reason it isn’t doubling on a per-share basis is that the fund issues new shares through its DRIP, whether it’s at a premium or discount.

This isn’t the standard for most CEFs, as when shares are trading at a discount, the reinvestment shares would actually be purchased in the open market. Issuing new shares is dilutive and can help keep the discount wide. To offset some of this, the fund has also implemented repurchases of both its common and preferred share offerings. This isn’t the only fund that issues shares at a discount, but they are definitely in the minority.

Besides portfolio positioning leading to higher income generation on the portfolio, another factor here could be that convertibles are now having to be issued with a decent coupon. This was noted by Calamos as one of the catalysts for making convertible securities more attractive.

This was echoed in the BCV manager’s notes in the last report, too:

During this period, issuance of new convertibles has modestly improved. In the first quarter of calendar 2023 there were 18 new convertible securities issued with proceeds totaling $11 billion, an improvement over 1Q 2022 but still slower than most of the last decade. That said, the terms of these issues continue to stay at more attractive levels to the buyer than they were through early 2022 and in 2021, with higher yields and lower premiums. This pace of issuance implies a material improvement over the 58 issues that generated $28.4B in calendar 2022.

(Note: Author bolded the particularly noteworthy part of the paragraph for added emphasis.)

Not only are convertibles having to be issued with better yields, but due to rates rising, it has made it a more compelling option for higher-rated companies. As companies have their debt maturity and they’re looking to refinance this debt, they can issue convertible at relatively lower coupons than going the straight debt route. It comes with future dilution potential for common shareholders, but it can still make sense instead of taking the higher interest rate costs.

All else being equal, better quality companies and higher yields could lead to better returns going forward. This would be because BCV (and other convertibles) can start covering more of their distributions via income. Having potentially more access to higher-rated companies should mean reduced risk as well.

BCV’s Portfolio

Convertible corporate bonds comprised 87.1% of BCV’s portfolio at the end of March 31st, 2023. They also listed another 6% allocated to mandatory convertible securities and convertible preferred stocks. They had only a touch of common stocks at around 2.5%, allocated to two REITs that included Crown Castle (CCI) and Innovative Industrial Properties (IIPR). The remainder was in U.S. Treasury Bills, which at that time were yielding anywhere from 4.562% to 4.743% – it’s great having cash pay something these days!

With all that said, the fund is overwhelmingly exposed to convertible securities. Therefore, that’s why a rising equity market can have a material impact on the fund and would benefit from a broader participation in performance from equities in addition to the yields rising from newer issuances.

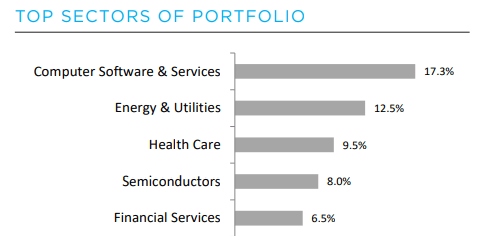

Gabelli provides a breakdown of their top sector allocations, but they are hard to compare apples to apples with other fund breakdowns. This is because they go with a more unusual naming of categories that’s more like an industry or sub-sector breakdown of listings.

BCV Top Sector Allocation (Gabelli)

Generally, as is the case with what we’ve seen with other convertible funds, they are going to be tilted toward tech. Tech companies often embrace the lower costs that convertibles can offer. Tech can generally receive investor interest because it’s associated with growth. Appreciation in the underlying company from said growth could lead to the upside of convertible securities investors seek. It’s also safer, assuming that the company doesn’t go bankrupt, as there is a floor and a face value that should be paid back at maturity should a common stock not run up as expected. So it gives a more overall balanced approach to investing in growth companies.

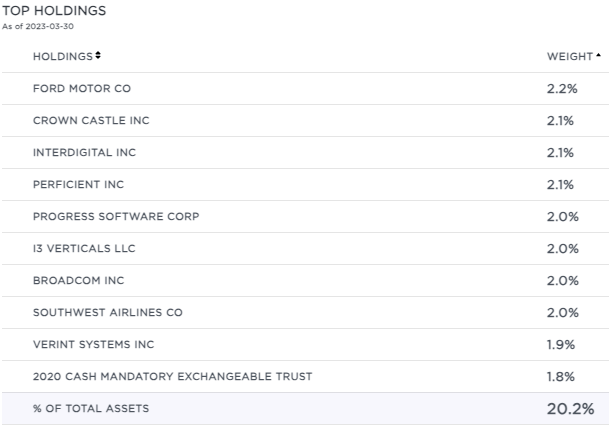

The top ten holdings were listed at just over 20% of the fund’s investments. This was actually the exact same at the end of December 29th, 2022. Additionally, these top names are also consistent with the exact same holdings at the exact same weights.

BCV Top Holdings 3/30/2023 (Gabelli)

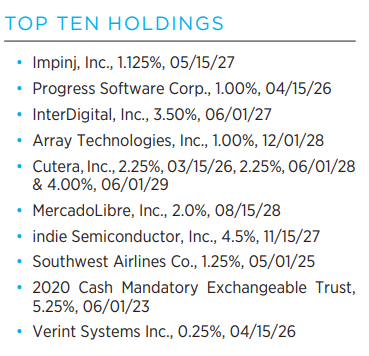

The largest weighting of the fund is (or was) a Ford Motor (F) zero coupon convertible that matured in 2026. However, note that the top holding list above was as of March 30th, 2023. Instead, if we look at the top ten holdings just a day later, Ford is not listed, and neither are CCI and Broadcom (AVGO). AVGO was another common stock position previously. This top ten list is as of March 31st, 2023.

BCV Top Ten Holdings (Gabelli)

According to the latest N-PORT that shows listings for the same March 31st, 2023 date, the fund holds no Ford or Broadcom position at all anymore. However, they have retained the common share position in CCI, but it is no longer a top holding.

So apparently, they saved all of their portfolio moves for the last day of the quarter. Or, the alternative explanation is that while they changed the date as of when these last top ten holdings were provided, they actually didn’t update the top ten list but only the “as of date.” I’ve seen strange errors and typos occur from fund sponsors, and seeing the exact same weightings of the same names over three months is quite suspicious. This doesn’t seem to be a regular error to have occurred, as we can go back to our prior update before the previous one, and we saw several changes at that time between holdings.

All that said, we can see that the top ten holdings still contain some fairly low-yielding convertible instruments. Some of these were previous top ten positions, so we don’t see an entirely different top ten. Once those lower yielders start to get flipped into higher-yielding convertibles that are being issued now, the NII should see a nice bump once again in the future, as we’ve seen with this previous report.

We’ve seen this flip occur, too, as in our October update, BCV listed only 4 positions with 1% yields or higher. As of this last update, 9 out of the top 10 holdings are now at 1% or higher. The only exception here is the Verint Systems Inc (VRNT) convertible with its 0.25% with 2026 maturity. This reinforces why we’ve seen NII increase substantially in the latest report.

Conclusion

Convertible securities took a big hit in 2022, along with the broader growth space of the market. This is consistent with what could be expected, given the general focus of growth companies issuing convertible securities. The ability for convertible securities to offer better returns going forward with higher yields now that we are out of the zero-rate environment makes convertibles something that could be interesting to consider. An additional catalyst for BCV could be the fund’s deep discount, which could provide potentially further upside should that discount narrow going forward.

Read the full article here