Rationalization is a process of not perceiving reality, but of attempting to make reality fit one’s emotions.”― Ayn Rand.

Today, we put Semler Scientific, Inc. (NASDAQ:SMLR) in the spotlight. The stock of this small cap medical device concern posted better-than-expected Q3 results four weeks ago. Can the rally in the shares continue? An analysis follows in the paragraphs below.

Seeking Alpha

Company Overview:

Semler Scientific is based in Santa Clara, CA. The company provides technology solutions to improve the clinical effectiveness and efficiency of healthcare providers. These products include Insulin Insights, which is a software program that is used to optimize outpatient insulin dosing, and QuantaFlo, a four-minute in-office blood flow test use for blood flow measurements as part of their examinations of a patient’s vascular condition.

August 2022 Company Presentation

The stock currently trades just under $42.00 a share and sports an approximate market capitalization of $280 million.

August Company Presentation

The vast majority of the company’s revenues come from its software/equipment product suite around QuantaFlo. Semler gets both fixed (unlimited use of equipment/software) and variable fee (paid per used) revenue from this product line.

August 2022 Company Presentation

Third Quarter Results:

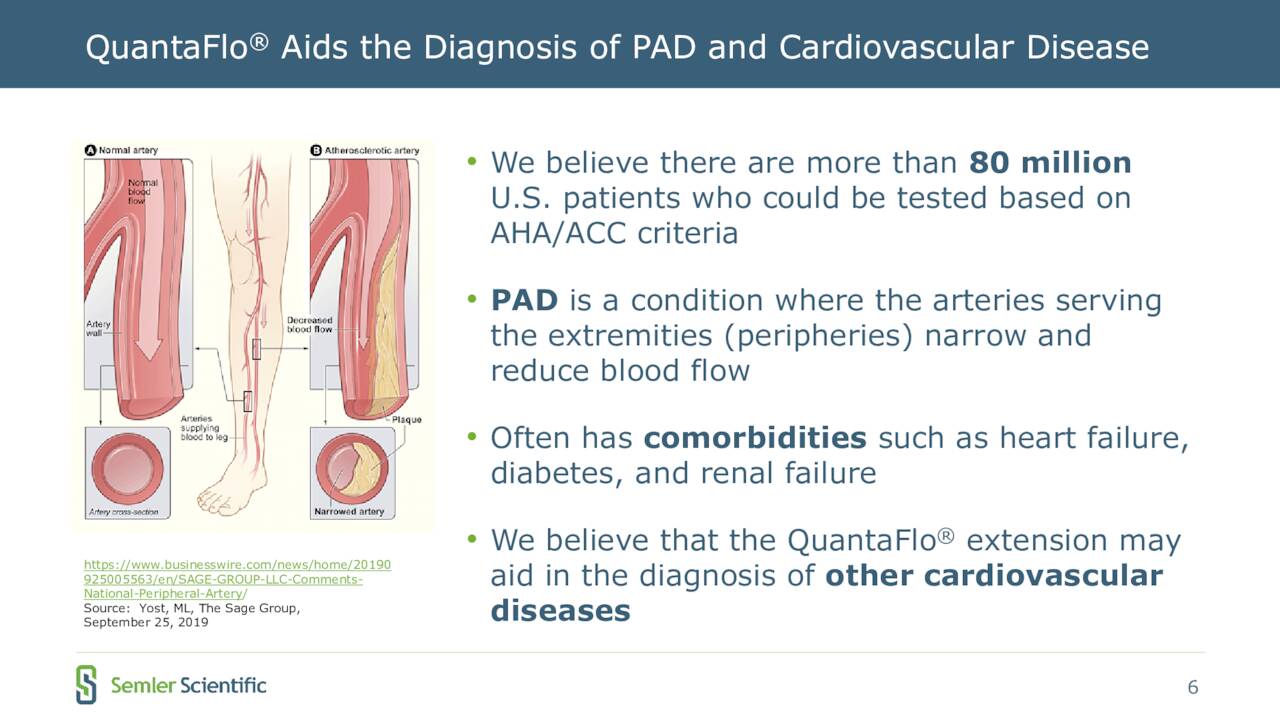

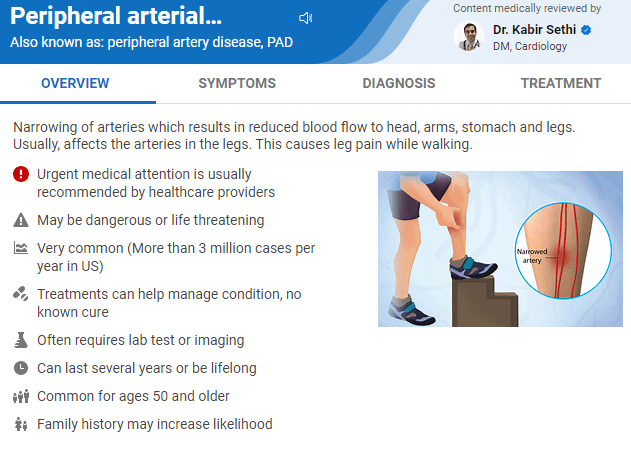

The company posted its Q3 numbers on November 9th. The company delivered 71 cents a share of GAAP profits for the quarter as revenues rose more than 16% to $16.3 million. Net income rose 50% from the same period a year ago to $5.5 million. In the second quarter, the company announced it was trimming its employee count by 30% to cut expenses and improve margins. The company also started to market QuantaFlo as an aid to diagnose heart dysfunction or HD in addition to Peripheral Artery Disease, or PAD.

Dr. Kabir Sethi

Top and bottom line numbers easily exceeded expectations, although it should be noted only one analyst firm seems to be offering up earnings projections on Semler Scientific at the moment. Fixed fee software license revenues rose 11% to $9.5 million compared to 3Q2022 while variable fee software license revenues rose 28% to $6.3 million. Other product revenue came in at $500,000, flat with the same period a year ago.

Analyst Commentary & Balance Sheet:

Lake Street reissued its Buy rating and $65 price target on SMLR on November 21st. It is the only analyst firm I can find that has chimed in around the company so far in 2023.

Just over four percent of the outstanding float in the shares are currently held short. A director purchased just over $2.1 million in new shares via three transactions from September 11th through September 13th. That has been the only insider activity in this equity so far in 2023. The company ended the third quarter with just over $55 million in cash and marketable securities on its balance sheet according to the 10-Q filed for the quarter. Semler lists no long-term debt on its balance sheet.

Verdict:

Semler Scientific made $1.79 a share on just less than $57 million of revenue in FY2022. The one analyst firm that has projections on Semler has the company delivering earnings of $2.65 a share of profits on sales of just over $67 million in sales in FY2023 followed by profits of $3.37 a share in FY2024 on revenues of $75 million.

Given its growth, Semler Scientific, Inc. stock seems attractive at under 16 times forward earnings, or under 13 times forward earnings taking the net cash on Semler’s balance sheet into consideration. However, there are some caveats to this valuation. First, it is based on one analyst firm’s estimates. Second, there are concerns around potential patent cliffs and insurance reimbursement issues that were articulated in this recent article.

Seeking Alpha

Then, there is the huge rally in Semler Scientific, Inc. stock since Q3 results hit the wires, triggering an approximate 50% rise in the shares. That is simply too much of a move for me to chase given the other concerns listed previously. However, if the stock came back down to the low $30s in the next overall market pull back, I would probably establish a small holding in Semler Scientific at that point at a more compelling valuation point.

Sometimes, we need little lies to save our pride. And sometimes we need big lies to save our souls.”― Bettie Sharpe.

Read the full article here