At a Glance

In the dynamic world of biotech/pharma stocks, Journey Medical Corporation’s (NASDAQ:DERM) recent surge has been nothing short of meteoric. The company, focused on dermatological conditions, has seen its stock undergo a parabolic move, catapulting it to the top of Seeking Alpha’s overall Quant rating. This ascent is a testament to Journey’s strategic vision in the pharmaceutical industry, particularly in dermatology, where it has made significant inroads with innovative products and savvy business maneuvers. However, beneath this success lies a complex financial landscape marked by both significant achievements and challenges. The following article delves into Journey’s journey, examining its strategic focus on dermatology, the implications of its recent financial performance, and the potential of its promising drug, DFD-29, amid the intricacies of the healthcare sector.

The Dermatological Pursuit: Journey’s Strategic Vision

Journey, established in 2014, has been navigating a complex landscape in the healthcare sector. Renowned for its focus on dermatological conditions, Journey’s product portfolio includes eight branded and two authorized generic prescription drugs. These products form the backbone of its business model, which is centered on licensing, developing, and commercializing FDA-approved pharmaceuticals.

Journey’s specialization in dermatological products positions it uniquely in the pharmaceutical industry. This specialization has been both a strength and a challenge. For instance, the company faced difficulties with its Ximino products, leading to a significant intangible asset impairment charge of $3.1 million in the nine months ending September 30, 2023 (page 8). This situation underscores the risks inherent in a focused product portfolio, where the underperformance of one product can have substantial financial implications.

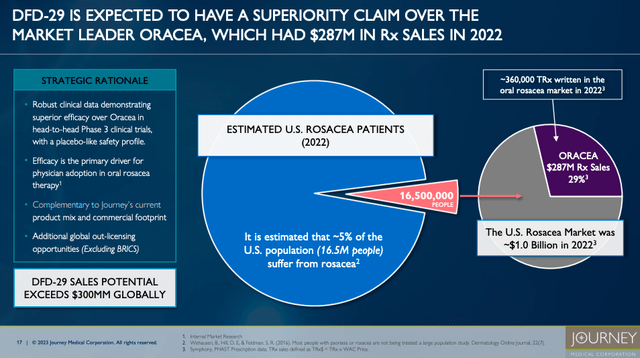

Notably, Journey has made significant strides with DFD-29, a modified release oral minocycline for treating rosacea.

Journey Investor Presentation

In June 2021, the company obtained the global development and commercialization rights from Dr. Reddy’s Laboratories, committing to contingent regulatory and commercial milestone payments up to $158.0 million, along with royalties on net sales (page 9).

DFD-29 appears poised to make an impact in the treatment of moderate to severe rosacea, aligning well with current treatment guidelines that favor oral antibiotics, especially tetracyclines. This development is particularly relevant as rosacea often escalates beyond the efficacy of topical therapies, necessitating a more systemic approach. The anti-inflammatory properties of minocycline address the core symptoms of rosacea, including inflammatory papules, pustules, and erythema. The successful outcomes of two Phase 3 clinical trials and the anticipated FDA approval in late 2024 highlight DFD-29’s potential as an effective and potentially superior treatment alternative. DFD-29’s modified release formulation could offer a more effective and potentially safer approach while also fitting into the current shift towards subantimicrobial doses in rosacea management. This positions DFD-29 not only as a promising new option for patients with more severe rosacea but also as a testament to Journey’s innovative strides in dermatological therapeutics.

Q3 Performance

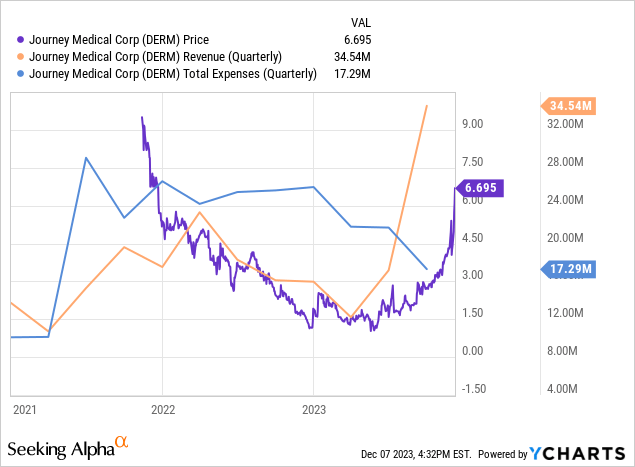

In the third quarter of 2023, Journey experienced a significant financial turnaround, with total revenue surging from $16.12 million in Q3 2022 to $34.54 million in the same period in 2023. This remarkable growth was largely driven by a lucrative licensing agreement with Maruho for Qbrexza in Asian markets, contributing an upfront payment of $19.0 million, and accounted for the substantial rise in other revenue from $73,000 to $19.3 million. Despite this, the company’s net product revenue declined slightly from $16.04 million to $15.28 million, signaling volatility in its core business operations. Notably, the gross profit margin improved as the cost of goods sold decreased from $7.2 million to $6.4 million, demonstrating efficient cost management. Additionally, a reduction in selling, general, and administrative expenses from $15.6 million to $8.6 million, coupled with a decrease in total operating expenses from $25.6 million to $17.3 million, resulted in a positive income from operations of $17.2 million, reversing a loss of $9.5 million from the previous year. The quarter concluded with a net income of $16.8 million, a stark contrast to the net loss of $10.1 million in 2022.

Balance Sheet

Turning to Journey’s balance sheet, their assets, including cash and cash equivalents ($24.7M), show a notable decrease from the previous period. The current ratio, calculated as current assets divided by current liabilities, stands at approximately 0.92 ($44.7M/$48.5M), indicating potential short-term liquidity challenges. When comparing assets to liabilities, there’s an evident increase in short-term obligations like accounts payable ($28.2M) and accrued expenses ($16.0M), with a total current liability of $48.5M against a total asset value of $65.9M. The net cash provided by operating activities over the last nine months is $21.8M, indicating a positive cash flow.

Speculating on the need for additional financing within the next year, given the current financial state and positive operating cash flow, the odds seem medium. The company’s current ratio below 1.0 and the reduction in cash and cash equivalents might necessitate future financing, but the positive cash flow from operations might offset some immediate concerns.

My Analysis & Recommendation

Wrapping it up, Journey stands out as an investment pick, especially given its financial comeback and the buzz around DFD-29, their promising rosacea treatment. The company’s impressive revenue uptick in Q3 2023, fueled by smart licensing deals and savvy cost control, points to a robust recovery path. But let’s not forget, investing in smaller firms like Journey comes with its own set of challenges. Their laser focus on skin products is a double-edged sword – it’s a niche strength but also makes them more susceptible to market swings, as we’ve seen with their main business activities.

DFD-29 figures to see uptake in the large rosacea market – its specialized formulation and adherence to current treatment standards place Journey at the cutting edge of skin care treatments. The drug’s potential in tackling rosacea, and the high hopes for FDA nod, are major factors in driving the company’s growth going forward. Yet, the bumpy road of drug development and regulatory approvals can’t be overlooked.

For those who want to play it safer, spreading their investments across different areas can lessen the risk of putting too much into one microcap stock. Keeping a close eye on Journey’s financial health, particularly cash flow and liquidity, is key. Also, staying updated on DFD-29’s regulatory and market journey will give some good insights into where the company is headed.

Given Journey’s strategic direction, financial bounce-back, and the bright prospects for DFD-29, I’d lean towards a cautious but optimistic “Buy” rating. Their recent financial success and strategic moves in drug development highlight their potential to grow and profit in the complex healthcare sector. The recent parabolic stock move appears warranted. But as always with smaller stocks, investors should tread carefully, weighing the chance for big gains against the typical risks of microcap investing.

Risks to Thesis

In evaluating Journey’s investment potential, I may have underemphasized certain risks inherent in their business model and sector. Firstly, the company’s heavy reliance on a focused dermatological portfolio, while a strategic advantage, also exposes it to significant market and product-specific risks. The difficulties faced with Ximino illustrate how dependency on a limited range of products can result in substantial financial implications if any product underperforms.

Regarding DFD-29, while its potential is promising, I may have underestimated the challenges in drug development, particularly in the dermatological space where patient response variability is high. The drug’s efficacy and safety profile, though seemingly aligned with current needs, must still navigate the rigorous and uncertain FDA approval process. Additionally, market reception post-approval is not guaranteed, given the competitive landscape and evolving treatment paradigms.

My analysis may have also placed excessive optimism on the company’s financial turnaround in Q3 2023. While the revenue growth driven by licensing agreements is encouraging, the slight decline in net product revenue raises concerns about the sustainability of its core business. The reduction in cash and cash equivalents, coupled with a current ratio below 1.0, indicates potential liquidity issues, which are critical for a microcap company like Journey, relying heavily on continuous capital infusion for R&D and operational expenses. Journey may have to resort to an equity raise that will result in significant dilution.

Lastly, investing in microcap companies like Journey comes with specific risks. These stocks often exhibit higher volatility and lower liquidity, leading to greater price swings and potentially challenging entry and exit strategies. Microcaps typically have limited access to capital markets, constraining their growth and R&D funding. There’s also a higher risk of information asymmetry due to less analyst coverage, which can lead to less informed investment decisions.

Read the full article here