Investment Thesis

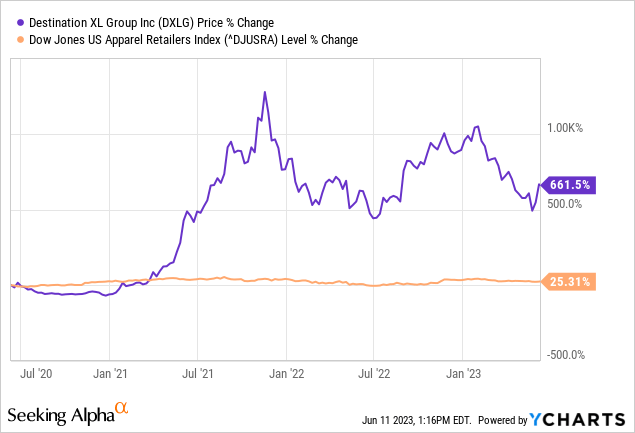

Destination XL Group (NASDAQ:DXLG) is a leading integrated specialty retailer offering Big + Tall men’s clothing and shoes through its 281 stores operating across 46 states in the country. It offers a broadly curated assortment of products with 5,000+ styles across 100 national brands including the likes of adidas, Reebok, Nautica, Ralph Lauren and Vineyard Vines. After years of patchy execution, it seemed to be at an inflection point post pandemic, with no debt and strong execution driving higher earnings. The stock has declined 15% since its listing in 1990s and has been a major laggard. However, post pandemic, it underwent transformational repositioning leading to double digit comp growth for a record 8 quarters and swinging to sustained earnings.

However, recent turmoil in the macroeconomic environment has led to a reset of expectations and DXLG is just another retailer at the receiving end of the consumer led slowdown. We believe at current levels the risk reward is fairly balanced with more risks to the upside and we would wait to see follow through on the execution. We initiate this at Neutral.

Earnings Corner

DXLG reported a revenue decline of 1.7% for Q1 with comparable sales improving marginally to 0.6% growth YoY. Q1 started off strong with February at 9.1% comp growth while March and April turned negative at (2.8%) and (1.9%) respectively primarily driven by broad-based decrease in foot traffic in the stores along with sustained decline in web traffic. Gross margins decreased 140 bps primarily driven by decrease in merchandise margins and increased shipping costs despite a tailwind from freight costs. This remains in stark contrast to other retailers who have seen improving gross margins due to freight tailwinds primarily due to IMU deterioration.

SG&A expenses as % of sales increased 200 bps driven by higher wage expenses and deleverage on account of declining sales. Earnings per share came in at $0.11 compared to $0.20 primarily driven by declining sales and lower operating margins. Inventory to sales spread increased to 4% in Q1 2022 vs 2.8% in the previous quarter. Clearance inventory levels increased to 7.8% from 6.9% in the previous quarter last year. We believe rising inventory levels amidst challenging macro conditions would resort management to increased markdowns and pressure margins. It maintained that it is trending at a lower range of its full year sales, EBITDA and earnings guide factoring a challenging macro environment.

What do Bulls and Bears Say?

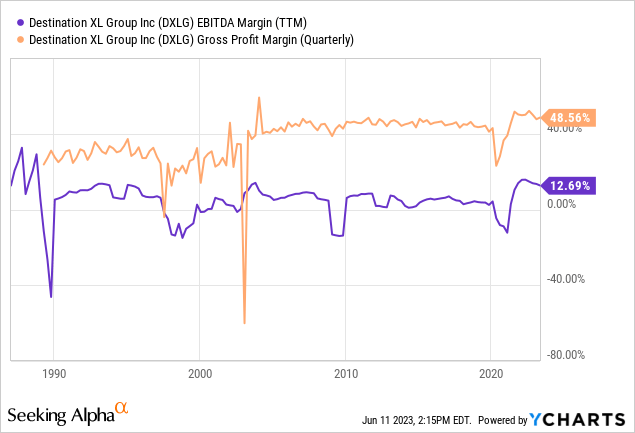

Bulls say DXLG’s exposure to higher end consumers would bode well for the company who are relatively less affected by the lower tax refunds and end of SNAP benefits. This has been echoed by several other retailers like TJX where stores within high income areas have been performing well compared to lower income areas. Despite the inventory levels rising, it remains below the pre-pandemic levels with inventory turnover up 25% compared to 2019 levels and it could expect to meet its guide of 49% gross margins for the year as it expects to moderate the impact of IMU deterioration going forward and improve 2H onwards.

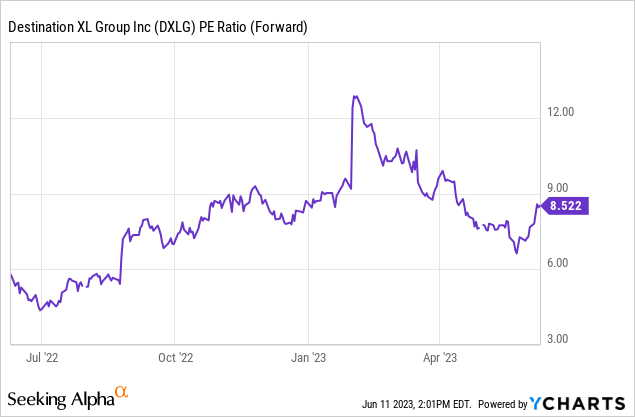

Bears say despite the 27% fall in the stock price YTD, it still trades at 8.5x P/E, almost at a similar level when the company was reporting double digit comp growth and sustainable LDD EBITDA margins.

Gross margins and EBITDA margins have likely peaked which has been almost at the highest in past 3 decades as it shifted away from discount based pricing. Increased competition in a challenging environment along with pent up inventory (which is expected to increase further due to decelerating sales) could force management to increase markdowns that could further pressure margins.

Final Thoughts

DXLG has transformed itself successfully post pandemic after having reported strong comp growth over the last two years driven by continued momentum in foot traffic as well as rising digital sales (forming almost a third of total). We believe its exposure to high end consumers would do relatively insulate them from a very adverse outcome, however, despite a 27% fall in stock prices YTD, it still trades at 8.5x 1Y Fwd P/E and we would wait for the follow through on the execution in the coming quarter in the challenging macroeconomic backdrop. We initiate at Neutral.

Read the full article here