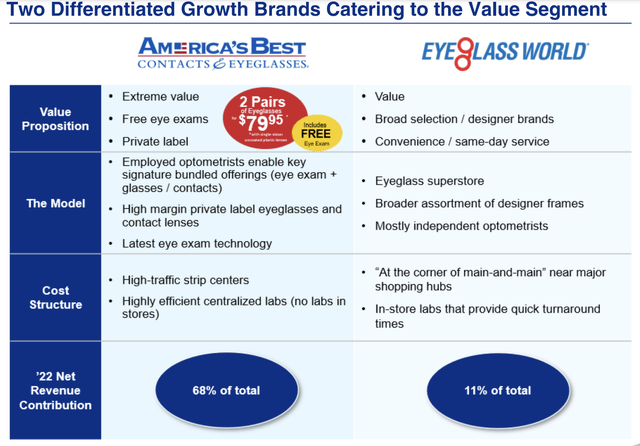

If generating strong returns from investing was as easy as buying cheap stocks, everybody could be like Warren Buffett. There are many cases where just buying a firm on the cheap does pay out well. But sometimes, changing conditions can alter a firm and the opportunities that it offers. One really good example of this can be seen by looking at National Vision Holdings (NASDAQ:EYE), an optical retailer that has not only its own standalone stores, but also that boasts in store partnerships. If you wear glasses, there’s a good chance that you know of its two key brands. The most well-known of these is America’s Best Contacts & Eyeglasses, which is an extreme value-oriented provider of optical solutions that generated 68% of the company’s revenue last year. The other is Eyeglass World, which was responsible for another 11% of sales.

National Vision Holdings

In the long run, the vision space is one that should do quite well. On top of this, shares of the institution look attractively priced. But since I last wrote about the firm in a bullish article in May of this year, some rather bad news has come on to the scene. Near the end of July, news broke that Walmart (WMT) had decided to end its partnership with National Vision Holdings in 2024. This, combined with some mixed financial performance so far this year, has resulted in shares dropping 22.2% since the publication of that article at a time when the S&P 500 is up 10.7%. Truthfully, this is painful to see. But when you consider how much cheaper the stock has become and look at management’s plan for recouping these losses, I would argue that the firm still offers upside from here.

A look at recent pain

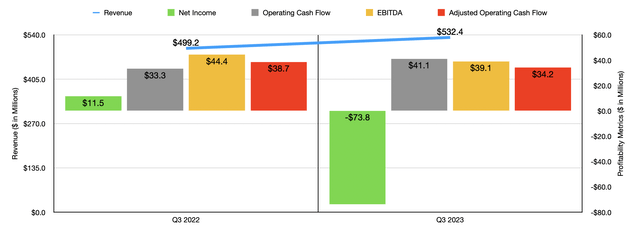

Recent financial performance achieved by National Vision Holdings has been somewhat mixed. If we look at the most recent quarter, which would be the third quarter of the 2023 fiscal year, we would see that revenue for the company has come in at $532.4 million. That’s 6.7% higher than the $499.2 million the company generated one year earlier. An increase in the number of stores in operation from 1,332 in the third quarter of last year to 1,402 the same time this year was responsible for a good portion of this increase. However, the company also benefited from increases in comparable store sales for some of its brands. America’s Best, for instance, saw a 5.7% rise in comparable store sales, while the military revenue generated by the company increased 3.8% on a comparable basis. There were some areas of weakness, such as a 1.2% drop for Eyeglass World and a 3.7% decline associated with Fred Meyer. But on the whole, adjusted comparable store sales growth increased by 4.3%.

Author – SEC EDGAR Data

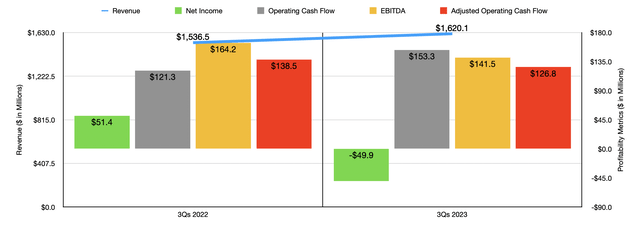

Despite this increase in revenue, profits for the institution took a beating. The company went from generating a net profit of $11.5 million in the third quarter of 2022 to generating a net loss of $73.8 million the same time this year. However, a lot of this had to do with an $80.8 million asset impairment charge that the company booked in the third quarter. Cash flow data looks significantly better. Operating cash flow, for instance, went from $33.3 million last year to $41.1 million this year. But if we adjust for changes in working capital, it would have fallen from $38.7 million to $34.2 million. Meanwhile, EBITDA for the company also dropped, declining from $44.4 million to $39.1 million. As you can see in the chart below, financial performance for the first nine months of this year relative to the same time last year looks very similar to the third quarter on its own. Clearly, this is not a great year for the business.

Author – SEC EDGAR Data

The Walmart problem

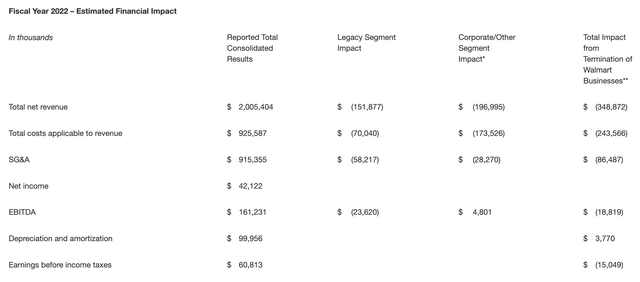

To make matters worse, in July of this year, management announced that its partnership with Walmart would be ending next year. At first glance, this looks absolutely awful. I say this because, using data for 2022, Walmart was responsible for about $348.9 million of the company’s revenue. That’s 17.4% of overall sales. For 2023, Walmart is expected to account for roughly $385 million worth of the company’s revenue. So this is a big hit from a sales perspective.

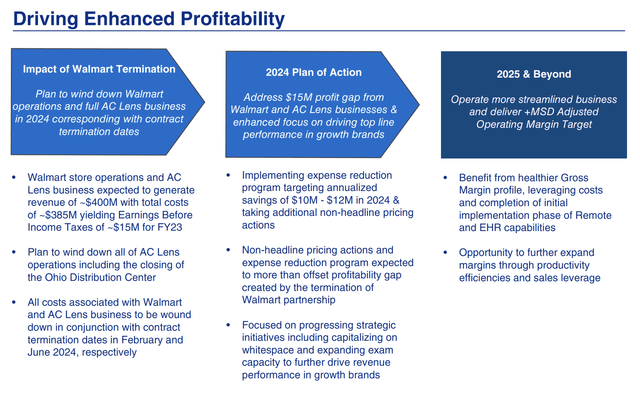

National Vision Holdings

The good news for investors is that the bottom line is not so bad. The massive partnership it had with the world’s largest retailer only brought in earnings, before taxes, of around $15 million. Admittedly, that is around 25% of the company’s pre-tax profits for 2022. The good news for investors, however, is that management already has a plan to make up for a good portion of this decline in profits. The firm’s current expense reduction program is targeting annualized savings of between $10 million and $12 million next year. In addition to this, the company is taking other pricing actions that it hopes will improve its bottom line. In fact, while management has not provided specifics on the matter, they did say that the combination of these efforts will more than offset the profitability gap created by the termination of this partnership.

National Vision Holdings

From that point on, management will be focused on improving margins further, though we have no idea what that will look like from a revenue or profit perspective. We also don’t know all that is included in this. However, just last month, the company did move forward with the repurchase of $100 million of convertible notes that are due in 2025. They paid $99.25 million for the notes in a maneuver that will save the company about $2.5 million per year in interest.

National Vision Holdings

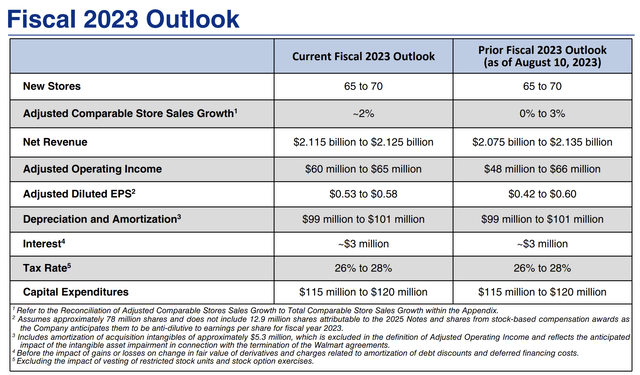

Given that management is forecasting offsetting this loss in profits, it’s reasonable in my opinion to still value the company based on estimates for 2023. For 2023, the company is forecasting revenue of between $2.115 billion and $2.125 billion. Earnings per share, at the midpoint, should translate to net profits of about $43.3 million. Based on my own estimates, adjusted operating cash flow should be around $143.5 million, while EBITDA should come in somewhere around $162.5 million.

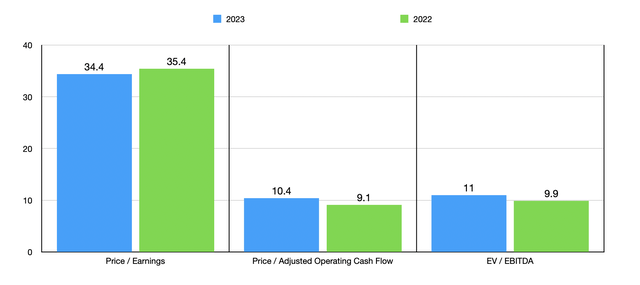

Author – SEC EDGAR Data

Based on those figures, I was able to create the table above. In it, you can see how shares are priced using estimates for 2023 and actual results for 2022. Clearly, the stock does look more expensive on a forward basis. But all the same, at least from a cash flow perspective, shares do look cheap. As part of my analysis, I then compared the company to five similar firms as shown in the table below. On a price to earnings basis, it is quite a bit pricier, with three of the five companies cheaper than it. But when it comes to the price to operating cash flow basis and the EV to EBITDA basis, only one of the companies that had positive results was cheaper than it.

| Company | Price / Earnings | Price / Operating Cash Flow | EV / EBITDA |

| National Vision Holdings | 34.4 | 10.4 | 11.0 |

| Alcon (ALC) | 72.1 | 28.8 | 36.4 |

| The Cooper Company (COO) | 335.1 | 29.6 | 22.7 |

| Bausch & Lomb Corporation (BLCO) | 15.1 | 41.7 | 20.3 |

| Olaplex Holdings (OLPX) | 2.5 | 8.4 | 10.1 |

| Warby Parker (WRBY) | 11.0 | 17.9 | N/A |

Takeaway

Right now, National Vision Holdings is going through some issues. The good news is that these don’t seem to be insurmountable. Had I known that the company was going to have this termination with Walmart, I probably would have rated it a ‘hold’. But given how cheap the stock is on a cash flow basis now that the stock has fallen and given management’s plan to address that matter, I would argue that the ‘buy’ rating I assigned the stock makes sense today.

Read the full article here