The First Trust Energy Income and Growth Fund (NYSE:FEN) is a closed-end fund aka CEF that provides an easy way for investors to add a selection of midstream corporations and master limited partnerships to their retirement accounts or other tax-advantaged accounts. This is something that can be a very attractive proposition for retirees, as master limited partnerships in general have a lot to offer someone in this stage of their life. This is because these companies typically have incredibly stable cash flows in any economic environment, which we saw during the pandemic. After all, while the unit prices of most of these companies collapsed along with crude oil prices, their cash flows remained remarkably stable. Midstream corporations and partnerships also tend to have very high yields, which is one reason why the First Trust Energy Income and Growth Fund is able to provide its investors with a reasonably attractive 8.26% yield at the current share price.

While the fund’s distribution yield is certainly attractive compared to many other things in the market today, it is not the most attractive yield available from midstream closed-end funds. For example, consider the yields that are currently being offered by some of the company’s peers:

|

Fund |

Current Distribution Yield |

|

First Trust Energy Income and Growth Fund |

8.26% |

|

Kayne Anderson Energy Infrastructure Fund (KYN) |

10.02% |

|

Tortoise Midstream Energy Fund (NTG) |

9.16% |

|

NXG Cushing Midstream Energy Fund (SRV) |

16.10% |

|

ClearBridge MLP and Midstream Fund (CEM) |

8.29% |

As we can see, all of these peers offer higher yields than this fund, although the ClearBridge MLP and Midstream Fund is not very much higher. As such, investors might be inclined to prefer one of these other funds unless the First Trust Energy Income and Growth Fund brings something unique to the table. Fortunately, it does in the form of utilities. First Trust’s energy infrastructure closed-end funds tend to have a higher allocation to utilities than other funds in this category, which helps them weather through crude oil price collapses such as the one that occurred in 2020 somewhat better than peers. This is something that might be very attractive to risk-averse retirees.

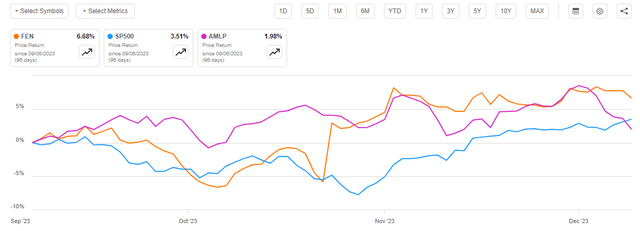

As regular readers are no doubt well aware, we last discussed the First Trust Energy Income and Growth Fund in early September. The fund’s performance since that time has been quite good, as its share price is up 6.68%. This is much better than the 3.51% gain of the S&P 500 Index (SP500) and the 1.98% gain of the Alerian MLP Index (AMLP):

Seeking Alpha

It is certainly possible that this fund has gotten ahead of itself, as there is little reason for this outperformance. The fund’s impending merger with the other First Trust energy infrastructure funds into an exchange-traded fund might be playing a role though, as exchange-traded funds trade at net asset value so some of this performance might be driven by the fund’s perpetual double-digit discount finally starting to narrow. It is still a few months until that merger takes place though, so a lot can happen during the intervening period.

About The Fund

According to the fund’s website, the First Trust Energy Income and Growth Fund has the primary objective of providing its investors with a high level of after-tax total return. This is not particularly surprising considering the strategy and portfolio that the fund employs in pursuit of this objective. The website describes its strategy and portfolio thusly:

First Trust Energy Income and Growth Fund is a non-diversified, closed-end management investment company. The Fund’s investment objective is to seek a high level of after-tax total return with an emphasis on current distributions paid to shareholders. The Fund pursues its objective by investing in cash-generating securities of energy companies, with a focus on investing in publicly-traded MLPs, MLP-related entities and other companies in the energy sector which EIP believes offer opportunities for income and growth. Under normal market conditions, the Fund will invest at least 85% of its managed assets in securities of energy companies, energy-sector MLPs and MLP-related entities.

As I have pointed out in a number of previous articles, it makes a great deal of sense for any closed-end fund that invests in common equity to have a focus on maximizing its total returns. After all, common equity is by its very nature a total return vehicle since investors purchase common equity both to receive an income in the form of dividends or distributions as well as benefit from the capital gains that should accompany the growth and prosperity of the issuing company.

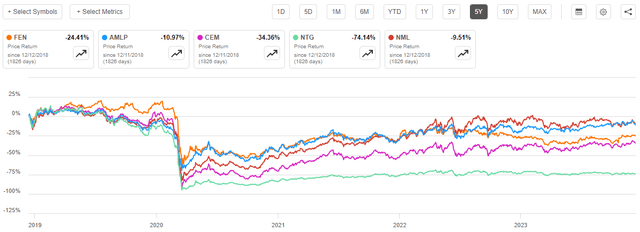

With that said, midstream companies typically deliver a much greater proportion of their total return in the form of distributions or dividends than in capital gains. After all, the Alerian MLP Index has actually declined by 10.97% over the past five years:

Seeking Alpha

However, investors who have held the index over the entire five-year period have still made quite a bit of money. The index’s total return over the same period is 39.02% due to the fact that the distributions paid by the constituent companies were more than enough to offset the price declines.

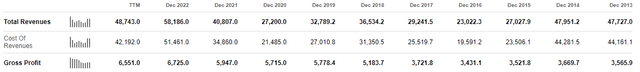

It has generally always been the case that the distributions or dividends paid by these companies comprised the majority of their total returns. After all, most midstream companies do not exhibit particularly rapid growth. As of the time of writing, the largest holding in the First Trust Energy Income and Growth Fund is Enterprise Products Partners (EPD), which is one of the best midstream partnerships available on the market today. Here are this company’s revenues over the past decade:

Seeking Alpha

As we can very quickly see, there has not been very much growth in terms of either revenue or gross profit. While it is true that the company’s gross profits roughly doubled, that is not representative of an impressive growth rate. Alphabet (GOOG) has seen its gross profits increase by around 500% over the same period, for example:

Seeking Alpha

The fact that midstream companies tend to have low growth rates means that they cannot really depend on the market to award them high multiples or strong capital gains. As such, they simply pay out a large proportion of their cash flows to their investors, which gives them fairly high yields. Enterprise Products Partners, for example, yields 7.64% today and many midstream companies are higher than that.

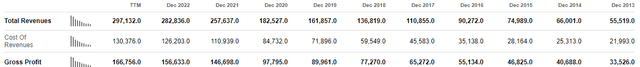

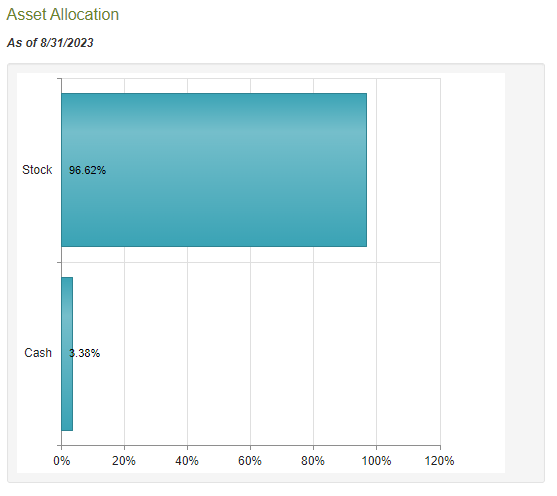

One thing that we notice from the fund’s description above is that the First Trust Energy Income and Growth Fund does not state that it will only invest in common equity from energy infrastructure companies. We do frequently see these companies issued preferred stock and bonds after all, but this fund does not currently include any of those securities:

CEF Connect

As we can see, right now the First Trust Energy Income and Growth Fund is currently 96.62% invested in common equity with only a relatively small allocation to common stock. This is not particularly surprising considering that it normally does not make a lot of sense to invest in bonds or preferred equity issued by these companies. As I pointed out in a previous article,

It might be somewhat surprising that this fund does not include preferred stock or bonds considering that these two assets can be much more stable than common equity. However, as I have pointed out in various previous articles on other energy infrastructure funds, these alternative securities do not offer the same value proposition in this sector as they do elsewhere. In particular, the common equity of midstream companies tends to offer comparable yields to the preferred equity and higher yields than the bonds issued by the same company. Common equity also has much greater upside potential. Thus, we do not really have the same rationale for purchasing preferred equity or bonds of midstream companies as we would in the case of a utility or financial firm.

As interest rates have increased over the past two years, the preferred equity offered by some midstream companies has come to offer very attractive yields when compared to the common. NuStar Energy’s (NS) class C preferreds (NS.PR.C) currently yield 12.23% based on their most recently declared dividend compared to an 8.79% yield of the common equity of that company. However, this is just a function of today’s interest rate environment. For most of the past decade, the common equity of most master limited partnerships had very comparable yields to the preferred equity. It seems likely that this will be the case again once the Federal Reserve pivots on its current monetary policy.

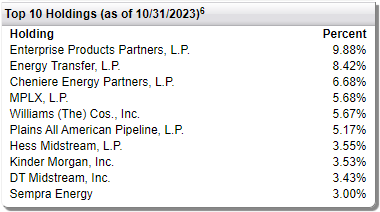

As regular readers are certainly well aware, I have devoted a considerable amount of time and effort over the past several years to discussing midstream companies and other energy infrastructure firms here at Energy Profits in Dividends as well as on the main Seeking Alpha site. As such, regular readers should be fairly familiar with all of the companies in this fund’s top ten positions. Here they are:

First Trust

I have discussed every one of these companies multiple times in the past, except for Cheniere Energy Partners (CQP). However, that company is mostly just a master limited partnership version of liquefied natural gas giant Cheniere Energy (LNG), which I have discussed multiple times over the years. As such, it should be reasonably familiar, at least when it comes to the company’s basic fundamentals. For example, the demand for liquefied natural gas is likely to grow substantially over the next ten or fifteen years. We have discussed this numerous times in past articles.

Most of the fund’s largest positions are the same as the last time that we discussed this fund, although there has been one major change. This change is that Magellan Midstream Partners was removed from the fund’s largest positions list and replaced with Sempra Energy (SRE). This is hardly surprising since Magellan Midstream Partners merged with ONEOK (OKE) in September. It appears that this fund’s management did not want to continue to own ONEOK after the merger, so it sold off the shares. Admittedly, I did not like the merger either, but I personally thought that ONEOK was better off without Magellan Midstream Partners.

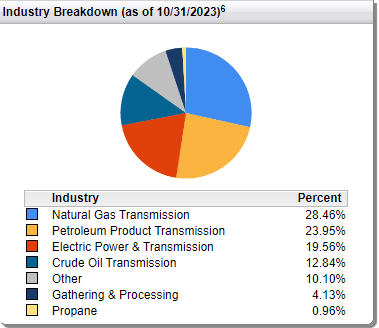

As mentioned earlier in this article, First Trust’s energy infrastructure closed-end funds tend to have allocations to utility companies, which was one of the reasons why they held up better than some peers back in 2020. The First Trust Energy Income and Growth Fund is no exception to this, as it has a 19.56% weighting to electric utilities:

First Trust

This could position this fund a bit better than some of its peers in the minds of those investors who are committed to the “green power” narrative and believe that electricity will soon completely replace fossil fuels for most functions. However, as I have pointed out before, that is highly unlikely to happen anytime soon. After all, the economics are just not there right now for solar and wind power given that both of these technologies are proving to be far more expensive than advocates claim, and their intermittent nature makes them unable to truly provide an adequate source of power for society. The stock prices of utilities do tend to be more stable than midstream companies, with the latter correlating more with energy prices. As such, this fund will probably exhibit less volatility than a fund that has no exposure to utilities. We, in fact, do see that as the fund held up better than some of its peers in 2020, and that has caused its price performance to be somewhat better since then:

Seeking Alpha

While we can see that this fund is not the best here, it still held up better than the Tortoise Midstream Energy Fund or the ClearBridge MLP and Midstream Fund over the period.

Leverage

As is the case with most closed-end funds, the First Trust Energy Income and Growth Fund employs leverage as a method of boosting its total returns from the investment portfolio. I explained how this works in my previous article on this fund:

Basically, the fund borrows money and then uses those borrowed funds to purchase master limited partnership units. As long as the yield of the purchased assets is higher than the interest rate that the fund has to pay on the borrowed money, the strategy works pretty well to boost the effective yield of the portfolio. This fund is capable of borrowing at institutional rates, which are considerably lower than retail rates, so this will usually be the case.

Unfortunately, the use of debt in this fashion is a double-edged sword because leverage boosts both gains and losses. As a result, we should ensure that the fund is not employing too much leverage because that would expose us to too much risk.

As of the time of writing, the First Trust Energy Income and Growth Fund has leveraged assets comprising 20.16% of its portfolio. This is slightly less than the 20.26% leverage that the fund had the last time that we discussed it, which is not especially surprising. After all, the fund’s net asset value per share is up by 2.08% since the last time that we discussed it:

Seeking Alpha

As such, if the fund were merely holding its leverage stable, its outstanding borrowings would represent a smaller percentage of the portfolio due to the larger size of the portfolio. Regardless, the fund’s leverage is not particularly high compared to most other closed-end funds. Overall, we should not have to worry too much about the fund’s use of leverage, although leverage was the factor that caused most energy infrastructure funds to take huge losses back in 2020 so obviously the lower the better.

Distribution Analysis

As mentioned earlier in this article, the First Trust Energy Income and Growth Fund has the primary objective of providing its investors with a very high level of after-tax total return. However, in order to achieve that objective, the fund invests in a portfolio that consists primarily of midstream partnerships and corporations. These entities deliver the overwhelming majority of their total investment returns in the form of direct payments to their investors. In this case, the payments would go to the fund and get pooled with the money that it receives from several similar companies. The fund combines this money with any capital gains that it manages to realize through the sale of appreciated equities. The fund then pays all of this money to its own shareholders, net of its expenses. As most midstream companies have fairly high yields, we can assume that this strategy will result in the fund itself having a very high yield.

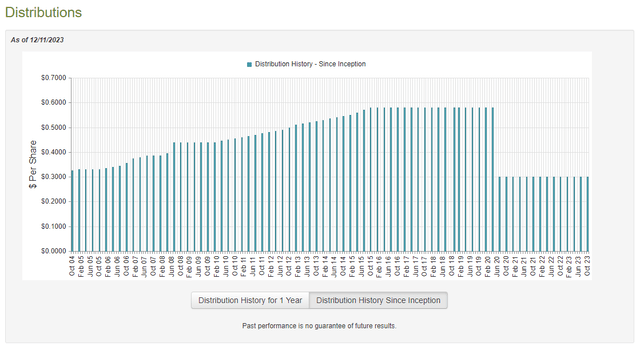

That is indeed the case, as the First Trust Energy Income and Growth Fund pays a quarterly distribution of $0.30 per share ($1.20 per share annually), which gives it an 8.26% yield at the current price. This is certainly reasonable, but it is not quite as good as the yield that is currently available from some other midstream funds. The fund has sadly not been particularly consistent with respect to its distribution over the years, as we can see here:

CEF Connect

As is the case with most midstream closed-end funds, this one cut its distribution substantially in response to the pandemic and the bear market that resulted from the pandemic. After all, the unit prices of most midstream companies collapsed, which resulted in the fund taking large realized and unrealized losses. It was forced to cut the distribution to avoid destroying its net asset value in such an environment. Perhaps the most disappointing thing here is that the fund has not made any attempt to increase its distribution now that the industry has recovered. We have seen a few other midstream funds raise their distributions over the past two years as higher crude oil prices and strengthening balance sheets have driven up the market values of some midstream partnerships.

As is always the case, we want to have a look at the fund’s finances to determine how well it is sustaining the current distribution. After all, we do not want the fund to distribute more money than it is actually generating from its investment portfolio. That scenario results in the destruction of capital and it is not sustainable over any sort of long-term horizon.

Unfortunately, we do not have an especially recent report that we can use for the purpose of our analysis. As of the time of writing, the fund’s most recent financial report corresponds to the six-month period that ended on May 31, 2023. As such, it will not include any information about the fund’s performance over the past six months. This is disappointing as quite a lot happened during that period. Over the summer, rising energy prices caused many energy stocks to appreciate even while returns in other sectors were quite difficult to come by. However, over the past two months or so, crude oil prices have been declining as the market begins pricing oil futures as though a near-term recession will hamper demand. These two events could have had a major impact on the performance of this fund, but they will not be reflected in this report. We will need to wait another six or seven weeks for this fund to release its annual report before we have an idea of how it performed during the past few months.

During the six-month period that ended on May 31, 2023, the First Trust Energy Income and Growth Fund received $3,998,160 in dividends and $132,344 in interest from the assets in its portfolio. This gives the fund a total investment income of $4,130,504 during the six-month period. This was not enough to cover the fund’s expenses during the period, and it ended up reporting a $2,914,817 net investment loss. Obviously, that was not enough to cover any distribution, but the fund still paid out $11,678,233 to its shareholders. At first glance, this certainly might be concerning as this fund is obviously not fully covering its distributions with its net investment income.

However, there are other ways through which the fund can obtain the money that it needs to cover shareholder distributions. In particular, the master limited partnerships in its portfolio make distributions that are not considered investment income for accounting purposes, but obviously still represent money coming into the fund. In addition, the fund might be able to generate some capital gains by selling appreciated securities. Realized capital gains result in money that can be distributed, but they are also not considered to be investment income for accounting purposes.

Unfortunately, the fund generally failed at this task during the period. It reported net realized gains of $10,415,421, but these were offset by $20,778,327 in net unrealized losses. Overall, this fund clearly failed to cover its distributions during the period.

This is obviously somewhat concerning, as the fund appears to be distributing more than it is actually earning through its investment activities. However, the market has generally been a bit friendlier to energy infrastructure companies during the second half of this year than it was during the first. Year-to-date, the First Trust Energy Income and Growth Fund’s net asset value per share is up 4.04%:

Seeking Alpha

This strongly suggests that so far this year, the fund has managed to fully cover all of its distributions and still has profits left over. This is a very strong sign that we do not need to worry about the fund suddenly being unable to maintain its distribution.

Valuation

As of December 11, 2023 (the most recent date for which data is currently available), the First Trust Energy Income and Growth Fund has a net asset value of $15.71 per share. However, the shares only trade at $14.46 each. This gives the fund’s shares a 7.96% discount at the current market price. This is generally in line with the 8.17% discount that the shares have had on average over the past month. As such, the current price looks very reasonable for potential purchasers.

With that said most energy infrastructure funds trade at much larger discounts. This one did too, until fairly recently. As mentioned in the introduction, this could be due to the fund’s merger with First Trust’s other energy infrastructure funds which is expected to be completed sometime in the second quarter of 2024. When that occurs, shareholders in the fund should realize a value equivalent to the net asset value of the fund. Thus, we can probably expect the fund’s discount to shrink as time passes and the merger date gets closer. This could serve as a source of capital gains for anyone who purchases the fund today, but there is no guarantee that this will happen as there are still several months to go.

Conclusion

In conclusion, the First Trust Energy Income and Growth Fund continues to look like a very reasonable way to add the generally stable cash flows and high yields characteristic of midstream partnerships to a retirement income portfolio without having tax problems. The fund is still a bit riskier than the Alerian MLP ETF due to leverage though, but it makes up for this with a larger variety of holdings and the addition of utilities to its portfolio.

First Trust Energy Income and Growth Fund appears able to sustain its 8.26% yield going forward. There also could be an opportunity to profit from the impending merger, although there is no guarantee that the opportunity will work out given the time period until it is consummated. The fund is still trading at an attractive price though, so it might be worth buying today.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here