We previously covered NIO Inc. (NYSE:NYSE:NIO) in September 2023, discussing its mixed FQ2’23 earnings call, attributed to the underwhelming top/ bottom lines and the likelihood of it missing the previous FY2023 delivery guidance.

We had opted to rate the stock as a Hold then, since it was uncertain if the automaker’s margins might improve moving forward, due to the intensified sales hiring, R&D, and capex for the mass market models.

This is on top of the stock consistently charting lower lows and lower highs, with it remaining to be seen when a floor might materialize.

In this article, we shall discuss why we are finally rerating the NIO stock as a Buy here, thanks to its increasing ASPs, growing sales, improving automotive gross profit margins, and enhanced monetization strategies, with these efforts likely to moderate its cash burn rate ahead while preserving its balance sheet.

Combined with the pulled forward mass market model launches, it appears that the worst is already here, with its prospects likely to lift from FQ4’23 onwards.

The NIO Investment Thesis Is Very Tempting Here Indeed

For now, NIO has reported a more than decent FQ3’23 earnings call, with automotive revenues of 17.4B Yuan (+142.3% QoQ/ +45.9% YoY) and a recovering Average Selling Price of 314.05K Yuan per unit (+2.8% QoQ/ -16.8% YoY).

The latter sum is derived from the automotive revenues and growing deliveries of 55.43K units (+135.6% QoQ/ +75.4% YoY) by September 30, 2023.

The ASPs are improved than the impacted ASPs of 297.18K Yuan per unit recorded in FQ1’23 (-19.3% QoQ/ -17.1% YoY) indeed, implying reduced promotional activities and growing consumer demand for its offerings.

This development has directly contributed to NIO’s recovering automotive gross margins of 11% (+4.8 points QoQ/ -5.4 YoY) by the latest quarter, though still a great distance away from its FQ4’21 peak automotive gross margins of 20.9%, thanks to the ongoing price war lead by Tesla (TSLA) in China.

Furthermore, we may see this profitable trend continue in FQ4’23, with the projected ASPs of 341.45K Yuan per unit (+8.7% QoQ/ -7.3% YoY), based on the management’s revenue guidance of 16.39B Yuan and delivery guidance of 48K units at the midpoint.

Part of the margin improvement tailwind is likely attributed to the automaker’s full transition to the NT2.0 platform by FQ3’23, with the improved cost efficiencies already allowing the management to guide 15% (+4 points QoQ/ +8.2 YoY) in automotive gross margin by FQ4’23.

Demand for NIO’s EV offerings appear to be excellent as well, attributed to the somewhat stable inventory levels of $967.44M (-17.3% QoQ/ +3.1% YoY) by the latest quarter.

October 2023 has also brought forth excellent delivery numbers at 16.07K units (+2.7% MoM/ +59.8 YoY) and November 2023 at 15.95K units (-0.7% QoQ/ +12.6% YoY).

While the YTD sum of 142.02K units (+33.1% YoY) and updated FY2023 delivery guidance of 158K units (+29% YoY) falls behind the management’s previous guidance of 250K units (+104.1% YoY), we already applaud the moderate improvements observed in its automotive gross margins.

This trend may be further aided by the launch of NIO’s affordable EV line up in the EU, namely Alps from Q3’24 and Firefly from 2025 onwards, likely to improve its mass appeal and adoption, boosting its top-line performance in the intermediate term.

For context, the automaker currently prices its flagship models at between €50K to €91K in the EU, in order to compete with many other legacy premium automakers, such as BMW (OTCPK:BMWYY) and Mercedes-Benz (OTCPK:MBGAF).

While the NIO management has yet to reveal the listed prices, the sub brands are rumored to bring down the Average Selling Price range to between €12.95K and €25.90K for the base-range Firefly EV models (based on the FX rate at the time of writing).

This is nearer to Toyota’s (TM) Lexus price range, implying a drastic -72.4% discount at the midpoint.

In the mean time, NIO’s Alps is rumored to offer mid-range EV models, at an estimated price range of between €25.90K to €38.84K, suggesting an attractive -54% discount from its premium range at the midpoint.

With Alps already being tested on the roads in China, it appears that the rumors may be right after all, triggering the automaker’s intermediate term tailwinds.

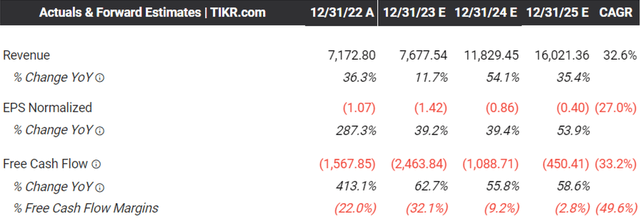

The Consensus Forward Estimates

Tikr Terminal

Perhaps this is why NIO is still expected to generate a robust top-line growth at a CAGR of +32.6% through FY2025, building upon its historical growth at a CAGR of +77.6% between FY2018 and FY2022.

While the automaker is not expected to break even over the next few years, we are not overly concerned since its balance sheet remains robust, with a cash/ short-term investments of $5.33B by the latest quarter (+39.1% QoQ/ -15.2% YoY).

Assuming that NIO is able to continue growing its gross profit margins ahead, we believe that its quarterly cash burn rate of approximately -$600M may decline from henceforth, allowing it to moderately grow its operations ahead.

If anything, the management is also exploring multiple paths to improve its margins and liquidity ahead.

Firstly, NIO has acquired certain equipment and assets for 3.16B Yuan from its current manufacturing partner, JAC, on December 5, 2023, with the exercise expected to improve its quality control while bringing its overall manufacturing costs down by approximately -10% in the long run.

Secondly, the management has announced its partnership with Changan Automobile and Geely Holdings Group (OTCPK:GELYF), allowing the two Chinese automakers to utilize NIO’s battery swap network for a fee, with several others already in negotiation.

This strategy is somewhat similar to TSLA’s opening up of the Supercharger network in the US, allowing the company to enhance its monetization rate through “access fees & revenues from other OEMs.”

Lastly, there are already market rumors of NIO potentially spinning off the battery production unit/ swapping technology as a separate unit, with the exercise likely to bring forth additional liquidity for the parent company.

As a result, we are cautiously optimistic about the automaker’s intermediate term prospects, with liquidity unlikely to be a major concern.

So, Is NIO Stock A Buy, Sell, or Hold?

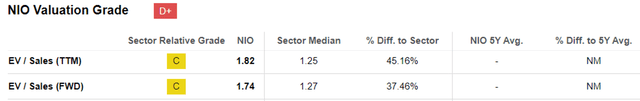

NIO Valuations

Seeking Alpha

For now, since NIO remains unprofitable, the only metric that we may use to measure its valuations is the FWD EV/ Sales of 1.74x.

This number appears to be somewhat reasonable, after the much needed correction from the pre-pandemic mean of 3.16x and the hyper-pandemic peak of 23.14x, nearer to the sector median of 1.27x.

This is especially since NIO is expected to generate an impressive top-line growth moving forward, well-exceeding TSLA’s projected growth at a CAGR of +21.5% with a FWD EV/ Sales of 8.04x, and nearer to XPeng’s (XPEV) rate of +41.7% over the same time period with a FWD EV/ Sales of 2.93x.

NIO 1Y Stock Price

Trading View

The NIO stock is also trading below its previous resistance levels of $8s, with it appearing to be well supported at $7s. As a result of its attractive valuation and potential reversal in FQ4’23, we are cautiously rerating the stock as a Buy here.

However, investors must also size their portfolios according to their risk appetite, since the stock records an elevated short interest of 10.69% at the time of writing, with the future upside potential likely to be negated by aggressive short sellers.

Read the full article here