Here’s a riddle. What do Blockbuster, Borders, Tower Records, and Kodak have in common? You are correct if you said they all went out of business (or declared bankruptcy) after failing to adapt to the internet and digital age. If you said they have all become incredible lessons of what not to do that today’s business leaders take very seriously, you are also 100% correct.

This is why 2024 could be a huge year for spending on artificial intelligence (AI).

Companies today know they cannot get left behind. AI may not prove practical for many businesses, or they may find the technology isn’t advanced enough yet. But you can bet they will spend money to find out.

IT budgets were crimped after a rough 2022, and many predicting a recession in 2023. There is still concern over the economy in 2024, but I would be surprised if budgets don’t loosen considerably this year. This is a massive opportunity for investors.

Let’s start with two under-the-radar stocks and then move on to the titans.

UiPath

Most of us can think of at least one task at work that is repetitive, time-consuming, adds little value, but is essential to complete.

One example this company demos is the case of a mortgage processor. The processor receives emails with numerous files, downloads them, and places them on the appropriate line in the PDF application. The time spent downloading, viewing, and entering data is not adding value, but it must be done.

Another example involves a company’s accounts payable department, which receives hundreds of invoices daily by email that must be manually downloaded and inputted into the accounting system. This is hugely labor intensive, prone to clerical errors, and inefficient.

UiPath Inc. (PATH) is a leader in Robotic Process Automation (RPA) and its Document Understanding programs allow companies to automate these tasks. There are numerous other case studies, and the implications for efficiency and cost savings are staggering.

Annual recurring revenue (ARR) reached $1.4 billion in Q3 fiscal 2024 on 24% year-over-year (YOY) growth. UiPath also reported a dollar-based net retention rate (DBNR) of over 120%, showing that customers value the product and are willing to pay more or add features.

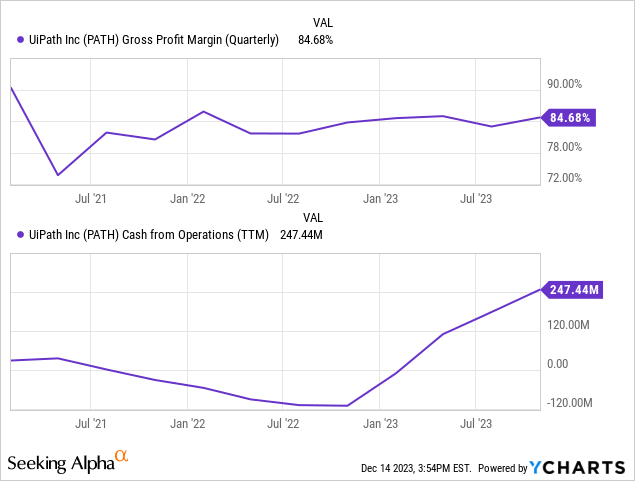

The company has a gross margin near 85% and achieved significant positive cash from operations (CFO) this year, as shown below.

The PATH balance sheet is solid, with $2.4 billion in current assets against $628 million in current liabilities and no long-term debt. Don’t expect GAAP profits anytime soon. The company spent 59% of its revenue on sales and marketing last quarter (as it should), and this will continue.

UiPath stock declined 63% since its high-flying IPO but is up 90% in 2023 and trades at 12x sales. The recent rise has been sharp, so investors should consider waiting for a pullback or using dollar-cost averaging to enter a position.

SoundHound AI

Like UiPath, SoundHound AI, Inc.’s (SOUN) speech recognition and conversational intelligence technology is transformative. I published this article last week, which goes into much more detail on the opportunities and challenges the company and investors face.

Fast food restaurants will be some of the immediate beneficiaries of this new technology. An ordering system that can understand human speech and update orders accurately in real-time will be the standard in the near future. White Castle will use SoundHound tech at 100 drive-thru locations by the end of next year.

Automotive is another huge opportunity. The difference between being able to tell your vehicle to “call Mom” vs. “find me an open restaurant within ten miles with excellent reviews known for great burgers” or “diagnose this check engine light” is night and day.

SoundHound has heavy competition from Big Tech companies with massive research and development (R&D) budgets and auto companies developing their own conversational speech technology. The company will also need more capital soon and has a ballooning share count (see my article linked above for details). But with a price tag of just $2.25 per share, the potential for it to hitch a ride on the AI hype train is obvious. It is a high-risk, high-reward stock not for the faint of heart.

Now, the big dogs.

Nvidia is now essential

We’re at the beginning of a basically across-the-board industrial transition to generative AI; to accelerated computing. This is going to affect every company, every industry, every country.

– Jensen Huang, Nvidia President and CEO, Q3 earnings call.

Nvidia Corporation (NVDA) stock has risen 230% in 2023, making it the world’s sixth-largest company by market cap and a member of the trillion-dollar club. It is seen as overvalued by many (and it could be), but the rise is not just hype. The results are staggering.

Nvidia’s high-performance graphic processing units (GPUs) and other hardware and software are essential to data centers, which are essential to society and commerce. Our cloud-based software, data storage, payment processors, banks, and generative AI software depend on data centers to operate.

Perhaps the biggest obstacle Nvidia faced in 2023 was meeting demand. And it believes demand will continue to rise through 2025:

Tim Arcuri – UBS

I wanted to ask a little bit about the visibility that you have on revenue…Do you think that Data Center can grow even in 2025?

Jensen Huang

Absolutely. (I) believe that Data Center can grow through 2025. And there are, of course, several reasons for that. We are expanding our supply quite significantly. We already have one of the broadest and largest and most capable supply chains in the world. Now, remember, people think that the GPU is a chip. But the HGX H100, the Hopper HGX has 35,000 parts; it weighs 70 pounds. Eight of the chips are Hopper. The other 35,000 are not. It is – even its passive components are incredible.

Even the manufacturing is complicated, the testing is complicated, the shipping is complicated, and the installation is complicated. And so, every aspect of our HGX supply chain is complicated. And the remarkable team that we have here has really scaled out the supply chain incredibly.

We are absolutely world-class. But meanwhile, we’re adding new customers and new products. So we have a new supply.

-Q3 fiscal 2024 conference call.

Nvidia is committed to keeping up with incredible demand with a robust global supply chain, which will be critical to staying far ahead of the competition and beating analyst estimates for revenue and profits.

Why did Nvidia stock skyrocket in 2023?

2023 (essentially Nvidia’s fiscal 2024 ending January 31) is an excellent lesson in finance 101: Supply, demand, and pricing power. Nvidia’s products are so popular that it sets the market, and customers will still line up to pay.

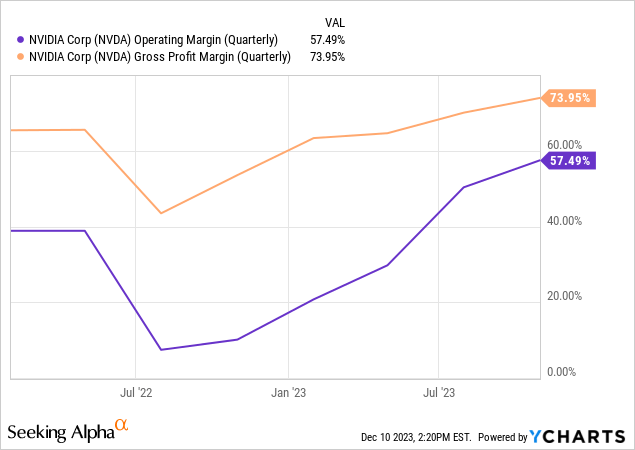

The company’s margins ballooned to eye-popping levels. The gross margin reached 74% and the operating margin 57% last quarter, as shown below.

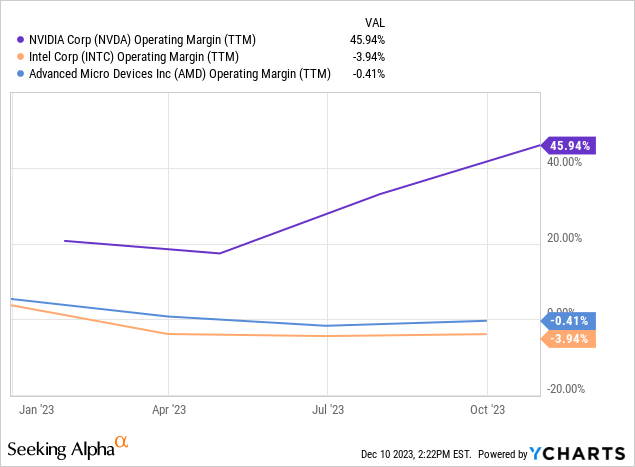

Perhaps nowhere is Nvidia’s competitive advantage over some competition more evident than when we look at the margins. Advanced Micro Devices (AMD), and Intel (INTC) aren’t in the same arena. Below are the operating margins for the trailing twelve months (TTMs).

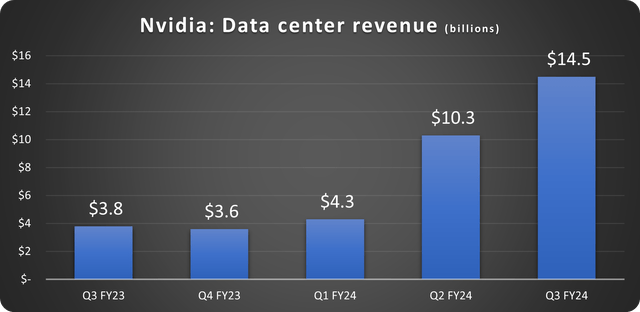

As discussed above, Data Center revenue was the primary driver, reaching $14.5 billion last quarter on ridiculous 279% year-over-year (YOY) growth. The trend is still strong, as last quarter saw quarterly sequential growth of 41%, as shown below.

Data source: Nvidia. Chart by the author.

Still, data center growth alone won’t sustain Nvidia stock at these levels forever. Gaming remains a stalwart, growing 81% YOY last quarter to $2.9 billion, and automotive and robotics offer fertile ground for the future. Nvidia believes the autonomous machine market will one day rival the size of the data center market.

Is Nvidia stock a buy now?

Cash flow

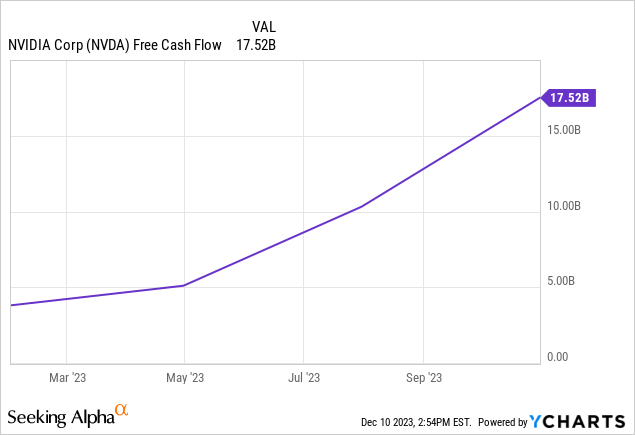

I’d be remiss not to discuss Nvidia’s cash flow, my favorite key performance indicator (KPI). Free cash flow (FCF) is already up 400% over fiscal 2023 through three quarters of fiscal 2024 and $17.5 billion over the TTMs, as shown below.

The company is ramping up a share repurchase program that took $10 billion worth of stock off the table in fiscal 2023 and $6.9 billion so far in fiscal 2024, with another $25 billion authorized. Shareholders should expect continued authorizations from here.

Rapidly rising EPS

Wall Street has been consistently behind the curve in estimating Nvidia’s earnings-per-share (EPS). Seeking Alpha depicts this clearly, as shown below.

Seeking Alpha

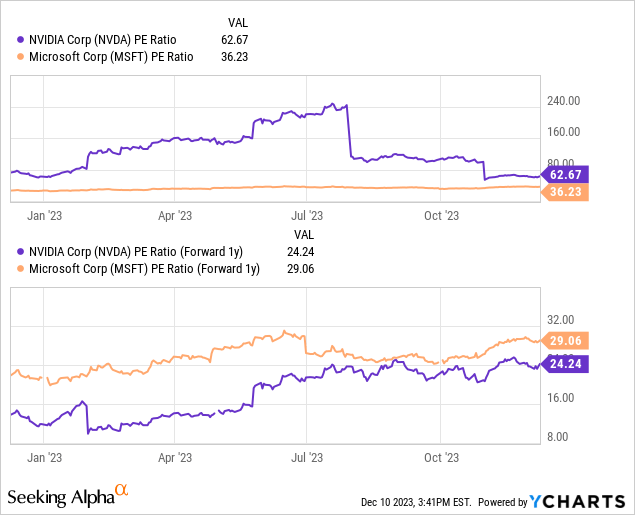

The average estimate for fiscal 2025 is over $20.50 per share, pushing the price-to-earnings (P/E) ratio down to a reasonable 24 based on fiscal 2025 estimates, as shown below. This is lower than Microsoft (MSFT), putting cold water on the notion that Nvidia is severely overvalued.

What are the risks?

This doesn’t mean that Nvidia stock is a no-brainer at this level. There is a risk of demand destruction. Companies that desperately need Nvidia products and technology have almost certainly been ordering more than they need because of the limited supply, building their inventories. If demand slackens even a little, Nvidia could see short-term headwinds as companies work through inventory on hand.

The U.S. continues to curb some high-performance chip exports to China and elsewhere. This puts Nvidia in a quandary as significant sales come from these spots; however, they believe there is enough demand elsewhere to make up for it. The company is also developing products that will meet the export restriction requirements.

Towards the end of the quarter (Q3 FY24), the U.S. government announced a new set of export control regulations for China and other markets…

Our sales to China and other affected destinations…have consistently contributed approximately 20% to 25% of Data Center revenue over the past few quarters. We expect that our sales to these destinations will decline significantly in the fourth quarter. So we believe will be more than offset by strong growth in other regions.

Following the government’s clear guidelines, we are working to expand our Data Center product portfolio to offer compliance solutions for each regulatory category…

-Colette Kress – EVP and CFO, Q3 earnings call.

Nvidia is a terrific company that will provide shareholders with solid gains in the long term. However, rapid multiplication of the share price has already taken place. The stock is still a solid portfolio holding, but there are plenty of other opportunities in the AI space.

Amazon

Amazon.com, Inc. (AMZN) deserves significant attention heading into 2024, and I will have a feature article out soon. But let’s chat briefly about its AI opportunity.

Amazon uses AI in logistics, cybersecurity, advertising, and elsewhere. Plus, Amazon introduced its foundational model, Bedrock, which allows customers to create their own generative AI tools, like chatbots, and its AI chips Trainium and Inferentia.

At the end of the day, what does AI require more than anything else? Data! This is why I scoff at those who say that the 2023 slowdown in AWS is permanent. Amazon knew that 2023 budgets were strict on data usage, and they planned accordingly, assisting customers with lower-cost solutions.

Customers want help finding ways to spend less during this challenging time (early 2023). And given that it’s best for customers long term, we’ve been actively helping customers make these adjustments…And people sometimes forget that 90-plus percent of global IT spend is still on-premises. If you believe that equation is going to flip, which we do, it’s going to move to the cloud. And having the cloud infrastructure offering with the broadest functionality…bodes well for us moving forward.

– Andy Jassy, CEO on Q1 2023 earnings call.

Going into 2024, IT budgets will bounce back with recession fears fading and the Fed potentially cutting rates. The work Amazon did to forgo profits while keeping customers will come to fruition even sooner than many expected. AI means data. Data means AWS. AWS drives Amazon, and this should drive gains in 2024.

Global X Robotics & Artificial Intelligence ETF

With all of the stocks in the robotics and AI space, maybe you want someone else to manage a fund geared toward these companies. The Global X Robotics and Artificial Intelligence ETF (BOTZ) is appealing.

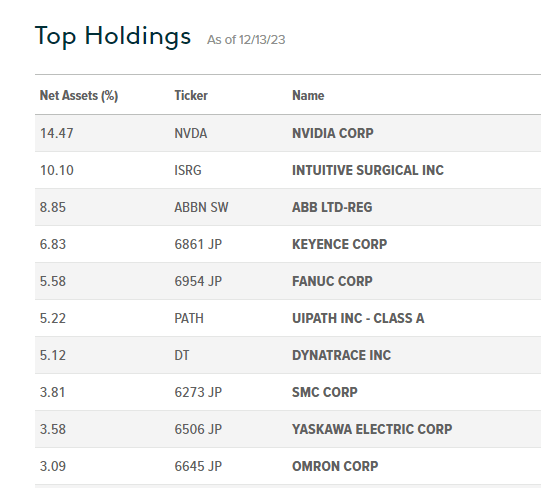

The fund holds 44 stocks, with the top ten shown below.

Global X

The fund is top-heavy, with Nvidia and Intuitive Surgical (ISRG) making up nearly a quarter of the holdings. However, relying on these stellar companies with tremendous results and balance sheets adds stability. The fund also holds UiPath in the top ten and a tiny position in SoundHound.

The expense ratio of 0.69% is competitive, and the fund has seen a resurgence recently that could continue into 2024. Other options in the ETF realm include the Robo Global Robotics and Automation Index ETF (ROBO) and the Roundhill Generative AI and Technology ETF (CHAT).

ROBO is more diversified for investors who want to fish with the widest net – no holding makes up more than 2% of the total. CHAT is heavily weighted into Big Tech. These are great companies, but buying the Nasdaq with Invesco QQQ Trust ETF (QQQ) with its 0.20% expense ratio (vs. 0.75% for CHAT) may make more sense for many.

Let’s put a bow on it

The AI space is fertile, and several other companies are worthy of mentioning, such as CrowdStrike (CRWD), which I have written about extensively, Alphabet (GOOG, GOOGL), Palantir (PLTR), and Meta (META). Some feel AI will be as transformative as the Internet, while others scoff and point to the hype. But the key is that companies in all industries are spending billions on it; this will continue, and investors can benefit handsomely.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Read the full article here