The Defiance S&P 500 Enhanced Options Income ETF (NYSEARCA:JEPY) is a recently established actively managed ETF with an objective to deliver consistent and outsized monthly yield distributions coupled with equity market exposure to the S&P 500.

Since the Fund was incorporated only a couple of months ago the history is not that deep, but up until now, the monthly distributions have been quite solid and attractive leading to a ~13.3% dividend yield (on a TTM and annualized basis).

Let’s now take a look at how the yield is supported.

In essence, JEPY applies a put-write strategy on the underlying, which in this case is the S&P 500 index. More specifically, this means that at-the-money (very close to the actual index strike price) and in-the-money put options (below the index price) are simultaneously sold allowing JEPY to achieve the following:

- Additional income in the form of option premium, which is the key enabler of JEPY’s ability to make high-yielding distributions, while carrying some exposure to the S&P 500 factor.

- To elaborate a bit on the S&P 500 factor, as a result of written in-the-money put options, JEPY obtains exposure to the value or movements of the index that are partially capped depending on the level of deviation between the then-sold option’s strike and index level.

Plus, it is worth mentioning that JEPY makes these option transactions on a daily basis, which is critical to more closely track the performance of the underlying (i.e., to avoid a major basis risk between JEPY and the S&P 500).

With that being said, we have to appreciate that the presence of a basic risk between JEPY and the S&P 500 is inevitable due to the nature of the chosen option strategy. So, this is a nice segue to explore whether allocating into JEPY makes sense, and if yes then based on what objectives.

Thesis

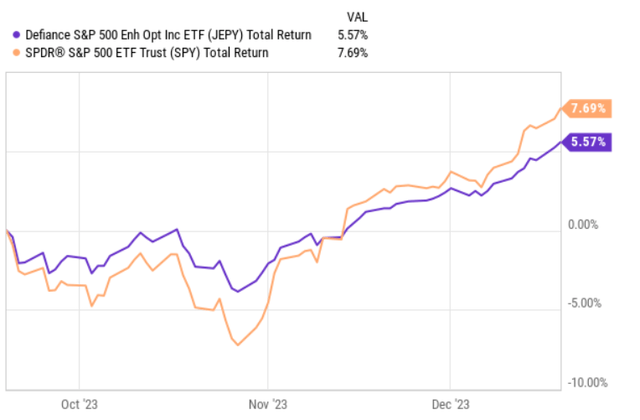

Looking at JEPY’s performance since its inception, we have to admit that the strategy has worked relatively well.

Ycharts

Although JEPY lags behind the index a bit the difference is not that significant especially considering the unfavorable dynamics for income-enhancing strategies.

In other words, the fact that JEPY is capped to the upside of realizing full gains in the case of a notable uptick in the index should per definition introduce headwinds for JEPY to deliver solid returns under a scenario of rising S&P 500 levels.

Yet, the deviation because of the aforementioned nuance has not been so wide, and there are two reasons for this:

- Since management sells very short-dated options and does so on a daily basis, there is inherently less time for the S&P 500 to significantly exceed the strike at which options were sold. It would have to take massive jumps in the S&P 500 to experience a significant difference.

- The above reflected total return chart also includes a period of sideways trading market during which JEPY managed to accumulate some alpha that helped offset negative (relative) performance during the period of an upward trending index.

Finally, in terms of the holding structure, JEPY also owns a series of U.S. Treasuries to fulfill the requirement of having collateral against the written put options. In fact, these fixed income securities are the only conventional instruments (beyond cash and options) that are directly held by JEPY as the exposure to the S&P 500 is achieved synthetically.

The good thing is that positions in the U.S. Treasuries also provide an additional yield-enhancing component in the JEPY’s structure that helps get the distribution yield higher.

The bottom line

From JEPY’s positions and the overall policy we can imply the following:

- The Fund performs well in a sideways trading market as under such circumstances there is no opportunity cost related to not being able to fully participate in the S&P 500’s upside. So, while the S&P 500 remains stable and provides a ~1.5% yield, JEPY can deliver attractive streams of current income at ~13%.

- While the Fund is fully exposed to the downside, it should register slightly better results than the S&P 500 in case of falling market conditions. The key driver here is the additional income component generated by written options, which can offset part of the decline. We can take note of this by looking at the chart above (right before November 2023).

- Under a scenario in which the overall market (including the S&P 500) surges higher and does so on a fairly consistent or frequent basis, it is clear that because of the embedded limits that are associated with the put-write option strategy JEPY would underperform. Starting from the first week of December this year we can notice how this has played out in a quite material fashion.

In my humble opinion, the choice of whether to buy JEPY or not boils down to the assumption of how the market will perform on a forward basis.

Namely, if there is a belief that the S&P 500 will spike higher due to, for example, more accommodative moves in the interest rate expectations, JEPY is certainly not the best choice.

If, however, the expectation is that the market will deliver relatively balanced results (either to the upside or downside), JEPY is a very appealing vehicle through which to capture the S&P 500 factor, while getting additional compensation in the form of an attractive yield.

Read the full article here