Today, Brunello Cucinelli (OTCPK:BCUCY) is one of Italy’s most influential contributors to the prestige of the “Made in Italy” label. Based in Solomeo, a small village in Umbria, Brunello Cucinelli uses the rich regional expertise in craftsmanship to produce the best cashmere products and simultaneously carry the Italian dream into the world. Throughout the last decade, the company predominantly flew below the radar, but especially the rising demand for “quiet luxury” and the business philosophy of its founder gave the company new interest.

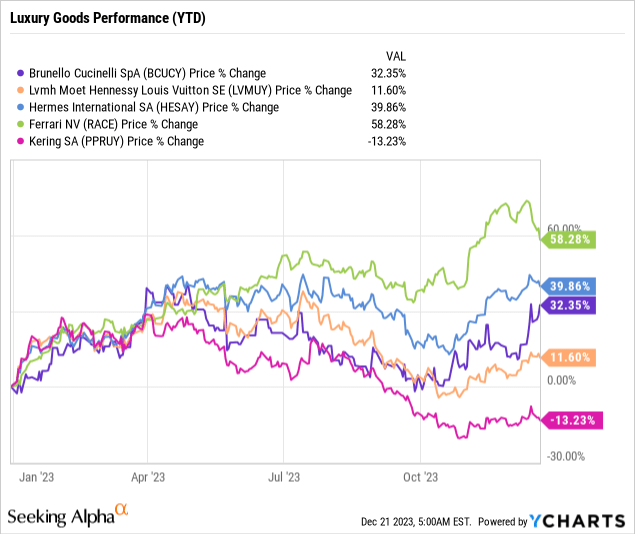

For existent shareholders, the year 2023 presented an astonishing return of 32%, while exhausted consumer budgets slowed the growth of more fashion-oriented brands, leading to a very differentiated result towards the years’ end. True luxury can continue to build on stable demand, which could make Brunello Cucinelli an interesting opportunity for long-term investors.

Business Approach

Brunello Cucinelli founded the company in 1978 with his original idea of creating excellent and colorful cashmere sweaters for women. He started with a handful of garments and the passionate idea, which soon attracted several bespoke persons around Italy and beyond giving him his first large orders and the confirmation that he was on to something.

During the following 45 years, the brand moved into the small village of Solomeo and continuously expanded its production facilities, while always preserving the beauty and heritage of traditional craftsman- and artisanship. This recognition as “artisanal industrialists” is building on the global acknowledgement of Italian craftsmanship and also transfers these values into modern times. Similar to Ermenegildo Zegna, which I covered already in another article, one can recognize the passionate dedication to create a successfully growing business in a sustainable manner by appreciating every part of the value chain and continuously sharing the fruits of the company’s success. More specifically, the philosophically literate Brunello Cucinelli introduced an approach called “Humanistic Capitalism” that incorporates rules he thought of being most significant in describing his values and ideas. In a speech to the World’s Great Leaders at the G20 summit in 2021, he described the philosophy as follows:

I wanted a company that made healthy profits, but did so with ethics, dignity and morals; we are listed on the stock exchange, I wanted a company that had a balanced and gracious growth. I wanted human beings to work in slightly better places, earn a little more in wages and feel like thinking souls at work. Let us try not to turn our backs on poverty. I wanted a small part of the company’s profits to go to beautify all of humanity and I wanted people to work a fair amount of hours and be online the right amount of time, so that Technology and Humanism could be harmonised and a healthy balance between mind, soul and body could be restored, because the soul and body also need nourishment every day.

This is just an excerpt from his speech, but I think it summarizes the key features of his business approach well enough that we can come back to it when we discuss the fundamentals of the company. But let’s pause for a moment and look at the underlying business model of Brunello Cucinelli today.

Business Model

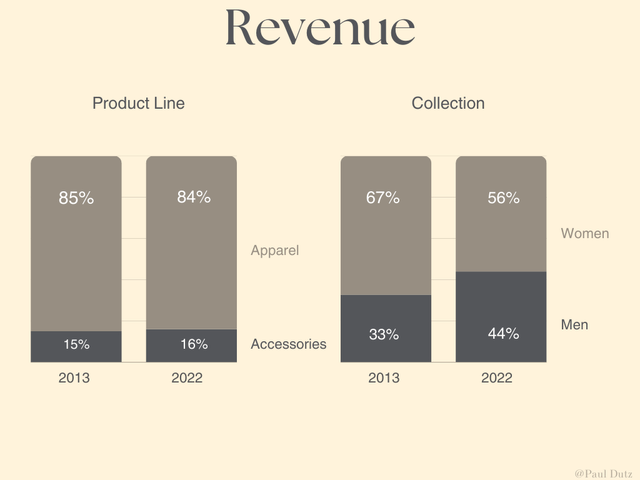

Brunello Cucinelli has successfully positioned the brand at the top end of the luxury segment, while slowly expanding both the production capacity and the range of products. Today, the brand offers clothing, accessories, perfumes and lifestyle items for home and travel – all of them introduced through total-look collections for women, men and children. However, the company classifies its revenues only between two product lines: Apparel and Accessories.

Revenue by Product Line and Collection, 2013 vs. 2022 (Annual Reports)

So while the company constantly introduced new product verticals, it does still mostly rely on its apparel collections and further on cashmere items as the core product. New product lines will be added cautiously and slowly in order to preserve the philosophy of the so-called Casa di Moda:

Our industry and Casa di Moda were established with the aim of producing high-quality, handcrafted products, expressing exclusivity in both materials and their production and packaging, seeking to create garments that will last over time and that can be handed down from generation to generation.

Excellent Craftsmanship

For this purpose, Brunello Cucinelli is putting high emphasis on the appreciation of traditional Italian craftsmanship throughout the entire manufacturing process. The label “Made in Italy” relies on around 400 craftsmen workshops, which are mostly located in Umbria and are using traditional handcrafted techniques and excellent materials from well-known suppliers, e.g. Zegna or Loro Piana. Throughout the supply chain, the company built long-term relationships that were additionally strengthened during the pandemic. And in order to preserve the values and skills of traditional craftsmanship, the company established a school in 2013 that is fully relying on the philosophy of Brunello Cucinelli:

The main objective has been to restore dignity to these trades, hiring highly qualified instructors, providing well-kept spaces, and offering a fair “remuneration” to apprentices, just like in the Renaissance workshops that inspired us.

Interestingly, while graduates are not required to work for the company after completing the program, they often stay, as the company pays an average of 20% more than industry peers. At this point, we can clearly draw lines back to the founder’s vision of a “Humanist Capitalism” that embraces all the people involved in creating the final product. But of course, this above-market dedication to the quality of materials and living standards of employees comes at a price.

Profitability

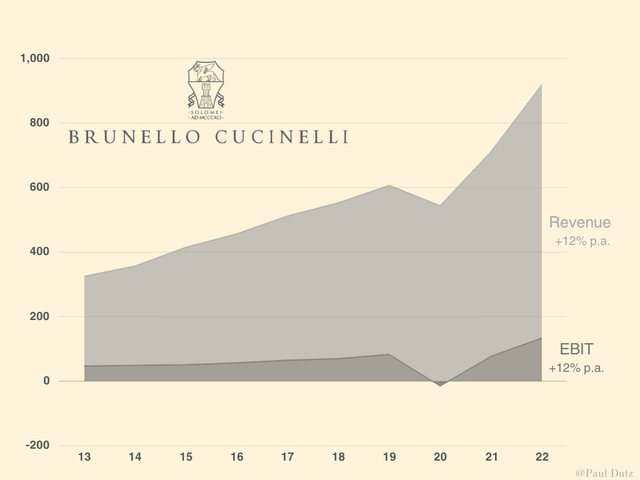

Contrary to one’s initial expectations, selling luxurious apparel does not necessarily equal a luxurious margin. During the fiscal year 2022, Brunello Cucinelli achieved total sales of €920 million, a new record high, and an operating income of €134 million, thus representing an EBIT margin of 14.6%.

Revenue and EBIT, 2013-2022, in € million (Annual Reports)

In comparison to 2013, the operating margin remained somewhat flat as both grew at a CAGR of 12% since that time. And again, we can find the answer in the philosophy of Brunello Cucinelli, who presented his idea of profit during the speech for the company’s original listing in 2012:

When we met with the investors […] we explained our business philosophy to them, and made it quite clear that we wanted to seek a sustainable and gracious profit […] We explained that our underlying intention was to imagine a company that could grow without harming humanity, or at least do as little harm as possible.

… and further addresses the profitability as one of the core values of his “Humanistic Capitalism” in 2022:

In 2022, we continued to devote great attention to our idea of Humanistic Capitalism and Human Sustainability. As a sign of respect for our core values, our commitment to the pursuit of the “right profit”, the “right growth” and the “right balance” continues. The right profit also presupposes the right recognition of the central value of those directly involved in manual labour, specifically our esteemed workers and artisans. For this very reason, in 2022 we introduced an extraordinary wage supplement with the desire to relieve the inflationary pressure on non-managerial employees. In order to further recognise the valuable efforts of our workers, we therefore decided on a general increase of their salary level at the beginning of 2023. In fact, we believe that our “human resources”, especially the artisans who employ their manual skills and creativity on a daily basis, deserve a slightly higher than average economic reward.

I hope you got a grasp on his perception of profitability through this excerpt as it is crucial to evaluate the company. The low double-digit margin is the consequence of Brunello Cucinelli’s idea for approaching business and will therefore most likely remain in that range. Some investors might recognize this as a weakness after comparing these margins with often-cited luxury peers. However, these solid margins are, from my perspective, an evidence for the sustainable growth of the brand and could further drive demand as especially younger people are becoming increasingly interested about the working conditions behind the product they buy. In this case, I recognize an advantage of companies I invest in that I really enjoy, which is the strength of being a nice business. Companies that are adding value to the society by doing good will more likely be positively surprised than negatively. Others would call this a sleep-well investment.

Current Performance & Outlook

That said, investors are currently confronted with a tiring amount of news and articles that write about the downturn of the luxury goods industry, and probably become concerned about the future prospects of the foremost beloved brands. And indeed, after reaching new highs in demand and profitability during the post-pandemic recovery, brands in the luxury goods market were faced with depleted budgets and a more concerned consumer sentiment. In particular, trend-led luxury brands have experienced the majority of this deceleration and have fallen short of analysts’ expectations, leading to an overall darkening perception of the industry’s prospects.

But let me cut you off right here with the words of Brunello Cucinelli during the 2022′ status update:

But you see, we do not see any slowdown in absolute luxury. We do not feel it for ourselves and not for the other beautiful brands.

And so far, the results for 2023 are more than significant evidence for his statement, as the company presented a top-line growth of 29% and 21% for the last nine-month and three-month periods, respectively.

|

Sales Growth |

Brunello Cucinelli |

Hermès | Zegna | LVMH (F&L) | Kering |

| Latest 9M | 29% | 22% | 19% | 16% | -3% |

| Latest 3M | 21% | 16% | 11% | 9% | -9% |

Luca Lisandroni, current co-CEO, has commented on their perception of demand even more promising, stating:

We see there is a robust demand for high-quality handcrafted garments that epitomize an idea of quiet and precious luxury that reflects our personality. Based on the above, we have chosen to raise or to review upward the year-end sales growth estimate from 19% to 20%, 22%.

Thus, Brunello Cucinelli not only continues to see an extraordinary demand that has experienced a beneficial boost by “quiet luxury” becoming a trend in the industry, but they even face a demand that has exceeded the company’s expectations, leading to an increased guidance for the fiscal year 2023. However, as Brunello himself said earlier, these growth rates are indeed exceptional, and after a normalization next year, the company expects a more balanced but still moderate growth of 10%, which is also more in line with the forward-looking view of the market outlined by the industry experts at Bain & Company. Similar to Hermès, Brunello Cucinelli will likely benefit from customers’ intention to buy more selectively with an enlarging focus on buying “less but better”.

From my point of view, Brunello Cucinelli has an excellent position in the absolute luxury segment and should therefore benefit from resilient secular growth, topped by promising trends in the industry and a changing consumer that places greater emphasis on brand sustainability.

Capital Allocation

This position should allow the relatively small luxury brand to continue to redeploy cash into the business, which is a good place to start talking about capital allocation. Over the last 10 years, the company deployed, on average, half of its operating cash flow (before WC changes) on investments into the business, while the latest years are trending more towards one third. However, the majority of these investments will be used to expand the distribution of the brands through the opening of new stores and the renovation and creation of showrooms, while maintaining excellent quality in manufacturing and logistics. In addition, the company has continued its efforts to create a digital presence that reflects the values and requirements of an absolute luxury brand.

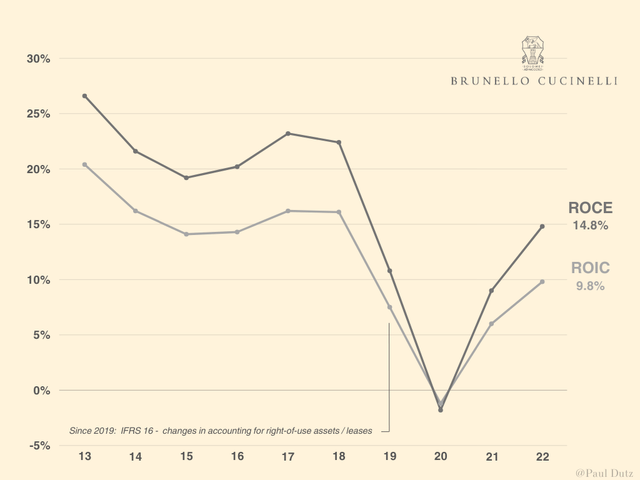

ROCE & ROIC, 2013-2022 (Own Calculation)

Since IFRS 16 has significantly changed the company’s balance sheet in 2019, the calculated ROIC and ROCE will remain lower as right-of-use assets, or in other words, leased spaces for boutiques and showrooms (99.9% are right-of-use properties) are now recognized.

Currently, Brunello Cucinelli is achieving solid returns on capital, but given the business model that only allows for limited efficiency improvements and the additional goal of “fair” profitability, I would not expect these metrics to increase significantly in the near future. However, I would like to add that basing one’s thoughts on expected growth rates on the combination of reinvestment rate and ROC can be misleading for luxury brands because it is difficult to account for the important intangible asset that is the value of the brand. And Brunello Cucinelli seems to be an excellent “guardian” that protects the exclusivity and rarity of the brand through thoughtful expansion and long-term investments.

Cash Flows

In order to analyze a company’s ability to generate cash from operations, I focus primarily on its free cash flow. Despite the usual calculation (OCF – CapEx = FCF), I adjust the operating cash flow for changes in net working capital and subtract the stock-based compensation. Using this approach, I try to get closer to the actual and sustainable cash generation of the business through the perspective of its owners.

For Brunello Cucinelli, the calculation looks like this:

| in € million | |

| Operating Cash Flow | 217 |

|

– Stock-based Compensation |

0 |

| – Changes in Net Working Capital | 3 |

| = Adjusted Operating Cash Flow | 214 |

| – Capex | 67 |

| = Free Cash Flow | 147 |

Considering the latest comprehensively reported period, H2/22-H1/23, Brunello Cucinelli was able to convert around 49% of the company’s EBITDA into FCF, which is below the historical average of 55%, though in line with the most other luxury companies I analyzed.

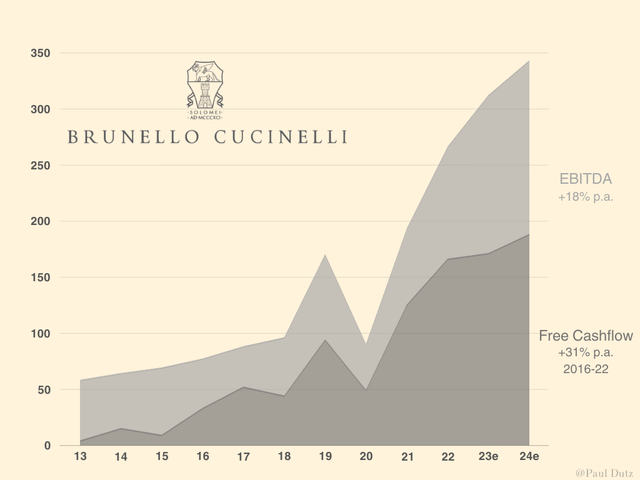

Free Cashflow & EBITDA, 2013-2024e, in € million (Own Calculations)

Over the last decade, Brunello Cucinelli clearly strengthened its cash conversion and delivered a free cashflow growth of 31% per annum even since 2016. This achievement even outperformed the share price, which appreciated around 22.9% p.a. during this period. In order to implement the company’s revenue outlook into this consideration, I applied an EBITDA margin of 28% and an average FCF conversion of 55% knowing that the actual FCF in these periods might differ due to certain investments. However, regarding a longer period of time, I assume the company to grow low double-digits at a constantly moderate margin that derives from the brands’ strong position in the absolute luxury segment, which already proved its resilience to broader economic changes and uncorrelated demand in relation to changing fashion trends.

Valuation

At the time of writing this article, the share price is €88.3, which indicates a market capitalization for Brunello Cucinelli of around €6 billion. Including the company’s net financial debt of €570 million, I arrive at an enterprise value of around €6.57 billion.

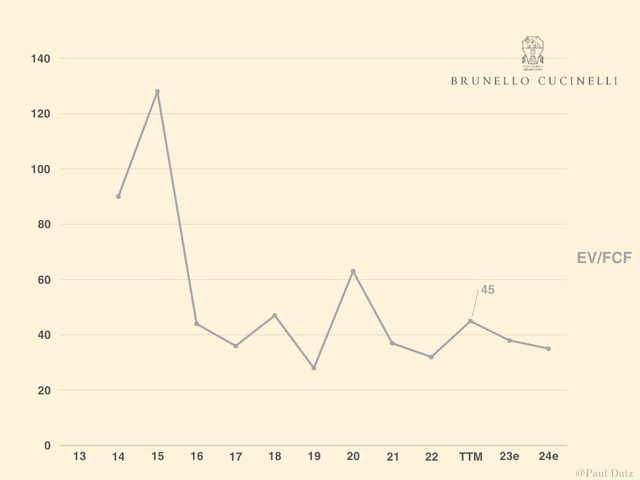

Regarding the latest 12-months figures for the company’s cash flows, Brunello Cucinelli is trading at an EV/FCF multiple of around 45, which predominately results from the most recent share price appreciation as the average multiple lies around 37. That said, considering the company’s guidance for FY23, we’re getting closer to the average with a valuation of 38x FCF.

EV/FCF, 2013-2024e (Own Calculations)

As we can see, the market currently seems to be much more optimistic about Brunello Cucinelli given the enlarged valuation in comparison to the last two years. Although I’m not a supporter of multiple comparisons between different luxury companies (given the significant differences between the brands and business models), one can clearly notice the premium that the company is receiving. From my perspective, this premium is mostly achieved due to the long expected runway of relatively resilient cashflows one can anticipate for Brunello Cucinelli. Nevertheless, I put last years’ free cashflow into an inverse DCF model to see what kind of growth rates the market is currently assuming according to the current valuation.

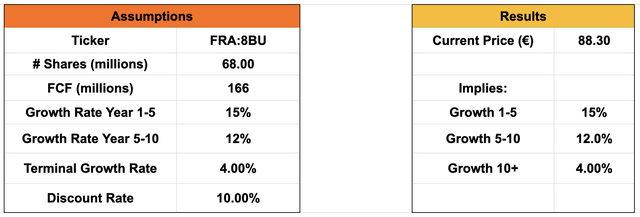

Inverse DCF (Own Calculation)

Looking out five years, the current share price implies an annual growth rate of around 15%, based on the strong momentum in 2023 and the normalization afterwards. Furthermore, given my standard discount rate of 10% and a reasonable terminal growth rate of 4%, the model projects an expected annual growth rate of 12% from year 5 to 10. Assuming a constant profitability and cash conversion, this would imply that the company is growing revenue around 2x the market growth. From my perspective, these growth rates could be achievable, yet being optimistically. It becomes clear that Brunello Cucinelli is currently trading at the upper end of the my expectations, resulting in little upside through multiple expansion or earnings surprises.

However, the inverse DCF model is only based on an estimate for the next 10 years before assuming a single terminal growth rate, which cannot reflect my assumption that such an exceptionally positioned company will likely be able to grow for a really long time.

Takeaway

Brunello Cucinelli is a unique company with an even more unique founder. The family-owned business has successfully positioned the brand in the absolute luxury segment and proved its resilience through various market environments. In addition, the company can build on a regional supply chain that benefits both the product and the heritage of the brand, making it increasingly difficult to build a brand with comparable pricing power. Further, the focus on the highest quality and the vision of a “contemporary lifestyle” are enhancing the resilience to changes in the fashion industry, while the recent “quiet luxury” trend has actually benefited the brand, resulting in record results. However, the company’s heritage also includes its founder’s vision to realize the idea of a “Humanistic Capitalism”, which benefits the quality of sustainability and employment, but limits profitability and the ability to expand margins in the future. From an investors’ point of view, it remains to be seen whether this approach will lead to outperformance among the group of absolute luxury brands (e.g. Hermès), although it certainly compromises the ability to remain profitable in special economic scenarios such as the pandemic. In addition, I would argue that Brunello Cucinelli’s products, although exclusive and high quality, are potentially less sought after by customers who are currently increasingly buying luxury items that are perceived as valuable assets, such as luxury bags or watches, making the brand’s resilience potentially more sensitive in my view. Furthermore, if I were looking at a comparable valuation, I would probably remain patient or look at the more established and exclusive flagship brand, namely Hermès (see my recent article).

Nevertheless, I consider Brunello Cucinelli to be a really interesting investment, given the long potential runway for growth and the resilient niche in which it operates. However, I will remain on the sidelines and wait for a more attractive opportunity, which is why I am initiating my coverage with a Hold rating.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here