Over the past year, one of the best-performing names in the market has been Snowflake Inc. (NYSE:SNOW). The cloud-based data platform has seen shares rise by more than 55% as investors have returned to favoring high growth names thanks to interest rates no longer on the rise. However, the huge rally has returned the valuation here to a very high level, one that may not hold in 2024 if the company’s growth trajectory does not improve as hoped.

Snowflake has been one of the best growth stories in recent years. Its cloud platform allows customers to store data and analyze it across a wide variety of applications. For its fiscal year ending in January 2019, the company reported less than $97 million in revenue, but just four years later, it was over $2 billion. Unfortunately, those sales have come at a major cost, with the GAAP loss going from $178 million to nearly $800 million over that same time. The current fiscal year ends at the end of this month, with revenues expected to rise another 35% to $2.79 billion, but GAAP losses have continued to widen.

Over the last year or so, revenue growth rates have come down significantly. Part of this is the law of large numbers, as it is just harder to grow revenues at 100% a year forever. However, in the company’s most recent fiscal quarter, product revenue growth came in at just 34%, basically half of what was seen a year earlier. The latest result was down another 10 percentage points since when I covered the name last March, and at that time, guidance was seen as disappointing. Guidance for Q4 suggests the number could be down to a 2 handle, although management is usually conservative with its forecast.

When I covered the name back then, I was a little worried about the stock trading at 16.5 times the expected revenues for the January 2024 fiscal year. Since then, analysts have actually cut their January 2025 average revenue estimate by $600 million, yet the stock is up more than $50 since. As a result, the stock is now trading at more than 17 times its expected sales figure, but now that forward-looking valuation is based on the January 2025 year instead of the current fiscal year.

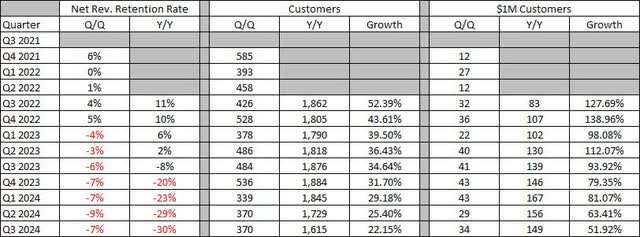

As we look into calendar 2024, everyone in tech is talking about artificial intelligence. Companies everywhere love to use AI buzzwords in their press releases, and Snowflake investors are hoping that this next tech boom will benefit the company. Currently, street analysts believe that revenue growth rates will actually level off and start rising again for the January 2025 fiscal year. Unfortunately, there are reasons to be skeptical, because many of the company’s key metrics are weakening considerably as seen below.

Q3 2024 Key Metrics (Company Earnings Releases)

At the moment, Snowflake isn’t adding as many customers as it used to be on a trailing 12-month basis. Over the past four quarters, the net revenue retention rate went from 165% to 135%, while the remaining performance obligation growth more than halved from 66% to 23%. Even deferred revenue growth on the balance sheet has seen its percentage increase plummet, which means the company needs to work a bit harder to get its top line moving.

To illustrate this point a little further, Snowflake over the last 9 quarters has averaged revenue dollar growth of about $197 million over the prior year period. At that same rate, it would mean that the fiscal 2025 year would see total sales grow by nearly $800 million. However, the street is currently looking for about $850 million of growth for that year and about $1.1 billion the following year. To make matters worse, the last two fiscal quarters have only averaged $177 million of year-over-year revenue growth. If the company doesn’t live up to this AI hype in the next couple of quarters, we could easily see growth rates come down into the low-to-mid 20 percent area.

The one area where Snowflake is really solid currently is the balance sheet. The company had over $3.5 billion in cash and investments at the end of the October quarter, with no debt, and generated more than $450 million in free cash flow during the first nine months of the fiscal year. The company is using that financial flexibility to buy back stock right now, but that comes with a bit of a catch. A main reason the company is free cash flow positive is due to a lot of its expenses are stock-based compensation, so the buyback is only really offsetting dilution to a point.

Until Snowflake shows at least a quarter or two where its key metrics and product revenue growth stop slowing considerably, I just cannot recommend buying at this current valuation. Many names in this space go for either high single digits or low double digits on a price-to-sales basis. If Snowflake could get its revenue growth trajectory to stabilize and perhaps even grow again, I wouldn’t mind paying say 11-13 times sales for this kind of name. However, I can’t justify running into shares when we are above 17 with growth rates declining every single quarter.

On the flip side, I think the overall market is slated to trend higher this year as we get some rate cuts from the Fed, so I wouldn’t be rushing in to short this stock either. Just take a look at Monday’s trading action where Snowflake jumped almost 4% as the tech sector soared with interest rates coming down a bit and inflation expectations cooling a bit. Thus, I am going to maintain a hold rating on these shares until we see how things play out over the next couple of months.

In the end, Snowflake faces a big year ahead of it. While the market is hoping that the artificial intelligence boom can boost the company’s revenues, many key metrics are showing significant signs of weakening. With the stock trading at a premium valuation, any disappointment on the top line could lead to a meaningful pullback here. For me to become a believer, I need to see that this company is taking advantage of the artificial intelligence boom and not going to be the latest example of a high growth, no-profit tech bubble.

Read the full article here