Summary

Realty Income Corporation (O / “Realty”), “The Monthly Dividend Company”, is an S&P 500 company and member of the S&P 500 Dividend Aristocrats index. It “invests in people and places to deliver dependable monthly dividends that increase over time.” Its monthly dividends are supported by the cash flow from over 13,000 properties primarily owned under long-term net lease agreements with commercial clients. It has declared 640 consecutive monthly dividends throughout its 54-year history and increased the dividend 122 times since its listing in 1994.

This report explores Realty’s recent operating trends, pending merger with Spirit, and the prevalent “slowing growth” narrative. We conclude that while the bear narrative has merit, it may not be as damning as some believe. However, we would feel more comfortable taking a closer look at the shares in the low $50s to provide a margin of safety and greater return potential.

History

Origins & Background

Realty has built a reputation for its distinctive investment strategy and consistent performance. Founded in 1969 by William E. Clark, the company specializes in acquiring freestanding, single-tenant properties under long-term net lease agreements. Their largely retail-focused portfolio grew steadily, benefiting from the consistency and predictability of rent income.

A significant milestone in Realty’s history was its listing on the NYSE in 1994, a move that enhanced its visibility and access to capital. This listing facilitated a period of accelerated growth, allowing the company to diversify its tenant base and expand geographically. By the early 2000s, Realty had established itself as a reliable dividend payer, earning the nickname “The Monthly Dividend Company” for its commitment to monthly dividend distributions, a rarity in the REIT sector.

In the 2010s, Realty continued its expansion through strategic acquisitions. A notable transaction was the acquisition of American Realty Capital Trust in 2013, which significantly increased its portfolio size.

More recently, Realty’s corporate actions reflect a strategic shift towards portfolio diversification and international expansion. The merger with VEREIT in 2021 marked a transformative phase, substantially enlarging its real estate portfolio and tenant base, and extending its reach into the office and industrial property sectors. This merger was a strategic move to reduce tenant concentration risk and enhance its growth trajectory.

In terms of international expansion, its entry into the UK and European markets demonstrated its commitment to global diversification. This move aimed to capitalize on the potential of these markets and reduce dependency on the US. The acquisition of a portfolio of Sainsbury’s stores in the UK in 2019 was a significant step in this direction, marking its first foray outside the US.

Spirit Merger

Realty is acquiring Spirit Realty Capital (NYSE:SRC, NYSE:SRC.PR.A) in a significant deal valued at approximately $9.3Bn. This all-stock transaction will result in Spirit Realty’s shareholders receiving 0.762 Realty Income common shares for each Spirit share they own. Following the merger, the ownership split will be approximately 87% for Realty Income and 13% for Spirit shareholders.

The completion of this merger is anticipated in the first quarter of 2024, contingent upon the approvals from both companies’ boards of directors and Spirit’s stockholders. Should the deal be terminated under certain conditions, termination fees would be ~$174MM or ~$94MM.

Furthermore, as part of this transaction, Spirit’s Series A Preferred Stock will be converted into new 6% Realty Income Series A Cumulative Redeemable Preferred Stock (n.b., with substantially identical terms).

Portfolio Snapshot

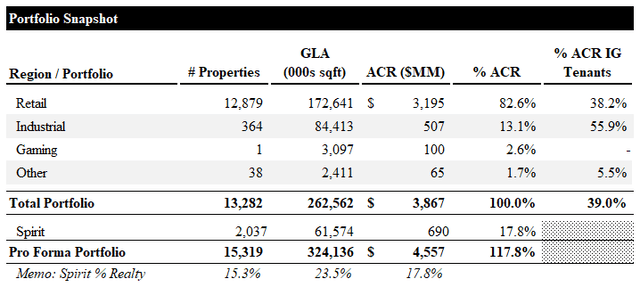

Realty’s portfolio comprises ~13,300 properties with ~263k sqft of gross leaseable area (“GLA”). The retail portfolio accounts for ~97% of total properties and ~66% of GLA, reflecting the largely small-footprint, freestanding nature of Realty’s retail assets (n.b., the average size of ~13.4k sqft per retail property vs ~232k sqft for the industrial portfolio). The industrial portfolio accounts for ~3% of total properties and ~32% of GLA. Collectively, the retail and industrial assets account for ~98% of total GLA and ~96% of annualized contractual rent (“ACR”).

Realty also owns one gaming property, the Bellagio, a ~3.1MM sqft property, and 38 agricultural, office, and development properties, which account for a de minimis share of properties and GLA, and ~4% of ACR. Across the total portfolio, ~39% of ACR is generated from investment grade (“IG”) tenants.

Portfolio Snapshot (Empyrean; O)

Pro forma for the Spirit merger, total properties will increase ~15%, GLA will increase ~23%, and ACR will increase ~18%. These metrics appear favorable in light of the fact that old Spirit shareholders will only receive slightly less than 13% of the combined entity (n.b., ~3% implied accretion of ACR per share). While this analysis is too simplistic to replace a full accretion/dilution analysis, it is a comforting data point.

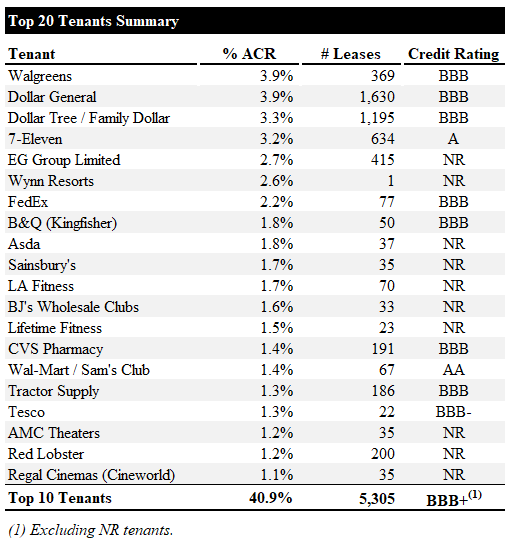

Realty’s top 20 tenants contribute ~41% of ACR through their ~5,300 leases. They have an ACR-weighted average credit rating slightly weaker than BBB+ (n.b., excluding the 10 unrated tenants representing ~17% of ACR). The only tenant on the list we are genuinely concerned about from a credit quality perspective is AMC, though Realty’s exposure is relatively small at ~1.2% of ACR.

Top 20 Tenants Summary (Empyrean; O)

Spirit has a ~30% overlap in its top 20 tenants with Realty, decreasing the risk of worrisome tenant exposure in the combined entity.

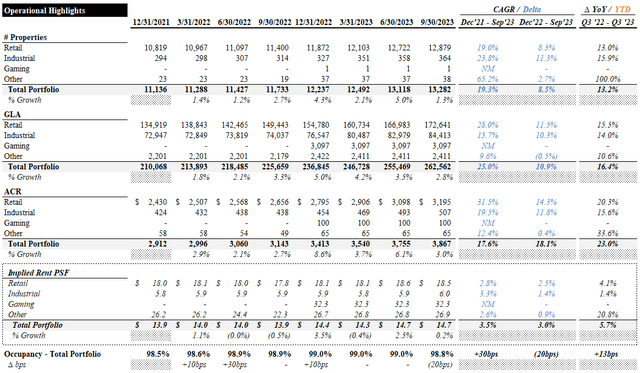

Recent Performance

Below, we review several key performance drivers for the period between Q4 ’21 to Q3 ’23. The total property count grew ~19%, driven by a ~19%, ~24%, and ~65% growth in retail, industrial, and other properties, respectively. This drove a ~25% growth in GLA (n.b., ~28%, ~16%, ~10% for retail, industrial, and other, respectively). ACR grew ~31%, ~20%, and ~12% across retail, industrial, and other, respectively. This drove a ~18% CAGR in total ACR, implying a ~4% CAGR in average rent PSF. Occupancy across the portfolio has remained stable between 98%-99%.

Operational Highlights (Empyrean; O)

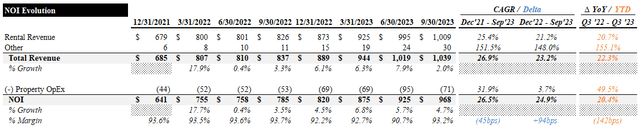

The portfolio growth above drove a ~25% CAGR in rental revenue (n.b., ~27% total revenue CAGR). However, property-related opex grew slightly faster, driving ~140bps of MOI margin dilution YoY in the YTD ’23 period.

NOI Evolution (Empyrean; O)

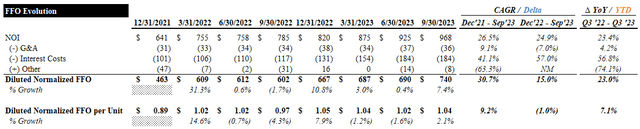

While interest costs have increased substantially, as expected, Realty has demonstrated cost discipline and positive operating leverage on the G&A line. This drove a ~31% CAGR in normalized, diluted FFO (n.b., ~9% CAGR on a per share basis).

FFO Evolution (Empyrean; O)

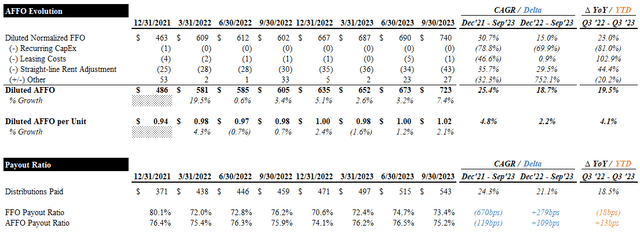

Due to the carefree nature of NNN properties, Realty’s recurring capex burden is de minimis. Leasing costs have remained minimal as well. However, the straight-line rent adjustment grew faster than FFO, at a ~36% CAGR. All told, diluted AFFO grew at a ~25% CAGR (n.b., ~5% on a per share basis).

Since Q1 ’22, dividend growth has closely matched FFO and AFFO growth, keeping payout ratios around ~73% and ~76% of FFO and AFFO, respectively.

AFFO Evolution & Payout Ratios (Empyrean; O)

Leverage

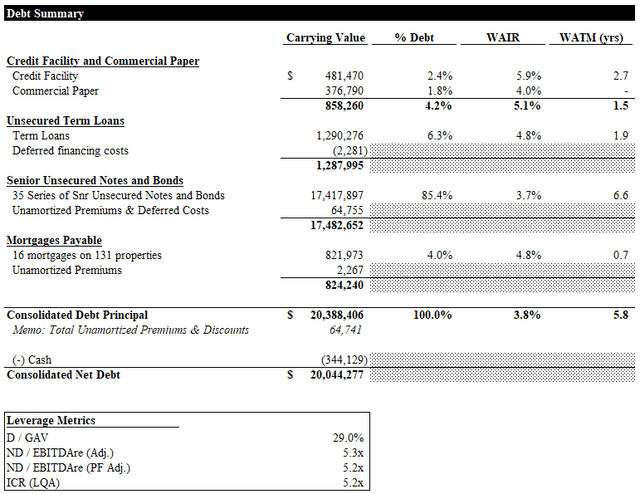

Despite having long-dated leases with largely IG tenants and significantly below-market rents, Realty maintains a fairly conservative capital structure. Approximately 85% of its debt stack is comprised of senior unsecured notes and bonds with a ~3.7% weighted average interest rate (“WAIR”) and ~7-year weighted average term to maturity (“WATM”). Net debt / gross asset value (“GAV”) is a conservative ~29%, and ND / adjusted EBITDAre is a modest ~5.3x (n.b., ~5.2x pro forma adjusted). Interest coverage is a conservative ~5.2x. Over 90% of its debt is fixed rate.

Spirit’s leverage metrics are materially in line with Realty’s, so we don’t expect pro forma leverage to change materially following the merger.

Debt Summary (Empyrean; O)

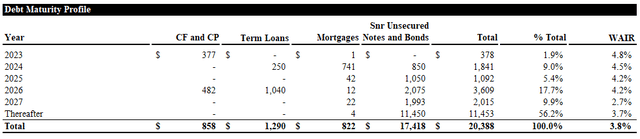

Roughly ~40% of Realty’s ’24 maturities are mortgages (n.b., straightforward to refinance). Excluding the expiring mortgages, ’24 maturities are a manageable ~5%, though we expect a small FFO/AFFO drag given the high rate environment. Realty recently placed $1.25Bn of 4.75% and 5.125% senior unsecured notes (n.b., ~4.9% and ~5.3% YTM, respectively). Assuming all ~$1.8Bn of Realty’s ’24 maturities are refinanced at the higher ~5.3% YTM, this would result in an incremental ~$14MM of interest costs (n.b., ~0.5% of LQA FFO per share).

Debt Maturity Profile (Empyrean; O)

Overall, we see Realty’s leverage as very conservative – almost too conservative. While this makes sense, given its focus on consistent dividend growth, increasing leverage modestly (especially if we see a few rate hikes) would help drive shareholder value if the market’s fears of slowing growth come true.

Risks/Catalysts

Slowing Growth = Negative Reflexivity

Due to the typical NNN lease structure, which is generally 10-20 years long with 1-2% (sometimes inflation-linked) rent escalators, NNN REITs generally experience low single-digit organic growth. However, due to the long lease term and slow rent escalation, releasing rates are usually quite large (n.b., average ~105% recapture rate for Realty in the last 8 quarters). For these reasons, public NNN REITs rely on external growth to drive meaningful returns. Such external growth requires a significant amount of equity financing. To be accretive, this equity financing requires robust multiples (i.e., low cost of equity). Therefore, NNN REITs are highly reflexive. High share prices make more acquisitions accretive, leading to higher growth, leading to higher multiples, and so on.

This cycle works the other way, too, and this is a primary concern for the market with respect to Realty. The higher cost of debt (elevated base rates) and equity (depressed share price), along with the absolute size of Realty’s portfolio, make growth more difficult. If the growth engine slows, the shares will reprice to reflect this, and dividend growth will slow, leading to further repricing. This is the bear case in a nutshell.

We think Realty still has a decent growth runway ahead of it, especially in international markets and non-retail submarkets (e.g., the growing industrial portfolio and recent foray into gaming and hospitality). Nevertheless, the bear case is credible, and we would prefer to buy Realty at a more attractive price to mitigate this risk.

Tighter Investment Spreads

Typically, a net lease REIT’s financing strategy is to initially fund acquisitions using their revolver/credit facility, which usually carry floating rates, and wait for an opportune time to place permanent financing and lock in a spread. As we all know, base rates have increased dramatically, leading some of the deals NNN REITs have closed on recently to have negative leverage. Fortunately, long-term financing options have remained relatively accommodative, allowing them to still capture some spread. For example, over the last 5-10 years, public NNN REITs were able to generate long-term investment spreads of ~200-300bps. For example, they could buy properties at mid-6% going-in cap rates and use permanent financing at an all-in cost of 3-3.5%. Today, they’re only able to capture somewhere between 100-150bps of spread. They are buying properties in the high-6% to low-7% cap rate range, and the all-in cost of debt generally ranges from 6-6.25%, hence the spread has narrowed. Thankfully, the spread has been around 100-200bps over the long term, so despite the more challenging environment, public NNN REITs are still creating value.

Valuation

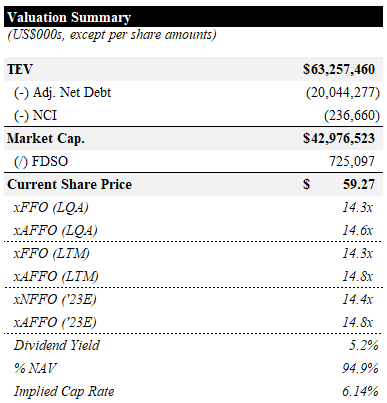

Realty trades for 14.3x and 14.6x LQA FFO and AFFO, respectively (n.b., 14.3x and 14.8x LTM, respectively). FFO and AFFO guidance for FY23 implies ~2% YoY growth. Its $3.08 annualized dividend yields ~5.2%. Based on our NAV estimate, the market is pricing it at a ~5% discount and a ~6.1% implied cap rate.

Valuation Summary (Empyrean; O)

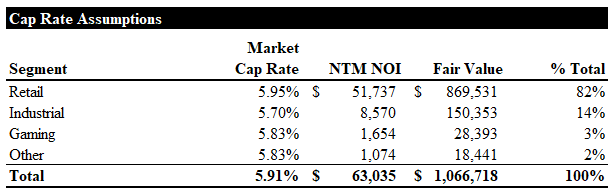

Our central NAV case is based on estimated US market cap rates for each subsector (n.b., we use US comps, as this is where most of Realty’s portfolio is located). We sourced our NNN cap rate assumption from Avison Young and our industrial assumption from Matthews.

Cap Rate Assumptions (Empyrean)

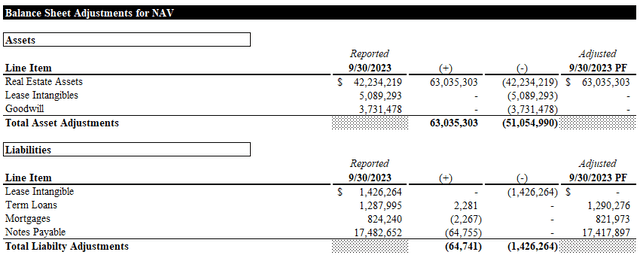

The major balance sheet adjustments for our NAV calculation can be seen below.

Balance Sheet Adjustments for NAV (Empyrean; O)

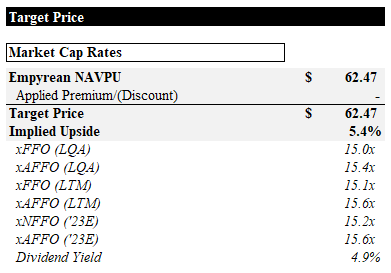

We apply no premium or discount to our NAV per share to derive our price target of ~$62.5 per share (n.b., ~5% upside).

Target Price (Empyrean)

With such a slim discount to NAV, we see little value in a fulsome pro forma valuation including Spirit at this time. We will continue to monitor the company and are eager to see the first quarter of combined financials.

Merger Arb

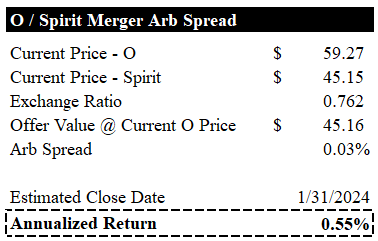

Based on current trading levels, the ~0.6% annualized merger arb spread does not look attractive even if we assume the transaction closes by the end of the month.

Merger Arb Spread (Empyrean)

Given the high likelihood of the transaction closing within a few months, we doubt this spread will widen to an attractive level.

Conclusion

Realty is a well-managed, conservatively financed NNN REIT. The size of its portfolio, tightening investment spreads, higher interest rates, and depressed share price are weighing on sentiment. We believe that the nature of NNN portfolios requires a long-term investment horizon and that Realty still has room to drive meaningful growth internationally and in adjacent real estate submarkets. However, we would feel much better about taking a position at a lower price. We would likely take a harder look in the low $50s price range.

Read the full article here