Introduction

With this article, I would like to expand the tickers I have so far covered on SA. However, the stock market is huge, so this year I made the choice to publish and integrate what I have done so far on SA with a niche that not many SA readers may know a lot about. In fact, I will from time to time write some articles to cover tickers lacking any SA or WS rating. More in detail, I will focus on the Italian stock exchange (called “Piazza Affari”, which translates into “Business Square”), which is among the leading European stock markets and part of Euronext (OTCPK:EUXTF). Since not many may be familiar with the main Italian index, called FTSE MIB (FTSEMIB), I have chosen to cover a few of the most interesting companies listed there.

Even though the Italian economy is nowhere near in size to the American, we should not automatically exclude the possibility of finding great companies there. Moreover, it seems to me that the Italian index is one of the cheapest ones, discounting perhaps too much a bias on an economy which, in recent years, has proven to be more resilient and dynamic than what many analysts (and journalists) thought.

As far as my investing experience goes, so far, my performance with Italian stocks has matched the one I have with North American ones. For example, I own Ferrari (RACE) shares listed in Milan, as well as Intesa Sanpaolo’s (OTCPK:ISNPY) shares listed there, too. Both stocks have performed well in the past two years and I am currently up almost 70% on the former and over 90% on the latter.

Now, the FTSE MIB is made up of 40 stocks, most of which belong to three industries: financial, energy, and industrials.

Here, I want to start with energy. In particular, I will cover a utility. While many around the world may be familiar with Enel (OTCPK:ENLAY), one of the largest utilities in the world, not many may know the smaller A2A (OTCPK:AEMMY; OTCPK:AEMMF). I own both stocks, but my position in A2A is much bigger because my expectations about how this company can develop are higher. While Enel has entered and exited my portfolio a few times, A2A has been part of it since its inception and I have never sold a single share of it, but I have actually kept on accumulating more shares during every dip I have gone through.

An overview of the company

Footprint

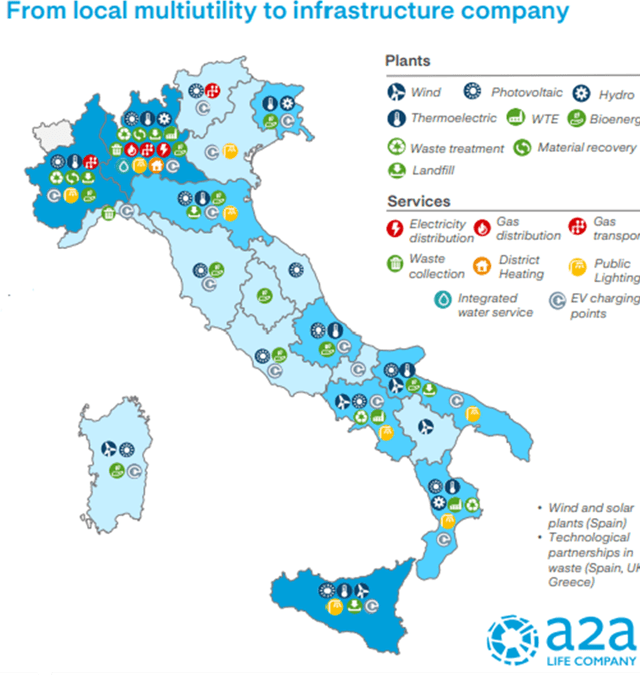

A2A started as a local multiutility based in the northern regions of Italy, but it is now developing into a true infrastructure company with services mainly in Lombardy and Piedmont, but plants all across the country, as we can see from the map below. However, it is rapidly expanding its EV charging points throughout Italy.

A2A 2023 Investor Guidebook

Shareholder structure

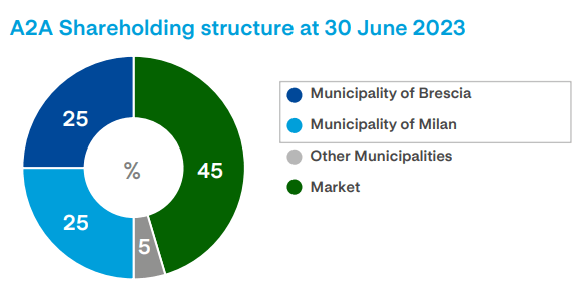

Investors should also be aware of the A2A shareholder structure, which sees the two municipalities of Brescia and Milan holding each a 25% stake in the company. By law, no individual shareholder other than the two mentioned municipalities may hold an equity interest exceeding 5% of the share capital. If anyone else should exceed that ceiling, the voting right attached to the shares in excess of 5% of the share capital is not allowed to be exercised.

A2A 2023 Investor Guidebook

I want investors to be aware of this structure because it is one of the reasons I picked this company. In fact, with the two largest municipalities in Lombardy playing such a big role in the company, I have usually looked at A2A as very reliable. Its clear shareholder structure shows right away who is in charge one who is not. Moreover, both municipalities have two major interests that play a significant role in my investing case. On one side, they need the company to be run efficiently because otherwise, they would have to pour into it money coming from the taxpayers, which is never a popular thing to do. In addition, they need A2A to be run at a profit to cash in hefty dividends every year.

Business lines

Going back to the company, among its key strengths we have around 2.5 GW of RES installed capacity and over 3 million customers. This goes along with the fact that A2A is the largest waste treatment in Italy, running around 80 plants. Of course, the company has ambitious sustainability targets such as reaching 5GW of RES installed capacity by 2030.

So, overall, I see a company with a nicely integrated and balanced business mix spreading from energy generation and electricity and gas sales to waste collection coupled with significant assets in the so-called smart infrastructures business, which includes electricity and gas distribution networks, heat distribution and sales, and similar. Currently, A2A has an electricity network of 16,553 km, a gas network of 13,705 km, and 5,763 km of aqueduct.

Of course, A2A operates in a regulatory framework, led by the ARERA (the Italian Regulation Authority for Energy, Networks and Waste). As a result, its return on invested capital is more or less known and hovers around 5.5% depending on the business line we are dealing with. However, there are several additional possibilities for A2A based on the regulations which allow it to consistently have a ROE above 10% and a ROI between 8% and 9%

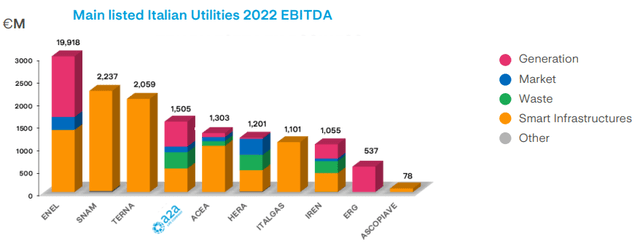

As we have said above, A2A is a regional utility. However, if we look at its 2022 EBITDA, we can see how it is second only to Enel, compared to which it has a more diversified revenue mix, dealing with waste management too.

Italy has just opened to competition in its electricity market. Now, as far as I see it, A2A has more chances to grow its customer base rather than Enel, which is already so widespread around Italy that it has less room to grow its customer base. So, I expect A2A’s generation and market EBITDA to grow and close the gap with Enel over the next few years.

A2A 2023 Investor Guidebook

Capex

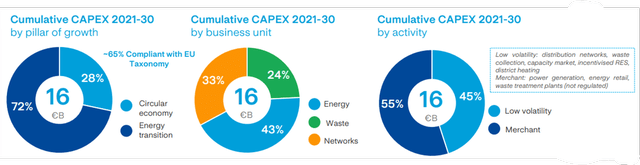

We can’t assess a utility without considering where most of the issues come from: capex and the related debt to fund it. Currently, many utilities are going through a big investment cycle to shift towards renewable energies. A2A is no different and it laid out plans for this decade to spend around €16 billion for this reason. A third of this will go to enhance and maintain its networks, while 43% is going to be used for energy and the remaining 24% will fund waste management. Interestingly, over 80% of projects are expected to be completed by 2026. This means that from 2026 to 2030 these investments should be EBITDA accretive and start showing their returns for the company.

A2A 2023 Investor Guidebook

Balance sheet

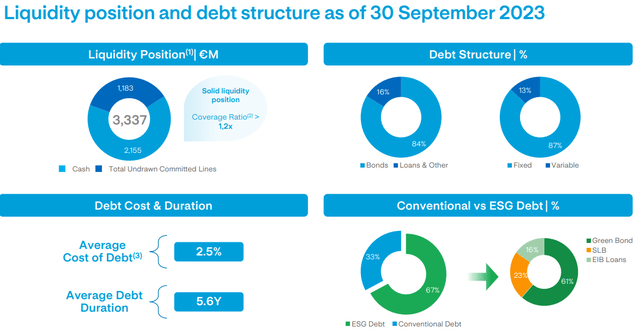

We are still waiting for A2A to release its FY 2023 annual report, but as of September 30th, 2023, the company had a very strong liquidity position and debt structure. It held €2.16 billion in cash, with another €1.18 billion of undrawn committed lines. This leads to a coverage ratio (expected cash outflows in the next 12 months over the liquidity position) of over 1.2x, which is good.

A2A 2023 Investor Guidebook

Around 13% of its debt is floating, while the other 87% is fixed. The average cost of debt is 2.5% and since its average duration is almost 6 years the company should not be endangered right away by the high rates we are seeing right now. This is important because utilities did trade down last year because of interest rates rising. In 2024, the company’s gross debt redemption profile sees €683 million due. This is around 10% of the total debt. Since I expect rates to come down this year, I am not particularly concerned about A2A’s debt given its EBITDA.

Latest Financials

Let’s take a quick look at A2A’s latest quarterly result. At the end of Q3, we see something particular which we need to interpret. On one side, A2A’s revenues dropped 35% to €11 billion compared to almost €17 billion in the nine months of 2022. On the other side, A2A’s EBITDA grew 19% YoY. Why is that? We all have seen how 2022 was particularly challenging for energy companies and utilities. The outbreak of the war in Ukraine sent gas and coal prices skyrocketing. This inevitably led to higher costs for A2A, but it also led to higher prices for the consumer. Therefore, most of the revenue growth of 2022 is linked to commodities and their volatility. Now that prices are coming down, A2A has actually been able to improve its profitability, another good sign.

Financial goals

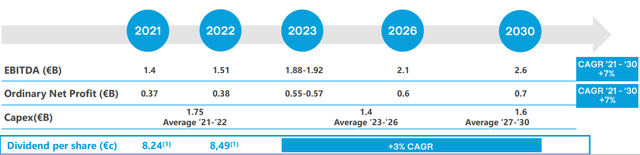

As a consequence of this increased profitability, the company has upped its guidance, expecting a 2023 EBITDA just shy of €2 billion. Keeping capex stable around €1.5 billion until 2030, we can expect A2A to grow its net profits at a 7% CAGR, which is more than decent for a utility.

A2A 2023 Investor Guidebook

Dividends

The main reason I started investing in A2A a few years ago was its dividend. At that time, I was mainly looking for yield. Those who have followed my investing journey here in SA know by now that I am not a yield chaser anymore, as I have gradually shifted towards picking strong compounders that are really dividend growers.

Moreover, some may wonder why I keep holding such a slow-growing stock. On growth, I think I have shown how A2A actually has enough room to grow at a good pace, considering it is a utility.

Regarding the dividend, I would like to spend a few words. In fact, we can see in the picture above that A2A targets to grow its dividend at a 3% CAGR from 2023 to 2030. This is not very enticing, isn’t it?

However, things are better than what they seem. In fact, A2A commits to a minimum growth of 3% per year. If we look at its dividend history, we see that, since 2011, the company has steadily grown its dividend. At that time it was €0.013 per share. Last year, it was €0.0904 per share, which translated into a 6.6% dividend yield. In 12 years it has compounded at a 17+% CAGR. And the payout ratio has always stayed between 40 and 75%. This means A2A usually underpromises and then over-delivers.

Risks

No investment comes at no risk. For a company such as A2A, there are two main ones to consider:

- Debt sustainability. Utilities operate on leverage and take on a lot of debt. When interest rates go up, it becomes more expensive to re-finance their debt. This is particularly true right now, during a big investment cycle caused by the transition towards renewable energy. However, A2A has a net financial position of €4.47 billion, up 5% YoY and an NFP/EBITDA ratio of 2.6x. If we look at its debt structure, we have seen how 87% is fixed-rated debt, and the debt maturities breakdown is well balanced, with more or less €400-600 million being due each year from 2024 to 2034. Moreover, 67% of A2A’s debt is ESG debt, which is easier to finance right now. Last, but not least, the company’s interest coverage ratio is 0.15 (net financial charges/EBIT), meaning it can cover its interest expense well.

- Oil and gas prices can fluctuate and compress margins, as we have seen happening in 2022 as a result of the outbreak of the war in Ukraine. However, since then, European countries, and Italy in particular, have worked to diversify their suppliers while accelerating on renewables. As a result, the situation is now a bit different and Russia doesn’t play the lion’s share among gas suppliers.

A further risk to consider is linked to the stock and its ADR. To buy a foreign company, investors usually can choose between F-share (AEMMF) and Y-share (AEMMY) traded on OTC markets in the U.S. To buy the ADR, investors should pick the ticker ending with a Y. Tickers ending with an F are, in fact, as Finra explains, foreign issues, except ADRs. Now, Y shares are usually better because they have more liquidity. Moreover, for those countries that maintain tax treaties with the U.S. (such as Italy), dividends are paid without foreign withholding. Of course, with ADRs exchange rate risk is always present, but I think we can consider the EUR:USD currency pair fairly stable.

Conclusion

The stock currently trades around €1.85 in Milan. Its ADR AEMMY has a 5:1 ratio and this is why we see it at above $8 per share. Since I am expecting interest rates to come down, sooner or later A2A should appear once again as a very sustainable company that is gradually expanding throughout Italy. This means that below €2 per share, the stock keeps on being a nice option since it now trades at a fwd EV/EBITDA of 5.7, well below the sector median of 11.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here