As traditional investment vehicles like stocks, bonds, and mutual funds continue to face volatility and uncertainty, many investors are turning to alternative investments in hopes of higher returns and greater diversification.

According to a report from Boston-based Cerulli Associates high net-worth clientele now have an average of 9.1% of their assets allocated to alternative investment options, and advisors expect this to increase to 9.6% by 2024.

Alternative investments are asset classes beyond traditional stocks and bonds, including, but not limited to, real estate, commodities, private equity, artwork, and hedge funds.

However, navigating the alternative investment landscape can be overwhelming, especially for those new to these types of investments. In this article, we will explore the different types of alternative investments, their risks and benefits, and how to navigate this complex set of options.

Private Debt

Private debt involves lending money to companies or individuals that are not publicly traded. Private debt can include everything from small business loans to real estate mortgages. It can offer higher yields than traditional fixed-income investments but comes with higher risk. Therefore, investors must be willing to do their due diligence and carefully evaluate the creditworthiness of borrowers or invest in a fund that does this.

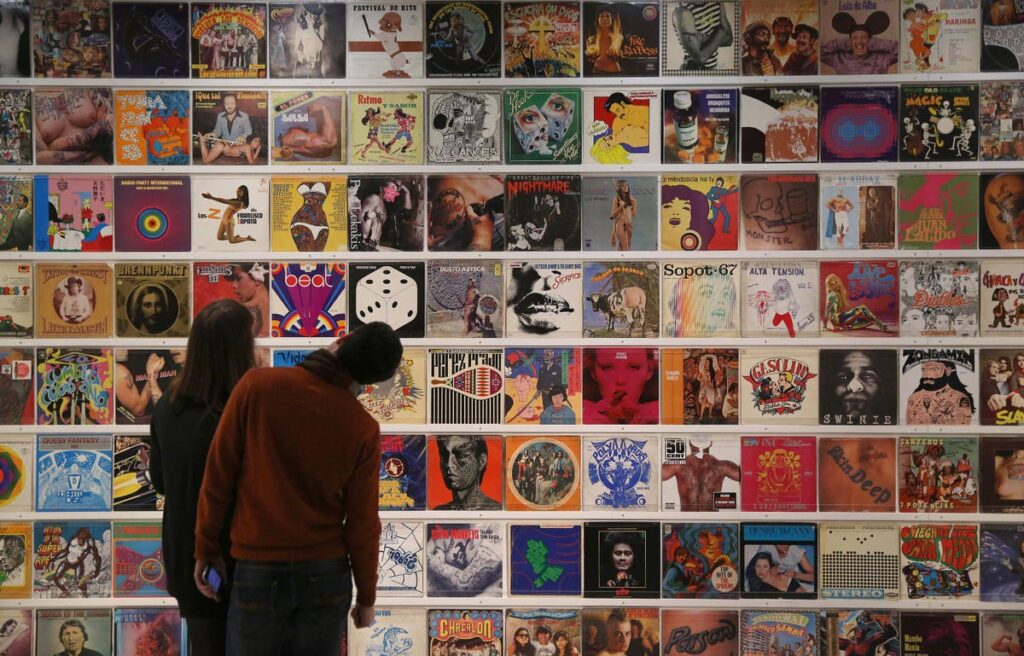

Arts and Collectibles

Art and collectibles, such as rare coins or vintage cars, have long been considered alternative investments. These assets can provide attractive returns over time but require specialized knowledge and expertise to evaluate. Investors must also be prepared to store and insure their collections, which can be expensive. Several websites allow investors to invest partially in pre-selected artwork from top artists.

Venture Capital

Venture capital involves investing in early-stage companies with the potential for high growth. This can be a high-risk, high-reward strategy, as many startups fail to take off. However, successful investments can provide significant returns. Investors must be willing to do their due diligence and carefully evaluate the management team, market opportunity, and competitive landscape of potential investments. In my experience, the best way to explore this asset class is to use a program that invests in many separate startups with smaller minimums to diversify your risk and increase your odds of “picking a winner.”

Real Estate Crowdfunding

Real estate crowdfunding platforms allow investors to pool their money for real estate projects. This can include everything from single-family homes to commercial buildings. Real estate crowdfunding can provide attractive returns and diversification benefits but comes with risks like market volatility and illiquidity. Therefore, investors must carefully evaluate crowdfunding platforms’ track records and reputations before investing.

Infrastructure Investments

Infrastructure investments such as toll roads or airports can provide stable and predictable returns over time. Infrastructure investments can also include digital infrastructure like cell phone towers and data centers. These assets typically operate under long-term contracts with governments or other entities, providing a steady income stream. However, infrastructure investments can be complex and require specialized knowledge and expertise. As a result, there are funds for accredited investors that pool money to invest in many infrastructure programs.

Managed Futures

Managed futures involve investing in futures contracts, which allow investors to bet on the future price of commodities, currencies, or other assets. Managed futures funds are typically run by professional commodity trading advisors, who use sophisticated quantitative models to identify trading opportunities. Managed futures can provide attractive returns and diversification benefits but also come with risks, such as high fees and volatility.

Peer-to-Peer Lending

Peer-to-peer lending platforms allow investors to loan money directly to individuals or small businesses. These can provide attractive yields but come with risks, such as borrower default. As a result, investors must carefully evaluate the creditworthiness of borrowers and diversify their investments across many loans.

Options Trading

Options trading involves buying and selling options contracts, which give the holder the right, but not the obligation, to buy or sell an underlying asset at a specified price. Options trading can provide attractive returns but comes with high risk and requires specialized knowledge and expertise. Therefore, investors must be willing to carefully manage their risk and understand the potential downside of options trading.

Who Can Take Advantage of Alternative Investments?

In many of the above alternative investments, an accredited investor can invest in private funds that invest in the category. So what is an accredited investor? In my world, anyone with a $1 million net worth, not counting their primary residence, or income of $200,000 or $300,000 if married.

As you can see, many unconventional investment strategies can provide the opportunity for attractive returns and diversification benefits for savvy investors. From private debt to art and collectibles, investors must be willing to do their due diligence and carefully evaluate the risks and rewards of each strategy. By embracing alternative investments and thinking outside the box, investors can build resilient portfolios in the face of market volatility and provide attractive returns over the long term.

Many alternative investments are illiquid, meaning they cannot be easily sold. Illiquidity can make selling difficult and impossible in some situations. But this illiquidity protects the investor from stock market risk.

Read the full article here