The times are changing for Baidu (NASDAQ:BIDU) (OTC:BAIDF). Having long been China’s leading search engine company and little more, the company is slowly but surely carving out a new leadership position in the Chinese artificial intelligence (‘AI’) space. Since I last covered the name, Baidu has further built on its successful AI-powered ‘Ernie Bot’ 4.0 (the equivalent of ChatGPT 4.0) launch, most recently acquiring over 100m users since its launch in Q3 last year. With Ernie’s professional version already monetized for per-month subscription charges as well, incremental AI revenues could surprise to the upside sooner than many think. There’s also the ecosystem-wide boost from AI synergies to consider, most notably in the online advertising and cloud businesses. While risks remain, particularly on the geopolitical side, as this month’s selloff (triggered by speculation regarding military links) showed, Baidu’s rate of change is overwhelmingly net positive.

Heading into Q4, we may well see some disappointment, particularly from Baidu’s advertising business, which remains tethered to slowing Chinese consumption and economic trends. Yet, there’s room here for Baidu to defend its margins, given the progress management has made in its cost control efforts. It remains early days but growing, higher margin AI-related revenue contribution also bodes well for overall profitability.

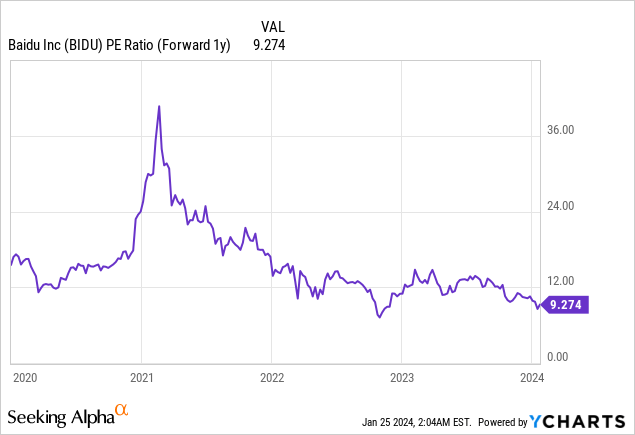

Baidu’s optionality expands beyond the income statement, as ‘trapped’ balance sheet value (net cash & equivalent position at up to 50% of market cap) looks set to be unlocked via buybacks, while prepayment recovery (up to $1.9bn) from the canceled YY Live acquisition could be on the table as well. AI or no AI, Baidu investors pay a cheap earnings multiple (~9x forward) for a growing business, so even after handicapping the risks, investors have many ways to win here.

Unlocking New Generative AI Revenue Streams

For all its execution mishaps in the past, Baidu has done a great job on AI. Not only was the company among the first to market with its AI-powered Ernie chatbot late last year, but it has also led the way in user acquisition, crossing 100m users this month. Building on its AI leadership over key big tech peers, Tencent (OTCPK:TCEHY) and Alibaba (BABA), Baidu was also among the first to monetize its chatbot, imposing a subscription fee of RMB59.9/month (~$9/month) for access to its professional version from November 2023. If AI developments in the West are any indication, generative AI-related revenues will come with higher capex but also higher margins (>50% gross margins for Anthropic) and thus, prove accretive to the Baidu core business.

Baidu

Unlike Western generative AI leaders, Baidu has a captive ecosystem through which it can derive AI-related synergies as well. Per management, call volume on ‘Wenxin Qianfan’ (i.e., its large model platform for enterprises) is already seeing significant growth – a positive sign for Baidu’s AI penetration throughout China’s broader corporate landscape. Momentum in the ads business is another key positive, as advertisers increasingly opt for the more streamlined, cost-effective process enabled by Baidu’s new AI-powered digital ad platform. Other verticals have yet to be tapped extensively, though even in today’s early stages, AI-related incremental revenue could prove more meaningful than many expect in the coming quarters.

Baidu

Structural Margin Tailwinds From AI

Below the revenue line, evidence from Q3 indicates margins are poised to expand once AI gains traction. The biggest rate of change near-term will likely come from machine learning/AI cloud (currently a low single-digit % revenue generator), which is guided to see a margin profile significantly higher than the legacy cloud business. In the likely scenario that AI-enabled advertising proves similarly margin accretive due to its superior value-add to advertisers, all signs point to Baidu’s operating margins moving structurally higher alongside its AI shift.

Baidu

There’s also potentially opportunity within Baidu corporate for operating cost efficiencies from the use of generative AI, though it’s probably too early to underwrite any benefits for now. Even balanced against the overhang from AI chip export restrictions from the US/EU (mitigated near-term by Baidu’s stockpile) and the associated opex/capex increases associated with running these models, Baidu should still come out well ahead.

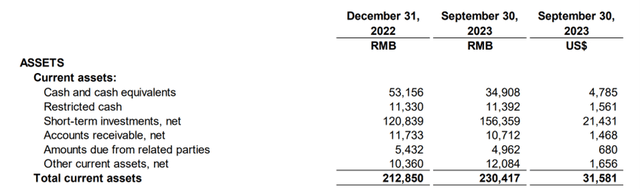

Unappreciated Balance Sheet Adds Downside Protection

As attractive as Baidu’s P&L looks, its balance sheet is even better. In addition to its two major financial stakes (48% of iQIYI (IQ) worth $1.7bn and an 8.7% stake in Trip.com (TCOM) worth $2.1bn), the company also has a very sizeable net cash position (approximately half of its current market cap). The current buyback authorization is a positive first step, though the market remains very reluctant to assign value to its net cash hoard; continued buybacks should nevertheless unlock this ‘trapped’ value over time.

Baidu

Another interesting balance sheet optionality is for Baidu to claw back some of its $1.9bn prepayment post-termination of its YY Live acquisition. Even if parentco JOYY (YY) successfully pushes back, the termination announcement is still a net positive outcome for Baidu following the broader sector de-rating in recent years. While I wouldn’t write in any value just yet, the market hasn’t either, and thus, any incremental dollar represents a ‘free’ option on top of the existing equity value.

Poised for Upside as AI Monetization Begins

It’s early days for China’s burgeoning generative AI industry, and for now, at least, Baidu looks to be firmly in the lead. Since releasing its AI-powered Ernie chatbot to the public, the company has not only onboarded >100m users but also begun monetizing via monthly subscriptions (a la OpenAI). In contrast to OpenAI’s purported ~$100bn valuation, though, Baidu trades at a rather undemanding high-single-digit multiple on forward earnings. Sure, the company carries baggage in the form of a decelerating (but still profitable) ad business, along with broader geopolitical risks. But this is more than offset, in my view, by the AI potential (both via Ernie and adjacencies across the Baidu ecosystem), as well as the net cash/balance sheet value currently being unlocked. With few positives in the price, I like the risk/reward heading into Q4 reporting.

Editor’s Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Read the full article here