A few months ago, I wrote an initiation article on E Split Corp. (TSX:ENS:CA), going over the mechanics of the split share corporate structure and some specific features of ENS. Since E Split Corp. is essentially a levered play on shares of Enbridge Inc. (ENB), I will present some thoughts on Enbridge’s prospects in this article.

(Author’s note, figures in this article references Canadian dollars unless otherwise stated)

Brief Fund Overview

First, for those who are not familiar with the split share corporate structure, they are unique to the Canadian capital markets, as I have not come across them anywhere else. Essentially, ENS is a closed-end investment fund that raises capital from investors and buys common shares of Enbridge.

However, instead of just holding the common shares of Enbridge, ENS itself is split into two share classes: A conservative ‘Preferred’ share class which provides shareholders with a fixed cumulative preferential quarterly cash distribution and preferential return of the original issue price of $10.00 upon maturity; and a leveraged ‘Class A’ common equity share class which provides shareholders with non-cumulative monthly cash distributions and the opportunity for capital appreciation through exposure to the underlying portfolio of ENB shares (Figure 1).

Figure 1 – ENS overview (middlefield.com)

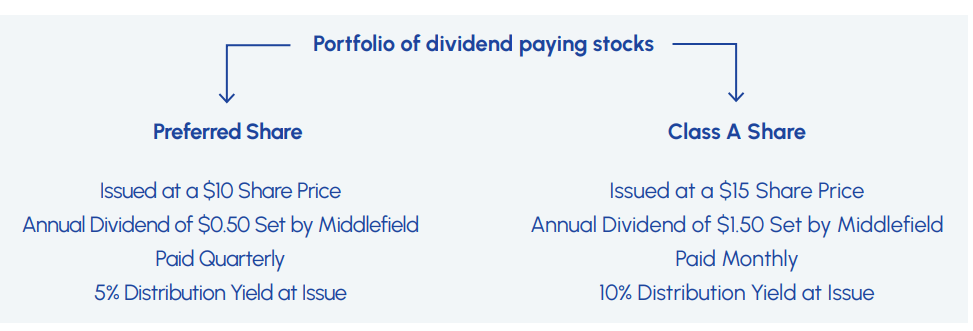

There are several key risks that investors should be aware of when considering the common shares. First, Class A shares are essentially a leveraged bet on Enbridge shares. When Enbridge does well, Class A shares will have strong total returns (Figure 2). But when Enbridge does poorly, like in 2020, Class A shares can also have sizeable drawdowns.

Figure 2 – ENS common shares are a leveraged bet on ENB shares (ENS factsheet)

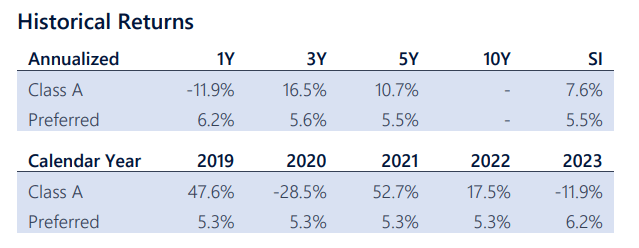

Another risk for ENS shares is that their distributions are not entirely funded from underlying Enbridge share dividends. In fact, ENS’s financial reports show that a significant portion of the distributions are funded from NAV amortizing return of capital (“ROC”) (Figure 3).

Figure 3 – ENS distributions uses ROC (ENS semi-annual report)

Tracking ROC and the net asset value of the shares is vitally important because if NAV of the whole structure (Preferred + Class A) dips below $15, Class A share distributions are suspended.

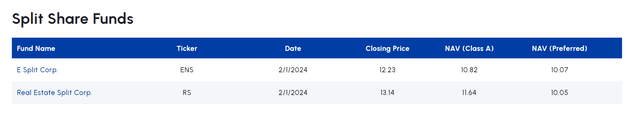

Investors can monitor ENS’s NAV on the manager’s website (Figure 4). Judging by the current market price of ENS shares ($12.23) and the share’s latest NAV ($10.82), ENS shares are trading at a 13% premium to NAV.

Figure 4 – ENS NAV (middlefield.com)

Enbridge – A Dominant Liquids Pipeline Company

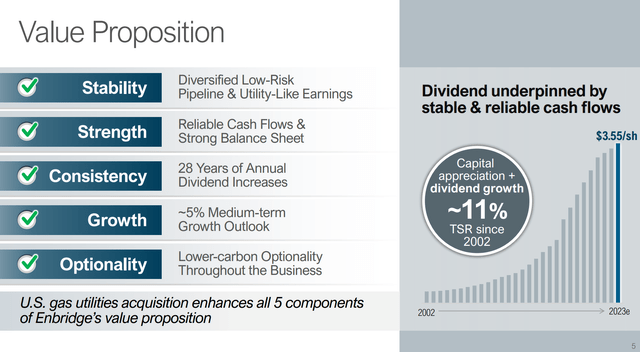

One of the main reasons I am hesitant to recommend ENS is because it is a leveraged bet on a single company, Enbridge. Enbridge is a diversified pipeline and utilities conglomerate that has consistently delivered 28 years of dividend increases and capital appreciation (Figure 5)

Figure 5 – ENB overview (ENB investor presentation)

However, even though Enbridge remains dominant in its core pipelines businesses, risks are emerging.

Competition For Mainline Entering Service In The Coming Months

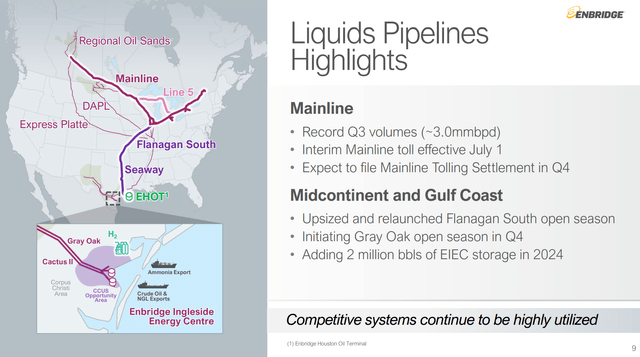

First, Enbridge’s most important asset is the Mainline system that controls over 70% of Canada’s takeaway capacity and is linked to U.S. refineries in the gulf coast. Due to the linkage to the refineries, demand is fairly secure in the near to medium-term for the Mainline (Figure 6).

Figure 6 – Mainline overview (ENB investor presentation)

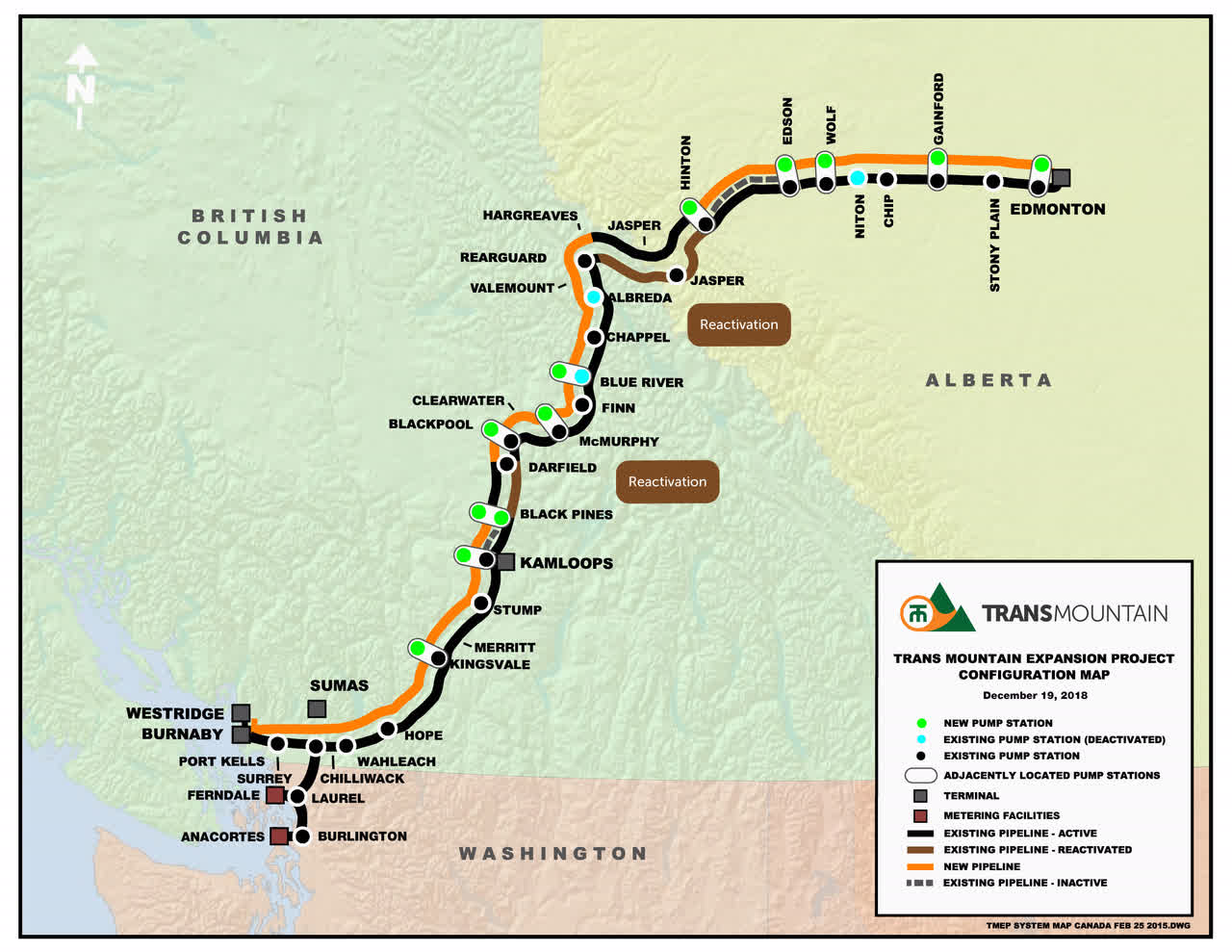

However, there are two risks to the Mainline. First, the competing Trans Mountain pipeline expansion from TC Energy (TRP) is nearing completion and is starting to attract shipper interest (Figure 7).

Figure 7 – Trans Mountain Pipeline overview (transmountain.com)

Trans Mountain will compete directly with the Mainline for oil that is currently produced within Alberta. Historically, Canadian oil has traded at a steep discount to international blends because takeaway capacity had been dominated by the Mainline. This new pipeline should help Canadian oil reduce its discount relative to international benchmarks.

In response to this emerging threat, Enbridge has pre-emptively reduced the toll rate on its Mainline pipeline. This ensures the Mainline operates near full capacity but at a potential hit to profitability.

Will Oil Sands Become Stranded Assets?

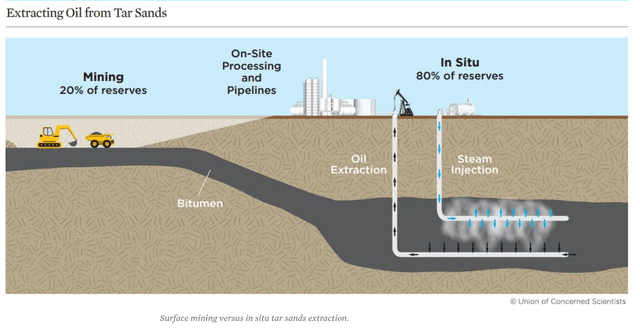

Furthermore, both the Mainline and the Trans Mountain pipeline transports Canadian heavy crude from the oil sands to the U.S. and the rest of the world. As ESG issues become front and center, the world may turn away from the highly polluting oil sands (water must be heated and injected into the tar-like oil sands to unlock hydrocarbons) (Figure 8).

Figure 8 – Illustrative oil sands extraction technique (ucsusa.org)

It is conceivable that in a few years’ time, as global economies wean themselves off hydrocarbons, Canadian oil sands and Enbridge’s Mainline may become stranded assets.

Diversification Into Gas Utilities May Be Buying High

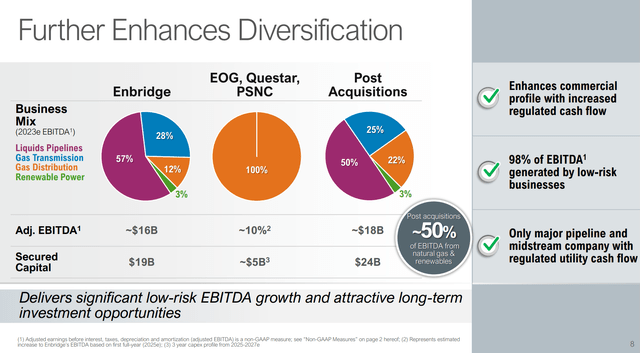

Recently, Enbridge announced plans to diversify its business by acquiring several gas distribution utilities from Dominion Energy. For $19 billion in cash plus the assumption of $6 billion in debt, Enbridge will acquire the Eash Ohio Gas Company (“EOG”), Questar Gas Company, and the Public Service Company of North Carolina (“PSCNC”) from Dominion (Figure 9).

Figure 9 – Enbridge diversifying into gas distribution (ENB investor presentation)

While the move makes strategic sense as it reduces Enbridge’s reliance on its waning liquids pipelines business, it does raise the possibility of Enbridge overpaying.

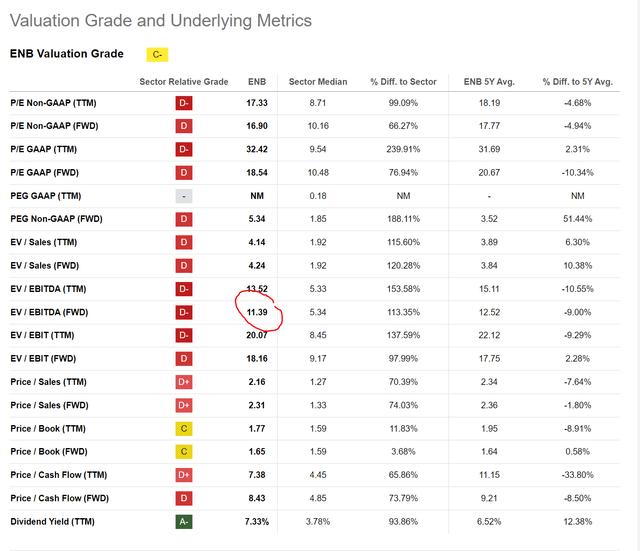

For example, according to Figure 9 above, Enbridge is paying $25 billion in cash + debt to add ~$2 billion in EBITDA, or 12.5x EV/EBITDA. However, Enbridge is only trading at 11.4x Fwd EV/EBITDA (Figure 10).

Figure 10 – ENB valuation (Seeking Alpha)

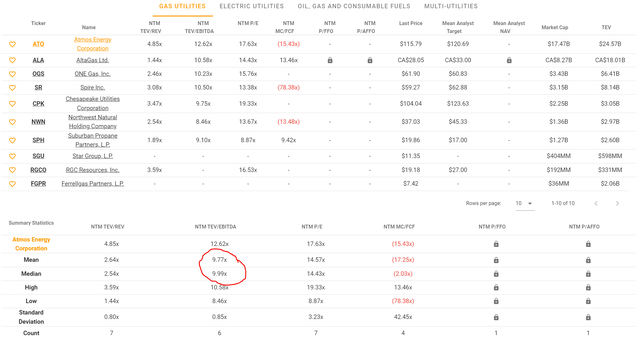

Furthermore, Gas Utilities as a group appear to trade at only ~10x Fwd EV/EBITDA, so Enbridge’s purchase price appears high (Figure 11).

Figure 11 – Gas utilities trade at 10x EV/EBITDA (tikr.com)

5% Growth Outlook De-risked

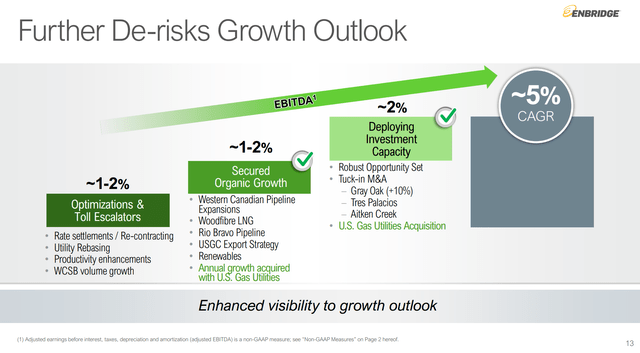

However, on the positive side, the addition of the gas utilities does de-risk Enbridge’s long-term 5% growth outlook, as it expands the company’s organic growth opportunities (from population and rate-base growth) and improves the outlook for additional tuck-in acquisitions (Figure 12).

Figure 12 – ENB de-risks growth outlook (ENB investor presentation)

Conclusion

Overall, I continue to advise caution on ENS common shares, as the fund is essentially a leveraged bet on Enbridge. While the Class A common shares have a 12.7% forward distribution yield, investors need to recognize that a large part of the distribution is simply a return of investors’ own capital.

Furthermore, Enbridge’s economic moat is weakening as a new competing pipeline is set to enter service. In the long-run, Enbridge’s Mainline is tied to oil production from the Canadian oil sands. If oil sands are phased out due to environmental concerns, Enbridge’s assets may become stranded.

Finally, while Enbridge’s recent diversification into gas distribution reduces the company’s reliance on liquids distribution, it does run the risk of Enbridge ‘buying high’.

I am personally not comfortable with the reward/risk profile of ENS common shares and continue to rate it as a hold.

Read the full article here