International Money Express (NASDAQ:IMXI) looks like a strong addition to portfolios looking for stable growth and relatively low risk at this time. The company’s shares look undervalued to me despite P/E ratio concerns, and profitability weaknesses could be eased through operational shifts.

Operations

International Money Express, or Intermex, is a specialist in money remittance services, which is the transfer of funds by a foreign worker to somebody in their home country. It offers these services primarily between the US, Canada, and 16 countries in Latin America, eight countries in Africa, and two Asian countries.

It operates through a vast network of digital platforms and agents, including physical stores, providing fast transactions with high security. Its main revenue streams include transaction fees and foreign exchange margins, and it has a high emphasis on technology. It aims to improve its digital services to meet the increasing demand for transactions online.

Additionally, the organization adheres to anti-money laundering and counter-terrorism financing regulations, and it is expanding its agent network, entering new markets, and aiming to strengthen the customer experience through advanced technologies.

Recent operational advances include an expansion in Intermex’s integration with Visa Direct, which enables customers in the US to send money to Visa (V) debit card holders in 20 countries. Visa Direct is a single point of access to billions of endpoints, helping to improve the capabilities of Intermex when the service was launched on 12/15/2023.

Financials

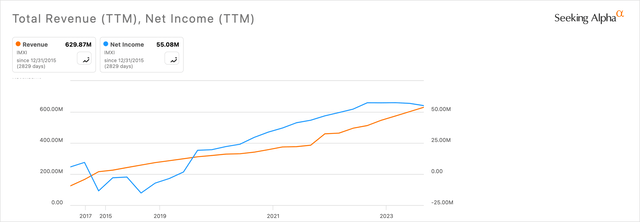

The company has a YoY revenue growth rate of 22.98%, which is a 413.71% difference from the sector median of 4.47%. Its five-year annual average for revenue growth is 20.46%.

The firm’s forward diluted EPS growth is 16.80%, which is a massive 2,394.01% lead on the sector median of 0.67%. Its five-year average on the metric is 29.59%. Its present YoY EPS GAAP growth is 23.33%.

Author, Using Seeking Alpha

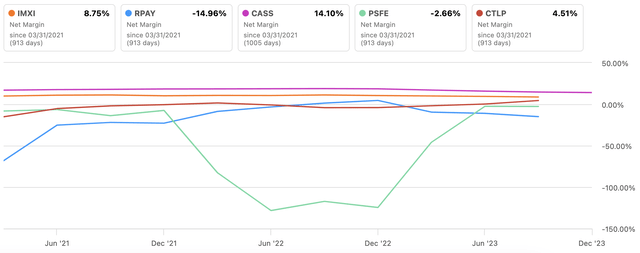

Intermex has a net income margin of just 8.75%, which is 62.56% less than the sector median of 23.36%. Its five-year average for net income is even lower, at 8.32%. Its gross profit margin is also poor relative to the sector median, being 32.4%, which is 45.69% less than the sector median of 59.66%.

Nonetheless, relative to an aggregated set of peers based on market cap and industry, Intermex does relatively well on net income margin:

Seeking Alpha

To help improve its margins, Intermex is growing its digital business. Its better app ratings are helping to attract users, which should aid in reducing customer acquisition costs. It is also selling wire processing as a service, and it is partnering with companies in Guatemala, Vietnam, and the Philippines in an effort to reduce expenses. The firm is also emphasizing bank deposits over cash transactions and making expansions to its mobile wallet services, which are all higher margin approaches.

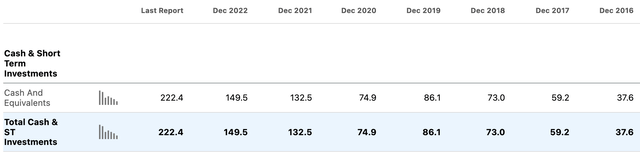

The company also has a significant amount of total cash & short-term investments:

Seeking Alpha

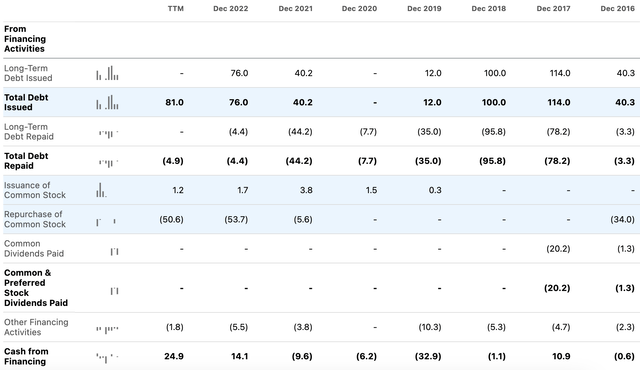

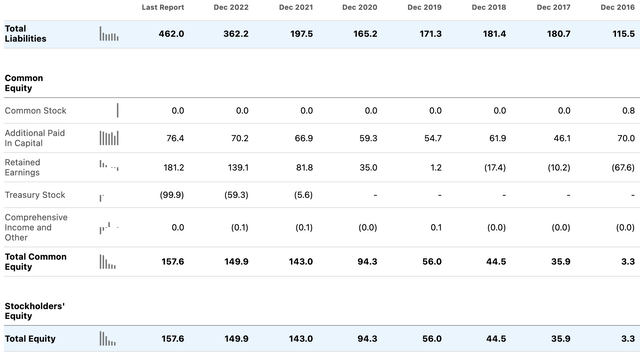

However, we can see that it has been issuing a lot of debt, which has contributed to its strong net change in cash recently but has had a negative effect on its balance sheet. However, its high recent repurchases and low issuance of common stock historically is positive in helping to bolster shareholder value:

Seeking Alpha

We can see that the balance sheet overall is highly leveraged. This is a significant concern for investors and remains one of my biggest risks for the stock. Its total liabilities are 2.9 times its total equity based on the last report:

Seeking Alpha

Valuation

Intermex has a forward P/E GAAP ratio of around 13, which is 19.7% higher than the sector median of around 10.9. IMXI has a five-year average forward P/E GAAP ratio of 16.41. The firm’s forward ratio is lower than its TTM ratio of around 14.1, showing the mild growth in earnings expected.

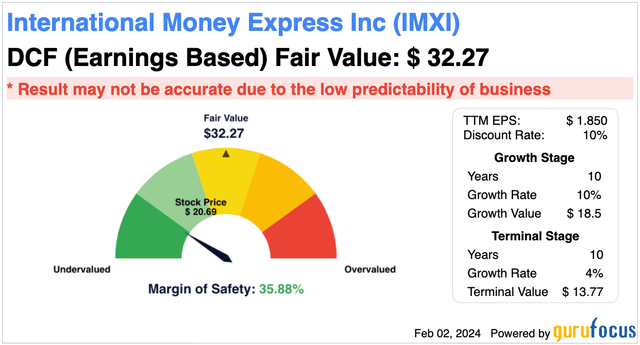

The company looks significantly undervalued based on my discounted cash flow analysis, even when projecting a conservative 10% EPS without NRI growth rate forward for the next 10 years. For my calculation, I used a 4% discount rate in line with inflation for a 10-year terminal stage following the growth stage and a 10% discount rate. My conservative and risk-averse fair value estimate is $32.27, implying a potential 35.88% discount at present, considering the shares are selling at $20.69 at the time of this writing:

Author, Using GuruFocus

Risks

My fair value estimate considers 10% growth for the next 10 years. While I think this is conservative, considering an average diluted EPS growth of 24.3% over the last three years, there is a chance it may not earn this much. Disruptions in its operational growth as a result of higher competition from more advanced technology companies could present a risk of less-than-expected performance. In addition, geopolitical risks in the current macroeconomic environment could affect transaction levels for Intermex, reducing earning power in the next 10 years.

Furthermore, the significant long-term debt and current liabilities on the balance sheet mean that the company is less agile than it looks with its high level of cash and equivalents. Significant damage to the business as a result of a periodic global economic downturn could mean Intermex is hit harder than most companies simply as a result of its present levels of high leverage. As such, the company isn’t ideal for a high allocation.

Conclusion

While risks do exist for IMXI stock, the company looks well-managed and has many favorable elements. Due to the significant potential undervaluation in the present share price and strong operational shifts underway to aid in boosting its profitability, my analyst rating for International Money Express stock is a Buy.

Read the full article here