For the most part, the stock market and underlying stocks’ fundamentals have been in a state of disconnect since the furious rally that began in November. Most companies are still reporting slowdowns in revenue growth driven by elongated macro pressures, even though the S&P 500 freshly hit records above 5,000.

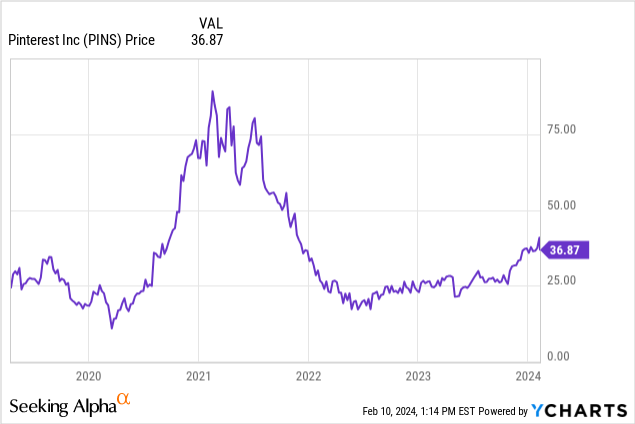

So it’s rare, then, when we see companies that have seen accelerating trends for the better part of a year: and Pinterest (NYSE:PINS) belongs in this vaunted club. Up ~50% over the past year, the stock took a dip after reporting Q4 results and pointing to an acceleration in revenue growth for next quarter – which, to me, creates a great buying opportunity.

I wrote a bullish note on Pinterest at the start of November, after having previously been bearish on the name for over a year. I cited the company’s improving user trends as well as furious cost-saving activities as the primary drivers behind my upgrade; and after parsing through the company’s latest Q4 results, I see continued reason to remain bullish on this stock, especially with the opportunistic post-earnings dip.

I see Pinterest as a differentiated social media platform that caters to a different user than the TikTok crowd. Instead of short-form entertainment and “cheap thrills,” Pinterest caters to personal interests and topic-driven content – which, in my view, insulates it somewhat from competing with the more fad-driven platforms like TikTok and Snap (SNAP).

Here is my updated long-term bull case for Pinterest:

- Purpose-driven user base and easily shoppable content lead to a very easily monetized platform. Because Pinterest users are already scrolling through items that they are interested in, among social media platforms, Pinterest is one of the most directly appealing to advertisers. The company has been building out its advertiser solutions and has succeeded at retaining large brand partners.

- Content innovation. Pinterest continues to add new ways to engage on its platform, including a recent update called Collages which allows users to cut sections of images and create their own collage boards.

- User growth in international markets. Though the U.S. currently drives the lion’s share of Pinterest’s revenue, the company is seeing double-digit growth in emerging markets. Its popularity with Gen Z ensures us that Pinterest has found a footing with a younger generation and will hopefully not fade as millennials age and get busier.

- Strong click-through rates. Higher outbound ad clicks are driving up ARPUs, which is a key source of revenue growth even in the U.S. where user growth is drying up.

- High gross margins. Pinterest’s high-70s gross margins lead to plenty of scalability for the company, if it can manage to both bring in a steady recurring advertising revenue base plus keep spending in check.

- Cost discipline. Pinterest’s recent across-the-board cost cuts (the company executed several rounds of layoffs over the past year) have helped promote a surge in profitability.

Stay long here, as I believe the post-Q4 dip will soon reverse.

Q4 download

Let’s now go through Pinterest’s latest quarterly results in greater detail. First, we’ll start with the user trends:

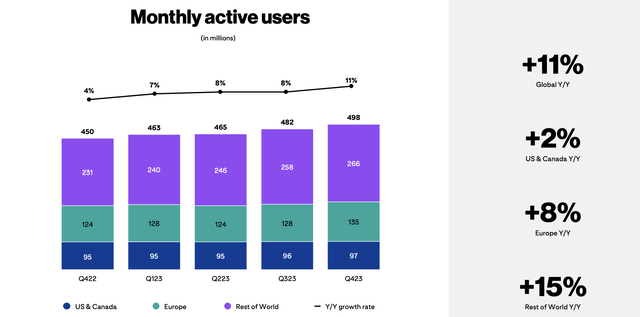

Pinterest MAU counts (Pinterest Q4 earnings deck)

Monthly active users grew 11% y/y to a record 498 million, adding 16 million net-new MAUs within the quarter. I’m also pleased to see every region growing, including the high-ARPU United States and Canada region, which added 1 million sequential MAUs (and 2 million within FY23). As a former Pinterest bear, one of my leading prior concerns was that the U.S. – which generates more than three-quarters of Pinterest’s revenue – would see disengagement in its user base driven by increased social media competition. But recent user trends disprove this fear.

It’s also worth noting that y/y user growth accelerated in Q4 relative to 8% y/y growth in Q3, and acceleration was present in every region including in the U.S.

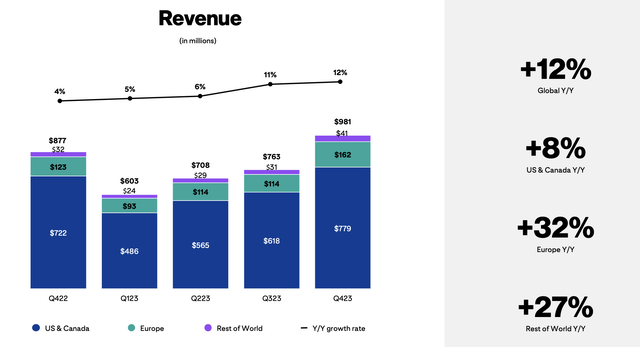

Revenue, meanwhile, continued a multi-quarter streak of acceleration, growing 12% y/y to $981 million:

Pinterest revenue trends (Pinterest Q4 earnings deck)

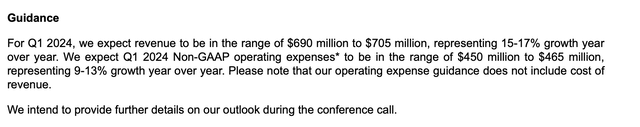

The company did miss Wall Street’s expectations of $990 million in revenue, which represents 13% y/y growth. However, I’d prefer to look ahead than behind: Pinterest’s guidance for Q1 calls for revenue to continue accelerating to 15-17% y/y growth:

Pinterest guidance (Pinterest Q4 earnings deck)

The company notes that recent strength is driven by strong ad funnel conversion, particularly with companies in the retail space. However, Pinterest continues to see ad weakness from food and beverage customers, who have pulled back from ad spending. Per CFO Julia Donnelly’s remarks on the Q4 earnings call:

Our fastest-growing objective was our lowest funnel conversion objective buoyed by strength in the retail vertical, including our shopping ad format.

This is a testament to the innovative work we are doing to drive more clicks and conversions for performance advertisers and demonstrates that our business is evolving as we are deploying more lower funnel products and getting access to more performance budgets.

Our awareness objective was also relatively resilient, with strength from new formats like Premier Spotlight, as this was the first holiday season with this offering. However, this growth was partially offset by headwinds from the food and beverage category, as these advertisers pulled back spending towards the end of the quarter due to challenges from macro headwinds. We estimate that the underperformance in the food and beverage category created roughly 1 percentage point of headwind to total revenue growth in Q4.”

Management also notes that ad impressions served grew 33% y/y, which was a function of both increased ad load (increasing the ad density on a page) as well as higher user traffic. Offsetting this was a 16% reduction in ad pricing, as the company continues to focus on converting more lower-funnel advertisers and improving their ad ROI.

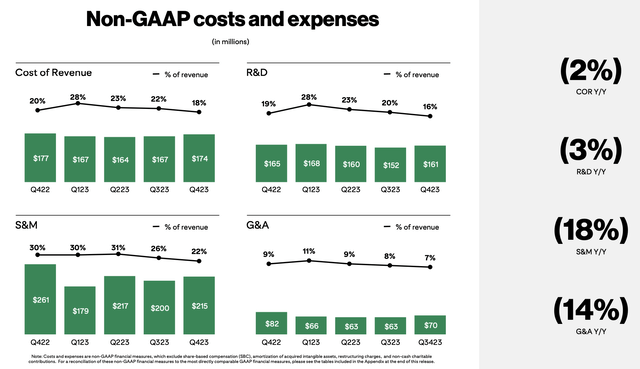

In spite of overall revenue growth, all components of Pinterest’s expenses declined y/y, including a -18% y/y reduction in sales and marketing costs, its largest bucket of opex:

Pinterest cost trends (Pinterest Q4 earnings deck)

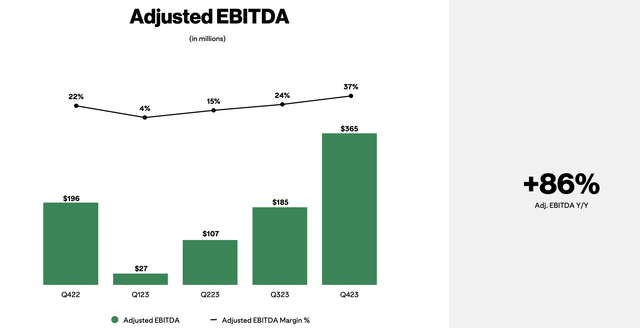

Adjusted EBITDA, in turn, surged to $365 million, an 86% y/y growth rate and a 37% adjusted EBITDA margin:

Pinterest adjusted EBITDA (Pinterest Q4 earnings deck)

Key takeaways

With accelerating revenue growth, encouraging user trends, and surging profitability, there’s a lot to like about Pinterest especially as it takes a short-term post-earnings dip. Buy the dip here and keep riding the recent upward trend.

Read the full article here