The Q4 earnings season has done an about-face after starting out a little rough with disappointing banking results. Better-than-expected reports in the last two weeks have been driving US stocks to new highs. On Thursday, the S&P 500® crossed the 5,000 mark for the first time ever in intraday trading.

Last week’s notable winners were once again concentrated in the tech and tech-adjacent spaces, with AI-focused companies leading the group. Recently IPO’d Arm Holdings (ARM) smashed quarterly expectations and issued bullish guidance for the current quarter.[1]

Arm’s chips are found in many smartphone and PC devices, and they count giants such as Nvidia (NVDA), Microsoft (MSFT), Google (GOOG) (GOOGL) and Apple (AAPL) among their customers.

Arm has benefitted from the race towards artificial intelligence as companies require more robust processors to support development. The stock catapulted nearly 50% in the day after its report.

Palantir Technologies (PLTR) is another AI-centric company that blew results out of the water last week. The company surpassed revenue expectations on the back of strong demand for its AI tools, typically from defense and intelligence branches of the U.S. government.[2] CEO Alex Karp said the demand for large language models “continues to be unrelenting.”[3]

Other standouts last week were consumer-focused, perhaps giving some clues around the health of the US consumer just ahead of major retail reports. Spotify (SPOT) pleased investors by reporting an uptick in premium subscribers.[4]

Disney (DIS) saw shares climb after reporting a stake in Epic Games as well as the planned launch of an ESPN streaming service in 2025 and an exclusive release of Taylor Swift’s Era’s Tour movie.[5]

Ralph Lauren (RL) showed certain pockets of apparel are still strong after their earnings beat came from a mix of price increases and strength from China.[6]

Fellow apparel company, Under Armour (UAA), noted weakness in sales, but it was proposed cost-cutting and increased profit expectations that took shares higher on Thursday.[7]

In contrast, other consumer-centered businesses such as McDonald’s (MCD) and Starbucks (SBUX) suffered poor results due to the Middle Eastern conflict and falling sales due to boycotts in that region.

As a result of better-than-expected reports last week, the FactSet blended S&P 500 EPS consensus now stands at 2.9%, an uptick from 1.6% the week prior.[8]

More Earnings on Deck

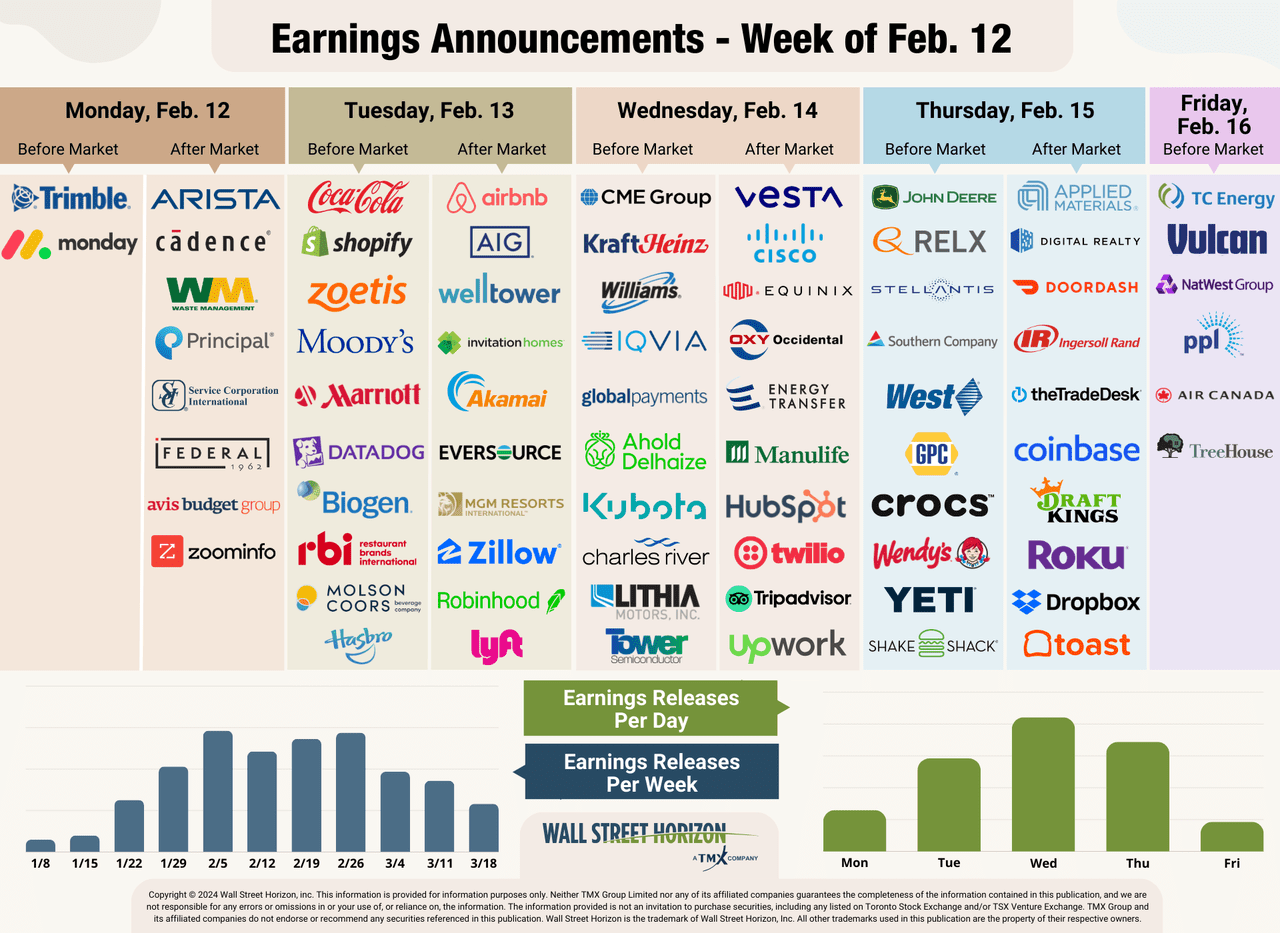

We get results from a smattering of industries this week including enterprise tech (monday.com (MNDY), HubSpot (HUBS), Twilio (TWLO)), travel & leisure (Airbnb (ABNB), Tripadvisor (TRIP), Marriott (MAR)), restaurants (Wendy’s (WEN), Shake Shack (SHAK)) and more.

Source: Wall Street Horizon

Outlier Earnings Dates this Week

Academic research shows that when a company confirms a quarterly earnings date that is later than when they have historically reported, it’s typically a sign that the company will share bad news on their upcoming call, while moving a release date earlier suggests the opposite.[9]

This week, we get results from a number of large companies that have pushed their Q4 2023 earnings dates outside of their historical norms.

However, only one of those companies is listed on the S&P 500. Alliant Energy (LNT) is set to report Thursday, February 15, a week earlier than usual, therefore giving it a positive DateBreaks Factor*.

There are also several consumer-focused companies reporting later-than-usual next week. Those names are Topgolf Callaway Brands (MODG), Lyft Inc. (LYFT), The Wendy’s Company, Yelp Inc. (YELP), Hanesbrands Inc. (HBI) and Cinemark Holdings Inc. (CNK).

* Wall Street Horizon DateBreaks Factor: statistical measurement of how an earnings date (confirmed or revised) compares to the reporting company’s 5-year trend for the same quarter. Negative means the earnings date is confirmed to be later than historical average while Positive is earlier.

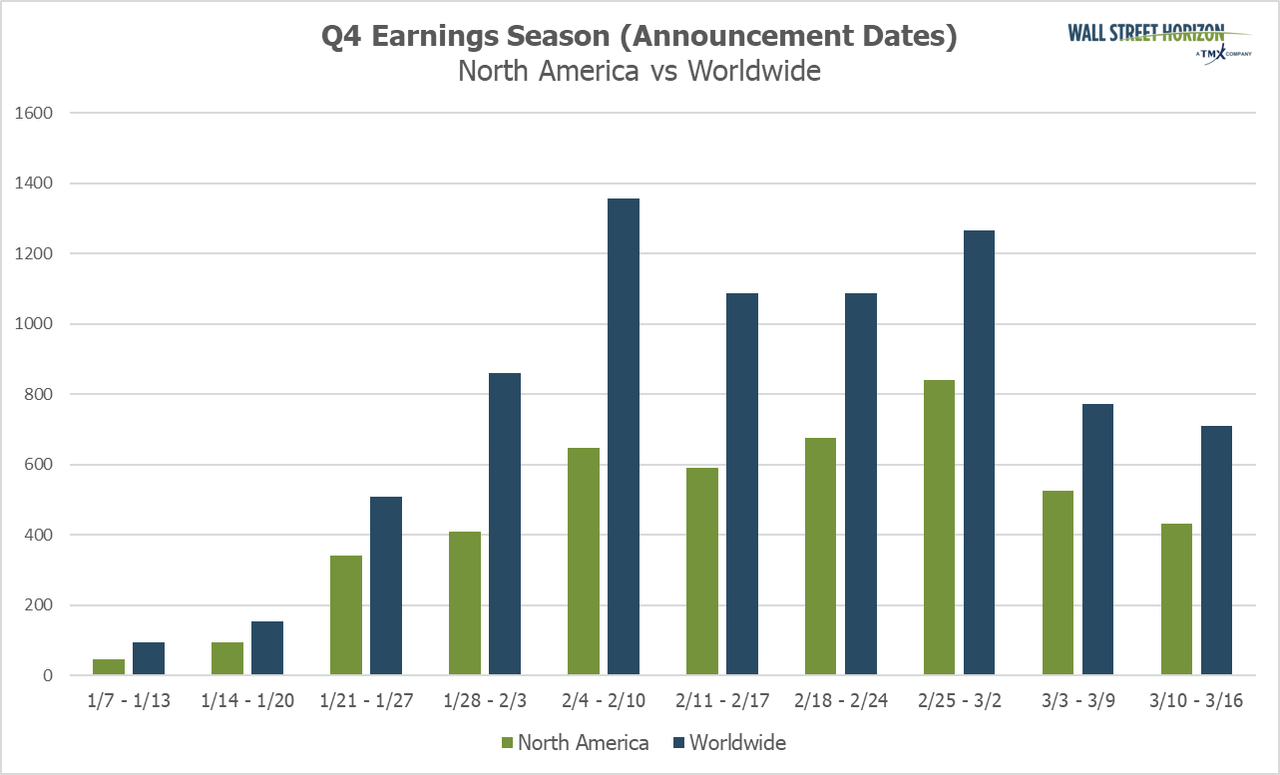

Q4 Earnings Wave

This season, peak weeks will fall between January 29-March 1, with each week expected to see over 1,000 reports. Currently, February 22 is predicted to be the most active day, with 549 companies anticipated to report.

Thus far, 69% of companies have confirmed their earnings date and 32% have reported (out of our universe of 10,000+ global names). Roughly 67% of the S&P 500 has reported.

Source: Wall Street Horizon

1 Arm Holdings FYE 24 – Q3 Shareholder Letter, February 7, 2024

2 Palantir Reports Its Fifth Consecutive Quarter of GAAP Profitability, February 5, 2024

3 Annual Letter from the Chief Executive Officer, Palantir, February 5, 2024

4 Q4 2023 Earnings Call Prepared Remarks, Spotify, February 6, 2024

5 The Walt Disney Company Reports First Quarter Earnings for Fiscal 2024, February 7, 2024

6 Ralph Lauren Reports Strong Third Quarter Fiscal 2024 Holiday Results Ahead of Expectations, February 8, 2024

7 Under Armour Reports Third Quarter Fiscal 2024 Results, February 8, 2024

8 Earnings Insight, FactSet, John Butters, February 9, 2024

9 Time Will Tell: Information in the Timing of Scheduled Earnings News, Journal of Financial and Quantitative Analysis, Eric C. So, Travis L. Johnson, Dec. 2018

Original Post

Read the full article here