Introduction

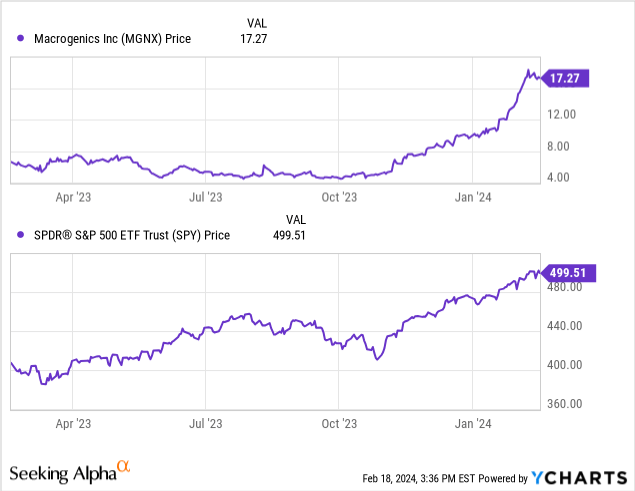

MacroGenics‘ (NASDAQ:MGNX) stock is up 230% since my “Buy” recommendation in September.

Seeking Alpha

Two major variables have contributed to the run. One, the macroeconomics (prospects of rate cuts later this year by the Federal Reserve) have been favorable to the biotech sector. Many stocks are up significantly without any fundamental changes to the companies. Second, there is much interest in the development of antibody-drug conjugates, or ADCs. For example, ADC developer ImmunoGen (IMGN) was acquired for over $10 billion by AbbVie (ABBV) in November.

The following article reassesses MacroGenics’ in light of its present valuation to see if there have been any changes internally, to merit the stock being more expensive, besides the fact it may have been undervalued when I last glanced at it months ago.

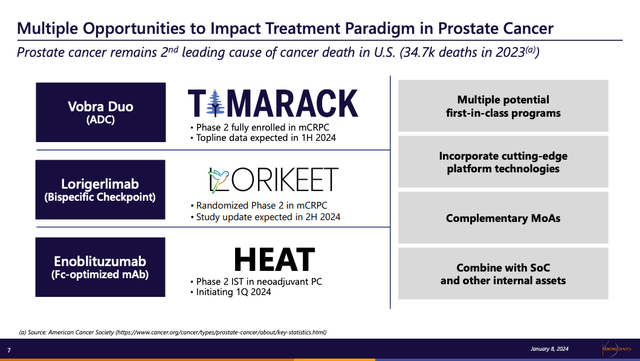

Vobra Duo: MacroGenics’ Bid for a Paradigm Shift in Prostate Cancer

Macrogenics announced in November that enrollment for the TAMARACK Phase 2 study of vobramitamab duocarmazine, an ADC also known as vobra duo, had been completed ahead of time. The company is testing the biologic for the treatment of metastatic castration-resistant prostate cancer (MCRPC).

Patients with MCRPC are typically treated with androgen receptor axis-targeted therapies like abiraterone, chemotherapies like docetaxel, immunotherapies like pembrolizumab, and radiopharmaceuticals. However, these therapies come with varying response rates, significant side effects, and resistance.

Vobra duo specifically targets B7-H3-expressing cancer cells to deliver a cytotoxic payload. This would be a unique target in MCRPC and would provide patients with another option with potentially fewer side effects than less selective alternatives like chemotherapy. It could also be utilized alongside other agents for synergistic effects. MacroGenics may also be able to identify patients, via biomarkers, that are most likely to respond.

High B7-H3 expression is associated with a more rapid and deadly progression of prostate cancer, so this is an interesting target. B7-H3 is being studied in multiple indications. Another MacroGenics’ asset, enoblituzumab, “a humanized, Fc-engineered, B7-H3-targeting antibody,” looked relatively safe and showed promising early efficacy in prostate cancer.

Both vobra duo and enoblituzumab are key to MacroGenics’ pipeline focusing on prostate cancer.

MacroGenics

Investors should approach the TAMARACK data cautiously, as the promise of a novel mechanism of action in a therapeutic area with high unmet need is there, but the hurdles to success will be formidable. The data, which is expected later this year, will be a significant event for the company and could propel the stock higher in the event of positive news.

Financial Health

Turning to MacroGenics’ balance sheet, the combined value of ‘cash and cash equivalents’ ($89.9 million), and ‘marketable securities’ ($166.5 million), total $256.4 million in liquid assets. The ‘current ratio,’ calculated as total current assets divided by total current liabilities, is approximately 5.68, indicating a strong short-term liquidity position.

Over the last nine months, ‘Net cash used in operating activities’ was $50.2 million, translating to a monthly cash burn of approximately $5.6 million. Dividing the liquid assets by this monthly cash burn gives a ‘cash runway’ of about 46 months, suggesting a longer period before funding concerns arise. However, these values are based on past performance and may not directly predict future outcomes.

Considering MacroGenics’ current financial position and its ability to cover short-term obligations with a significant amount of liquid assets, the odds of requiring additional financing within the next twelve months are low.

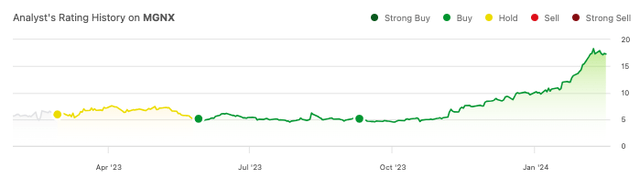

Market Sentiment

According to Seeking Alpha data, MGNX presents a nuanced investment profile marked by contrasting elements. With a market capitalization of $1.07 billion, the company stands on substantial financial footing. Analysts project revenue growth from $80.88 million in 2023 to $153.38 million by 2025, indicating robust growth prospects. MGNX’s stock momentum is exceptional, outperforming the SPY significantly across all observed timeframes within the past year, highlighting strong market confidence.

Short interest stands at 8,338,224 shares (~5%), suggesting a moderate level of investor skepticism or hedging activity, which is worth monitoring for potential volatility. Institutional ownership is high at 99.64%, with notable movements including Bellevue Group, Blackrock, and T. Rowe Price showing increased positions, while Armistice Capital and Vanguard decreased theirs, reflecting a dynamic institutional sentiment. Insider trades over the past 12 months reveal a net positive activity, with more shares purchased than sold, which could indicate insider confidence in the company’s future.

Considering these factors, MGNX’s market sentiment can be classified as “robust,” supported by its growth prospects, strong stock momentum, and positive insider trading activity.

Is MGNX Stock a Buy, Sell, or Hold?

I continue to like MacroGenics’ stock. Even after tripling, it doesn’t look too expensive here. They are making interesting progress in prostate cancer with their unique mechanism of action. The swift completion of TAMARACK Phase 2 study enrollment underscores their operational efficiency and potential market impact. According to Data Bridge Market Research, the global market for MCRPC is expected to reach $17.7 billion in 2029, underlining the significance of MacroGenics’ efforts.

Financially, MacroGenics exhibits resilience with a solid liquidity position, reducing near-term funding risks. However, investors should monitor upcoming TAMARACK data and remain aware of the inherent volatility in biotech investing. Even in the event of clinical, regulatory, and market success (a low probability event), MacroGenics remains years from meaningful revenue and, thus, is a speculative investment.

Nonetheless, given the company’s strong pipeline, financial health, and positive market sentiment, MacroGenics offers an intriguing, if speculative, “buy” opportunity.

Read the full article here