Investment Case

Over the past few years, shareholders of Equity Commonwealth (EQC) have patiently waited for management to deploy their large cash reserves. For years, management has been on the lookout for an M&A deal to transform the company from an Office REIT to an Industrial REIT. The company got close years ago when it attempted to purchase Monmouth Real Estate (MNR) in 2021 for approximately $3.4 billion. However, shareholders of MNR ultimately shot down the deal by voting against the acquisition a few months later. Since then, EQC has not attempted to acquire another company and shareholders have been left questioning whether management will ever finalize a deal. As such, shareholders have recently started to ponder whether it’s in their best interest to seek a wind down of the business instead of a transformative deal to unlock shareholder value. Thus, my investment case for EQC is focused on the potential wind down of the business and how investors may be able to profit from liquidation.

So, one of the main reasons why I decided to outline this investment case now is the fact that management has provided investors with a timetable for either a transaction or the potential wind down of the business. Before the end of the year, the company plans to announce either of these scenarios to shareholders. Thus, although I am not recommending an investment today, this is something that all investors should keep on their radar as we approach the end of the year. In my opinion, at the right price, an investment in the company’s preferred shares (EQC.PR.D) offers a potential risk-free return opportunity if the company does indeed wind down the business. Although the common shares also have potential upside, I am going to focus solely on the preferred shares since this is where I see the potential for guaranteed returns.

Activist Investor Pushes Management to Consider Liquidation

On March 13, 2024, Land & Buildings Investment Management, LLC released a letter it had sent to EQC’s board of directors that urged the company to consider selling the remaining four assets in its portfolio and to liquidate the company. This push from Land & Buildings Investment Management, LLC seems to have worked, as management included a business update section within its most recent earnings release that outlined its plans for the business. In that section, management highlighted some of its accomplishments since taking over the company, but the heart of the update resided in the last paragraph:

“Today, we are continuing our efforts to maximize shareholder value. We remain focused on opportunities in our pipeline where we can create long-term value for our shareholders, while concurrently taking steps to facilitate the potential wind down of our business. Before the end of this year, we expect to either announce a transaction or move forward with a plan to wind down our business.”

That last sentence in the above excerpt is important because it now seems management is open to the idea of winding down the business and returning the remaining value to shareholders. I believe this to be the most appropriate course of action for the company, as a transformative acquisition comes with many risks and shareholders have already been patient enough with management.

Preferred Stock Investment

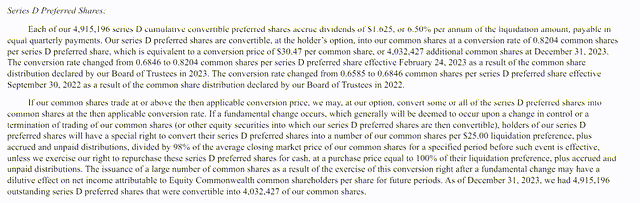

In addition to the company’s common shares, investors can also purchase EQC’s series D cumulative convertible preferred shares that pay 6.5% annually on the liquidation value of $25.00. If the company continues to operate as usual and doesn’t liquidate, holders of the preferred shares can convert their shares into common stock at the conversion rate of 0.8204 or can continue to hold the shares and collect the dividend. Thus, in this scenario, investors would be looking at a conversion price of $30.47 per common share but would still earn a nice yield of 6.5%. However, if a fundamental change occurs, such as the termination of trading in their common stock, the company has the right to repurchase the series D preferred shares at the liquidation preference of $25.00. Thus, if the company winds down, investors are practically guaranteed the liquidation value of $25.00.

EQC SEC 10-K

In my opinion, this latter scenario has the opportunity to provide risk-free returns, as the company has more than enough cash to cover both the dividends and the total repurchase amount. For instance, the total repurchase amount for the preferred shares at $25.00 would be equivalent to $122.88 million (4,915,196 shares * $25.00). Given the company has over $2.0 billion in cash and cash equivalents, the company can easily cover the repurchase amount many times over. Thus, I believe there is potentially no downside to an investment in their preferred shares when purchased at a discount to its liquidation value of $25.00.

Scenario Analysis

For our analysis, let us assume that the company announces their plan to wind down the business at the end of the year. This announcement would most likely occur after the payment of the fourth preferred equity dividend in November. Thus, if an investor purchased shares prior to the July record date, they would receive two additional dividends totaling $0.8125. Given the current market price of the preferred shares of $24.80, this provides an investor with a yield of 3.28% over the next six months (which is equivalent to a 6.67% annualized yield). In addition, given the preferred shares are trading at a discount, an investor would be able to realize an additional 0.8% return on their investment for a total return of 4.08%. All-in-all, this total return over the next 7 months is not terrible, but when you compare this return vs. the 6-month treasury yield of 5.36% the investment does seem wanting.

Thus, to provide some different investment return scenarios, I compiled the below table showing various returns based on the trading price of the preferred shares at the time of investment (all assuming the investment is made prior to the July record date). As you can see, if you’re looking for a return that’s equivalent to the 6-month treasury yield, I would wait to purchase the preferred shares at a price that’s around $24.50 as that would provide you with a total return of 5.36%. For this reasoning, I would recommend waiting to see how the preferred shares trade over the next month before making an investment if you seek a total return equal to the treasury yield. However, I will say that an investment at any of the below prices is not a terrible option given the practically risk-free nature of this investment.

|

Preferred Share Investment Price |

Dividend Yield Over Next Six Months |

Discount to Liquidation Value |

Total Return |

|

$24.80 |

3.28% |

0.8% |

4.08% |

|

$24.70 |

3.29% |

1.2% |

4.50% |

|

$24.60 |

3.30% |

1.6% |

4.93% |

|

$24.50 |

3.32% |

2.0% |

5.36% |

|

$24.40 |

3.33% |

2.5% |

5.79% |

|

$24.30 |

3.34% |

2.9% |

6.22% |

Risks

The biggest risk I see to an investment in the preferred shares would involve management’s decision to go ahead with a transformative deal that they ultimately overpay for. This is not something that is entirely out of the question. The risk of overpaying for a deal is something everyone should consider, and it is for that reason alone that I would not recommend investing in their common shares, despite the potential upside. With an investment in the preferred stock, if the company overpays for an acquisition, an investor is still entitled to the 6.5% yield on the shares. In addition, the dividend is cumulative, so any unpaid dividends accrue overtime, which provides a little protection in case the company runs into trouble.

Read the full article here