Walgreens Boots Alliance (NASDAQ:WBA)

Walgreens, a pharmaceutical healthcare and beauty product retailer since 1901, is headquartered in Deerfield, IL. It operates in three segments: U.S. Retail Pharmacy, International, and U.S. Healthcare. In the US it has over 8500 locations which allows almost 75% of all Americans having a location within 5 miles to patronize. It has its own line of health, beauty and wellness products launched in April 2021 under the name “No. 7” Beauty company.

It completely now owns the German wholesaler GEHE Pharma Handel (GEHE) and Alliance Healthcare Deutschland (AHD) purchasing the remainder from McKesson. Village Health and Summit Health rounds out its expansion into hospital and wellness care. It also has pursued and has merged with CityMD in NY and NJ to increase its presence in specialty and urgent care. All of these new additions, including other recent pickups, Shields Health Solutions and Care Centrix, have performed well and will add to the healthcare experience. It more recently sold 10.8 million shares of Option Care Health for $330 million to now complete the exit from the home infusion provider. It still maintains a BBB S&P credit rating.

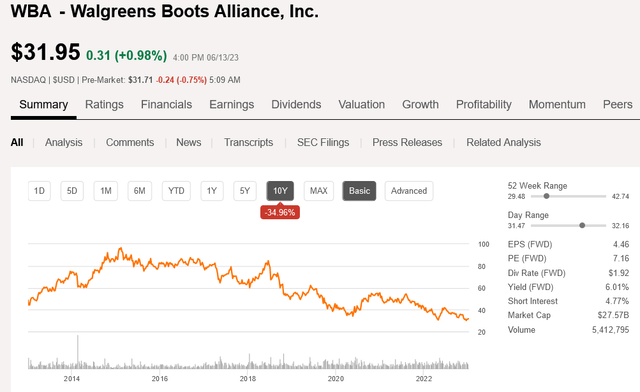

Price

It has been disappointing in price for almost 8 years now, moving primarily from a high of ~$99 in 2015 to a low of under $29 just recently.

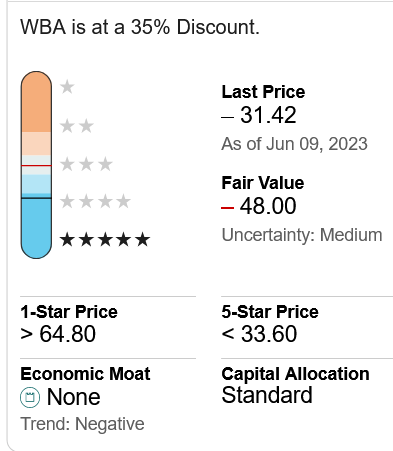

Morningstar “M*”

M* analysts give it a 5-star undervaluation rating and a suggested cheap buy price of $33.60 which it is now definitely at or below today. The suggested pricing from them is shown below.

Pricing Targets for WBA (Morningstar June 12th, 2023)

Note the fair value from M* is $48.

Yahoo Finance – “YF”

YF lists a 1-year price target of $40, definitely not as optimistic as M*.

Seeking Alpha – “SA”

The SA 10-year price chart below is certainly quite eye opening and shows the down trend in price quite well. Note the price is starting to move up from the last low and is now ~$31.95.

WBA 10 year Price chart information (Seeking Alpha June 14th, 2023)

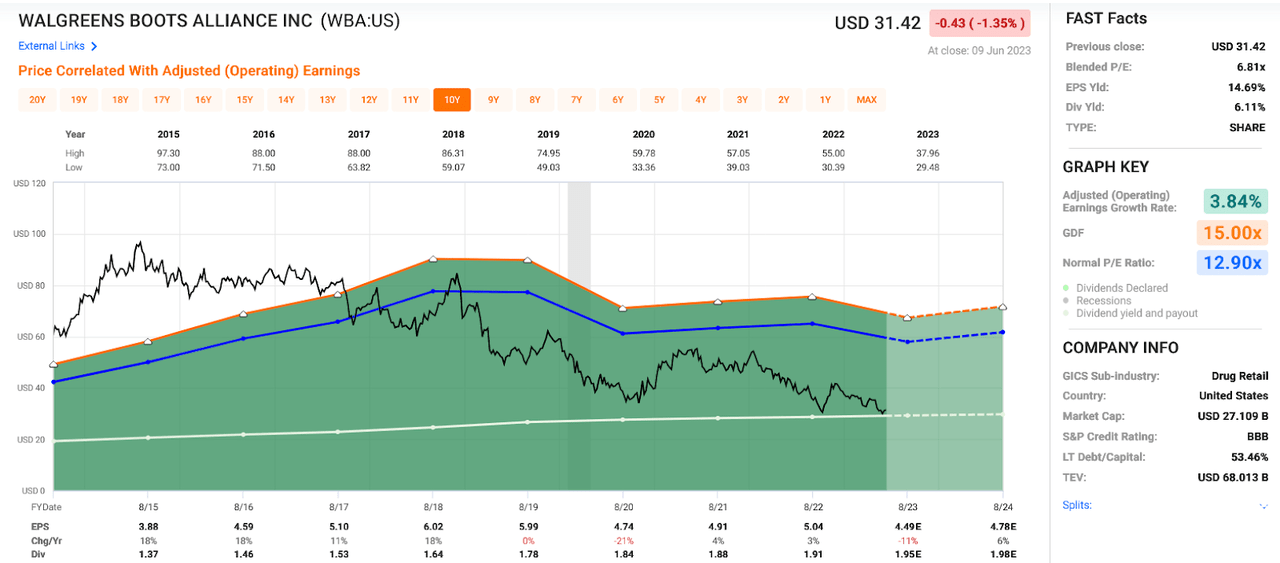

FASTgraph- “FG”

FASTgraph/ FG below is shown for 10 years: 8 years of actual metrics and about 1.5 years of estimates using dotted lines.

FG offers the same similar looking downward price, the black line, in the chart, but it does show the undervaluation not to be seen just looking only at the price.

The FG below reveals earnings and offers numerous other technical metrics along with FAST Facts on the right side of it. The earnings or dark green area in the graph supports easily the white dividend line.

WBA 10 year Technical Analysis Price Earnings (FASTgraphs June 12, 2023)

The normal P/E, blue line, during this period is 12.9x earnings, while now it sells for 6.81x earnings, very low for a P/E. The FAST facts relate all of that information, and the colors coincide with the lines used in the graph.

The future potential seems to point to a better 2024 with all the synergies from its purchases starting to come to fruition and start to grow.

It also helps to note it has reached a US states opioid settlement which can now be put behind it with payments to be made over many years.

Value Line- VL

VL offers pricing and safety, rating of 1 is the best and 5 very bad. Walgreens is at a mid-point level 3, the Goldilocks rating, as many say. It does have a high financial A rating. The price target at the 18 month out mid-point is $32, right near where it is today. The 3–5-year price target is $45 to $70, which is just fine, but not exciting.

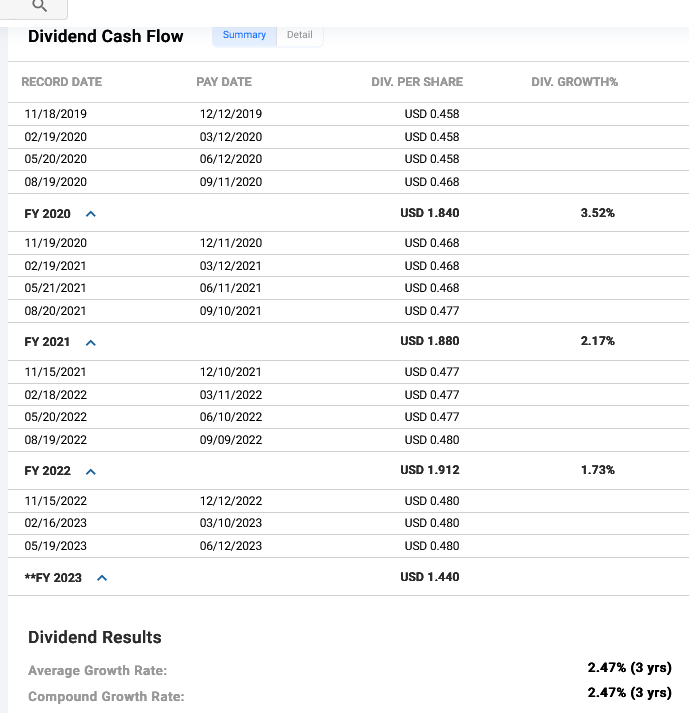

Dividend

Dividend champion WBA has continued to pay a regular rising dividend for 47 years with a yield now of 6.1%. Sad to report the reason for the high yield is the continued price decline. The 5-year dividend growth rate is 4.67%, but it has declined to 2.47% over the last 3 almost 4 years shown below from FG.

3 years of WBA dividend payments (FASTgraphs )

The June 12th dividend was just paid, and the next announcement would be for the annual September raise. If you look at the FG above in this article it indicates a maybe 1c raise to 49c; which is ~2%.

Summary/ Conclusion

The next raise will reveal how Walgreens feels about the future. If it is that suggested raise to 49c, or that 2% on top of an already 6.1% yield, it’s better than most short-term bonds and CDs generally ~5% yielding now. Owning it now would be primarily for income not price growth. It has a 6.1% yield, a safe slowly rising dividend with a quality BBB S&P rating. Not a “Hot” rising price for sure, not a “hot” rising dividend, not too low or cold either. It’s rising. It’s sitting in the Goldilocks chair of just about right to buy if you want something fair and boringly safe, hold on and enjoy the just right income. It is a long position in Rose’s Income Garden “RIG” portfolio of 80 stocks found at The Macro Trading Factory.

Macro Trading Factory is a macro-driven service, run by a team of experienced investment managers.

The service offers two portfolios: “Funds Macro Portfolio” & “Rose’s Income Garden”; both aim to outperform the SPY on a risk-adjusted basis, in a relaxed manner.

Suitable for those who either have little time/knowledge/desire to manage a portfolio on their own, and/or wish to get exposed to the market in a simple, though more risk-oriented (less volatile), way.

Each of our portfolios, spanning across all sectors, offers you a hassle-free, easy to understand and execute, solution.

Read the full article here