Right now, as investors get back into risk-taking mode, the market is suddenly re-discovering a lot of downtrodden tech stocks that were trading at underwater valuations far below their intrinsic worths. This group of stocks has been among the biggest rebounders over the past few weeks, and in my view, continuing to focus on these “growth at a reasonable price” names remains one of the best ways to beat the market in this environment.

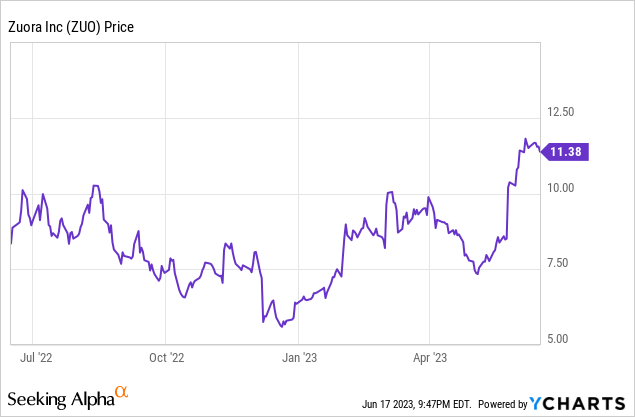

Zuora (NYSE:ZUO) is a great example of this. This subscription revenue-management software company has seen its share price jump ~75% year to date, with recent momentum fueled by a very strong Q1 earnings cycle. In my view, there’s still plenty of upside left to go.

The bull case for Zuora resonates as it shows great execution in a tough climate

Earlier in April, I expressed a bullish opinion on Zuora with a $11.50 price target on the company, at the time representing ~25% upside. I remain at a buy rating for Zuora stock and am raising my year-end price target to $14, representing north of 20% further upside in this stock.

In my view, Zuora is a great example of smart execution in a challenging macro environment. Though the company is not immune to slowing sales in the software sector, it has pivoted its sales force as well as its channel partners to focusing on smaller, faster deals that have more immediate ROI – instead of chasing the multi-year, larger deals that are getting more executive scrutiny right now. This approach has allowed Zuora to post consistent growth rates that don’t show much deceleration amid macro pressures.

Here, in my view, is the full long-term bull case for Zuora:

- Subscription-based business models are becoming dominant. Given the fact that more and more businesses are adopting this type of model, Zuora’s base of potential customers has widened significantly. Zuora’s uniqueness in this regard is also important to point out: companies can choose a regular ERP, but Zuora’s subscription-focused solutions help to address common pain points.

- Innovation track record is strong; the product portfolio is expanding. There’s virtually no other company that markets itself as a purpose-built platform for subscription companies. Zuora has also done a good job at fleshing out its portfolio of solutions, ranging from revenue management to billing tools to CPQ (configure, price and quote) applications.

- Zuora grows along with its customers. As Zuora’s clients grow their subscriber bases, so does Zuora’s opportunity to monetize and grow alongside its customers. The company has noted that upsells have hit a “record pace”, and highlighted several key milestones like GoPro’s (GPRO) subscription-based storage and insurance program (a key feature of the company’s planned turnaround) hitting one million subscribers.

- Offloading services work to partners. As Zuora has scaled, it has also been able to ramp up its third-party vendors and resellers to take on more of the unprofitable services/onboarding work that typically acts as a drag on software-company margins. Zuora’s mix of subscription versus services revenue has grown over the past several quarters, helping boost gross margins and illustrating where Zuora would prefer to be at scale.

- Acquisition possibility, especially after the company hit breakeven. While I never like to base any investment decision based on high hopes that the stock will get acquired, Zuora checks off a lot of boxes for being acquired: it’s small with just a ~$1.5 billion market cap; it offers a very unique product that many larger software companies may want to get their hands on, especially during times when organic growth is fading; and it has positive pro forma operating margins.

Valuation checkup and price target

Even after Zuora’s recent rally, the stock remains quite modestly valued in my opinion. At current share prices north of $11, Zuora trades at a $1.56 billion market cap. Netting off the $396.9 million of cash and $212.3 million of debt on Zuora’s most recent balance sheet yields an enterprise value of $1.38 billion.

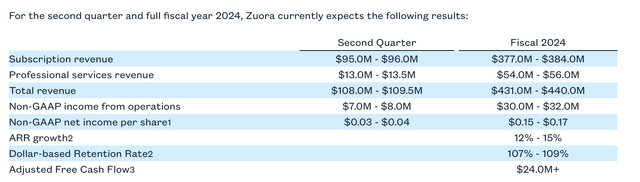

Meanwhile, for the current fiscal year FY24 (the year for Zuora ending in January 2024), the company has guided to $431-$440 million in revenue, representing 9-11% y/y growth (considering the company’s 14% growth in the first quarter, this outlook could prove light).

Zuora outlook (Zuora Q1 earnings release)

Against the midpoint of this revenue outlook, Zuora trades at 3.2x EV/FY24 revenue. Again, my updated price target on the company is $14, which represents a 4.0x EV/FY24 revenue multiple and ~22% upside from current levels.

My recommendation is to continue riding the upward momentum here until Zuora hits that threshold.

Q1 download

To hammer home the point that Zuora has executed well relative to expectations as well as its own modest valuation, we’ll now dig into the details of Zuora’s latest quarter in more detail. The Q1 earnings summary is shown below:

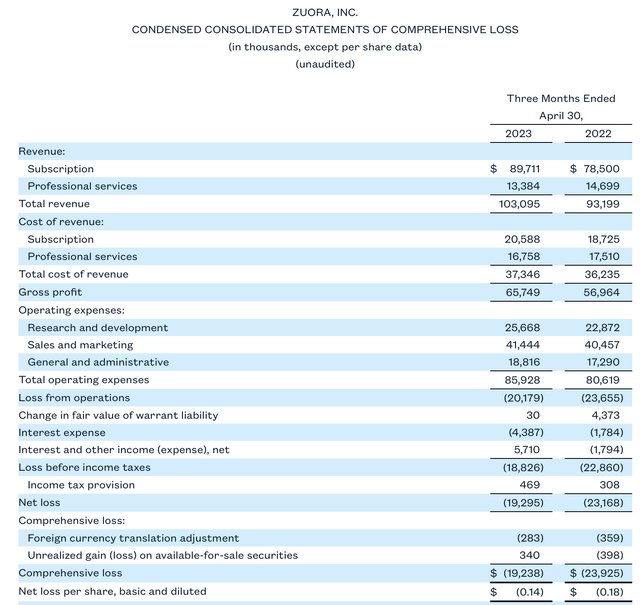

Zuora Q1 results (Zuora Q1 earnings release)

Zuora’s total revenue grew 11% y/y to $103.1 million, beating Wall Street’s $102.1 million (+10% y/y) expectations. Subscription revenue continued to grow at a faster pace, up 14% y/y to $89.7 million, while professional services revenue declined. As a reminder to investors who are newer to Zuora, the decline in professional services is both intentional and desirable: the company has continued to involve more channel partners to do integration work for clients, which Zuora continues to do at a loss. Opening the door for channel partners to take over this work gives Zuora access to a wider pipeline than its own sales team can handle, plus helps with margin expansion.

Zuora’s execution strategy in Q1 was marked by an intentional shift to smaller, higher-confidence deals. Per CEO Tien Tzuo’s remarks on the Q1 earnings call:

At the same time, buyers continue to be cautious, knowing this at the start of the year, we made some adjustments in the field to focus our sellers on smaller, faster, new logo wins and these adjustments seem to be paying off. In fact, we closed more new logos in Q1 than we did in any quarter of fiscal year 2023 […]

Now, of course, our partners continue to be an important part of our strategy. In fact, in Q1, over half of our go-lives included an SI partner. Given the macro backdrop, we’re adjusting with our partners as well. We’re focusing with them on closing smaller, faster lands that provide a quicker ROI.

In an environment where these global SIs are seeing less demand for large multiyear transformation deals. The good news is that Zuora solutions are not exclusively tied to such large projects. In fact, our SI partners are creating more pipeline for us year-over-year.

So we’re seeing faster lands, including with our partners, but that’s only part of our land-and-expand strategy.”

Key wins in the quarter included TELUS (TU), which is Canada’s second-largest telecom provider, as well as Gannett (GCI), a leading news corporation with more than 2 million subscribers. The company still also maintained a high net revenue retention rate of 108%, versus 110% in the year-ago quarter: indicating that existing customers are still upselling.

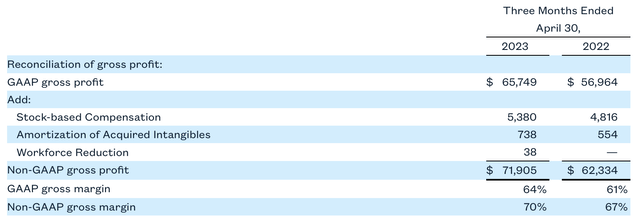

Zuora’s pro forma gross margins also inched upward by three points to 70%. This was driven both by a two-point boost in subscription gross margins to 81%, as well as a more favorable revenue mix shift away from loss-leading professional services and into subscriptions.

Zuora gross margins (Zuora Q1 earnings release)

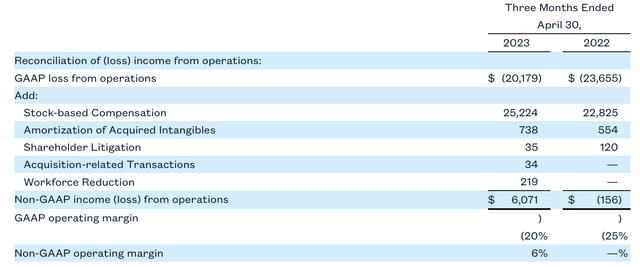

Pro forma operating margins, meanwhile, expanded six points to 6%, putting Zuora well above breakeven when excluding stock compensation.

Zuora operating margins (Zuora Q1 earnings release)

It’s worth noting as well that FY24 free cash flow is off to a good start, with $13.0 million in FCF in Q1 more than tripling the year-ago FCF of $3.7 million.

Key takeaways

After seeing the comforting success of Zuora’s sales execution in this challenging macro environment, I’m comfortable holding onto my Zuora stock and extending my price target to $14 with ~20% extra runway. Stay long here as the company continues to inch closer toward its true valuation worth.

Read the full article here