Intro

We wrote about Brookdale Senior Living Inc. (NYSE:BKD) in November of last year when we pointed to the company’s clear potential regarding the trend of growing occupancy levels, which was finally gaining traction. Our disclaimer however was the company’s significant overhanging debt which we will get into later in the article.

Although it was not until early 2023 that shares of BKD finally bottomed, shares remain down almost 10% since we penned that piece back in November 2022. Suffice it to say, given the 13%+ positive return in the S&P500 over the same timeframe, holding BKD over the past 7+ months or so would have resulted in a sizable opportunity cost for the investor.

Q1 Momentum Expected To Flow Into Q2

Despite this opportunity cost, Brookdale currently seems to have the wind in its sails, which has us eyeing up a potential swing-trade opportunity on the long side. Investor sentiment turned bullish in early April of this year when management announced preliminary Q1 guidance which was significantly ahead of what the market was expecting. Year-over-year RevPar growth of almost 13% was guided for Q1 and this growth came to fruition when Q1 numbers were later announced in May. Brookdale reported significant beats in both the top-line and bottom line for the quarter. Operating income of $9.1 million and adjusted EBITDA of $89 million in the quarter were numbers that quite frankly would not have been expected just a few months prior.

Furthermore, Brookdale’s renewed momentum is expected to continue in the second quarter with above-average RevPar growth and sustained reductions in the expense labor space contributing to better profitability numbers at the company.

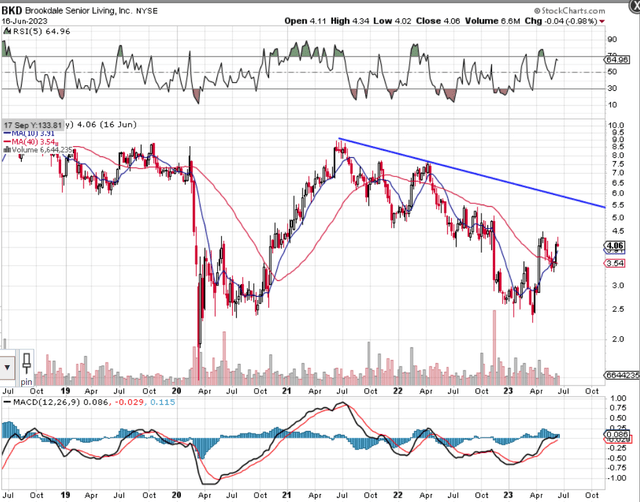

Management is guiding for almost 12% RevPar growth in Q2 and approximately $75 million in adjusted EBITDA for the quarter. As we can see from the technical chart below, investors clearly like what they see with the stock’s 10-week moving average having recently pushed above Brookdale’s corresponding 40-week average delivering an intermediate buy signal. This momentum paves the way for a sustained move in Brookdale’s share price back up to overhead multi-year resistance at approximately the $5.50 level (35%+ above the prevailing share price of $4.06). However, moving beyond the $5.50 level in this present up-move may be a bridge too far for Brookdale for the following reason.

Brookdale Senior Technical Chart (Stockcharts.com)

Access To Cheap Cash

If present RevPar growth rates were to continue for some time, for example, investors will most likely take little notice of Brookdale’s liquidity or solvency metrics for that matter. This premise though is predicated on the continued performance of one crucial area which is Brookdale’s ongoing ability to generate cash either through its internal activities or the rolling over of its debt over time.

What do we mean by this? Well, Brookdale’s long-term debt came in at $3.77 billion at the end of its first quarter. This is a sizable number for a company with a market cap of a mere $764 million. Furthermore, the company’s current ratio of 0.94 (at present) demonstrates that the resources are not there at present to pay the interest on this debt regularly from internal cash. To this point, the CEO on the recent Q1 earnings call discussed recent ‘liquidity-boosting’ transactions which included the amending of the Welltower agreements as well as an asset sale (which will be seen as an entry on the balance sheet in Q2).

Suffice it to say, apart from growth in occupancy numbers, ongoing successful financing will continue to play a major role in the fortunes of Brookdale and long-term investors would do well in not dismissing this. The CFO pointed to this on the recent Q1 earnings call where he stated that only 60% of the company’s debt has a fixed interest rate and that the company was already working on finding the best solution for the rolling over of its mortgage debt which is due in September of next year. Improving current contracts (such as what took place with WellTower) is always welcome but what Borrokdale needs now is for RevPar growth to remain in strong double-digit territory. This would ensure the company can start generating its own cash which as a result would slowly but surely take some pressure off those upcoming financing deals.

Conclusion

Therefore, to sum up, sentiment has changed in Brookdale with investors eyeing significant share-price appreciation in upcoming quarters due to a significant increase in RevPar growth. Let’s see what the second quarter brings. We look forward to continued coverage.

Read the full article here