Summary

I reiterate my long thesis for Paycom (NYSE:PAYC), where I believe PAYC is a disruptive company displacing incumbents in the vast payroll industry. At its core, I think the reason why PAYC wins is due to its single point of contact and quick response times, compared with those of service bureaus such as Automatic Data Processing (ADP). Additionally, I believe PAYC platform compares favorably with existing incumbent solutions, usually characterized by disparate HR and Payroll systems that have been integrated through back-end software – which don’t work well. More importantly, PAYC operates in a very large TAM that, I believe, can enable it to grow for a very long time.

Recent PAYC results are confirming my optimistic outlook, as management has increased their revenue and adjusted EBITDA guidance for FY23. This indicates that demand is stable and PAYC is performing admirably; in particular, PAYC is gaining ground in the upmarket. In the near-term, I also see PAYC continuing to enjoy the high interest rate tailwind, which carries very high margins. Overall, I reiterate my buy rating based on performance so far, and am now looking forward to the upcoming catalyst got growth and stock rerating – the international opportunity. However, I anticipate it will be several years before this effort significantly affects revenue growth.

Business fundamentals/financials

Both PAYC’s revenue and EBITDA have been performing above expectations recently. As a result of this outstanding performance, management increased their prior projections. Moreover, the increase in guidance exceeds the beat versus consensus numbers, indicating that the company expects the remaining three quarters of FY23 to perform better than consensus expected. As the underlying factors persist in their success, I expect PAYC will maintain its track record of delivering against this strong guidance. Other business metrics are also supportive of the current growth momentum, such as: adoption for BETI is also on the rise, with over 3,000 new BETI clients added in 1Q and a retention rate for BETI customers that is significantly higher than the company average; Investments into brand market and retargeting has seen positive ROI; upmarket momentum continues to be strong.

Global HCM product

With the introduction of PAYC global HCM product, I think the TAM has significantly expanded with an extended growth runway ahead of the business – Global HCM is available in 180 countries and 15 languages. The strategy that management is adopting is what excites me, aside the product itself. Management is concentrating on current demand within its client base, which bodes well for the first stage of the rollout: existing customers with overseas subsidiaries or operations are likely to adopt this product. However, I do want to stress that this may take some time due to the complexity of the various operational and regulatory factors involved. Within the next few months, I anticipate a limited rollout to a select number of countries. Nonetheless, I view PAYC’s global launch as a means of expanding their TAM, which management has said this product does by 50%. Notably, this growth is not margin dilutive as management noted the margin should be very similar to what they are seeing now, according to management (1Q23 earnings call). As a result, I think going global will have a significant impact in the long run (in terms of both upmarket and whitespace opportunities).

Capital allocation

Management has also stepped up their game of showing the market that they are in line with shareholders. The introduction of a dividend policy by management is something I can use as a lever for allocating capital. As PAYC begins to generate significant cash flows, it plans to begin paying a dividend to shareholders at a rate of 37.5 cents per quarter, or $1.50 per year. Non-growth investors are likely to view this as a sign of PAYC’s self-assurance in the face of the current market conditions.

Valuation

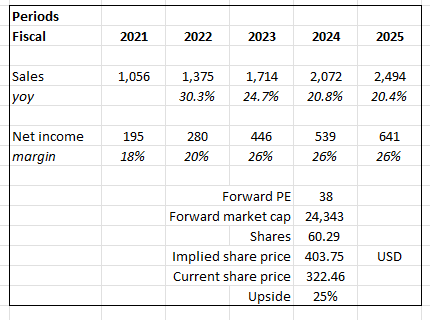

This business is expected to generate $640 million in earnings in FY25, using consensus figures as a proxy for market expectations for PAYC earnings growth. Assuming PAYC continues to trade at its current multiple (38x forward PE), this translates to $400 per share, or a 25% increase. However, I believe the upside could be much greater because the consensus expects growth to flatten/decelerate modestly over the next two years in FY24 and FY25, which I believe is unlikely given the current growth momentum. My model also did not account for the potential upside from international TAM (which could materialize in the second half of the 2020s). Finally, given its higher growth profile, PAYC should be able to maintain its current multiples versus ADP, which is trading at 24x forward earnings. It is worth noting that ADP is only growing in the high single digits and has lower margins than PAYC.

Own model

Risks

A favorable interest rate environment is helping PAYC grow thanks to the interest it earns on its customers’ deposits. Interest rates will normalize eventually which may have a large impact on the business, depending on how fast rates normalizes.

Conclusion

PAYC is poised for continued growth and success in the payroll industry. With a large TAM, I believe PAYC has ample room to expand and grow for years to come. Recent financial results have been strong, with increased revenue and guidance exceeding expectations. Additionally, the international opportunity through the global HCM product opens up new avenues for growth and extends the TAM by 50%.

Read the full article here